- Pip Munch

- Posts

- 📉 Grumpy Market

📉 Grumpy Market

Tired of trading your small account? The game has changed, and you no longer need to trade your own money. You need prop firms.

☕️ GM Munchers! My wife found my browser history and asked why I have 47 tabs open about Canadian food inflation, magic mushroom clinical trials, and Southwest Airlines baggage fees. I told her it's "research for work." She told me it looks like "a mental breakdown disguised as curiosity." Both statements can be true simultaneously.

On today’s menu:

📉 Grumpy Market & Buffett Sells Amazon

🍁 Canada's Food Inflation Nightmare

🍄 Magic Mushrooms & Hollywood Bidding Wars

🤯 Warren Buffett Just Bought This Stock

👀 This Billionaire Just Updated His Portfolio

Yesterday’s numbers:

S&P 500 | 6,843 | +0.10% |

Nasdaq | 22,578 | +0.14% |

Dow Jones | 49,533 | +0.06% |

Bitcoin | $67,500 | -1.88% |

BREAKING NEWS

📉The Market Woke Up Grumpy: AI Fears & Broke Consumers

The market returned from the long weekend clearly not well-rested, because it immediately had an identity crisis. At its lowest, the S&P 500 was down nearly 1%, driven by two overlapping nightmares:

The AI Hangover Continues: Investors kept stressing over Big Tech's astronomical AI spending. Wall Street's essentially demanding to know when these billions in data centers will actually make money instead of just burning cash.

The Consumer is Tapped Out: General Mills crashed 6.9% after slashing profit forecasts, warning that everyday shoppers are pulling back. Genuine Parts also dropped double digits after ugly results. Translation: the average person is broke, which is bad news for literally everyone.

The Munch Take: The market turned around and closed essentially flat. This is textbook volatility whiplash—markets can't decide if AI spending is visionary or financial suicide, and consumer weakness keeps popping up like a bad ex. Until Big Tech proves the ROI on their $200 billion spending spree, expect more days like this.

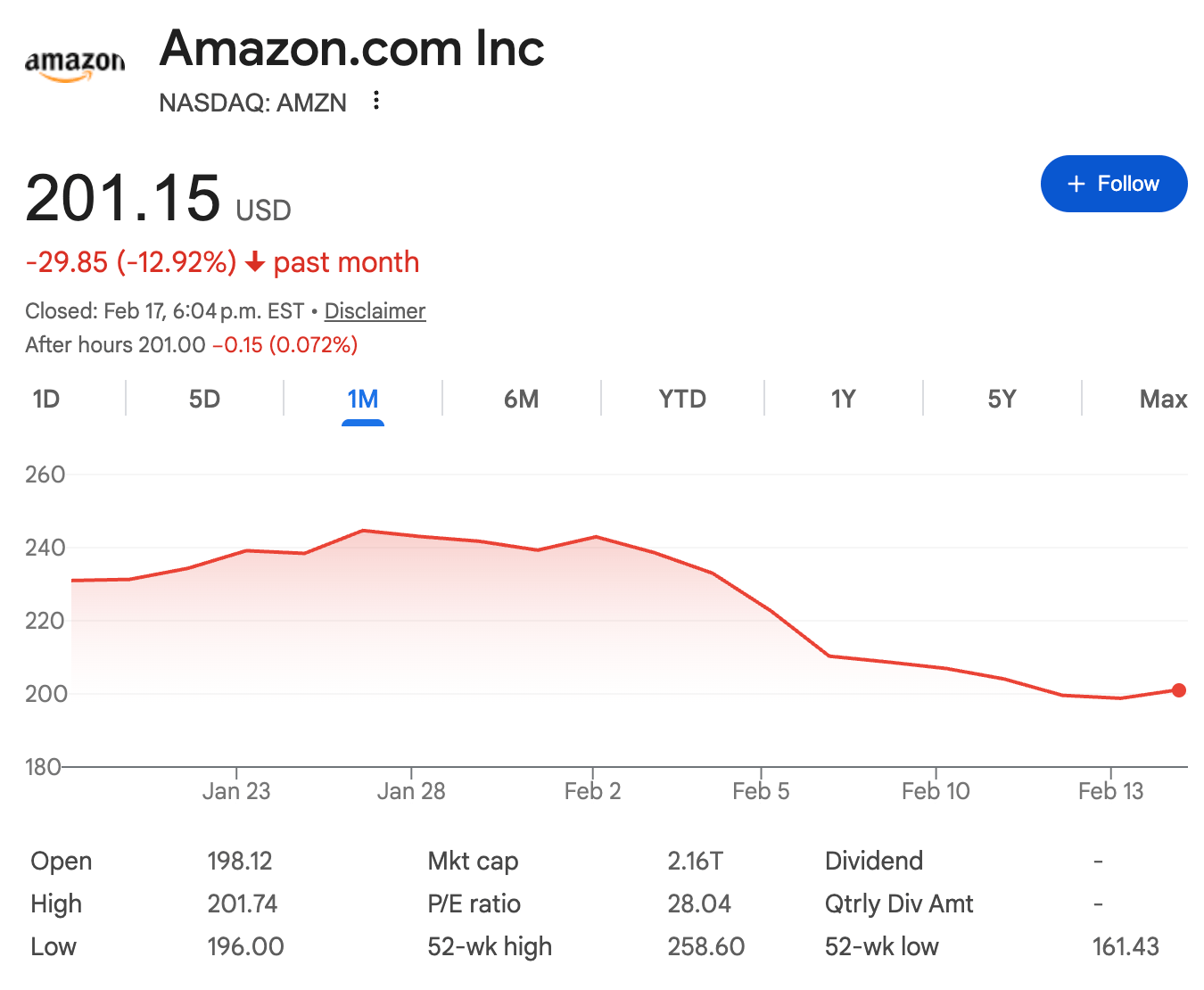

💈 Amazon's $450 Billion Haircut: When Buffett Bails

Amazon just snapped a 9-day losing streak yesterday—tying its worst stretch since 1997. The stock's down 11% over the past year while the S&P ripped 16%. That's not just underperformance, that's getting left behind at the airport.

The damage? Amazon lost roughly $450 billion in market value since early February. Even Warren Buffett had enough—Berkshire dumped 77% of its Amazon stake in Q4 2025, worth $1.7 billion.

Why the Crash? Amazon announced it's spending $200 billion on AI infrastructure this year—nearly 60% more than Wall Street expected. Investors are terrified the "AI Arms Race" will incinerate cash without guaranteeing returns.

The Bull Case: Amazon's not building for fun—AWS added more data center capacity than anyone else last year and customers are begging for it. History rhymes: in July 2006, investors panicked when Bezos spent billions building AWS. The stock soared 128% the following year.

The Munch Take: This is either the dumbest use of capital in tech history or the next trillion-dollar monopoly in its awkward teenage phase. Buffett bailing tells you the moat isn't clear. We're watching, not touching.

BROUGHT TO YOU BY

Stop trading your own money.

Here's the brutal truth: Your $500 account isn't making you rich—it's making you frustrated. A 10% monthly gain gets you $50. Congrats, you just earned enough to cover… one tank of gas?

This is why prop firms exist.

How It Works:

Sign up for a challenge at Lark Funding

Hit the trading objectives

Get a simulated funded account (up to $200K+)

Keep up to 90% of your profits

The February Deal: Buy ANY challenge this month and we'll throw in a $1,000 instant funded account. No eval. No waiting. Start trading immediately while you work through your challenge.

The Math: 5% monthly return on a $100K account = $4,500 in your pocket. On your $500 personal account? That's $25. Which one sounds better?

Stop grinding pennies. Start trading with actual capital.

FOREX

🍁 Canada's Food Inflation Nightmare: Shopping Bags or Grocery Bags?

Canada just released January inflation data, and it's a tale of two economies—one where you can't afford to eat, and one where at least your gas is cheap.

The Grocery Store Horror Show: Food inflation came in at a blistering 7.3% year-over-year—the highest in the G7. Groceries up 4.8%, restaurant food absolutely obliterated at 12.3%, and meat prices up 9.4%. If you're Canadian and you like eating, you're getting destroyed.

The Twisted Irony: While food costs are crushing consumers, overall inflation actually fell to 2.3%. Gasoline plunged 16.7%, and core inflation dropped to 2.4%—the lowest since April 2021. Translation: Canadians can't afford groceries, but hey, at least they can afford to drive to the store and look at food they can't buy.

Forex Whiplash: USD/CAD initially spiked to 1.37 on the news as traders bet on a weaker Canadian Dollar, but eventually pulled back as cooler heads realized overall inflation is actually moving in the right direction.

The Munch Take: This is economic whiplash at its finest. Food inflation is legitimately painful, but the broader economy is cooling exactly as the central bank wants. Don't confuse a sector crisis with a total collapse.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

🍄 $CMPS Magic mushrooms just got one step closer to your psychiatrist's office. Shares of COMPASS Pathways exploded 38% after their Phase 3 trial using psilocybin successfully treated treatment-resistant depression. This is a massive clinical win that boosts the odds of actual FDA approval for psychedelic therapy. Your future antidepressant might be a shroom microdose prescribed by a doctor. What a time to be alive.

📺️ $WBD The Hollywood bidding war escalated. WBD climbed 3.5% while Paramount Skydance jumped 7% after Netflix gave Paramount a seven-day window to make its "best and final" counteroffer. Shareholders vote March 20. Nothing says entertainment like watching entertainment companies fight over who gets to own the entertainment.

📈 $ETOR eToro gained 20.43% on strong Q4 results with total trades up 55%, despite crypto activity cratering 50% in January. Turns out people will trade things other than dog coins.

✈️ $LUV Southwest Airlines Climbed 6.16% on a UBS upgrade predicting $3.2 billion in revenue by 2027 from—wait for it—assigned seating, extra legroom fees, and checked-bag charges. They're literally becoming every airline they swore they'd never be. Capitalism wins again.

Three Nobel Prize Winners expose this once-in-a-generation wealth shift:

AMERICA’S NEXT 1776 MOMENT

IS COMING ON OUR 250th ANNIVERSARY

“It could trigger the greatest transfer of wealth in American history”

🚀 Pre-Market Fuel

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER