- Pip Munch

- Posts

- 📈 Market Cheers: Middle East Conflict Might Chill Out

📈 Market Cheers: Middle East Conflict Might Chill Out

Ready to trade without draining your own account? Lark Funding lets you prove your skills on a simulated funded account—earn up to 90% profit splits, get instant payouts, and skip the fine print.

☕️ GM Munchers! The only thing more unpredictable than this week’s Fed decision is my wife’s mood when I say “I’m just gonna trade for 10 more minutes.”

On today’s menu:

📉 Oil Drops, Stocks Pop, Debt Explodes

😏 Most Traders Lose Money—Here’s How to Flip the Script

📱 Trump Is Selling Phones?

😬 Insiders Are Hitting the Sell Button Hard

🥇 Gold Continues To Break Records

Yesterday’s numbers:

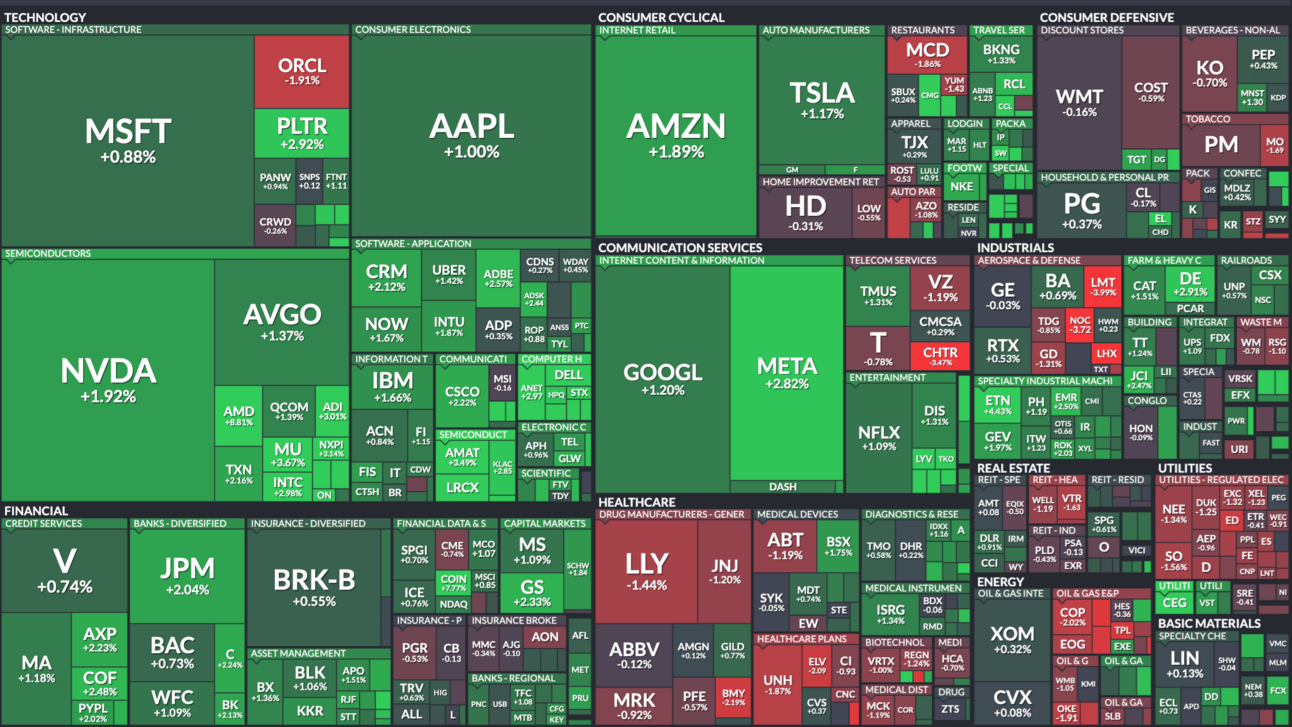

S&P 500 | 6,033 | +0.94% |

Nasdaq | 19,701 | +1.52% |

Dow Jones | 42,515 | +0.75% |

Bitcoin | $108,61 | +2.81% |

BREAKING NEWS

📈 Market Cheers: Middle East Conflict Might Chill Out

Stocks bounced like my toddler on a sugar high. After a brutal Friday selloff, Monday flipped the script.

Why?

Investors now think the Israel-Iran drama may stay semi-contained. Iran floated a ceasefire in exchange for nuclear talks, and Trump is saying peace is “easy to get” — which is definitely how peace has always worked. 😅

Translation? Risk-on is back (for now). If tensions simmer down, expect equities to keep climbing and volatility to take a nap.

What to watch next: Any flare-up will kill this rally faster than you can say “Strait of Hormuz.” But if peace talks progress, it's rocket fuel for stocks — especially tech and risk assets.

🛢️ Oil Drops, CAD Slips, Markets Breathe

Oil cooled off faster than my coffee after one sip. WTI fell over 2% to $71.50 after peaking above $77 in the overnight session. It’s a classic unwind of the geopolitical fear premium.

Why this matters:

Less war risk = less oil supply fear = lower prices

CAD often rides oil's coattails — so it's slipping too

Lower oil means softer inflation = better odds for future Fed cuts

Playbook:

Short-term: Risk assets like equities and high-beta FX (AUD, NZD) get a lift

Mid-term: If oil keeps falling, watch for dovish repricing across rate markets

And yes, CAD bulls just got kicked in the loonies.

💸 America’s Interest Bill: $1.2 Trillion and Climbing

How did we arrive at a point in this country where 25% of all tax revenue goes to just paying the interest in $37 trillion in govt debt?

Annually:

US govt total reveneue = about $5 trillion

US govt interest on debt = about $1.2 trillionUS govt spending = about $7 trillion

— Wall Street Mav (@WallStreetMav)

2:47 PM • Jun 16, 2025

This chart slapped harder than my wife when I suggested naming our kid “Dow Jones.” Elon Musk just reposted a stat that’s setting off alarms: 25% of U.S. tax revenue now goes to interest on debt.

Quick math:

Total debt = $37 trillion

Annual interest = $1.2 trillion

Annual revenue = $5 trillion

We’re borrowing to pay interest. Gulp.

This isn’t just a budget issue — it’s a macro one. The more money the U.S. government spends on interest, the less it has for...well, anything. And if rates stay elevated, that bill balloons.

Why it matters for traders:

Long-term risk to USD strength (who wants to hold debt that spirals?)

Potential future inflation as the Fed becomes political again

Real assets (Bitcoin, gold, etc.) get more attractive in debt spiral scenarios

Dalio mode: “When empires overspend and overprint, currencies die slowly… then suddenly.”

BROUGHT TO YOU BY

Most Traders Lose Money—Here’s How to Flip the Script

Ever wanted to trade like the pros—but without dumping your life savings into the market?

That’s exactly what prop firms are for. You pay for a challenge, prove you can trade, and if you pass, you get access to a simulated funded account where you can earn a share of the profits.

But not all firms are created equal.

Some hit you with “consistency” rules, payout delays, and surprise restrictions that make it nearly impossible to win.

Lark Funding does it differently:

✅ No news restrictions

✅ No consistency rules

✅ First payout on demand

✅ Zero hidden BS

And right now, they’re offering 15% off with code JUNE15.

If you’ve never taken a prop firm challenge before, this is the cleanest way to start—with rules that actually make sense.

👉 LarkFunding.com – go check them out.

COMMODITIES

📉 Insiders Are Hitting the Sell Button Hard

Corporate Insiders are dumping stocks at the fastest pace since November 2024 🚨🚨

— Barchart (@Barchart)

1:53 AM • Jun 16, 2025

If your barber tells you to buy a stock, ignore him.

If your dentist does, ignore her too.

But when insiders start dumping shares? Time to pay attention.

According to fresh data, corporate insiders are offloading stocks at the fastest pace since November 2024. Translation? The folks running the companies don’t seem too stoked about what’s coming.

Here’s the deal:

Insider selling is spiking — fast.

This doesn’t always mean a crash is coming… but historically, it does tend to pick up before major market tops.

Why? Because these aren’t Reddit traders chasing breakouts. These are the CFOs, COOs, and CEOs who know exactly where revenue, costs, and demand are heading.

So what now?

Keep an eye on sectors with the most selling. That’s often where cracks show up first.

Rising insider selling = bearish sentiment signal. Might be time to trim risk or hedge exposure.

But don’t panic sell — this is a yellow light, not a red one. Yet.

The bottom line?

When the captain bails off the cruise ship early… it’s probably not because he left his sunscreen at home.

Stay alert. Trade smart. And if you see Zuck selling, maybe don’t buy the dip.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

$META ( ▼ 1.34% ) WhatsApp is getting ads. Which means your chats will now feature your aunt’s conspiracy theories and retargeting ads for socks you looked at once in 2023. Meta’s cash printer just found a new ink cartridge.

$DJT ( ▼ 2.28% ) Trump’s launching a smartphone. Yes, you read that right. The 45th (and maybe 47th) president is selling a $499 “Freedom Phone” with a $47.45/mo plan.

We’re not saying it’ll run Truth Social faster… but we’re also not not saying that.

$JPM ( ▼ 1.9% ) Credit card wars are heating up. Rumor is Chase is dropping a major update to its Sapphire Reserve. American Express saw that and basically said, “Oh yeah? Just wait ‘til our Platinum glow-up later this year.”

$AMD ( ▼ 1.7% ) Chip stock snapback? Analysts think so. AMD popped 9% after Wall Street whispered “Q4 comeback.” Why Q4? That’s when they’re expected to wrap up an $800M China export bill. Nothing like clearing a tab to get bullish again.

$X ( ▼ 0.02% ) US Steel jumped 5% after Trump greenlit its merger with Japan’s Nippon Steel.

But here’s the kicker: both firms had to give the US gov a “golden share” of control.

Charlie got the chocolate factory. Uncle Sam got the blast furnace.

PROP FIRMS

🤑 Tuesday Motivation

LETS GOOOO, @FTMO_com approved the $43,000 payout

💀💀💀💀Alhamdulillah!!

— ZamcoCapital (@ZamcoCapital)

12:05 PM • Jun 16, 2025

🚀 Pre-Market Fuel

🍪 Munchy Memes

stop thinking about crypto, relax, get outside and chill out a little bit

the outside :

— naiive (@naiivememe)

4:34 PM • Jun 16, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER