- Pip Munch

- Posts

- 📉 Game Day

📉 Game Day

Most traders can't quit their job because one bad month = $0 income. Lark Funding just solved that. They'll pay you a monthly salary—even when you're in drawdown.

☕️ GM Munchers! Today is Fed day, which means I'll be watching Jerome Powell with the same intensity my wife watches Love Is Blind reunion episodes, except my outcome actually affects our mortgage.

On today’s menu:

📉 Fed Cuts, Bitcoin Rips, Silver History

🏦 JPMorgan Just Tanked the Dow (Single-Handedly)

😴 More Drama With Nvidia

👀 Is My Forex Funds Making a Comeback?

🤯 Japan Has The Lowest Birth Rate Since 1899

Yesterday’s numbers:

S&P 500 | 6,840 | -0.08% |

Nasdaq | 23,576 | +0.13% |

Dow Jones | 47,560 | -0.38% |

Bitcoin | $93,055 | +2.66% |

BREAKING NEWS

🏦 Today's Fed Decision: The Cut Is Done, Powell's Words Matter

It’s game day for traders. The Fed announces their rate decision today at 2 PM EST, and the 25 bps cut is already baked in. Markets are pricing it at near certainty, so the cut itself won't move anything.

So, what will move markets? Powell's press conference.

Here's What Actually Matters:

The rate-setting FOMC is split between members who want more cuts to counter labor market weakness and those who think easing has gone far enough and could reignite inflation. This internal tension means Powell's language about future cuts is everything.

What Wall Street's Watching:

The "dot plot": Individual officials' rate expectations for 2026

Powell's tone: Hawkish (fewer cuts ahead) or dovish (more easing coming)

The statement: Any language changes suggesting they're "done cutting for now"

Former Cleveland Fed President Loretta Mester said Tuesday: "Inflation is not back to 2% so they're going to need to keep policy somewhat restrictive if they're going to put downward pressure on inflation. Right now, inflation is pretty well above the goal, and it's not just all tariff-driven."

Translation? Some Fed members think they should pause after today's cut.

Market Setup:

Stocks rallied yesterday, then gave up most gains. We're basically sitting at all-time highs waiting for Powell to either validate the rally or crush it with hawkish language.

The Munch Take: Classic "buy the rumor, sell the news" setup. If Powell signals fewer cuts in 2026 than markets expect, stocks could sell off despite getting the cut everyone wanted. The cut is priced in—his forward guidance isn't.

₿ Bitcoin Rips Thousands of Dollars in Minutes (Again)

Bitcoin just pulled off another one of its signature moves: thousands of dollars of gains in a matter of minutes, driven by short liquidations and traders positioning ahead of today's Fed meeting.

The Numbers:

There's now a 53% chance on prediction markets that Bitcoin climbs above $100K before year-end. That's up 14% just from the recent surge.

What Drove It:

Short squeezes: Overleveraged shorts got wiped out, creating explosive upward pressure as forced buybacks cascaded

Rate cut front-running: Traders aren't waiting for Powell's announcement—they're positioning now for easier liquidity conditions

Dip-buying momentum: After a rough year, every stabilization signal triggers sharp moves off depressed levels

The Munch Take: This is Bitcoin being Bitcoin. If Powell sounds dovish today, Bitcoin could legitimately challenge $100K by year-end. If he sounds hawkish? Hopefully I’ll be getting some tissues for Christmas for my tears.

🥈 Silver Just Made History at $61 (Up 108% YTD)

Silver hit $61 for the first time ever, capping off an absolutely ridiculous 108% year-to-date gain.

Why Silver's Going Parabolic:

Structural supply deficits: Mine production hasn't kept up with industrial and investment demand for years

Industrial demand surge: Solar panels, EVs, electronics, and tech applications are consuming massive amounts of silver

Macro tailwinds: Rate cut expectations, weaker dollar, and inflation concerns are pushing investors into precious metals

"Critical mineral" status: The US reclassified silver as a critical mineral in 2025, linking it to battery metals and rare earths—implying future stockpiling, subsidies, and faster permitting

The Munch Take: Silver's move isn't a fluke, it's a perfect storm. Gold's rally also pulled attention back to the gold-silver ratio and traders started to pile in like Costco running out of their $5 rotisserie chickens. The rally might not be over, but we would wait for a pullback.

BROUGHT TO YOU BY

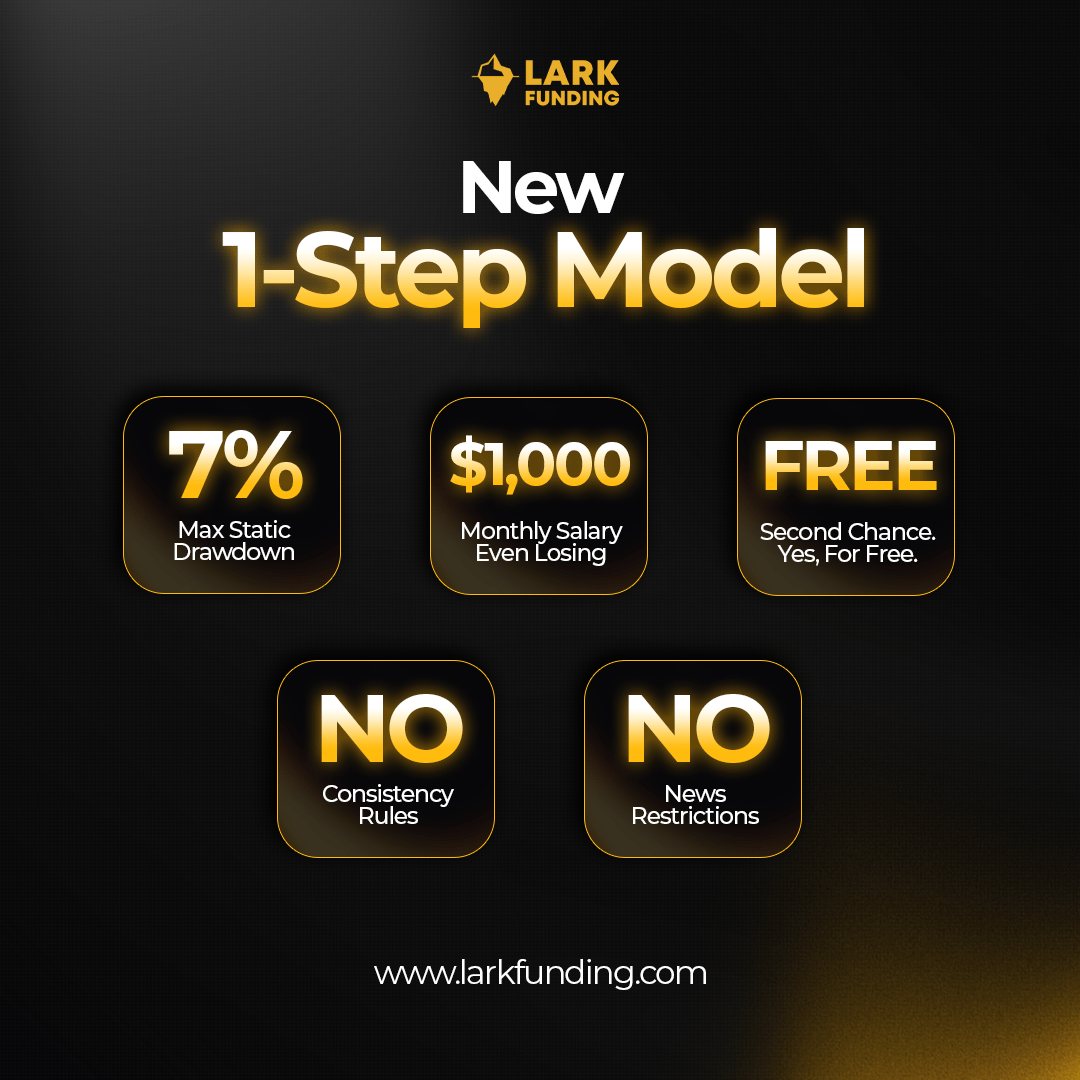

Most prop firms are designed to fail you.

Consistency rules that deny payouts. News restrictions during volatility. Resets that cost hundreds.

Lark's new 1-Step Career Program is different.

7% max drawdown—the most forgiving in the industry. Monthly salary up to $1,000 even during losing months. Free second chances when you need them. Zero consistency rules. Zero news restrictions.

We've been paying traders for 3+ years because we're here to build careers.

One evaluation. Get funded. Start your trading career.

STOCKS

🏦 JPMorgan Just Tanked the Dow (Single-Handedly)

JPMorgan crashed 4.3% yesterday—its biggest one-day drop since April 4—and was responsible for roughly half of the Dow's decline.

What Happened:

CFO Marianne Lake told investors at a Goldman Sachs conference that 2026 expenses will hit $105 billion, driven by growth-related costs, consumer banking expansion, and community banking investments. That's nearly 10% higher than their $95.9 billion of expenses this year.

Analysts were expecting around $100.84 billion, so JPM just blew past expectations by about $4 billion (I wish I could just magically find $4 billion).

Why the Market Freaked:

Higher expenses = lower profit margins. Even though revenue is expected to grow, the street hates seeing costs climb faster than anticipated. It’s as simple as that.

The Bigger Picture:

Despite yesterday's bloodbath, JPM is still up 25% YTD, trades at a 14.88 P/E ratio, and pays a 2% dividend. The stock's not broken—it just got repriced for reality.

The Munch Take: Banks don't grow expenses 10% just for fun—they're investing in something. The question is whether or not the investment will pay off. If you've been eyeing JPM, this pullback might be your entry—just don't expect fireworks until they prove those investments actually pay off.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

🖥️ $NVDA The Nvidia-China chip saga is giving us whiplash. Trump originally greenlit selling H200 chips to China, but now China's reportedly refusing to accept them and increasing restrictions on their use. At this point, nobody knows what's actually happening—not even the people making the decisions. Peak geopolitical chaos.

🍺 $PEP Pepsi plans to cut prices and eliminate 20% of its products according to the Wall Street Journal. Trimming the fat, literally. Sounds like a solid branding move—fewer SKUs nobody buys, lower prices to win back customers. Your move, Coke.

💊 $LLY Eli Lilly is building a $6 billion manufacturing plant in Alabama to pump out more obesity drugs. For the people of Alabama, this is like getting a gym membership for Christmas—it's a nice gesture, but we all know what message is being sent here.

🥫 $CPB Campbell's soup continues getting demolished. Quarterly profit dropped year-over-year and the stock tanked 5.23%, now down 32% for the year. Turns out nobody wants ultra-processed canned soup anymore. Time to rebrand? Maybe launch a "Make Soup Great Again" campaign and see if that moves the needle.

🚀 Pre-Market Fuel

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER