- Pip Munch

- Posts

- 🚀 Are We Back?

🚀 Are We Back?

Tired of waiting weeks for your payout?

Lark Funding gets you paid fast. Under 6 hours, on average. No delays. No fluff. Just raw spreads, fast payouts, and up to 90% splits.

☕️ GM Munchers!

On today’s menu:

📈 Markets Rip Thanks To Trump & Musk

🧠 The Trader Who Made $2M Betting 'No'

🧐 Are We in a Recession? Depends Who You Ask.

🇨🇭 Switzerland Buys Bitcoin

🤯 Warren Buffett now owns 4.6% of the entire US Treasury Bill market.

BREAKING NEWS

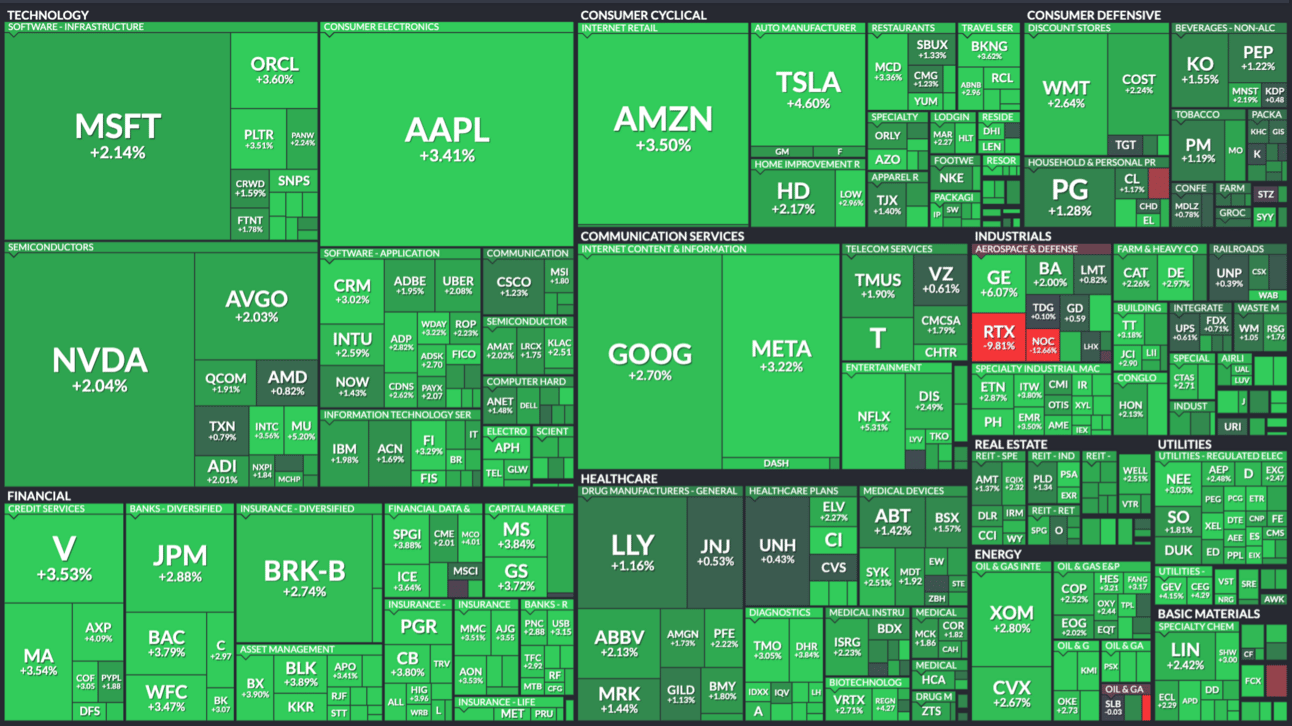

📈 Markets Ripped After Trump + Musk Tried to Calm Everyone Down

The market was down bad on Monday. So yesterday, the Trump admin basically said: “Our bad.”

And just like that, we got a full 180.

Dow: +2.66% 🚀

S&P 500: +2.51% 🚀

Nasdaq: +2.71% 🚀

The S&P closed at 5,287.76, snapping a nasty losing streak and recovering most of Monday’s wipeout.

🧢 Trump: “I’m not firing Powell”

After nuking market confidence by calling Powell a “major loser” and flirting with firing him, Trump reversed course:

“No intention of firing him. Never did.”

Translation: please stop selling.

That was enough to get algos and traders breathing again—Powell’s job (and the Fed’s independence) appear safe for now.

🇨🇳 Bessent: “De-escalation” with China is coming

Treasury Secretary Scott Bessent told investors he expects a “de-escalation” in Trump’s trade war with China.

No deal was announced, but the vibes were good enough to send the Dow up 1,100 points intraday.

Even better? The White House said there are 18 trade deal proposals “on paper.”

No details… but hey, paper’s better than nothing.

BREAKING: The White House says there are 18 proposals on paper for trade deals.

— The Kobeissi Letter (@KobeissiLetter)

5:25 PM • Apr 22, 2025

China-related ETFs jumped ~3% on the news.

🚗 Elon: “I’ll be spending less time at DOGE HQ”

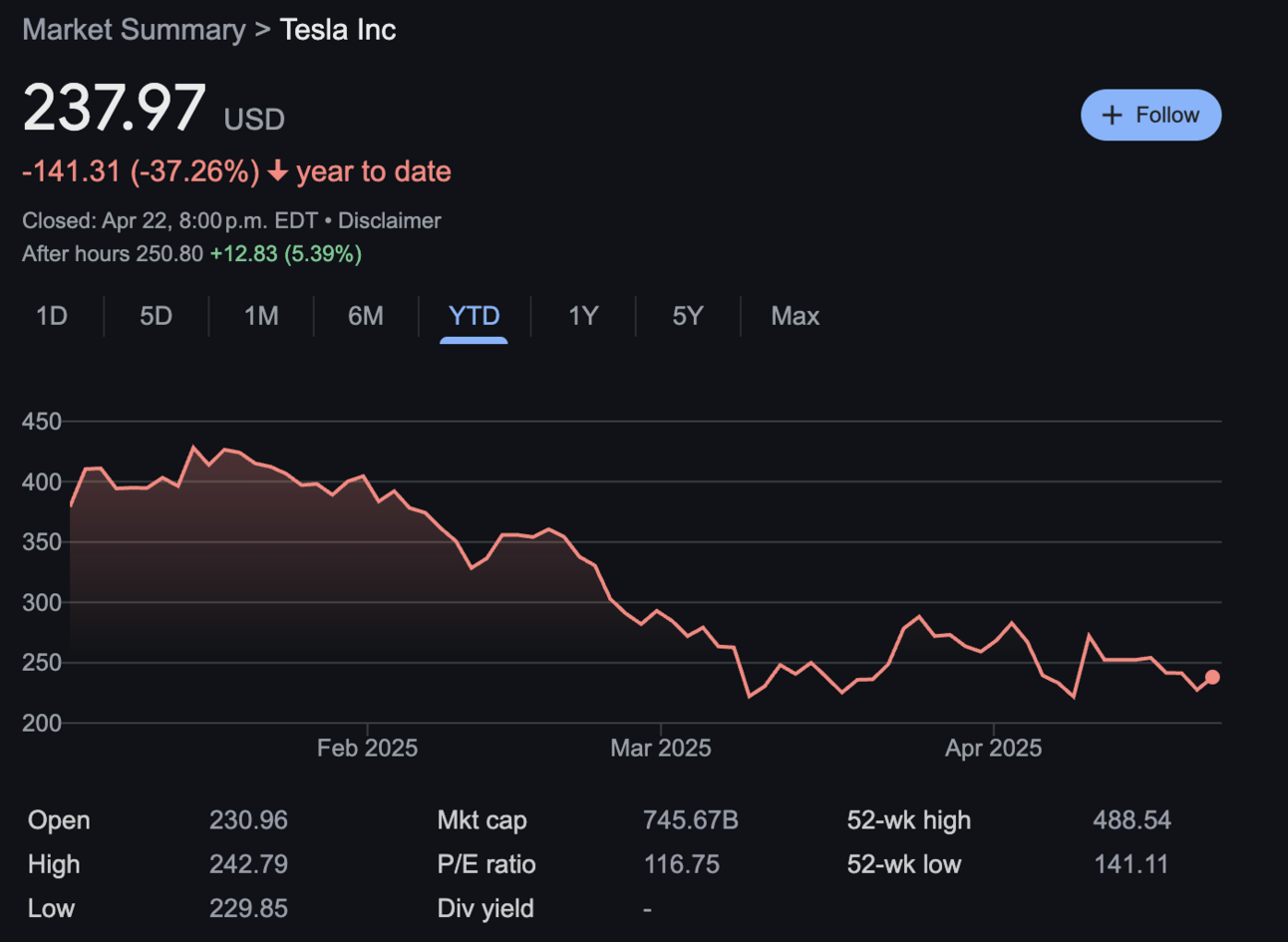

Even though Tesla’s earnings were a full-blown disaster (revenue down 20%, profit down over 70% 🤯 ), the stock still climbed 4% yesterday.

Because apparently, bad news is good news again.

Part of the rally came after Musk promised to spend “significantly” less time in D.C. lobbying and Tweeting from the Oval Office.

In other words, he's going back to the factory. Probably.

💡 Trader takeaway

This wasn’t a fundamentals rally—it was a PR rally.

No rate cut. No trade deal. Just damage control.

But hey, we’ll take it. In this market, sometimes that’s all it takes to turn the tide.

BROUGHT TO YOU BY

The Fastest Payouts In The Industry—Since 2022

Since 2022, Lark Funding has built a reputation on one thing: speed.

They process payouts in under 6 hours on average—even on weekends. No long waits. No excuses.

Choose from 1-step, 2-step, 3-step, or Instant challenges. Up to $600K funding. 90% splits.

When you’re ready to trade fast, scale fast, and get paid fast—there’s only one prop firm to call.

SUCCESS STORIES

🧠 The Trader Who Made $2M Betting 'No'

> Bets 'NO' on almost everything happening

> Over $2 million in profits

Maybe this guy is onto something??

— Polymarket (@Polymarket)

8:10 PM • Apr 14, 2025

Most people dream of winning big by betting on wild stuff happening.

Not this guy.

Meet JustPunched — a Polymarket trader who’s made $2.1 million doing the opposite: Betting ‘No’ on everything.

Will Trump pardon Hunter Biden?

No.

Will Diddy get declassified?

No.

Will Giannis win MVP?

Still no.

Will aliens show up and make a podcast?

Big fat no.

He’s placed over 6,700 bets and has one of the most consistent edges in prediction markets.

His strategy? Simple:

Fade the noise.

🤔 Why Saying ‘No’ Pays

Most people overestimate the odds of rare things happening — especially in politics, crypto, and financial Twitter.

That creates opportunity.

The edge isn’t in betting against events.

It’s in betting against human nature.

The world loves hype.

The headlines scream “historic,” “unprecedented,” “inevitable.”

But most things? They fizzle. They get delayed. They don’t happen.

“JustPunched” figured out that in chaotic environments, the smart bet is often no bet at all — or even better, a bet against.

📉 Traders, Take Note:

This is the same psychology that drives bad trades:

FOMOing into a “guaranteed” breakout

Buying news that’s already priced in

Betting on the possibility instead of the probability

Want to trade like a pro?

Be the guy who shrugs at the headlines.

Bet less. Bet smarter. And sometimes, bet against the noise.

Turns out, “No” might be the most profitable word in trading.

MARKET ANALYSIS

🧐 Are We in a Recession? Depends Who You Ask

The market’s acting like it just Googled “Am I sick?” and now thinks it’s dying. But is the economy actually crashing—or just a little bloated?

Here are 5 signals sending very mixed messages:

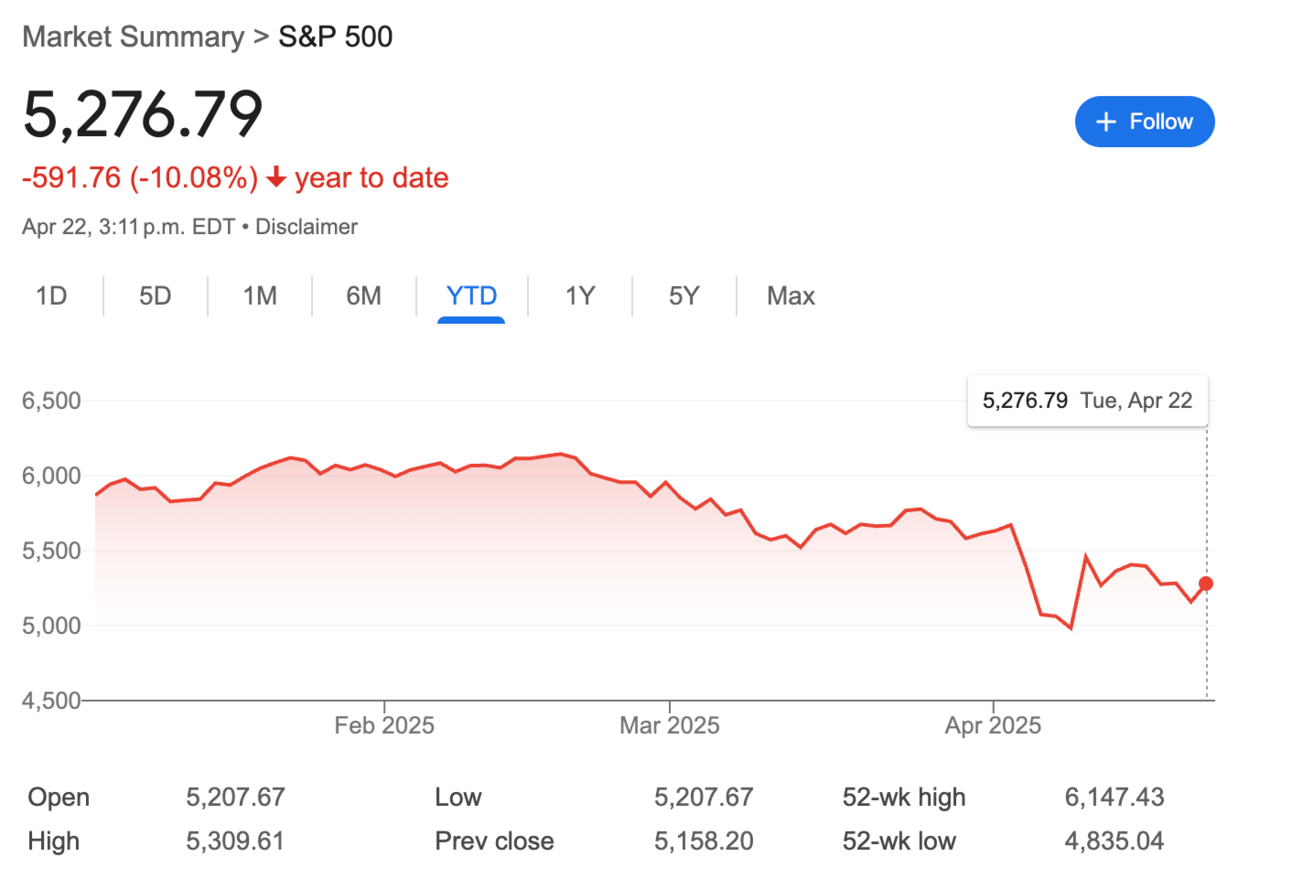

1. 🪦 Death Cross Alert

The S&P 500 just printed a death cross (50-day moving average crossing below the 200-day).

The S&P 500 has formed a "death cross" for the first time since 2022.

— Brew Markets (@brewmarkets)

1:36 PM • Apr 16, 2025

Historically, it’s a spooky signal.

But in reality?

Since 1940, stocks on average rise +6.3% over the next 12 months after a death cross.

Not exactly apocalyptic. More like a bad Tinder date—awkward but survivable.

2. 🥉 Copper-to-Gold Ratio: Screaming Recession

Another recession signal has arrived:

The copper-to-gold ratio has dropped to its lowest level in at least 40 years.

This ratio has halved over the last 3 years.

The decline has accelerated over the last month as gold prices have risen +9% while copper prices have plummeted

— The Kobeissi Letter (@KobeissiLetter)

1:07 PM • Apr 22, 2025

This ratio just hit its lowest level in 40+ years.

Gold is up +9% in the last month. Copper? Down -8%.

That combo has historically signaled weakening global growth—the last two times this crashed? 2008 and 2020. Yikes.

3. 💼 Unemployment: Holding Up... In the US

US unemployment is at 4.2%—not great, but not bad either.

Compare that to Canada, where it's up to 6.7%, and you can see why CAD is having a rough time.

The labor market isn’t falling apart… yet.

4. 🌍 Foreign Investors Are Dipping

Foreigners just pulled $5B from US corporate bonds—the biggest exodus since April 2020.

It’s a sign of declining confidence in the US economy.

And when global capital gets nervous, risk assets usually feel the heat.

5. 📉 Stocks Are... Actually Fine?

Despite all the drama, the S&P 500 is only down 9% this year.

Not great, but hardly a disaster. For context: during COVID, it dropped 34% in a month.

So What’s the Trade?

Right now, markets are torn between “this is the top” and “this is the dip.”

Signals like copper and bond outflows suggest the global economy is weakening.

But unemployment and stock performance aren’t confirming doom just yet.

At Pip Munch?

We’re keeping a close eye on the dollar and gold. If we’re really heading for recession, those two will tell you faster than any economist will.

PROP FIRMS

🤑 Wednesday Motivation

Just requested my first ever 5 figure payout!! The biggest milestone in my trading career!!

The years of suffering I had to endure to get to this point, the debt I went into, the lonely nights locked in my room just backtesting, the mental breakdowns, the countless failed evals,

— RyanK (@TraderRyanK)

5:54 AM • Apr 22, 2025

🚀 Pre-Market Fuel

🍪 Munchy Memes

"Mom, why are we so rich?"

"Because daddy diamond-handed through tariff wars"

— Lark Davis (@TheCryptoLark)

9:31 PM • Apr 17, 2025

My portfolio My portfolio

in 2024: in 2025:— Not Jerome Powell (@alifarhat79)

12:44 PM • Apr 15, 2025

"they're called collateralized coachella obligations"

— Dip Wheeler (@DipWheeler)

5:01 AM • Apr 15, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER