- Pip Munch

- Posts

- 📉 Huge Crash

📉 Huge Crash

Want to make more money from trading? Stop trading your small $500 account. It’s not going to go anywhere. The answer? Prop firms.

☕️ GM Munchers! If you thought yesterday would be calm, the market woke up, chugged five Red Bulls, and decided to personally assault every long position with the energy of a caffeinated honey badger. My therapist is going to hear about this one. Happy hour starts at 9 AM today, right?

On today’s menu:

📉 Microsoft's $440 Billion Evaporation:

🚀 Meta's 10% Moonshot

😥 Bitcoin, Gold & Silver Crash

🚗 Tesla Kills Model S & X

📱Apple Crushes Earnings

Yesterday’s numbers:

S&P 500 | 6,969 | -0.13% |

Nasdaq | 23,685 | -0.72% |

Dow Jones | 49,071 | +0.11% |

Bitcoin | $84,100 | -6.00% |

BREAKING NEWS

📉 Microsoft's $440 Billion Evaporation: When Beating Earnings Isn't Enough

Yesterday wasn't just a bad day for Microsoft—it was a financial apocalypse wrapped in a press release. The stock cratered 11%, its worst single-day massacre since March 2020 when the world was panic-buying toilet paper and pretending Zoom calls were "the new normal."

The damage:

Market cap vaporized: $440 billion (yes, with a B)

Their CEO’s net worth: -$14 billion in a single session

Historic context: 2nd-largest single-day wipeout in history (only Nvidia's January 27, 2025 collapse was bigger)

What went wrong? Microsoft beat earnings ($4.14 vs $3.97 expected) and revenue ($81.27B vs $80.27B expected). So why the carnage? Cloud growth is slowing—Azure grew 39% vs expectations of 40%—and they spent $37.5 billion in capital expenditures, almost $3 billion more than Wall Street expected.

Translation: Microsoft's burning cash faster than my wife at Barnes & Noble on Black Friday, and investors aren't convinced the AI bet will pay off.

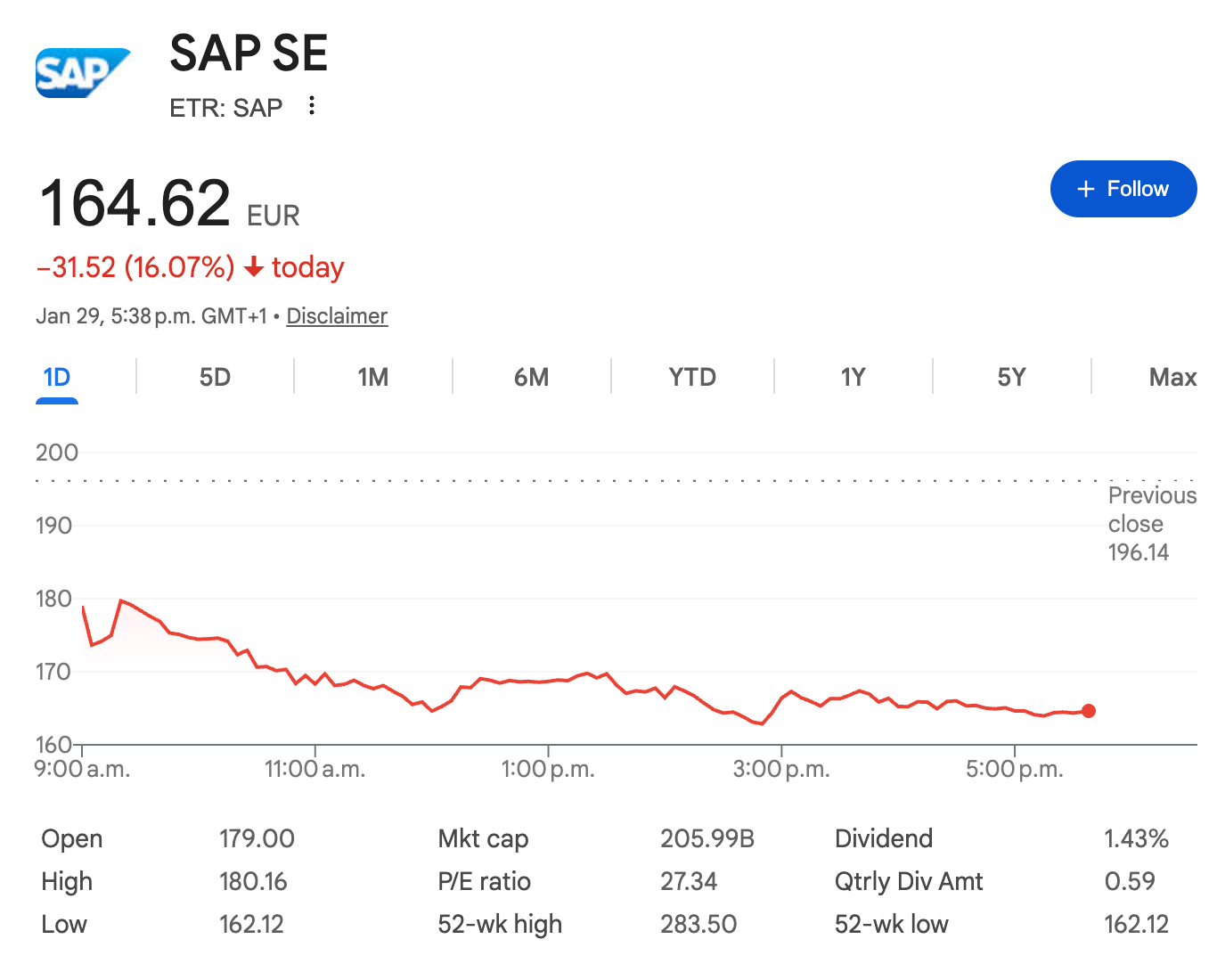

The contagion spread fast. Software stocks got absolutely obliterated on fears that AI will cannibalize their business models. The $IGV ETF (software sector tracker) crashed 5%—its worst day since last April. German software giant SAP plunged 16% after reporting weak cloud growth.

The Munch Take: This isn't just Microsoft weakness—this is Wall Street repricing the entire software sector on AI disruption fears. When billion-dollar companies beat earnings and still crater double digits, that's existential panic, not temporary weakness. If you're holding software stocks, buckle up.

🚀 Meta's 10% Moonshot: Zuck Goes All-In on AI (Again)

While Microsoft burned, Meta absolutely ripped—surging over 10% after earnings that made investors forget they ever doubted Zuckerberg's vision.

The numbers:

Revenue grew 24% year-over-year—insane for a company this massive

AI spending guidance: $115B to $135B in 2026—nearly double 2025's spend

Zuck's mission: "Building personal super intelligence" (whatever that means, but Wall Street loved it)

Why markets went wild: Meta's proving AI spending actually drives revenue growth, unlike Microsoft's "trust me bro" capital burn rate. Their 24% revenue growth is validation that pouring billions into infrastructure pays off when you have the distribution to monetize it.

The Munch Take: Meta's the anti-Microsoft right now. Same AI spending story, completely opposite market reactions. We mentioned months ago that we like Meta’s stock. Did we buy? Of course not. Will we be silent crying in the bathroom this weekend? Absolutely.

BROUGHT TO YOU BY

Want to make money trading? Use prop firms.

Lark's 1-Step Career Program pays you up to $1,000 monthly even during drawdowns. Hit 3 profitable days of 0.5% and stay above -3.5%—that's it.

January Promo: Get your first payout and we'll give you a free account of the same size. Automatically. No extra cost.

One payout = instant second evaluation. Scale faster. Pay less.

7% max drawdown. Free retry. TradingView included. AI journal. Fast payouts. 24/7 support.

Build consistency while getting paid to learn. Most firms make you start over. We help you scale.

CRYPTO & COMMODITIES

😬 Precious Metals & Bitcoin: Everything That Glitters Also Bleeds

Microsoft wasn’t the only one that got a ticket on the pain train yesterday. It was a brutal day for “safe havens” that suddenly weren’t so safe.

The carnage:

Gold: -1%+

Silver: -1.5%+

Bitcoin: -6%, dropping below $84,000

Bitcoin's now 33% down from its October all-time high of $126,000 and dangerously close to the $80,000 support level. If that breaks, who knows how low it goes. And that’s when panic could really start.

The Munch Take: When both tech and metals crash at the same time, that’s not sector rotation — It’s panic vibes and a flight to cash. Bitcoin approaching $80K is a line in the sand. Break it, and things could get really ugly for not just Bitcoin, but the entire market.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

🧑✈️ $AAL For the first time since 2019, American Airlines is offering flights to Venezuela—just weeks after the US captured Venezuela's president.

📉 $FIG Remember Figma, one of 2025's hottest IPOs? It's now down 75% from its debut. Another beautiful reminder that IPO hype is financial fool's gold—shiny, exciting, and utterly worthless once reality kicks in. If you're chasing freshly public stocks because FOMO told you to, maybe reconsider your life choices.

😬 $MSTR Remember Michael Saylor, the guy who's been buying billions in Bitcoin with borrowed money? MicroStrategy crashed 10% yesterday, hitting new lows and now down nearly 70% from July highs. Turns out leveraging your entire company's balance sheet on a volatile asset isn't the genius move Twitter convinced everyone it was. Leverage giveth, and leverage taketh away—violently.

📱 $AAPL Apple absolutely demolished expectations with sales up 16% thanks to strong demand in China and Asia. Net income came in at $42.1 billion vs $36.33 billion expected. The stock climbed in after-hours because apparently someone can still execute flawlessly in 2026. Refreshing, honestly.

STOCKS

🚗 Tesla Kills Model S & X: Elon Bets the Factory on Robots

Elon Musk just announced Tesla's discontinuing the Model S and Model X to convert factory lines for Optimus humanoid robot production.

Why this matters: Tesla's eliminating 2 of its 5 car models. The Model X makes sense—it's redundant with the Model Y. But killing the Model S? That's the flagship sedan that started the EV revolution. Gone. Replaced by robots that don't exist at scale yet.

Market reaction: Stock dropped 3%+ because betting your factory capacity on unproven humanoid robots while your core car business struggles is… let's call it "bold."

The Munch Take: This is peak Elon—visionary or reckless depending on whether Optimus actually works. If the robots flop, Tesla just torched production capacity for luxury vehicles that generated reliable revenue. If they succeed, Elon's a genius and we're all buying robot butlers. Either way, this is not the move of a company focused on automotive fundamentals. Trade accordingly.

🚀 Pre-Market Fuel

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER