- Pip Munch

- Posts

- 🚀 You Can't Turn $1,000 Into $100,000

🚀 You Can't Turn $1,000 Into $100,000

PLUS: The market could go crazy on Friday 📉

Welcome to Lark Digest, your 3x weekly guide on everything trading and prop firms.

I hope you’re in a good mood because we’re about to dive into a controversial topic. One that I recently got a lot of heat from on Twitter…

You're not going to flip a $1,000 trading account into $100,000.

You won't.

It's just not going to happen.

So why not focus on something else?

— Matt L (@MeetMattL)

12:02 AM • Nov 5, 2023

We’ll take a look at:

Why you can’t flip a $1,000 trading account into $100,000 ❌

Why Friday is a huge day for the markets 👀

YOU CAN’T TURN $1,000 INTO $100,000

📉

When I first started trading back in 2016, it was a time when Trump was President, men were men, and boys could be boys. Oh, wait, wrong story…

I was only 17 at the time and was making $10.75/hour folding baby pants at The Gap. Yeah, not my proudest moment.

It’s safe to say all I wanted was to turn my $500 trading account into thousands of dollars. And I always thought I was just a couple of trades away from doing so.

And the numbers don’t lie:

A weekly return of 10% on a $1,000 trading account is almost $150,000 at the end of the year. Lambo, here I come! 🚘

But here’s the thing: It’s never that straightforward. If it were, everybody would be flipping accounts and becoming overnight millionaires.

The sad reality is that nothing has crushed the dreams of traders more than a compound interest calculator.

And here’s another kicker: I wish I could go back to my 17-year-old self and tell him that wanting to flip my small trading account is the goal of a gambler. Not a trader.

Don’t get me wrong, there’s nothing wrong with gambling. Heck, it’s over a $300 billion industry in the US alone. But it’s about determining what you actually want.

If you’re having fun and want to play around, more power to you.

But what if you’re in it for the long haul? Do you want to make long-term gains? Do you see trading as a potential career? If that’s you, then there’s no account flipping happening.

It’s an important topic and one that nobody talks about. That’s why you should check out this YouTube video to dive deeper👇️

FRIDAY = ROLLERCOASTER? 🎢

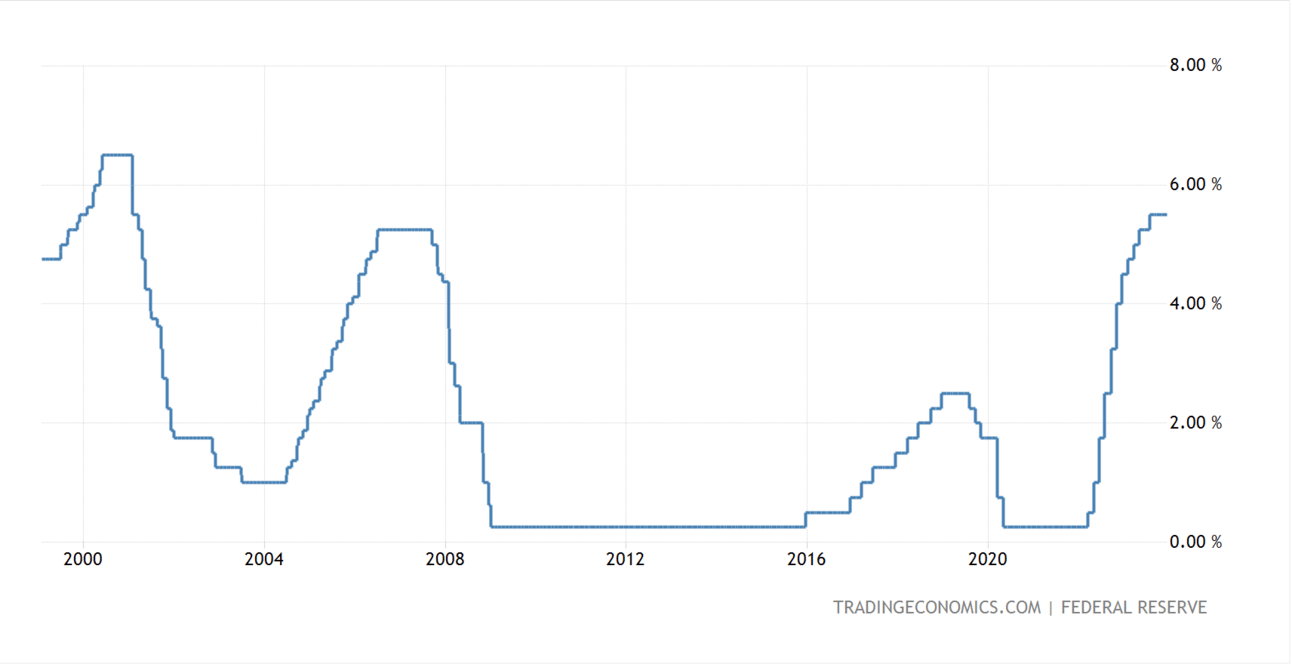

The current unemployment rate in the US is 3.7% 🇺🇲. That means there’s a good chance even your lazy cousin is working. But it also means Jerome Powell is more likely to keep interest rates high.

And what’s what we saw throughout 2023:

But there’s a major kicker: Many expect rates to drop in 2024.

One of those people is the chief economist at UBS, a massive investment bank based out of Switzerland who recently said he expects rates to be below 3% by December 2024.

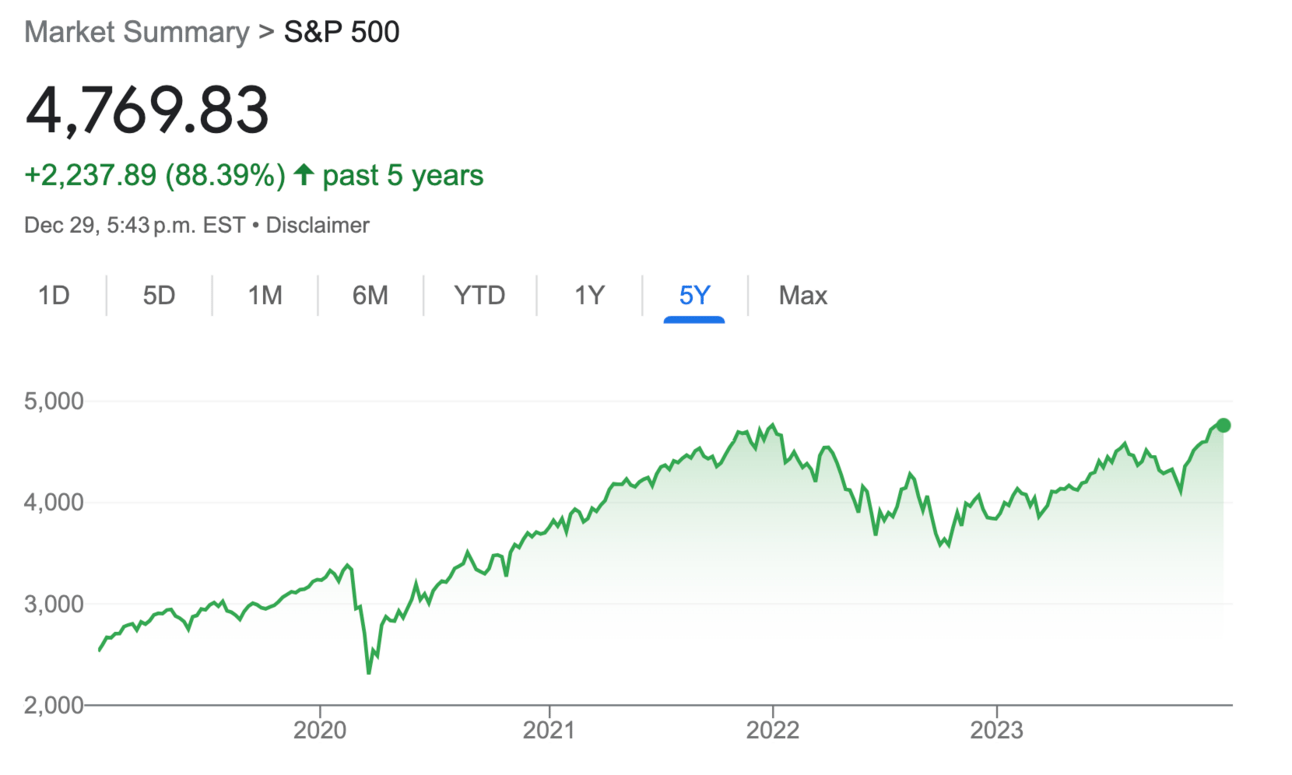

But an even better example is a recent post by our friend Pomp (okay, we’re not actually friends with him, but highly respect him). Pomp correctly pointed out that asset prices ripped higher in 2023 despite high-interest rates.

With the US needing to fund proxy wars, “local governments begging the national government for financial support, a southern border that has become invisible, and national debt interest payments that have eclipsed the national defence budget,” all of that means they’re desperate for cash.

AKA, lower rates and money printing might be around the corner.

But let’s hold our horses. The first step to that happening is seeing an increase in the unemployment rate. And that’s exactly what’s expected on Friday: a rise from 3.7% to 3.8%.

To recap, for those of us who want to make money (AKA all of us), what does all of this mean?

It means two things:

Increased volatility

Asset prices potentially inflating

We’re already seeing stock indexes near or at all-time highs, so it’s possible that all of this is already priced into the market. That extra uncertainty could lead to more volatility, though.

The good news is it’s all happening on Friday.

The bad news is, as we’ve seen time and time again, more traders lose money from these events than make money.

So pretend we’re your old wise grandfather and take our advice: Play it safe.

We’ll see you on Friday, where we’ll share some secret stats on our most successful trader.

Happy Pip Hunting,

Matt | Your Lark CEO