- Pip Munch

- Posts

- 📉 Lots of Red

📉 Lots of Red

Most traders can't quit their job because one bad month = $0 income. Lark Funding just solved that. They'll pay you a monthly salary—even when you're in drawdown.

☕️ GM Munchers! Between the market bleeding red and our portfolios joining the carnage, we're on coffee number six today—and it's only 9am. At this point we're basically just drinking anxiety with cream.

On today’s menu:

📉 Tech Crashes, Bitcoin Does A Loop

🇯🇵 Japan's About to Blow Up Your Carry Trades

🚀 The Biggest IPO of 2025

😬 Historically, Things Get Ugly Before Midterm Elections

❌ There’s New Drama With This Futures Prop Firm

Yesterday’s numbers:

S&P 500 | 6,721 | -1.16% |

Nasdaq | 22,698 | -1.79% |

Dow Jones | 47,886 | -0.47% |

Bitcoin | $85,900 | -2.23% |

BREAKING NEWS

📉 When Tech Giants Decide to Ruin Everyone's Day

Yesterday started off beautiful—green across the board, birds chirping, portfolios smiling. Then Oracle and Broadcom decided to crash the party harder than your drunk uncle at Christmas.

Here's what happened: The market was vibing until Oracle dropped 4% and Broadcom tanked 5%. Nvidia, not wanting to be left out of the misery, joined in and fell 3.5%.

The result? S&P 500 down 0.8%, Nasdaq down 1.1%, and the Dow slipped 100 points.

The damage this month is even uglier: Oracle's down 10% and Broadcom's hemorrhaging 19%. Yesterday’s Oracle dump came after reports that Blue Owl Capital won't back their $10 billion data center project. Translation? The AI infrastructure build-out might not be the money printer everyone thought it was.

The Munch Take:

We're seeing a clear rotation from large-cap growth into large-cap value. The market's asking: "Who's actually going to make money from these massive AI investments?" Until we get answers or more irrational optimism, we expect continued volatility in mega-cap tech. If you're long these names, tighten those stops—this rotation isn't stopping anytime soon.

😥 Bitcoin's Bipolar Episode Continues

Bitcoin just pulled off one of the most absurd moves we've seen: pumped $3,300 in 30 minutes, liquidating $106 million in shorts. Then it immediately dumped $3,400 in the next 45 minutes, liquidating $52 million in longs.

This isn't trading—it's financial whiplash. The manipulation is so blatant it's almost funny (it's not funny if you got liquidated, sorry).

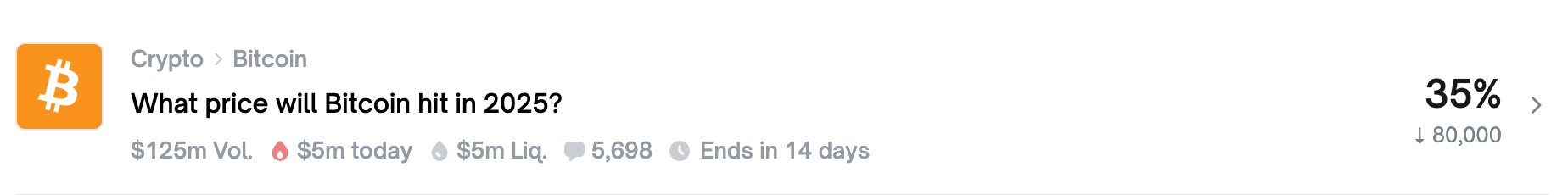

There's currently a 35% chance Bitcoin drops below $80K before year-end. Almost a coin flip.

The Munch Take:

Full transparency: We're holding our original position from 2023 at $35,000 (yes, we're smug about that one). But we also built a new position that's currently down 11.89% (less smug about this one). We're long-term holders, so if Bitcoin drops below $80K, we're buying more. But if you're swing trading this? Good luck—you're basically gambling against algos and whales with deeper pockets and faster execution. Maybe sit this volatility out unless you enjoy pain.

BROUGHT TO YOU BY

Tired of Trading Your Small Account?

Prop firms let you trade up to $200K without risking your own money. You pass an evaluation, get funded, and keep up to 90% of profits.

The catch? Most firms bury you in rules designed to deny payouts.

Lark Funding is different.

They just made their 1-Step Career Program even easier:

✅ Base Monthly Reward requirements dropped from 5 days to just 3 profitable days

✅ Get paid up to $1,000 monthly—even during losing months (now indefinite, not just 3 months)

✅ 7% max drawdown—the most forgiving in the industry

✅ No AI journaling—one less hoop removed

✅ 3+ years paying traders—if it was a scam, they'd be gone by now

Most firms tighten rules after launch. Lark's loosening theirs because they're not afraid of traders who win.

FOREX

🇯🇵 Japan's About to Blow Up Your Carry Trades

The Bank of Japan is expected to raise rates on Friday to 0.75%—the highest level since 1995, about 30 years ago. Markets are pricing this in with near-100% certainty.

Why This Matters:

A stronger yen means the end of the "yen carry trade"—where traders borrow cheaply in yen to invest in higher-yielding assets like US stocks, crypto, and emerging markets. When this unwinds, all those funded positions get sold. Fast.

Analysts are warning of potential 20-30% declines in risk assets like Bitcoin. We're talking forced selling of US stocks, crypto, and anything with high beta as positions unwind.

The Munch Take:

This could trigger serious risk-off sentiment across global markets. Carry trade participants are about to feel pain. If you're long risk assets funded by cheap yen borrowing, you might want to hedge. This isn't a gradual unwind—these moves are violent and fast. Watch the yen carefully on Friday. If it spikes post-announcement, buckle up for volatility everywhere else.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

$AAPL – While the rest of tech got obliterated yesterday, Apple only dropped 1%. That's what we're calling a "win" in this market. They're now just $100 billion away from overtaking Nvidia as the world's largest company. So basically one decent earnings beat and Tim Cook reclaims his throne. The iPhone loyalty cult remains undefeated.

$MDLN – Medline just had the biggest IPO of 2025, exploding 40% on day one from $29 to $35. Apparently selling bandages and hospital gowns is more profitable than anything we've been trading. Note to self: pivot to medical supplies, stop pretending we understand tech valuations.

$NFLX – Netflix is partnering with FIFA to launch a simulation game this summer. If you're confused about why a streaming company is making soccer video games instead of, you know, streaming content—join the club. Maybe this explains why the stock's down 20% in six months. Stick to what you're good at, guys.

$F – Ford cancelled a $6.5 billion EV battery deal with a South Korean energy company. Stock dropped 2%, but honestly? This is bullish. The EV hype train is officially derailing, and Ford's smart enough to hop off before it crashes. Turns out people still like engines that go vroom.

$GOOGL – Alphabet tanked 3% yesterday for absolutely no reason other than markets being markets. The stock's up 50% YTD, and our buddies won't shut up about telling us to buy it earlier this year. Yeah, we get it. You were right. Can we move on now?

🚀 Pre-Market Fuel

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER