- Pip Munch

- Posts

- 📉 Markets Melt, Bitcoin Bleeds, Elon Wins

📉 Markets Melt, Bitcoin Bleeds, Elon Wins

Imagine buying one prop challenge and walking away with three. No strings. Lark Funding’s legendary Buy 1 Get 3 is officially back.

Grab any $100K challenge and get two $50K accounts completely free. Works on 1-step, 2-step, and 3-step. Use code BUY1GET3 at checkout.

☕️ GM Munchers! Another day, another emotional rollercoaster. If your trades didn’t make you cry this week, you’re probably not trading enough. Let’s dig into the wreckage.

On today’s menu:

📉 Markets Melt & Bitcoin Bleeds

🤑 Elon Wins His $1 Trillion Payday

😭 GTA VI Gets Delayed & Stock Tanks 20%

😬 These Stocks Join The Pain Train

👀 Another Update From My Forex Funds

Yesterday’s numbers:

S&P 500 | 6,720 | -1.12% |

Nasdaq | 23,053 | -1.90% |

Dow Jones | 46,912 | -0.84% |

Bitcoin | $100,870 | -2.91% |

BREAKING NEWS

🧠 The Market Has Split Personality Disorder

We’re officially living in the most bipolar market in history.

Yesterday we talked about how the strong ADP jobs report had everyone feeling bullish and singing “soft landing” again. Well, those good vibes lasted about as long as a trader’s discipline after two green trades.

Cue the crash.

October saw 153,074 job cuts — the biggest in 22 years, up 184% from September and 175% higher than last year.

Yeah, it hasn’t been this bad since 2003, and it’s shaping up to be the worst layoff year since 2009 (and we all remember how that movie ended).

The data comes from the Challenger Job Cut Report, which tends to be volatile — meaning ADP might still be showing job gains while Challenger is screaming “recession.”

The reality’s somewhere in the middle, but the market didn’t care.

Stocks tanked across the board as traders tried to process whether this means the Fed will cut sooner or if the economy’s just rolling over.

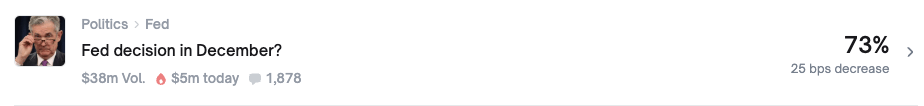

December rate cut odds climbed to 73%

The Munch Take:

If you’re a short-term trader, stay nimble — this is scalp season, not swing season. For long-term investors like us, we’re channelling our inner Buffett and stacking cash for when the discounts get even juicier.

😢 Bitcoin Feels the Pain Too

If watching stocks tank wasn’t enough emotional damage, Bitcoin decided to join the misery parade — dropping almost 3% yesterday for all the same reasons we just talked about.

But here’s the kicker: prediction markets now say there’s a 45% chance Bitcoin dips below $90K before the end of 2025.

Translation? The market’s betting that crypto winter might be back on the menu.

As our intern likes to remind us: “Bitcoin always goes higher than you think… but also crashes harder than your ex’s rebound relationship.”

Full transparency — we bought some Bitcoin earlier this week, and if it dips below $100K, we’re buying more.

Not financial advice. Just a guy who paid for his first house with Bitcoin he bought at $30K and is now trying to manifest that same luck twice.

💰 Elon’s $1 Trillion Pay Day

While the rest of us are deciding whether we can afford extra guac, Elon Musk just got a $1 trillion pay package approved by 75% of Tesla shareholders.

Now before you go full Twitter meltdown screaming “late-stage capitalism,” let’s remember one thing: incentives.

This isn’t a “here’s your check, Mr. Musk” situation — he actually has to earn it. And the goals are… well, borderline delusional:

The package includes 12 tranches of shares vesting over 10 years.

The first unlocks when Tesla’s market cap hits $2 trillion (it’s at $1.54T now).

The rest unlock every $500 billion after that — all the way up to $8.5 trillion.

Oh, and Tesla also has to deliver 20 million vehicles, 10 million active FSD subscriptions, and 1 million robotaxis. So basically, Elon has to turn every car on Earth into a Tesla.

If he somehow pulls this off, Elon would earn an extra 423 million shares, on top of his 13% stake.

Our take? Love him or hate him, this is peak capitalism done right — reward the guy only if he actually changes the world.

And if he doesn’t? No bonus, no problem. We’ll still be here trying to change our own lives… one $100 trading account at a time.

BROUGHT TO YOU BY

⏰ 1 Week Left - The Industry’s Best Prop Firm Promo Is Back

Now through Nov 14, grab a $100K evaluation (with Weekend Holding + 90% split) and get two bonus $50K accounts — totally free.

✅ Works on 1-step, 2-step, and 3-step

✅ Perfect time to stack before Lark 3.0

✅ Use code BUY1GET3 at checkout

Let’s be honest — if you’re serious about scaling in 2026, this is your shot.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

🎮 $TTWO

GTA VI just got delayed again. Take-Two dropped 10% after-hours after announcing the game won’t drop until November 2026. Yeah, we got the first trailer in 2023, and now we’ll probably have flying cars before the game itself.

💉 $LLY / $NOVO-B

Trump struck a deal with Eli Lilly and Novo Nordisk to slash weight-loss drug prices, thanks to new Medicare coverage. Both stocks finished green yesterday — guess Big Pharma’s bulking and cutting at the same time.

🦉 $DUOL

Duolingo just had its worst day ever, down 25% and now 40% YTD. This is what happens when your P/E ratio hits 100 — live by the sword, die by the app store. Maybe we’ll finally get another free trial to learn how to say “bagholder” in German.

💾 $QCOM

Qualcomm slipped 4% after posting great earnings but warning it could lose future business with Apple. Translation: “We’re crushing it… but we might get ghosted.”

📉 $META

Zuck’s empire dipped another 2.67%. As we said earlier this week — Meta’s valuation is the best of the Mag 7, and we’re not brave enough to bet against the guy who turned Facebook into a $600B machine while wearing flip-flops.

🏘️ $AIRBNB

Shares climbed in the after-hours thanks to a solid earnings report, with revenue rising 10%. Guess people aren’t tired of paying a $150 cleaning fee, but still needing to clean the whole place themselves.

🚀 Pre-Market Fuel

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER