- Pip Munch

- Posts

- 📉 2026 Market Predictions

📉 2026 Market Predictions

Want to compete against traders around the world? Lark Funding’s January Competition just changed the game. It’s completely FREE and gives you a shot at winning a $100K prop firm challenge. 100 winners. 14 days. Your move.

Register now → larkchallenge.com

☕️ GM Munchers! While everyone's nursing their New Year's hangover, we're mapping out what 2026 has in store. Spoiler: it's going to be messy, volatile, and absolutely loaded with opportunity if you know where to look.

Here are our five big predictions for the year ahead. We'll probably be wrong about at least three of them, but that's never stopped us before.

🎯 Prediction #1: Stock Market Gets a Reality Check

What Happened in 2025:

Stocks went up 17-20% for three straight years. Sounds great, right? Here's the problem: companies aren't actually making more money. People are just willing to pay higher prices for the same profits.

It's like paying $50 for a burger that used to cost $25. Same burger, dumber buyer.

The "Buffett Indicator" (fancy way of measuring if stocks are expensive) is at 221%. To put that in perspective, it was at 140% before the dot-com crash and 110% before 2008. We're in "everyone's losing their mind" territory.

Why This Matters:

Tech companies spent hundreds of billions building AI stuff—computer chips, data centers, enough electricity to power a small country. But they're not making money from it yet. They're building first, profiting later.

History shows this always ends the same way: investors eventually ask "Where's the money?" and the stock price collapses faster than my confidence after a margin call.

The Trade:

Wall Street banks are saying the S&P 500 goes to 7,600 (another 11% gain). We think they're huffing hopium. Costs are rising. Profit margins are shrinking. Something's gotta give.

What We're Doing:

As always, focusing on quality stocks and not companies trading at 100x earnings. When a correction comes (and it always does), we want to own businesses that survive, not stories that evaporate.

Will we time the top perfectly? Not a chance. Could stocks rip another 10% while we're sitting in cash looking stupid? Absolutely.

But we're not playing the "get rich quick or get liquidated" lottery. We'd rather find a few quality companies and hold them through the chaos than watch our account balance do the Hokey Pokey every time Jerome Powell clears his throat.

🌍 Prediction #2: The Dollar Keeps Falling (And That Changes Everything)

The US dollar lost 10% of its value in 2025—worst year since the '90s. Your dollars literally became less valuable while sitting in your bank account. Fun times.

Two things caused this:

The Fed cut rates: Lower rates = less reason to hold dollars

Government keeps spending money it doesn't have: The US deficit is 6% of GDP with zero plan to fix it

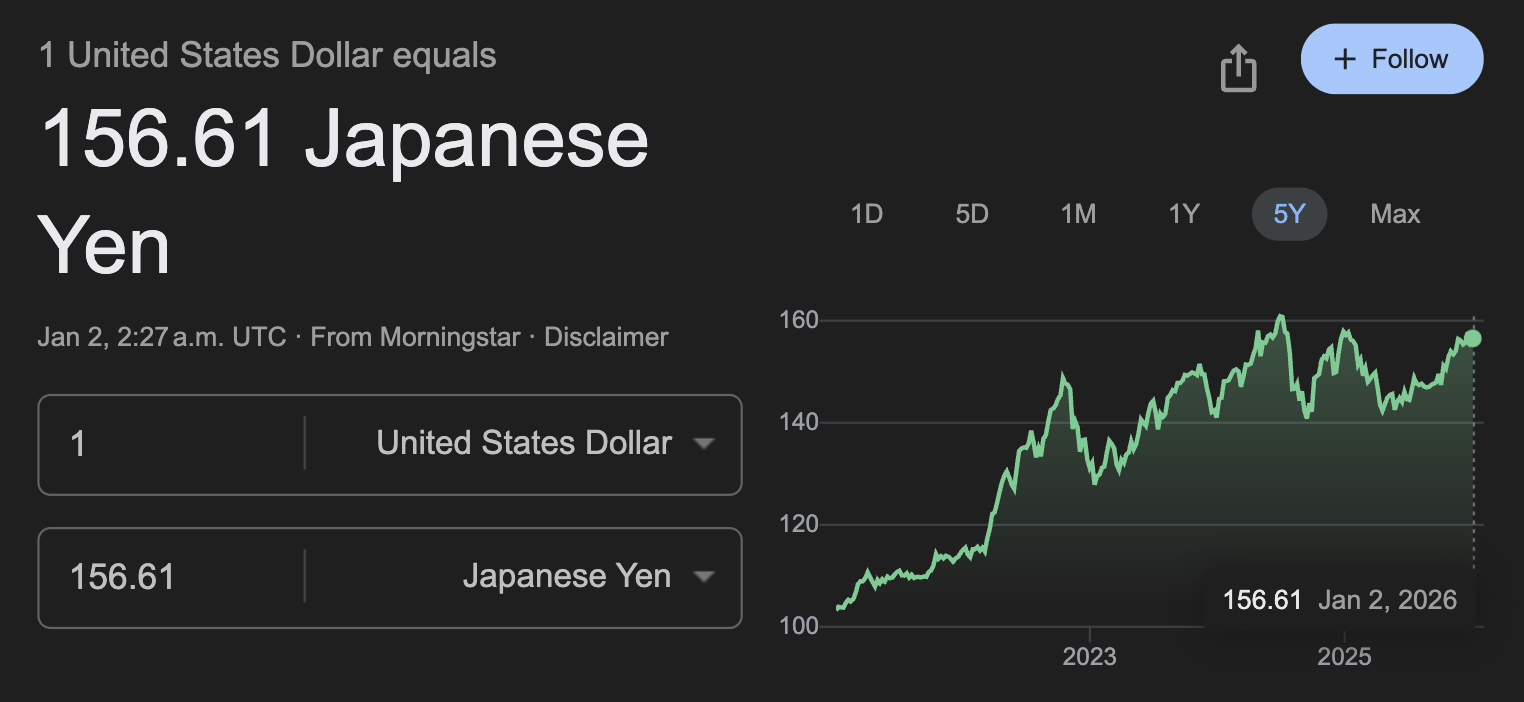

Meanwhile, Japan—after sleeping for 30 years—finally raised rates. Twice. The era of free Japanese money is over.

Why This Matters:

For decades, big investors borrowed cheap Japanese yen and bought higher-yielding US assets. It was free money. Now that trade is reversing. When it fully unwinds, it triggers a margin call on the entire global financial system. No big deal.

The Trade:

We're calling USD/JPY (dollar vs yen) to drop below 140 in 2026. It won't be smooth. It'll be violent, chaotic, and will probably happen at 3 AM on a Tuesday when you're trying to sleep.

🥇 Prediction #3: Gold and Silver Go Absolutely Insane

What Happened in 2025:

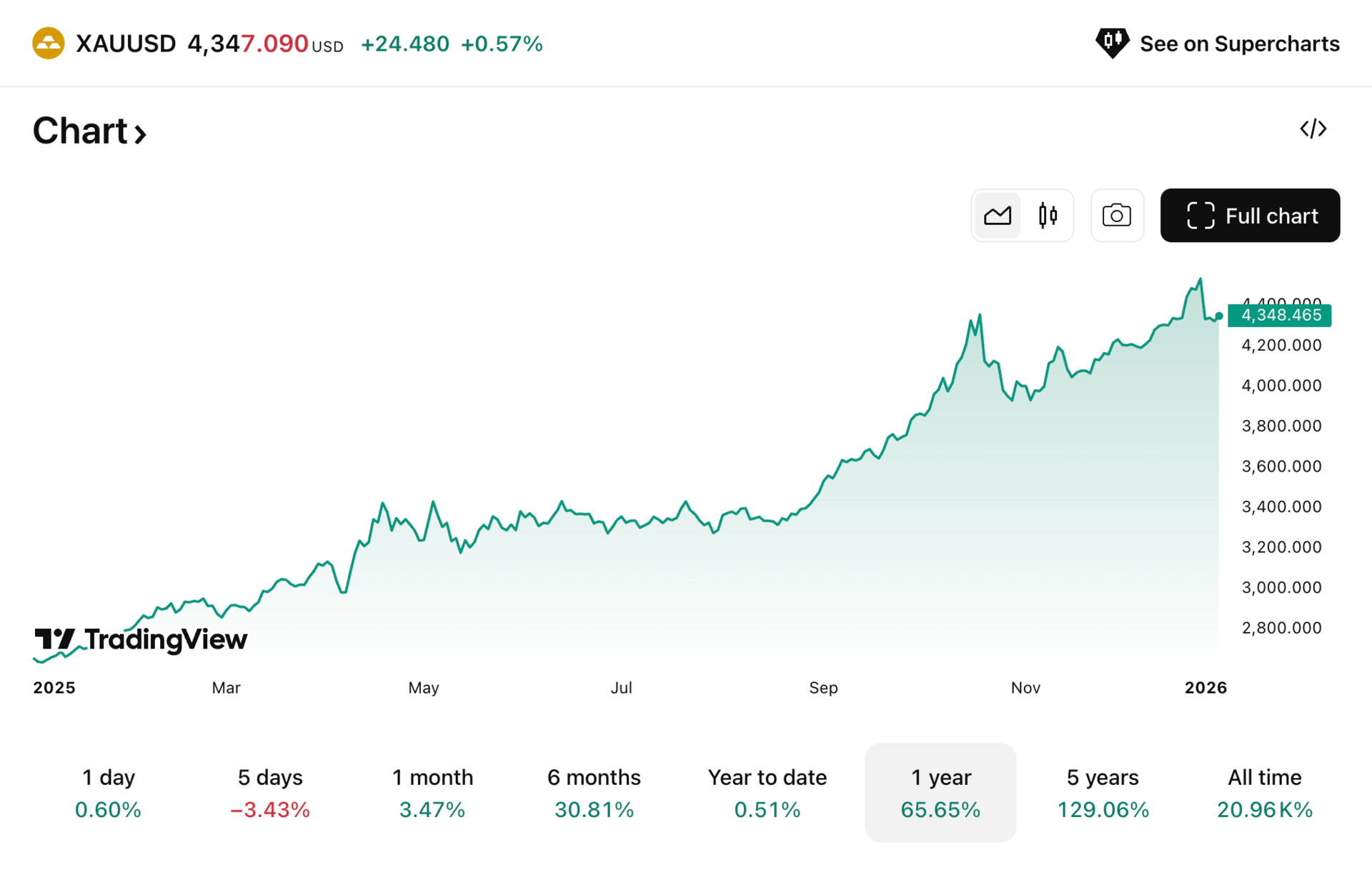

Gold went up 65%. Silver went up 144%. These aren't normal moves. These are "the financial system is broken" moves.

Why? Three reasons:

Central banks are panic-buying: China, Russia, and others are dumping dollars and buying gold

Currency is becoming worthless: Governments can print unlimited money, but they can't print gold

We're running out of silver: Five straight years of using more than we mine

Why This Matters:

Money used to be backed by gold. Now it's backed by nothing except government promises. When people stop trusting those promises, they buy gold.

Silver's even crazier. It's not just a shiny metal—it's required for solar panels, electric cars, and AI data centers. You literally can't build green energy without it. And we're running out.

The Trade:

Big Wall Street banks are calling for gold to hit $5,000 per ounce by the end of 2026. We agree. Every time central banks buy 100 tonnes of gold, the price goes up 2%. They're buying hundreds of tonnes this year.

Silver? We're calling $100 per ounce. The ratio of gold to silver prices is still way out of whack. When it corrects, silver explodes.

₿ Prediction #4: Bitcoin Swings Like a Drunk Pendulum ($60K-$140K)

Bitcoin hit $126,000 in October (cue champagne), then crashed to $87,000 by year-end (cue tears). Classic Bitcoin. The "Crypto President" hype drove it up, then reality smacked it down.

But here's what's different now:

The US government owns 233,736 Bitcoin

Big companies are putting Bitcoin on their balance sheets

Retirement accounts might be allowed to buy crypto in 2026

Why This Matters:

Bitcoin is going mainstream. It's not just degenerates on Reddit anymore—it's governments, pension funds, and Fortune 500 companies. Even a tiny 1% allocation from traditional finance unleashes billions in buying.

But Bitcoin's also becoming more tied to regular stocks. It's losing its "Bitcoin moves independently" status and acting more like a leveraged tech stock.

The Trade:

Analysts are calling for $120,000-$170,000 if things go well. But it could also crash to $50,000 or lower if the economy tanks or people stop buying.

What We're Doing:

The only reason I bought my first house at 25 is thanks to Bitcoin.

I treat Bitcoin as a bet on money printing. If the Fed prints more money, Bitcoin flies. If they tighten, Bitcoin crashes. I’m long-term bullish and have like 50% of my portfolio in it.

As Munger says, you only need a few great bets in your life to get rich, so why diversify?

⚠️ Prediction #5: The Sleeper Threat – Tariff War 2.0

The Scenario Nobody's Pricing In:

A full-blown tariff war that creates stagflation—prices rising (tariffs tax everything) while the economy tanks (nobody buys expensive stuff). The Fed gets trapped: can't cut rates (inflation) or raise them (dying economy). Your portfolio gets destroyed from both sides.

Our Actual Take: Probably Won't Happen

The TACO Trade (Trump Always Chickens Out) made us money all through 2025. Every tariff tweet = buy the dip. He threatened, markets panicked, we bought, he backed down, markets ripped. Rinse, repeat, profit.

We're betting this playbook continues in 2026.

The "But" That Keeps Us Awake:

Three geopolitical powder kegs could force Trump's hand:

China-Taiwan: Real conflict shuts down semiconductor supply, craters global trade

Russia-Ukraine: Escalation spikes energy prices, triggers global risk-off

Israel-Palestine: Middle East chaos disrupts oil, ignites regional war

Any of these erupting gives Trump cover to actually follow through on tariffs "for national security." Suddenly the TACO trade stops working and you're catching falling knives instead of buying dips.

🎊 The Bottom Line: Chaos Is the Only Certainty

2026's going to be a financial roller coaster built by a committee that couldn't agree on safety standards. Stocks are expensive, the dollar's melting, metals are mooning, Bitcoin's schizophrenic, and tariffs are a loaded gun.

But here's the play: volatility creates opportunity. Winners in 2026 won't be chasing meme stocks or believing "stonks only go up." They'll respect risk, stay flexible, and keep cash ready for panic.

Our strategy: Positioned to win either way. Enough invested that if markets rally, we profit. Enough cash that if markets crash, we buy the discount.

Not financial advice—just our gameplan. You do you.

We'll see you every morning in 2026 breaking down the chaos.

Happy New Year,

— Pip Munch

P.S. That $1 Million trading competition? Free to enter. My wife registered specifically to beat me, which stings but is probably justified. Don't let her be the only one flexing on me in 2026. Register here →

What do you think of today's edition? |

Get In Touch 📫️

Want to advertise with us? Email Matthew at [email protected]; follow him on Twitter.

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER