- Pip Munch

- Posts

- 📉 Market Whipsaw: Big Tech Earnings & Trump's Tariff Talk

📉 Market Whipsaw: Big Tech Earnings & Trump's Tariff Talk

Tired of waiting weeks for your payout?

Lark Funding gets you paid fast. Under 6 hours, on average. No delays. No fluff. Just raw spreads, fast payouts, and up to 90% splits.

☕️ GM Munchers! Happy election day to our Canadian traders — where the only thing more split than the vote is my household over whose fault it is we’re out of coffee.

On today’s menu:

📉 Market Whipsaw: Big Tech Earnings & Trump's Tariff Talk

🛢️ Oil’s Forecasts Just Got Smacked

🚀 Bitcoin Decouples From Reality

😏 Coinbase CEO Goes Bullish

❌ Trump’s Approval Rating Crashes

Here are Friday’s numbers:

S&P 500 | 5,525 | +0.74% |

Nasdaq | 17,382 | +1.26% |

Dow Jones | 40,113 | +0.05% |

Gold | $3,310 | -1.40% |

Bitcoin | $93,863 | +1.90% |

BREAKING NEWS

📉 Market Whipsaw: Big Tech Earnings & Trump's Tariff Talk

Well folks, the vibes are… confusing.

Wall Street is gearing up for the busiest week of Q1 earnings season, with over 180 S&P 500 companies set to spill their financial guts.

Among the headliners? Amazon, Apple, Meta, and Microsoft—four of the "Magnificent Seven"—plus Visa, Coca-Cola, Eli Lilly, and Buffett’s own Berkshire Hathaway.

So far, earnings season has felt like that friend who promises to pick up the dinner tab but “forgets” their wallet—technically disappointing but not a total disaster.

About 73% of companies have beaten analyst expectations, a bit below the 5-year average of 77%.

📉 April Showers Bring... Pain?

April hasn’t exactly been winning any "best month" awards:

S&P 500 (last 30 days): down 2.95%

Dow Jones (last 30 days): down 5.17%

Nasdaq (last 30 days): down 2.37%

Translation: If your portfolio feels like it needs therapy, you’re not alone.

The S&P briefly flirted with bear market territory earlier this month but has since staged a wobbly comeback—kind of like a trader swearing off coffee during earnings week (good luck with that).

🇺🇸 Trump’s Trade Talk Shakes Things Up

President Trump added some extra spice to markets this weekend during his Time Magazine interview.

Highlights:

Proposed sweeping tariffs between 20% to 50%

Declared they would be a “total victory” for the U.S. economy

Floated new taxes on millionaires

Discussed new trade deal negotiations

What does all of this mean?

Nobody knows. But Adam Turnquist of LPL Financial warned investors to stay on "high alert" for a shift back toward risk-off mode.

In plain English: Keep your stops tight... and maybe order that second coffee.

BROUGHT TO YOU BY

The Fastest Payouts In The Industry

Other firms drag their feet.

Lark Funding moves at your speed.

Built for traders who hate waiting, we process payouts in under 6 hours—weekends included.

Choose your path: 1-step, 2-step, 3-step, or Instant.

Scale up to $600K.

Keep up to 90% of your profits.

Fast evaluations. Faster payouts.

No games. No hold-ups. Just trading the way it should be.

COMMODITIES

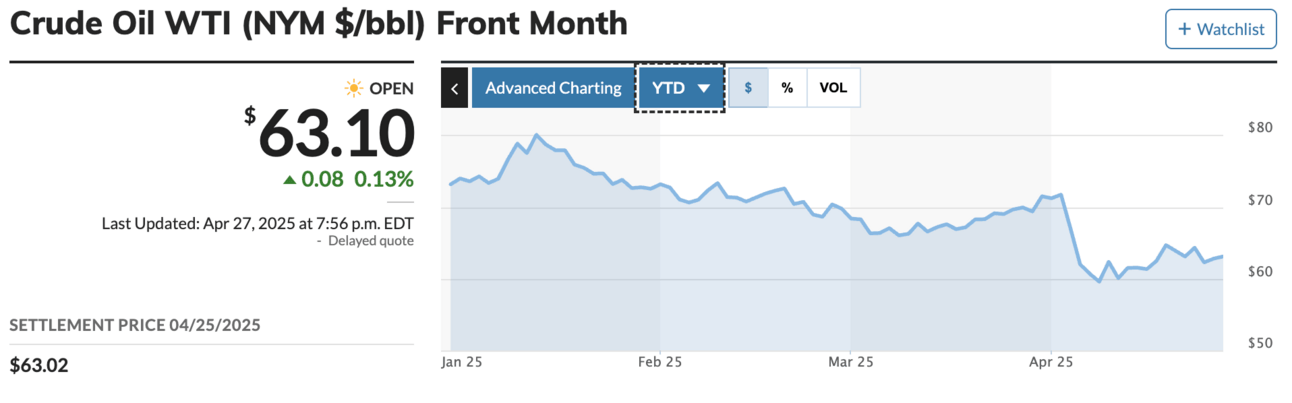

🛢️ Oil’s Forecasts Just Got Smacked

If oil were a boxer, it just got dropped faster than my diet plans on a Saturday night.

Morningstar DBRS slashed their forecast for West Texas Intermediate (WTI) to $60/barrel for 2025 — down from $65.

Deloitte also trimmed their numbers, now calling for:

$68 in 2025

$66 in 2026

$65 in 2027

Translation: the oil market’s optimism is leaking faster than my confidence in a 1-minute scalp trade.

The reasons?

1️⃣ The U.S.-China trade war is crimping global demand (they’re the two biggest oil guzzlers). 🔹 OPEC+ is unwinding production cuts just as demand softens.

2️⃣ Economic uncertainty is spreading faster than bad trading advice on Twitter.

Since peaking above $80 in January, WTI has plunged into the $60s — sitting at four-year lows.

Why it matters for traders:

If oil stays weak, expect the Canadian Dollar (CAD) to stay under pressure too. Remember, CAD is basically oil’s clingy ex — when crude tanks, so does the loonie.

In short: oil’s on shaky legs, and CAD traders better be wearing helmets. 🪖

CRYPTO

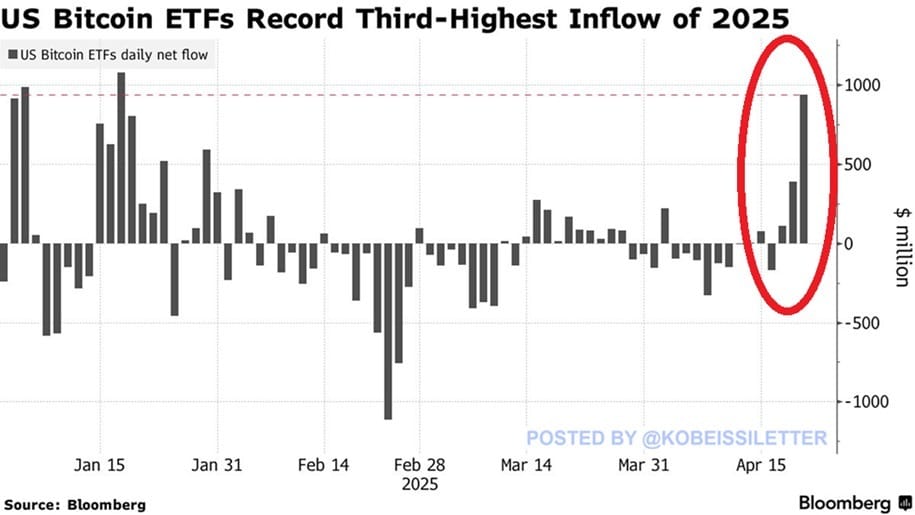

🚀 Bitcoin Decouples From Reality (and Risk Assets)

If you’re sitting there thinking Bitcoin was dead, the crypto market just hit you with a “hold my beer.”

In the last week alone, investors have thrown $1.4 billion into US-listed Bitcoin ETFs — with $936 million pouring in on Tuesday alone. That's the third-highest single-day inflow of the year.

Since the April 7 low, Bitcoin has surged over 25% and is now trading above $93,000.

Meanwhile, the S&P 500 is down -6% for the year.

Bitcoin? It's basically flat YTD — a massive win when you realize that every other "risk asset" looks like it’s been run over by a truck full of recession fears.

For the first time in 2025, Bitcoin is officially decoupling from stocks. Safe haven demand is real, folks.

The question now: Is Bitcoin heading for $100,000+?

At this rate, maybe. If Bitcoin had a LinkedIn profile, it would finally get to add “Uncorrelated Asset” under its Skills section.

Bottom line: Traders aren't just YOLO'ing into Bitcoin anymore because it’s shiny and confusing. They’re seeing it as a real safe haven — right up there with gold, U.S. Treasuries, and hoarding canned beans in the basement.

Is this sustainable? Maybe not.

But with supply on exchanges hitting a new low, Bitcoin might keep flexing harder than that guy at the gym who insists on deadlifting in jeans.

This is kind of crazy.

— Bitcoin News (@BitcoinNewsCom)

11:14 PM • Apr 25, 2025

PROP FIRMS

🤑 Monday Motivation

🚨 New Payout Alert! 🚨

Neil received his $900 payout in just 5 hours.

Not days. Not weeks. Five. Hours.At Lark Funding, we process payouts faster than any other prop firm in the game.

Ready to get paid fast?

— larkfunding (@larkfunding)

11:12 AM • Apr 24, 2025

🚀 Pre-Market Fuel

🍪 Munchy Memes

Traders in January Traders in April

— Michael Brown (@MrMBrown)

6:49 PM • Apr 24, 2025

Waiting for my portfolio to 10X so I can finally live my life

— naiive (@naiivememe)

1:47 PM • Apr 26, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER