- Pip Munch

- Posts

- 🍎📦🏠 Apple, Amazon, Airbnb — Earnings Smackdown

🍎📦🏠 Apple, Amazon, Airbnb — Earnings Smackdown

Still waiting for your payout? That’s cute. At Lark Funding, traders get paid in under 6 hours. No red tape. No fine print. Just raw spreads, fast payouts, and up to 90% profit splits.

☕️ GM Traders! The market's like my morning bedhead—wildly unpredictable and refusing to cooperate despite my best efforts with premium Japanese styling products. Speaking of Japan...

On today’s menu:

🍎📦🏠 Big Tech's Earnings Circus

😯 Why This NFP (Shockingly) Might Not Matter

🇯🇵 Japan's 0.1% Problem

😍 Fear Is Leaving The Market

💰️ Microsoft Becomes The World’s Most Valuable Company

Yesterday’s numbers:

S&P 500 | 5,504 | +0.63% |

Nasdaq | 17,710 | +1.52% |

Dow Jones | 40,752 | +0.21% |

Gold | $3,239 | +0.09% |

Bitcoin | $96,571 | +0.08% |

STOCKS

🍎📦🏠 Big Tech's Earnings Circus

If your portfolio feels like it's riding a mechanical bull today, blame the tech earnings trifecta that just dropped. Let's dissect the carnage and opportunity.

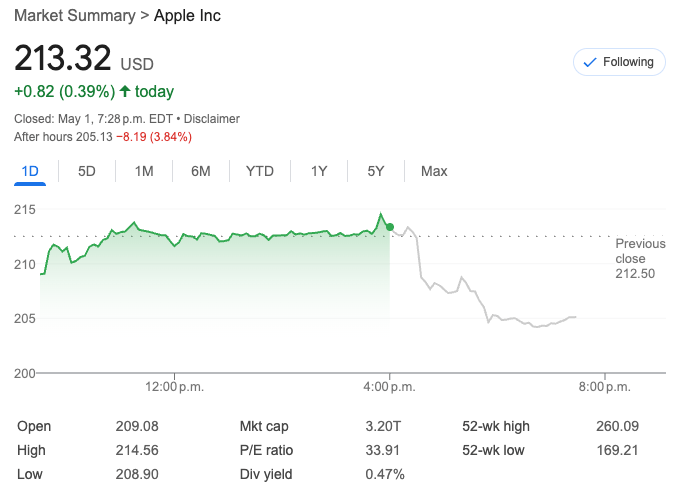

🍎 APPLE: BEATS, BUT NERVOUS ABOUT WHAT’S NEXT

Apple delivered $95.4B revenue (vs $94.66B expected) and $1.65 EPS (beating $1.63 estimates). iPhone sales crushed it at $46.84B, handily beating $45.84B forecasts.

The buzzkill: Tim Cook warned it's "very difficult" to predict tariff impacts beyond June, with $900M in extra costs expected this quarter. They're scrambling suppliers between China, Vietnam, and India faster than traders can update their spreadsheets.

📉 The market's response?

Shares tumbled 4% after hours, reacting to uncertainty like a cat to a cucumber. Services revenue ($26.65B vs $26.7B expected) missed by a whisker, proving even Apple's golden goose occasionally lays a dud.

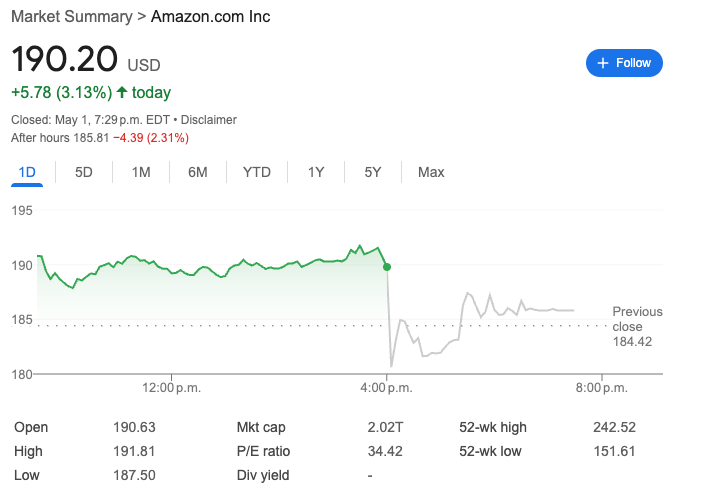

📦 AMAZON: PROFITS UP, BUT GUIDANCE SPOOKS

Amazon crushed Q1 with $155.67B revenue (beating $155.04B expectations) and $1.59 EPS (demolishing $1.36 forecasts). AWS pulled in $29.3B, slightly missing targets but still impressive.

The stock still dropped 2% after hours because... guidance.

Classic market overreaction? Perhaps.

Q2 operating income guidance of $13-17.5B fell short of $17.64B consensus, with management muttering anxiously about "tariffs and trade policies." With Trump's 145% China tariffs looming, Amazon's import-heavy business model suddenly looks as precarious as a Jenga tower in an earthquake.

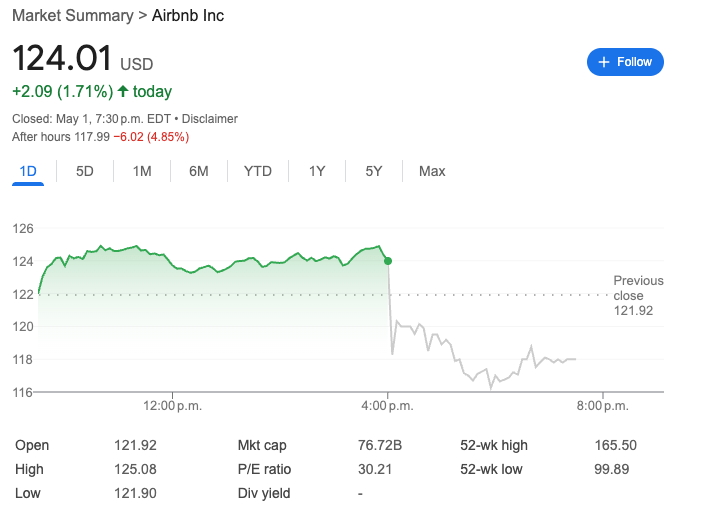

🏠 AIRBNB: TRAVEL COOLS, STOCK DROPS

Airbnb squeaked by with $2.27B revenue (vs $2.26B expected) and matched $0.24 EPS estimates, but Q2 guidance landed like a lead balloon: $2.99-$3.05B versus the $3.04B Wall Street wanted.

The culprit?

Weaker cross-border travel, especially from Canada to the U.S. (though Canadian visits to Mexico jumped 27% – apparently tequila beats maple syrup).

Shares dropped 5% faster than a bad host's rating.

💡 TRADER’S COMPASS

The through-line here isn't subtle: solid recent performance overshadowed by tariff terror.

For traders navigating Q2, technical analysis alone won't cut it – you'll need geopolitical instincts sharper than a hedge fund manager's suit. The smart money is hedging against tariff impacts while keeping powder dry for the inevitable overreactions.

Remember: In markets driven by fear, the real opportunity often hides behind the headlines.

SPONSORED BY

Want to trade larger accounts—without risking your own savings?

That’s exactly what prop firm challenges are designed for.

At Lark Funding, traders can access simulated accounts up to $600K and earn up to 90% profit splits based on performance.

No need to fund a big account. No risking personal capital.

Prove your skill in a challenge, and you’ll be eligible for real payouts—fast. In fact, they process most in under 6 hours.

MARKETS

😯 Why This NFP (Shockingly) Might Not Matter

Depending when you read this, the non-farm payrolls (NFP) report is either just hours away or already on your screen.

For those living under a trading rock, NFP drops the first Friday of every month — the Super Bowl of market data. It’s the key snapshot of U.S. jobs, giving both traders and the Fed a read on the economy’s pulse.

This month, expectations are:

✅ Unemployment steady at 4.2%

✅ Payrolls adding ~124K jobs

But here’s why some think this print won’t move the needle:

→ If the report’s strong, markets may shrug — because the data reflects a pre-tariff economy.

→ If the report’s weak, traders might chalk it up as a one-off fluke.

Honestly, markets have been a snoozefest this week, so we’re hoping NFP brings some fireworks. Either way, keep those stop losses tight — no one wants to start the weekend bleeding.

FOREX

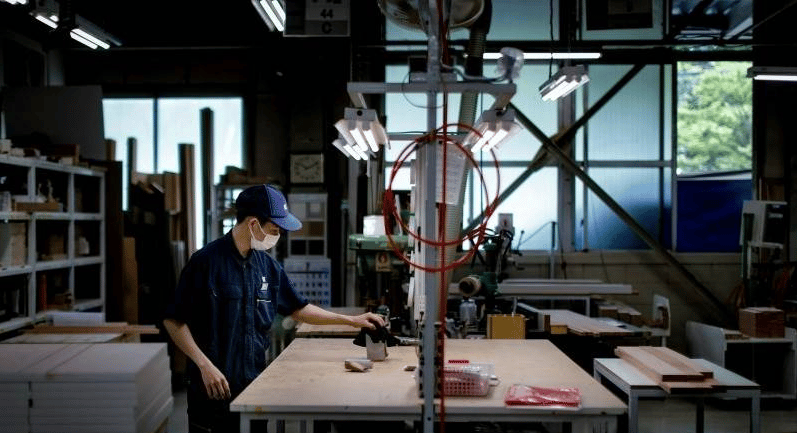

💴 Japan's Jobless Surprise: The Tiny Number That Could Move Big Money

Remember when 0.1% meant nothing? In forex, it's the difference between champagne and cup noodles.

Japan's unemployment hit 2.5% for March (seasonally adjusted), up from February's 2.4%. In JPY trading, that tiny uptick is like someone juggling nitroglycerin near your trading setup.

The economists missed again. Shocker.

The Job Market Paradox

Plot twist: Despite higher unemployment, Japan's job-to-applicant ratio increased to 1.26 from 1.24.

Translation: 126 job openings for every 100 job seekers.

More jobs AND more unemployment? Pure economics – where contradiction is the national sport. This signals structural mismatches rather than economic weakness. Like having premium ingredients but no recipe.

JPY Trading Playbook

For bleary-eyed USD/JPY chart watchers, here's the deal:

BoJ Pressure Relief: Higher unemployment could keep the Bank of Japan's foot off the tightening pedal. Trader's version: Yen likely stays weaker, making USD/JPY longs potentially juicier than forbidden midnight snacks.

Risk-On Momentum: Current USD/JPY sentiment suggests traders are in adventure mode. Dollar strength strategies have runway, but keep your exit strategy ready like a samurai's sword.

The Bottom Line 🧵

Japan's job market is throwing mixed signals like a malfunctioning traffic light. The 2.5% unemployment rate alongside that 1.26 job ratio has seasoned traders scratching their heads.

Smart money is laser-focused on the Bank of Japan's next move. Blip or trend? Your yen positions are hanging in the balance.

PROP FIRMS

🤑 Friday Motivation

I have Just received my first payout $34,537.14 in 2 weeks by @FTMO_com

this isn’t luck, it’s skill, discipline, and consistency.

Huge thanks to FTMO for being a legit prop firm that actually pays out.To anyone grinding: stay focused, it’s 100% possible. I did it, and so can

— Shōgun (@1FX_SHOGUN)

6:51 PM • Apr 30, 2025

🚀 Pre-Market Fuel

🍪 Munchy Memes

Me with $127 in my pocket worrying about negative GDP and a consecutive recession

— Not Jerome Powell (@alifarhat79)

1:47 PM • Apr 30, 2025

I’m not trading this market. I’ll stay in cash till the tariff nonsense is over.

5 minutes after the market opens:

— Not Jerome Powell (@alifarhat79)

10:03 PM • Apr 14, 2025

Me telling my wife i lost our entire net worth on memecoins

— lynk (@lynk0x)

2:17 AM • Mar 9, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER