- Pip Munch

- Posts

- 📈 Markets Climb, Silver Soars, Trump Buys

📈 Markets Climb, Silver Soars, Trump Buys

Want to make money trading without risking your own capital? Prop firms are the move — and Lark Funding is one of the best.

✅ Up to 90% profit splits

✅ Zero hidden rules

✅ Trusted by traders for 3+ years

☕️ Mornin’ Munchers! I told my wife I finally found the perfect setup. She asked, “For a trade or an excuse?” Anyway, I’m sleeping on the couch again.

On today’s menu:

📈 Markets Climb, Silver Soars, Trump Buys

🟠 Bitcoin Bounces Back (Again)

🍿 Tasty Movers & Shakers

📉 Bonds Vs Stocks (It’s Ugly)

🍭 Sugar Gets Crazy Cheap

Yesterday’s numbers:

S&P 500 | 6,005 | +0.09% |

Nasdaq | 19,591 | +0.31% |

Dow Jones | 42,761 | +0.00% |

Bitcoin | $110,000 | +3.86% |

BREAKING NEWS

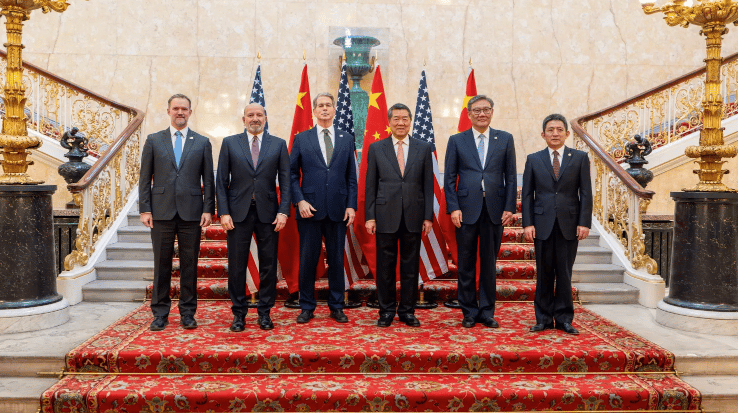

🇺🇸 U.S.–China Trade Talks: Markets Smell a Deal

Stocks ticked higher Monday as U.S. and Chinese officials held marathon trade talks in London. On the table? Critical mineral exports and handshake-level diplomacy.

The S&P 500 is now just 2% away from a record high.

— Brew Markets (@brewmarkets)

6:41 PM • Jun 9, 2025

💡 Why traders care:

Semis popped as the market priced in lower tariff risk.

U.S.-China peace = bullish for supply chains, chipmakers, and Apple’s supply lines (yes, even if Apple just announced another boring OS redesign).

Risk-on vibes lifted large caps and commodities alike.

BREAKING: US-China talks reportedly lasted around 6 hours.

Chinese officials have left, while Bessent, Lutnick, and Greer remain.

Negotiations will resume at 10 AM tomorrow in London.

— The Kobeissi Letter (@KobeissiLetter)

7:23 PM • Jun 9, 2025

👀 What to watch:

Talks resume Tuesday. If there's an actual breakthrough, expect a rotation into China-linked names, semis, and industrials.

If talks fall apart? Get ready to short the optimism out of the S&P faster than my confidence during earnings season.

🪙 Silver Hits a 13-Year High

JUST IN 🚨: Silver blasts to highest price in more than 13 years 📈📈

— Barchart (@Barchart)

2:13 PM • Jun 9, 2025

Silver hit $36.6/oz — its highest level since 2011 — and traders are acting like it’s the GameStop squeeze all over again.

💥 What happened:

Metal markets are catching fire. Some say it’s due to inflation hedging. Others say it’s Musk's next battery idea. We say: just ride the momentum.

📈 Why it matters:

Silver is the risk-on cousin of gold. It spikes when inflation jitters + industrial demand heat up.

A surge here usually drags up mining stocks, precious metal ETFs, and TikTok trading advice that definitely should not be followed.

📊 What to watch:

$36.6 is a key resistance. Break it and silver could test $40.

Keep an eye on gold/silver ratio — narrowing = risk-on.

If Powell sneezes about inflation, silver might moon again.

👶 Trump Wants to Buy $SPY for Babies

BREAKING: President Trump has officially rebranded the InvestAmerica $1000 accounts given to children at birth as "Trump Accounts."

Every US citizen born after December 31st 2024 and before January 1st 2029, the Federal Government will make a one time contribution of $1000 that

— amit (@amitisinvesting)

7:06 PM • Jun 9, 2025

Trump is proposing “Trump Accounts” — a $1,000 investment into the stock market for every American baby born between 2025–2029.

Yes, really. Your newborn might be long $SPY before they’re out of diapers.

📜 The plan:

$1K from the government + optional $5K/year from family/friends.

Funds are invested in the stock market.

Kids get access to half at 18, full at 25.

🧠 Why traders care:

If passed, it’s bullish for the S&P 500 (even if junior can’t spell ‘dividend’).

Promotes long-term buying pressure.

Could lead to a generational wave of equity holders (translation: more bagholders by 2035).

🎯 What to watch:

Senate still needs to approve the plan.

If passed, expect a media blitz and speculative inflows into $SPY (and maybe $VTI).

If babies are about to out-invest you… it might be time to step up your game.

BROUGHT TO YOU BY

Get Paid to Pass? Yep, We’re Serious.

Lark Funding just dropped its new JUNE15 promo — and if you’re even thinking about starting a challenge, this is your sign.

Here’s what you get:

✅ 15% off any challenge (yes, even Instant Funding)

✅ 125% refund on your first payout (for 1-, 2-, and 3-step programs only)

Translation? You’re going to get paid just for passing a challenge.

Fast payouts, up to 90% splits, no hidden rules. Just a prop firm built to get you funded — not frustrate you.

🎯 Code: JUNE15

📆 Valid until June 30

⚠️ Refund bonus excludes Instant Funding

CRYPTO

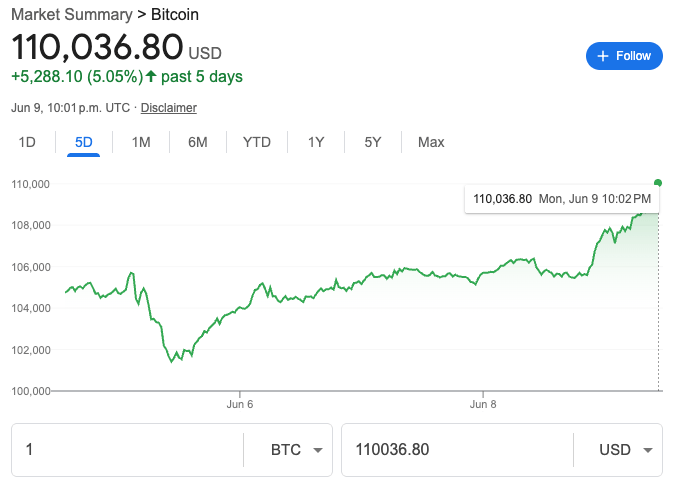

🟠 Bitcoin Bounces Back (Again)

Bitcoin is back.

After dipping below $101K last week, BTC has launched itself back above $110,000 like it forgot it was supposed to be in a bear market. That’s a +9% bounce fueled by big money, macro fears, and—of course—whales doing whale things.

Here’s why it ripped:

✅ ETF flows: Institutions are still YOLO-ing into Bitcoin ETFs. Billions flooded in during May/June.

💼 Risk hedge: With Powell and tariffs stirring the pot, BTC looks tasty as a safe-haven play.

🐋 Whales bought the dip: A classic “thank you for your liquidity” moment.

📈 Broad market vibes: Stocks are strong, traders are feeling spicy, and the risk-on rally lives.

Bonus catalyst: SEC Chair Paul Atkins just publicly backed crypto self-custody, calling it “a foundational American value.” Somewhere, Satoshi just fist-pumped.

JUST IN: SEC Chair Paul Atkins announces he's in favor of Bitcoin & crypto self custody. 👀

"The right to have self custody of ones private property is a foundational American value." 🇺🇸

— Bitcoin Magazine (@BitcoinMagazine)

6:11 PM • Jun 9, 2025

What to watch next:

ETF inflows 📊

Yields and CPI 📉

Elon’s next meme 🤡

Bitcoin’s back. Again. And if this keeps up, my wife might finally stop calling it “magic internet money.” Might.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

$AAPL ( ▼ 3.21% ) We called it. Apple’s WWDC was more snooze than news. Stock dipped after Tim Cook unveiled... a redesigned iPhone operating system called Liquid Glass. It’s the first refresh since 2013, which is coincidentally the last time anyone was excited about a new iOS.

$OPENAI ( 0.0% ) ChatGPT has officially hit beast mode. OpenAI just crossed $10 billion in annual recurring revenue—only 2.5 years after launch. That’s faster than my trading account hits zero on CPI days.

$QCOM ( ▼ 2.22% ) Qualcomm jumped 4% after announcing a $2.4B acquisition of Alphawave. Smart move. When in doubt, buy the chips. (Preferably before Nvidia does.)

$TSLA ( ▼ 1.49% ) Tesla spiked 5% after Trump said he’s keeping his gifted Tesla. No word on whether he actually knows how to charge it.

$HOOD ( ▼ 4.53% ) Robinhood tanked as much as 4% after traders realized it’s not getting added to the S&P 500. Hope you didn’t FOMO in early thinking it was the next Tesla.

$LULU ( ▼ 0.5% ) Lululemon’s still stretching—for a bottom. Stock’s down 20% in a week, and Morgan Stanley just cut its price target to $280. That’s a 6% upside from here… or what we call a rounding error.

PROP FIRMS

🤑 Tuesday Motivation

200k Breached after 355 days,

49K from ONE 200k account taking 19 payouts, Not your average trader.

I’ll forever respect @QuantTekel & @AlexQuantTekel, Made me into the person I am today. Thank you for everything. 💚

— J3 (@J3_Trades)

2:37 PM • Jun 9, 2025

🚀 Pre-Market Fuel

🍪 Munchy Memes

The market vs Trump’s tariffs

— Not Jerome Powell (@alifarhat79)

3:17 PM • Jun 3, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER