- Pip Munch

- Posts

- 📉 Is the U.S. About to Go to War?

📉 Is the U.S. About to Go to War?

Ready to trade without draining your own account? Lark Funding lets you prove your skills on a simulated funded account—earn up to 90% profit splits, get instant payouts, and skip the fine print.

☕️ GM Munchers! The S&P is flirting with all-time highs, oil’s flirting with $80, and my wife says if I make one more WW3 meme she’s filing for peace talks.

On today’s menu:

📉 Are We About To Go To War?

👀 Fed Preview: The Forecast is the Trade

🇨🇦 CAD Gets Crushed After BOC Holds Steady

🏆 Gold Just Set a Record (Again)

🇺🇲 Proof The US Dollar Is Collapsing

Yesterday’s numbers:

S&P 500 | 5,982 | -0.84% |

Nasdaq | 19,522 | -0.91% |

Dow Jones | 42,215 | -0.70% |

Bitcoin | $104,767 | -1.91% |

BREAKING NEWS

🪖 Is the U.S. About to Go to War?

BREAKING: The U.S. is projected to take imminent military action against Iran.

67% chance.

— Polymarket (@Polymarket)

11:58 PM • Jun 16, 2025

Polymarket now shows a 67% chance the U.S. takes military action against Iran before July. That’s not exactly background noise.

Why?

Trump just demanded “UNCONDITIONAL SURRENDER” from Iran, like he’s roleplaying Risk. Meanwhile, the U.S. reportedly rejected a recent Israeli plan to assassinate Iran’s Supreme Leader, and Trump’s latest comments are basically “surrender or else.”

So why isn’t the market freaking out?

WTI is still trading around $75, not $100.

The S&P 500 is 2% off all-time highs.

Translation? Traders aren’t fully pricing in a full-scale war. Yet.

US OFFICIALS SAY TRUMP 'SERIOUSLY CONSIDERING' STRIKE ON IRAN: AXIOS

— zerohedge (@zerohedge)

4:52 PM • Jun 17, 2025

Watch this next:

🔺 Oil spikes = risk-off (buy gold, short equities).

🏦 Defense names could fly on escalation headlines.

💬 Any ceasefire hint could send oil down fast. Don’t get caught sleeping.

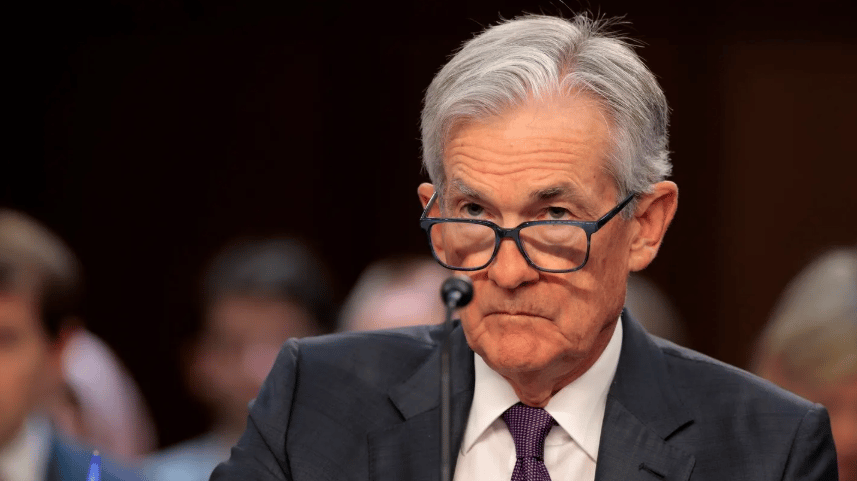

📉 Fed Preview: The Forecast is the Trade

The Fed wraps its meeting today and nobody expects a rate cut. But the real market juice? The dot plot and Powell’s tone.

Here’s what traders care about:

Will the Fed still project 2 cuts this year?

How high do they think inflation will run?

Are they spooked by Middle East tensions?

Goldman says one cut is likely. BofA says zero. Powell probably says “we’ll see” (classic Powell).

Why this matters:

Lower rates = weaker dollar, stronger stocks.

Higher-for-longer = tech pain, growth puke.

This is basically the FOMC’s quarterly earnings call. Buckle up.

🛢️ Oil Pops Again on Iran Risk

🚨 BREAKING: Oil has climbed more than 4% on fears of the war with Iran escalating.

— Pip Munch (@pip_munch)

7:46 PM • Jun 17, 2025

WTI crude jumped $3.13 to $74.90 today (+4.4%) as the market finally caught up to the fact that, yeah, missiles flying over the Strait of Hormuz is kinda bullish for oil.

Trump’s “surrender now” post and reports of slower tanker traffic in the Gulf helped push prices higher.

Here’s what traders are watching:

$77 is resistance — if we break it, we might scream to $80.

If Iran actually blocks the Strait? Hello $100.

Safe havens (gold, CHF) rally on escalation.

CAD gets tricky — oil up helps, risk-off hurts.

Long story short? Oil’s not just about barrels — it’s about bombs.

BROUGHT TO YOU BY

Most Traders Lose Money—Here’s How to Flip the Script

Ever wanted to trade like the pros—but without dumping your life savings into the market?

That’s exactly what prop firms are for. You pay for a challenge, prove you can trade, and if you pass, you get access to a simulated funded account where you can earn a share of the profits.

But not all firms are created equal.

Some hit you with “consistency” rules, payout delays, and surprise restrictions that make it nearly impossible to win.

Lark Funding does it differently:

✅ No news restrictions

✅ No consistency rules

✅ First payout on demand

✅ Zero hidden BS

And right now, they’re offering 15% off with code JUNE15.

If you’ve never taken a prop firm challenge before, this is the cleanest way to start—with rules that actually make sense.

👉 LarkFunding.com – go check them out.

FOREX

🇨🇦 CAD Gets Crushed After BOC Holds Steady

The Bank of Canada just kept rates unchanged at 2.75%, and the loonie responded by doing what my wife does when I forget to clean the sink: lost all strength instantly. USD/CAD spiked to 1.36 as traders digested a rate hold, weak inflation signals, and fresh Middle East fears.

Here’s the deal:

BOC held rates and gave no strong signal of future cuts (but didn’t rule them out either).

Canadian and U.S. officials said they’re setting a 30-day deadline for a trade deal—markets weren’t impressed.

The BOC’s tone was basically: “Yeah we’re watching inflation… but we also might nap through it.”

Why it matters:

The loonie got dunked like a weak playoff team.

Fear of an Iran conflict also spooked markets into buying USD, sending the CAD down even faster.

If crude keeps rising on geopolitical tension, CAD could rebound. But for now, it’s in the penalty box.

🧵 Plain-English Play:

Trade negotiations. Anything positive = CAD boost.

Oil. If it spikes, CAD could recover.

BOC rate cut odds. A dovish shift would mean more CAD pain.

Translation? Don’t go long CAD just because it’s cheap. It might be on clearance for a reason.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

$JPM ( ▼ 1.9% ) The Chase Sapphire Reserve is getting an upgrade—and by upgrade, we mean it now costs $795/year. You’ll get a $500 hotel/resort credit (select properties only, of course). The real perk? Flashing your metal card at dinner so your friends know you’ve been financially irresponsible on purpose.

$GM ( ▼ 2.58% ) GM just dropped the fastest Corvette ever—0 to 60 in under 2 seconds. That’s faster than you can explain to your wife why you “need” one. It tops out at 233 mph, runs on a hybrid system, and pricing is still TBD. Translation: if you have to ask, you can’t afford it.

$AMZN ( ▲ 1.0% ) Amazon’s CEO basically said, “Sorry, humans.” AI is replacing jobs, trimming headcount, and making the company more “scrappy.” Great for margins. Not so great if you were hoping to keep your warehouse gig.

$META ( ▼ 1.34% ) Meta is teaming up with Oakley and Prada to launch $360 smart glasses. They’re smart enough to livestream your morning walk… but not smart enough to make you look good wearing them.

$RGC ( ▼ 0.23% ) A no-revenue herb company in Hong Kong just pulled a 58,000% year-to-date rally after claiming it can treat ADHD and autism with traditional Chinese medicine. It now has a bigger market cap than Lululemon. Traders, meet your next YOLO short.

COMMODITIES

🏆 Gold Just Set a Record (Again)

BREAKING: US Gold ETF assets under management have surpassed $190 billion for the first time in history.

The value of gold ETF assets has skyrocketed by ~$100 billion over the last 2 years.

Furthermore, assets in the most popular gold fund, $GLD, have recently crossed above

— The Kobeissi Letter (@KobeissiLetter)

6:54 PM • Jun 16, 2025

Gold isn’t just glimmering—it’s breaking records like Jordan in ‘96.

Assets in U.S.-listed gold ETFs have crossed $190B for the first time ever, with the SPDR Gold Trust ($GLD) alone smashing through the $100B mark. That’s +$100B in just 2 years. Why? Everyone’s scared.

Translation:

Geopolitical chaos (👀 Iran), sticky inflation, and central banks dragging their feet have pushed investors into safety mode.

And in this market? Safety = shiny metal in vaults.

Why traders care:

Gold’s moon mission is a giant “risk-off” signal.

Equities may be dancing near all-time highs, but smart money is quietly hedging.

Gold ETF flow can front-run major sentiment shifts before equities catch up.

🧵 Plain-English Play:

If GLD keeps ripping, expect more volatility ahead.

Dollar strength vs gold resilience = sentiment tug-of-war.

Gold’s hot. My trades? Still lukewarm.

PROP FIRMS

🤑 Wednesday Motivation

99.7% of traders who take a prop firm challenge will never get consistent payouts from it

Here’s how you can be part of the top 0.3% of traders do:

— Tom (@t0mbfx)

10:40 AM • May 19, 2025

🚀 Pre-Market Fuel

🍪 Munchy Memes

Not right now babe…

I’m monitoring the situation.

— Not Jerome Powell (@alifarhat79)

1:07 PM • Jun 17, 2025

My average trading day

— Tom Dante (@Trader_Dante)

10:43 AM • Jun 17, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER