- Pip Munch

- Posts

- Jobs Data Incoming: Big Moves Ahead for Markets? 📉📊

Jobs Data Incoming: Big Moves Ahead for Markets? 📉📊

Will the latest reports spark volatility or calm nerves? Let’s dive into the signals traders can’t afford to miss.

Today’s market breakdown is powered by Lark Funding—helping you hit your trading goals faster.

Use code FEB90 for 9% off + free 90% rewards on our new 1-step challenge with just a 9% target and 6% max drawdown. Let’s get you funded!

☕️ GM Munchers! And happy Friday! Remember, trading is like my morning coffee—if you’re not paying attention, it’ll burn you.

On today’s menu:

Jobs Data Incoming: Big Moves Ahead for Markets? 📉📊

UK Growth Slows, BOE Acts: Trading Opportunities You Can't Miss 👀

The Czech Republic Removes Capital Gains Tax on Bitcoin?! 🤯

Is Utah About To Buy Bitcoin? 😏

US NEWS 🇺🇲

Jobs Data Incoming: Big Moves Ahead for Markets? 📉📊

Ladies and gents, it's that time again—Non-Farm Payrolls (NFP) Friday, also known as the Super Bowl for traders.

Forget the halftime show; this is where the real action happens.

NFP drops like clockwork on the first Friday of every month, and it's the ultimate market-moving event.

Why?

Because it’s the closest thing we have to a report card for the U.S. economy.

If the labour market is the Fed's favourite child, NFP is the report they use to decide if it’s getting dessert—or grounded.

Here’s what to expect this month:

Expected Non-Farm Payrolls: 170,000 (previous: 256,000)

Unemployment Rate: Holding steady at 4.1%

Why Traders Obsess Over NFP

Think of NFP as the market's mood ring.

A strong number?

That screams economic resilience, and the markets might rally (or crash, because they want rate cuts).

A weak number?

The Fed could cut rates to try and give the economy a Redbull to wake it up.

But there’s a twist this time. 🎢

With inflation still on the Fed’s radar, they’re paying extra-close attention.

If wages tick up or job growth slows, it could mess with their plans faster than a trader on 100x leverage during a flash crash.

Why You Should Care

Even if you don’t trade currencies or bonds, NFP is a ripple that touches every corner of the market.

A surprising print can send the USD flying, stocks tumbling, and even crypto wiggling.

For traders:

A hot number (above expectations) could mean the Fed delays cutting rates—bad for risk assets, great for the USD.

A cool number (below expectations) might give the Fed more breathing room to cut rates—bullish for stocks and crypto, but bearish for the USD.

The Bottom Line 🧵

So, set your alarms and brew that extra cup of coffee, because NFP is the must-watch event this Friday.

Whether you're trading USD/JPY or just sitting on the sidelines with popcorn, this report has something for everyone.

Oh, and remember, no matter how good your trades are, the Fed still has the final say.

Good luck, Munchers! ☕

We Want Your Input! ✅

At Pip Munch, we're all about providing the most value to you.

We're working on creating a free resource, and we’d love to know which one excites you the most:

Which resource excites you the most?Tell us which one you'd be most excited to receive (for free, of course!) |

FOREX

UK Growth Slows, BOE Acts: Trading Opportunities You Can't Miss 📉🇬🇧

Yesterday, the Bank of England dropped the hammer, cutting interest rates to their lowest level in 18 months. 🔨

If you missed it, don’t worry—we’ve got you covered (but your GBP trades? Maybe not).

Let’s break this down:

Why Did the BOE Cut Rates? 🇬🇧

The UK economy is slowing down faster than my willpower at an all-you-can-eat buffet.

The Bank of England slashed its growth forecast from 1.5% to 0.75% for 2025, barely dodging a recession.

With inflation cooling and Brexit chaos firmly in the rearview, they decided it was time to give the economy a little boost.

But here’s the thing about rate cuts: they’re great for businesses and borrowing but terrible for a currency.

Lower interest rates make a currency less attractive to investors—why hold GBP if you can park your money in USD or JPY for a better return?

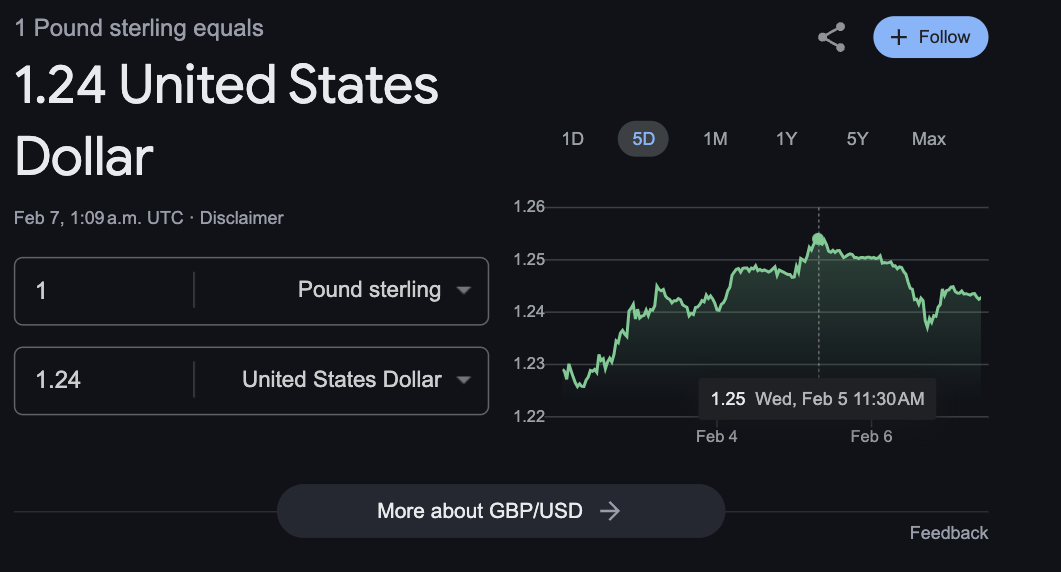

How the Market Reacted 📉

If you were trading GBP/USD yesterday without checking the news, well, RIP.

The pound tanked from 1.2540 to 1.2360 in what felt like a blink. Sure, it stabilized a bit after, but the damage was done.

Short-term traders who caught the move made bank.

But for anyone who went long on the pound thinking it was a quiet day?

That’s a learning experience you won’t forget. ❌

What Traders Need to Know

Interest Rate Cuts 101: Lower rates = weaker currency. It’s Economics 101, but when it happens, it still packs a punch.

Pay Attention to Central Banks: Miss the news, and the market will teach you a lesson (and not a cheap one). The BOE’s next move could send the pound tumbling further—or give it a chance to recover.

Trading Opportunities: Look at pairs like GBP/USD or GBP/JPY. The pound’s weakness opens the door for short setups, but watch for signs of stabilization if the market digests the rate cut fully.

The Bottom Line 🧵

The BOE just reminded everyone why staying informed is the real edge in trading. Miss a headline, and your portfolio might look like a chart of Luna’s collapse.

Keep an eye on the news, watch those central banks, and as always, trade smart.

Have a great weekend, Munchers! ☕

🚀 Pre-Market Fuel

🇨🇿 The Czech Republic officially removes capital gains tax on Bitcoin. Canada and the US, are you listening?

Legislation is being passed in Utah that would allow the state to buy Bitcoin. Will it get through the Senate?

🍪 Munchy Memes

Me and bro waiting for the alt season

— naiive (@naiivememe)

3:09 AM • Feb 6, 2025

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER