- Pip Munch

- Posts

- 📉 Bitcoin Whiplash, Fed Pivot, OpenAI Bleeds

📉 Bitcoin Whiplash, Fed Pivot, OpenAI Bleeds

The Debt Crisis Has Begun. America’s $37 trillion time bomb just detonated – and the shockwave could rip through your stocks and retirement…

☕️ GM Munchers! My wife asked if I'm "winning" in the markets and I had to explain that technically losing money slowly is a form of risk management.

On today’s menu:

📉 Bitcoin Whiplash, Fed Pivot, OpenAI Bleeds

🪙 Gold Just Embarrassed Every Stock Picker Alive

👀 Dell Donates & Tesla Stagnates

😬 The Fed Is Pumping Up Banks

✅ FTMO Finalizes Oanda Acquisition

Yesterday’s numbers:

S&P 500 | 6,829 | +0.25% |

Nasdaq | 23,413 | +0.59% |

Dow Jones | 47,474 | +0.39% |

Bitcoin | $91,482 | +6.00% |

BREAKING NEWS

🎢 Bitcoin's Emotional Rollercoaster Continues (We're Getting Whiplash)

Let's recap this week's absolute chaos:

Sunday: Bitcoin stabilized around $90K. We said so confidently.

Monday: Bitcoin crashed 6%. We looked like idiots.

Tuesday: Bitcoin said "psyche!" and ripped 6%+ higher, climbing back above $90K to around $92,000.

Yesterday was Bitcoin's biggest daily gain since May 2025, and once again—zero headlines, zero catalysts, zero logic.

So, what happened?

Once again it was just pure mechanical chaos driven by excessive leverage.

Here's the wildest part: In a single one-hour period, $140 million of shorts got liquidated. People betting against Bitcoin got steamrolled as leveraged positions collapsed, forcing buybacks that pushed prices higher.

As a result, Bitcoin added $75 billion in market cap in 10 hours.

Stocks caught a bid too, with all three indexes closing in the green.

The Munch Take: This is what happens when leverage dominates price action—fundamentals take a backseat and mechanical liquidations drive the bus. December volatility is just getting started and we’re loving it.

💵 The Fed Just Ended Quantitative Tightening (And That's Huge)

The Federal Reserve officially ended quantitative tightening (QT), and odds of a December rate cut hit 91% according to CME FedWatch.

Translation: The Fed stopped draining cash from the financial system. That means easier liquidity, lower rates, and more support for risk assets like stocks and crypto.

What This Means:

Equities: Bullish for tech, small caps, growth stocks, real estate, and consumer discretionary

Risk assets: Corporate bonds and crypto benefit from friendlier conditions

Cash becomes less attractive: Lower rates make holding cash less appealing

It's no coincidence Bitcoin ripped 6%+ yesterday as this news hit. Risk assets love easy money.

The Munch Take: This is a green light for risk assets into year-end. The Fed's pivot is exactly what bulls needed. Expect continued strength in crypto, tech, and growth stocks.

🤖 OpenAI Declares "Code Red" as Google's Gemini Takes Off

Sam Altman reportedly declared "code red" at OpenAI after Google's Gemini 3 started gaining traction. Internal memos show OpenAI is pausing projects like ads and shopping to focus on improving ChatGPT.

Competition breeds innovation—bullish for AI.

But here's the problem: OpenAI just paused their ads business (the thing that makes money) to focus on product. Meanwhile, reports show they need to raise $207 billion by 2030 to stay in business, and even then, they'll still be losing money.

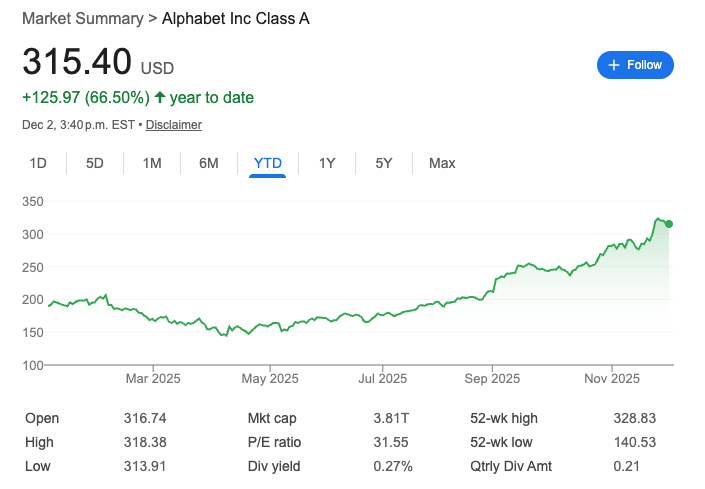

Reality check: If you're investing in AI companies, they need to actually make money. This is why Buffett bought Google—they print cash, dominate search, and crush in AI. Google's up 11% this month and 66% YTD because they have innovation and profitability

The Munch Take: Innovation is exciting, but cash flow pays bills. Bet on AI companies with proven business models and actual revenue—not just hype. Google's looking pretty good right now.

BROUGHT TO YOU BY

Fail Once. Try Again for Free.

Thinking about your first prop firm challenge? Don't do it without a safety net.

Lark Funding 3.0 just changed the game:

🔄 Buy 1, Get 2 Tries: Flunk the first one? The second one is on the house.

💸 Get Paid: Earn up to $1,000/month salary plus your split.

📉 7% Max Drawdown: The most breathing room in the industry.

🚫 No Consistency Rules: Trade how you want, when you want.

It’s the smartest way to get funded in 2025.

COMMODITIES

🪙 Gold Just Embarrassed Every Stock Picker Alive

Gold is now outperforming the S&P 500 over the last 30 years. Read that again. A shiny rock with zero cash flow just beat the greatest wealth-creation machine in human history.

This year alone? Gold is up 60%. Meanwhile, Bitcoin is down 10%, and the S&P 500 is up a respectable 16%—which would normally be phenomenal, except gold just made it look pedestrian.

Here's What Should Blow Your Mind:

This isn't a fluke year. Gold has crushed stocks over three decades. No earnings calls. No product launches. No dividends. No charismatic CEO promising "10x growth." Just a hard asset sitting there, appreciating while everyone debates which AI stock to buy.

Why This Matters:

The market has figured out the game: Regardless of who's in office, debt will climb and dollars will get printed. The only real hedge is owning hard assets—gold, real estate, Bitcoin (when it's not having an identity crisis), commodities.

Fiat currency is slowly melting like ice cream on a hot day, and the smart money is rotating into things that can't be printed into oblivion.

The Munch Take:

Own assets or get left behind. That's it. That's the entire message. While you're debating entry points and P/E ratios, gold is quietly outperforming your entire portfolio over 30 years without lifting a finger.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

$DELL Michael and Susan Dell just dropped $6.25 billion to fund "Trump Accounts" for 25 million kids—giving each one a $1,000 grant for new federal investment accounts that parents can open for children under 18. Say what you want about billionaires, but handing 25 million kids a grand to start investing? That's actually pretty cool.

$AAPL Apple's artificial intelligence chief is stepping down. Considering Siri still can't understand basic requests without having an existential crisis, we're honestly shocked they even had an AI chief. Maybe the next one can teach Siri to set a timer without asking three clarifying questions.

$TSLA Plot twist: Tesla hasn't grown revenue in two years according to this chart, yet the stock is somehow up 13% YTD. At this point Tesla's valuation is less about selling cars and more about pure vibes and Elon tweets. Welcome to 2025.

$AMZN Amazon popped 2% after announcing a new in-house AI chip that's supposedly more "cost effective" than Nvidia's. Translation? Amazon's tired of paying Nvidia's premium prices and decided to build their own. Classic Big Tech move—if you can't negotiate a better deal, just become your own supplier.

🚀 Pre-Market Fuel

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER