- Pip Munch

- Posts

- Fed Day Madness: Powell’s Speech Could Shake Everything 🌪️

Fed Day Madness: Powell’s Speech Could Shake Everything 🌪️

PLUS: A new prop firm challenge is coming.

Tired of failing prop firm challenges? The Prop Firm Masterclass will help you pass in 90 days—or you’ll get 100% of your money back.

☕️ GM Munchers! Today’s the day—the last big news event of 2024 is finally here.

At 2 PM EST, the Fed will announce its rate decision.

At 2:30 PM EST, Jerome Powell will grab the mic, and markets will go absolutely bananas.

If you’re a trader, grab your coffee, set your alerts, and maybe tighten those stops. This could get spicy.

On today’s menu:

BREAKING: Fed Set to Cut Rates—Markets on High Alert 🔥

New Program Jan 1st: Instant Funding or Stock Trading? 🤔

The Last Fed Meeting of 2024: Buckle Up, Traders 🎢

What to Expect 🧐

Here’s the setup:

The Fed is expected to cut rates for the third time in a row, bringing the federal funds rate down to 4.5-4.75%.

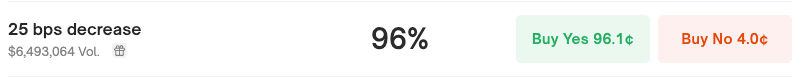

Polymarket is pricing in a 98% chance of a 25-basis-point cut. The market is basically calling this one a done deal.

But here’s the catch: Inflation is creeping up (2.7% in November), unemployment ticked higher (4.2%), and consumer spending is still strong.

Translation: Powell’s got a tough job.

Too dovish? He risks fueling inflation. ❌

Too hawkish? He’ll send risk assets into a tailspin. ❌

The Bigger Picture 🔎

This isn’t your grandpa’s Fed. Back in the 1980s, rates were flying like Canadian geese:

The all-time high was 20% in 1980 during the Great Inflation era.

Mortgage rates hit a staggering 20%, too. Imagine trying to buy a house with that loan.

Today? Rates move in baby steps—typically 0.25% increments—because the Fed’s got an economy to balance and markets to soothe.

Still, the current 4.5%-4.75% range is a big deal. It's miles higher than the near-zero rates we got comfy with during 2020.

What’s at Stake for Markets? 📊

Traders, pay attention:

1️⃣ Stocks

Rate cuts = potential for risk-on rallies. The S&P 500 is already hovering near record highs after a stellar year.

But if Powell sounds hawkish at 2:30 PM, expect some knee-jerk pullbacks.

2️⃣ Gold

A rate cut usually means a weaker dollar, which is like rocket fuel for XAU/USD. Gold bugs are licking their chops.

3️⃣ FX Pairs

Watch USD pairs like EUR/USD and GBP/USD. If the Fed eases, the dollar could slide, and we’ll see some big moves.

4️⃣ Bitcoin

BTC has been on fire lately, and a dovish Fed could add more fuel to the fire. But watch out—crypto volatility loves Fed days.

What I’m Doing 🕵️♂️

Here’s my game plan:

Lock In on Powell’s Speech: The move happens at 2:30 PM when Powell answers questions. Markets love to overreact to his tone, so that’s where the juice is.

Focus on High-Confluence Trades: I’m keeping a close eye on gold, USD pairs, and BTC—but I’m not chasing anything. Let the market show its hand.

Tighten Risk: Fed days are notoriously whippy. I’m trading smaller size and keeping stops tight—no YOLO trades allowed.

Why This Matters 📆

This is the last big market event of 2024. After today, the charts will likely quiet down like your office on December 23rd.

So make the most of this opportunity. The Fed is about to shake things up one last time—and how traders react will set the tone for early 2025.

Stay sharp, stay disciplined, and let’s close the year strong.

Fast Payouts or $500 on Us 💸

Waiting forever for a payout? Not with Lark Funding.

We’ve got a 24-hour payout guarantee:

If you don’t get your payout within 24 hours, we’ll add $500 to your payout.

No excuses. Just fast, reliable payouts—because you earned it.

☕️ Pre-Market Fuel

Instant funding or stock trading? Vote in this poll and let us know at Lark Funding which one you’d prefer on January 1st.

🍪 Munchy Memes

Good morning Canada.

— Martin Pelletier (@MPelletierCIO)

12:51 PM • Dec 17, 2024

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER