- Pip Munch

- Posts

- 📉 BREAKING: Bitcoin Climbs Over $3,000 In Minutes

📉 BREAKING: Bitcoin Climbs Over $3,000 In Minutes

Dear Trader,

PropFirm Pulse just released a devastating report. 87% of traders who passed challenges in Q3 are already blown out.

The reason? One bad trading day during a drawdown, and their $100k account vanished. But there's a firm quietly solving this exact problem — and funded traders are noticing.

A colleague who runs due diligence on prop firms called me last week about what he's seeing with our traders at Lark.

"Matthew, you're paying traders a salary during drawdowns. Nobody else is doing this."

He's right. While other firms are collecting challenge fees and blowing out 9 out of 10 traders, we're doing something radically different.

The difference? A 7% max static drawdown (vs. the industry's brutal 5%), and we actually pay you monthly even when you're in a drawdown. This could be the edge between becoming a career trader or another blown account statistic.

Matthew

Lark Funding, CEO

☕️ Howdy Munchers.

If you're reading this email in real-time, Bitcoin is currently going absolutely parabolic.

In the last 60 minutes, Bitcoin surged above $93,000 as over $130 million worth of leveraged shorts got liquidated. That's not a typo—$130 million in forced buybacks in one hour.

What's Happening Right Now:

This isn't just organic buying. This is a short squeeze on steroids combined with traders front-running tomorrow's Fed decision.

Here's the setup:

Rate cut is locked in: 94% odds the Fed cuts 25 bps tomorrow

Shorts got overleveraged: After Bitcoin's recent volatility, too many traders bet against it

Liquidity cascade: Once Bitcoin broke key resistance, stop-losses and margin calls triggered a chain reaction of forced buying

The Bigger Picture:

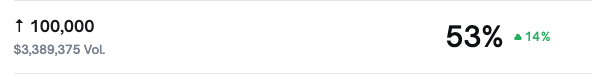

There's now a 53% chance on prediction markets that Bitcoin hits $100K before the end of the year. That's up 14% just today.

Why This Move Makes Sense (Sort of):

We've been screaming this for weeks: rate cuts are rocket fuel for risk assets. Lower rates mean:

Cheaper borrowing costs

More liquidity flooding the system

Investors rotating out of cash into anything with upside

Bitcoin, as the ultimate risk-on asset, is the first to move when rate cut expectations solidify. Tomorrow's Fed decision is basically a done deal, and traders are positioning now instead of waiting for Powell to confirm what everyone already knows.

What Drove Today's Spike:

1. Short liquidations: $130 million in shorts getting wiped out in an hour creates explosive upward pressure. When shorts are forced to buy back, it creates a feedback loop—price goes up, more shorts liquidate, price goes up more.

2. Rate cut front-running: Smart money isn't waiting for tomorrow's announcement. They're buying today because by the time Powell finishes his press conference, the opportunity will be gone.

3. Dip-buying after a rough year: 2025 has been a rollercoaster for Bitcoin. Every sign of stabilization or positive narrative (like rate cuts or clearer US crypto legislation) triggers sharp percentage moves off depressed levels.

The Polymarket Odds:

Prediction markets now show a 53% probability Bitcoin crosses $100K before year-end. That's a massive shift in sentiment in a single day.

What to Watch Next:

Tomorrow's Fed decision: The cut is priced in, but watch Powell's language about 2026. If he signals more cuts ahead, Bitcoin could rip even higher.

$100K psychological level: If Bitcoin breaks six figures, FOMO will kick in and retail will flood back in.

Liquidation cascades: This works both ways. If Bitcoin reverses sharply, overleveraged longs could get wiped just as fast.

The Munch Take:

This is what we've been saying: bad economic data = Fed easing = bullish for risk assets. Bitcoin is leading the charge because it's the most sensitive to liquidity conditions.

If you're holding spot Bitcoin, congrats—you're up big today. If you're leveraged long, tighten those stops because this kind of volatility cuts both ways. And if you're still sitting in cash waiting for "the right time," the market just moved without you.

Tomorrow's rate cut is the confirmation. Today's move is the market saying "we're not waiting around."

See you tomorrow when Powell makes it official.

— Pip Munch

PS: Yes, you can trade Bitcoin with Lark Funding. Many traders are up big with this move.

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER