- Pip Munch

- Posts

- 📉 Markets Green, Consumers Spending, Trump Tweeting

📉 Markets Green, Consumers Spending, Trump Tweeting

Trading's chaotic enough without wondering where next month's rent comes from. Lark Funding now pays monthly salaries—even when your account's red.

☕️ GM Munchers! Pip Munch here, your trading newsletter that ate its weight in mashed potatoes last week and is now ready to help you digest market movements instead of family drama.

On today’s menu:

📉 Markets Green, Consumers Spending, Trump Tweeting

🥈 Silver Just Did Something It Hasn't Done Since 1980

🇨🇦 This Canadian Stock Is Ripping

😏 December Is Usually A Good Month For Stocks

😬 US Credit Card Debt Just Hit a New Record High

Friday’s numbers:

S&P 500 | 6,849 | +0.54% |

Nasdaq | 23,365 | +0.65% |

Dow Jones | 47,716 | +0.61% |

Bitcoin | $90,500 | -0.40% |

BREAKING NEWS

📈 Markets Ate Turkey, Now Eyeing Santa's Sleigh

Last week the market closed green, presumably fueled by tryptophan-induced optimism and everyone pretending their uncle's political rants at Thanksgiving dinner didn't happen.

We're now staring down the barrel of the million-dollar question: Are we getting a Santa rally?

Here's where things stand: Bitcoin has parked itself around $90K like a well-behaved asset (shocking, I know), and despite everyone screaming about impending doom, the S&P 500 is literally a few percentage points off all-time highs.

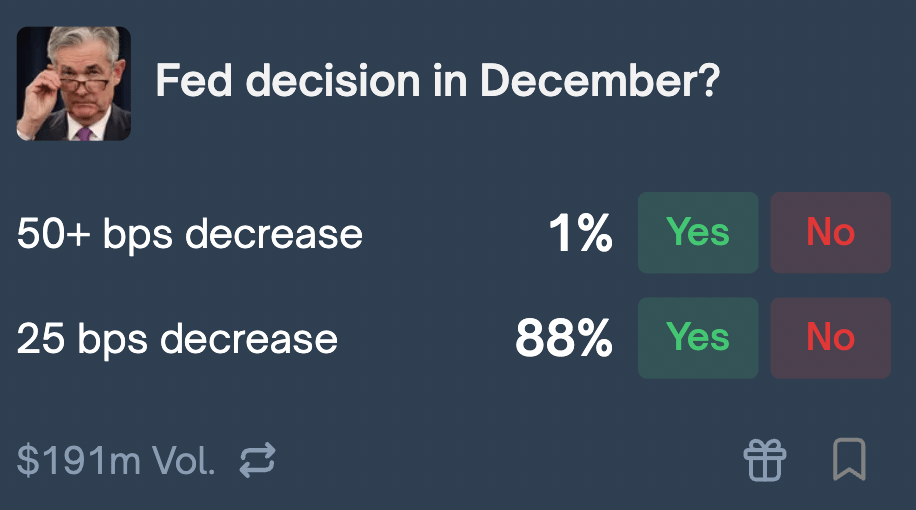

Market odds for a December rate cut just hit 88% probability for a 25 basis point cut. Translation? The Fed's basically got a bow on that rate cut already, just waiting to unwrap it on December 10th.

JP Morgan's out here saying the S&P could hit 7,500 by end of 2026—an 11% gain that would be driven by AI hype and continued earnings growth.

But hold your eggnog.

AI stocks are still experiencing more mood swings than a teenager. Valuations are stretched, sentiment flips faster than a pancake, and if the Fed surprises with hawkish language, this rally could turn into a tantrum real quick.

The Munch Take:

We're cautiously optimistic but not stupid. The setup for year-end is bullish—rate cuts, stabilized crypto, solid fundamentals. But keep stops tight because December volatility is a feature, not a bug.

🛒 Black Friday Proves Americans Will Still Buy Stuff (Shocking)

Remember when we all thought the American consumer was dead? Buried under student loans, crushed by inflation, crying into their overpriced lattes?

Yeah, turns out we were wrong. Again.

US online Black Friday sales just hit $11.8 billion—up 9.1% from last year. Apparently, nothing says "economic anxiety" quite like rage-buying discounted air fryers and PlayStation 5s at 3 AM.

Why This Matters:

Consumer spending is basically the entire US economy. When Americans are buying, companies make money, stocks go up, and portfolio managers can afford their second vacation homes in the Hamptons.

The 9.1% jump in Black Friday sales is a massive green flag for consumer sentiment heading into year-end. Combine that with the near-guaranteed 25 bps Fed rate cut on December 10th, and you've got a recipe for continued market strength.

Translation?

Lower rates = cheaper borrowing = more spending = corporate earnings go brrr = your stocks (and hopefully crypto) keep climbing.

The Munch Take:

The consumer isn't just alive—they're thriving. This is bullish for retail stocks, bullish for tech (since half those purchases were gadgets), and bullish for overall market sentiment into 2026.

✈️ Trump's Venezuela Airspace Tweet (Because Of Course)

Just when you thought the weekend would be quiet, Trump dropped a social media bomb aimed directly at Venezuela, declaring their airspace "closed in its entirety" to all airlines, pilots, drug dealers, and human traffickers.

What's Actually Happening:

The US just ramped up military pressure on Venezuela with F-35 fighter jets, warships, the aircraft carrier Gerald R Ford chilling in Latin American waters, and reportedly authorized covert CIA operations inside the country.

The official reason? Cracking down on drug trafficking networks.

Venezuelan authorities, predictably, told the US to kick rocks and insisted their airspace remains open despite American "colonialist threats." Several international airlines have already suspended flights and rerouted to avoid the area due to security concerns.

Why Traders Should Care:

If this escalates into actual military conflict, risk assets are going to get hammered. Think oil volatility, defense stocks popping, and a general flight to safety that crushes crypto and tech in the short term.

Right now it's saber-rattling. But saber-rattling has a nasty habit of turning into actual sabers when geopolitical egos get involved.

The Munch Take:

Keep this on your radar but don't panic yet. Geopolitical noise tends to be more bark than bite—until it isn't. If tensions escalate further, expect a risk-off move. For now, it's a headline to watch, not a position to trade.

No one in Washington is telling you the truth:

The Debt Crisis Has Begun

America’s $37 trillion time bomb just detonated – and the shockwave could rip through your stocks and retirement…

COMMODITIES

🥈 Silver Just Did Something It Hasn't Done Since 1980

While everyone's been screaming about the "AI bubble," silver quietly became the most interesting trade nobody's talking about.

Silver just broke above $55/oz for the first time in history—surpassing both the 1980 and 2011 peaks. The "Devil's metal" is now outperforming literally everything while traders were busy fighting over Nvidia.

What's Driving This:

Supply crisis meets perfect storm. Mine production has been declining for 10 years, while demand is exploding from three places: EVs, AI infrastructure, and solar panels. Electric vehicles might soon require a kilo or more of silver each for solid-state batteries.

Meanwhile, London's vaults are basically empty—down from 31,023 metric tons in 2022 to 22,126 tons by March 2025. Physical silver became so scarce that overnight borrowing costs hit 200% annualized in October. People were literally flying silver by plane instead of cargo ships just to meet delivery deadlines.

The Munch Take:

Silver hit a 71% year-on-year gain in mid-October and experts think it's got room to run. The gold-silver ratio is screaming that silver's undervalued. This isn't your grandfather's precious metals trade—it's an industrial commodity with tech tailwinds.

Own assets or watch from the sidelines. Your call.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

Silver isn't the only metal having its moment. Copper just casually hit a new all-time high while everyone was distracted arguing about AI bubbles.

$DOL.TSX While Americans were trampling each other for Black Friday deals, Canadians were quietly stacking wins at Dollarama. The stock's up a disgusting 42% YTD and RBC just raised their price target because apparently discount shopping is now a growth industry.

$INTC Intel surged 10% on whispers of a potential Apple partnership. Nothing says "we're back" like your ex calling to see if you're still good with semiconductors.

$COIN Coinbase climbed 3% after Bitcoin remembered it's supposed to be a legitimate asset and stopped acting like a meme stock. When crypto stabilizes, Coinbase collects rent. Tale as old as 2017.

🚀 Pre-Market Fuel

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER