- Pip Munch

- Posts

- BREAKING: Trade Tensions Heat Up. What’s Next for Global Markets? 🌍

BREAKING: Trade Tensions Heat Up. What’s Next for Global Markets? 🌍

Markets are heating up with tariffs, rates, and earnings on the radar. Get the scoop. 📈

Today’s market breakdown is powered by Lark Funding—helping you hit your trading goals faster.

Use code FEB90 for 9% off + free 90% rewards on our new 1-step challenge with just a 9% target and 6% max drawdown. Let’s get you funded!

☕️ GM Munchers! This is Pip Munch, the trading newsletter that’s here to outshine last night’s Super Bowl snooze-fest. Unless you’re an Eagles fan… In which case, we’ll humbly take second place.

On today’s menu:

Trade Tensions Heat Up: What’s Next for Global Markets? 🌍

What’s Moving Markets This Week? Inflation, Rates, and Major Earnings 📈

Trump Is Serious About Canada Becoming The 51st State 🇨🇦

A New Prop Firm/Influencer Scam 🤔

TRADE WAR

Trade Tensions Heat Up: What’s Next for Global Markets? 🌍

Just when you thought it was safe to sit back with your coffee and charts, tariffs decided to crash the party again.

President Trump is back on the mic, and the headline is this: 25% tariffs on steel and aluminum imports are coming Monday, with reciprocal tariffs on the table for countries that tax U.S. imports.

Markets?

Oh, they’ve taken notice.

The U.S. dollar has been climbing 30-50 pips on various crosses, but the real action could be just around the corner.

Let’s break it down.

Tariffs = Risk Sentiment Wrecker 📉

👉️ Here’s the deal: tariffs don’t just make goods more expensive—they mess with global trade flows, consumer prices, and market sentiment.

Traders hate uncertainty, and tariffs serve it up in extra-large portions.

Key takeaway? Risk-off sentiment could kick in.

That means currencies like JPY and CHF could catch a bid while equities and commodity currencies (looking at you, AUD and CAD) feel the pain.

How Would a Pro Trader Play This? 🤑

If you were a trading ninja (you know, the kind who looks at the chart and somehow always knows what’s next), here’s how you’d position yourself:

USD Strength: With tariffs likely to disrupt global trade, the USD could stay firm. Keep an eye on pairs like EUR/USD and AUD/USD for potential moves lower.

Safe Havens: Risk-off sentiment tends to boost safe-haven currencies. Look at AUD/USD for downside moves and USD/CAD for volatility as traders flee to safety.

Commodities: Higher tariffs could put pressure on industrial metals like steel and aluminum. Gold might catch a bid if risk-off sentiment really picks up.

Equities: Watch out for U.S. stocks, especially industrial names like Caterpillar and Boeing. These companies have the most to lose from higher trade costs. Keep your eye on the S&P 500—risk-off could drag it lower.

What’s Next? 🤔

We’re in “wait and see” mode until these tariffs are set to go live.

But here’s the kicker: markets don’t think Trump actually wants a trade war.

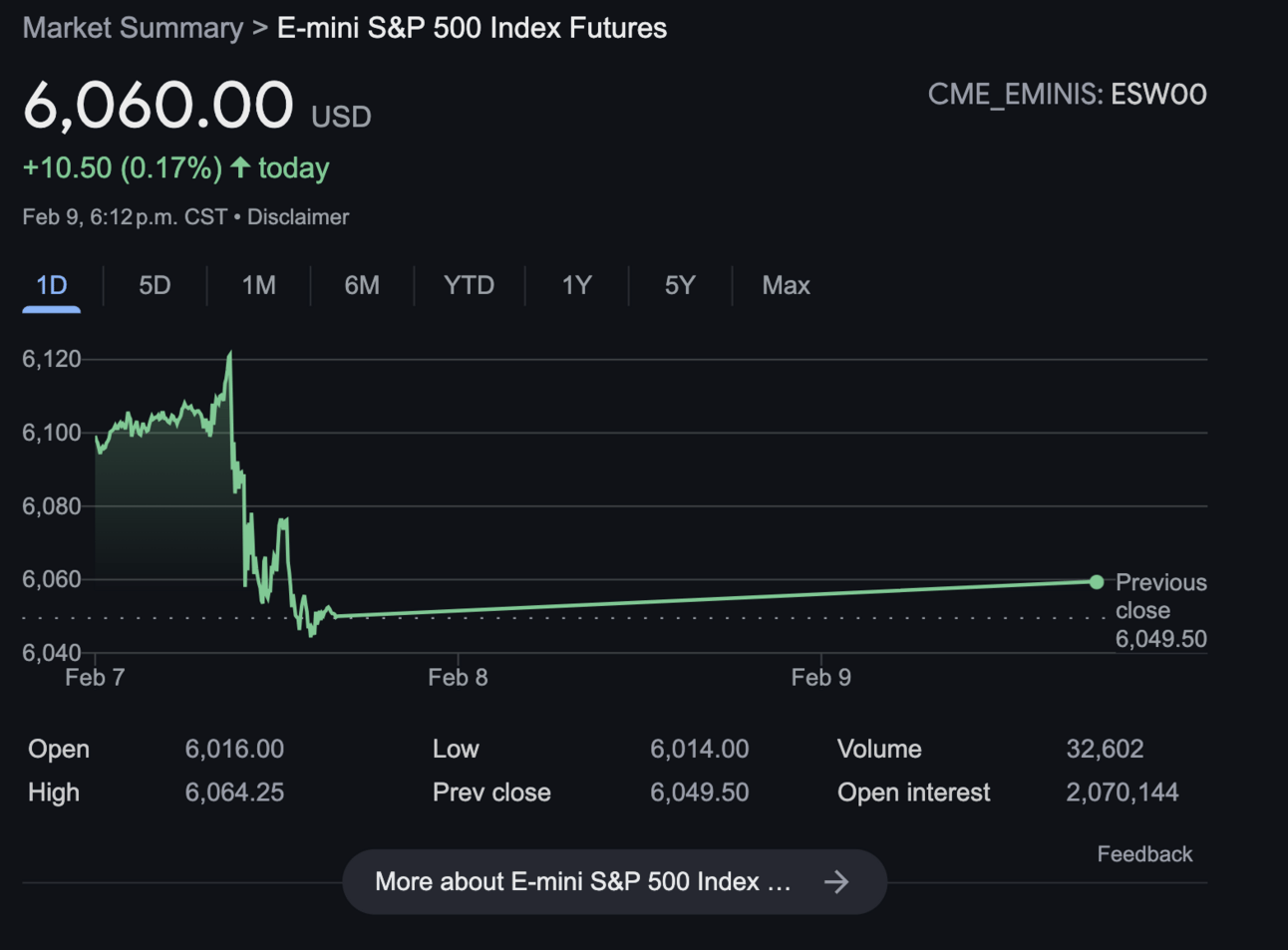

Futures have been steady, and traders are skeptical this will escalate into full-blown chaos. (Famous last words, right?)

If the tariffs go into effect, expect volatility in both currency and equity markets.

If they don’t?

Well, traders who positioned for the worst might have to unwind their trades—and fast.

The Bottom Line 🧵

Trade tensions are like that one guy at the party who can’t stop bringing up politics—annoying, unavoidable, and guaranteed to spark drama.

As traders, our job is to stay calm and focused.

This week, that means keeping an eye on tariff headlines, watching how global markets respond, and being ready to pivot at a moment’s notice.

Oh, and maybe double-checking that stop-loss, just in case.

A 1-Step Challenge Built for Traders Like You

Lark Funding just raised the bar, and traders are taking notice.

Here’s why this new 1-step program is turning heads:

✅ One & Done Challenge – Hit 9% once, and you’re in. No resets, no waiting.

✅ 6% Max Drawdown (Static) – More breathing room, more confidence in your trades.

✅ 90% Payouts – You earn it, you keep it. Simple.

✅ No Lock-Upon Payouts – Your profits, your control—withdraw anytime.

✅ No News Restrictions – Trade through FOMC, NFP, CPI… you name it.

✅ No Consistency Rules or Minimum Days – Trade at your pace, your way.

📈 Time to level up?

Use code FEB90 for 9% off all challenges and a free account of the same size when you get your first payout.

MARKET OUTLOOK

This Week’s Market Movers: Powell, CPI, and PPI – Oh My! 📊

Traders, grab your calendars and circle a few dates, because this week’s economic lineup is stacked.

From Powell’s testimony to inflation data, markets are about to get a workout.

Here’s what you need to know—and how to position yourself like a pro.

Tuesday: Powell Takes the Mic 🎤

Fed Chair Jerome Powell is stepping into the spotlight on Tuesday to testify before Congress.

Expect the markets to hang onto his every word like he’s revealing next week’s lotto numbers.

Why it matters: Powell’s tone will be key.

If he signals confidence in inflation cooling down, expect risk-on sentiment to follow (stocks, crypto, and high-beta currencies could see a lift).

But if he hints at concerns about sticky inflation or rate hikes sticking around? Cue the risk-off crowd (hello, JPY and USD).

Pro Tip: Watch for volatility in USD pairs during and after Powell speaks. Even the smallest hint of hawkishness could send the dollar climbing.

Wednesday: US CPI Drops the Inflation Bomb 📉

The main event this week? Inflation data. 🔑

The Consumer Price Index (CPI) for January hits on Wednesday, and here’s what the market is expecting:

Headline CPI YoY: Expected to hold steady at 2.9%.

Core CPI YoY: Expected to dip slightly, from 3.2% to 3.1%.

Why it matters: CPI is the Fed’s inflation report card.

If the numbers come in hotter than expected, markets might brace for more rate hikes.

A softer-than-expected reading? That could fuel hopes for a dovish Fed pivot (and maybe a little rally in risk assets).

Pro Tip: Key pairs to watch include EUR/USD, USD/JPY, and gold. A softer CPI print could weaken the dollar and send gold climbing.

Thursday: PPI Keeps the Spotlight on Inflation 📦

Just when you thought you were done with inflation talk, the Producer Price Index (PPI) rolls in on Thursday.

This measures wholesale prices—what producers pay before those costs hit us (and our wallets).

What’s expected:

PPI MoM: Expected to hold steady at 0.2%.

Why it matters: PPI gives us a sneak peek into potential future inflation.

If producer prices are rising, consumer prices might follow.

A higher-than-expected print could keep inflation fears alive and weigh on risk assets.

Pro Tip: Look for moves in S&P 500 futures, USD/CAD, and commodity-linked currencies like the AUD if the print surprises.

The Bottom Line: Buckle Up for Volatility 🚀

This week is all about inflation and the Fed.

Powell’s testimony, CPI, and PPI will likely set the tone for the rest of February, so don’t sleep on these events.

Here’s your cheat sheet:

If inflation comes in hotter than expected: Risk-off sentiment could spike, with safe-haven currencies like JPY and CHF leading the charge.

If inflation softens: Stocks, crypto, and high-beta currencies might rally as markets price in a more dovish Fed.

It’s shaping up to be a busy week, so stay nimble, keep your stop-loss tight, and maybe double up on the caffeine. ☕

Let’s get it!

🚀 Pre-Market Fuel

In Trump’s pre-Super Bowl interview, he says he’s serious about Canada becoming the 51st state. Should get interesting…

This well-known influencer is claiming this new prop firm is “100% A-book”. Be careful of claims like this as they’re not true.

What do you think of today's edition? |

🍪 Munchy Memes

When your last $20 get rugged but at least the stress is gone

— naiive (@naiivememe)

3:48 AM • Feb 9, 2025

Just checked my crypto wallet

— naiive (@naiivememe)

10:20 AM • Feb 7, 2025

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER