- Pip Munch

- Posts

- 📉 Markets Rip, Gold’s Back & Burry Warns

📉 Markets Rip, Gold’s Back & Burry Warns

Imagine buying one prop challenge and walking away with three. No strings. Lark Funding’s legendary Buy 1 Get 3 is officially back.

Grab any $100K challenge and get two $50K accounts completely free. Works on 1-step, 2-step, and 3-step. Use code BUY1GET3 at checkout.

☕️ GM Munchers! Green candles everywhere. I told my wife I’m back. She said, “You said that last time — right before crying in the shower.”

On today’s menu:

📉 Markets Rip, Gold’s Back & Burry Warns

💶 Europe Just Declared War on Cash

☕️ Nvidia Climbs & Starbucks Strikes

🦃 Warren Buffett Wrote a Thanksgiving Letter

🤑 This Politician Bought $162 Million of Bitcoin

Yesterday’s numbers:

S&P 500 | 6,832 | +1.54% |

Nasdaq | 23,527 | +2.27% |

Dow Jones | 47,368 | +0.81% |

Bitcoin | $105,900 | +1.08% |

BREAKING NEWS

🧃 Market Rips as Traders Sip the Optimism Juice

I guess everyone had one too many drinks this weekend because traders rolled into Monday buzzing with optimism.

Or maybe it’s just the thought that the 40+ day government shutdown might finally be over.

Either way, the Nasdaq ripped 2%, and crypto traders were partying even harder — adding $150 billion in market cap in just one day.

Even Microsoft broke its eight-day losing streak (its longest since 2011) with a modest 1% gain. I guess even Bill Gates needed a win this week.

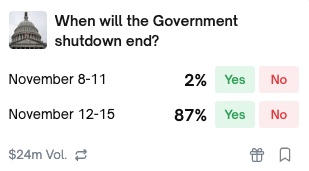

Now, the Senate still has to vote, and the House needs to sign off, but markets are already pricing in an 87% chance this shutdown wraps up this week.

Why does it matter?

Because right now, the market’s like a bipolar teenager — euphoric one day, existential the next.

Ending the shutdown gives traders something to believe in again (even if it’s temporary).

Sometimes it really is that simple: less uncertainty = more green candles.

🥇 Gold’s Back on Its Throne

Gold was partying harder than college kids on spring break — up over 2.5% yesterday and holding strong above $4,000.

And it’s no coincidence that this move came 24 hours after Trump promised everyone a $2,000 “tariff dividend.”

Because nothing says “fiscal responsibility” like handing out free money while inflation’s still hanging around like an ex who won’t move out.

Here’s the deal:

When the market starts losing faith in the dollar, it runs straight into gold and Bitcoin — the two assets that don’t care who’s president, as long as the money printer’s working overtime.

Since the Covid era, gold’s been the quiet overachiever of the group — and it’s already up more than 55% year-to-date.

If that’s not the market screaming, “We don’t trust your Monopoly money anymore,” I don’t know what is.

🤔 Michael Burry Thinks Big Tech Is “Cooking the Books”

Michael Burry — the guy who shorted the housing market in The Big Short — is back, and this time he’s coming for Big Tech.

In a post that lit up FinTwit yesterday, Burry accused companies like Meta and Oracle of artificially inflating their profits by stretching out how long they say their equipment lasts.

Basically, he’s saying they’re using creative math to make their AI spending boom look healthier than it is.

Here’s how:

When you buy something like servers or chips, it loses value over time — that’s depreciation.

But if you change that “useful life” from four years to six (like some of these firms are doing), your near-term expenses magically look smaller, and your profits suddenly look better.

Burry estimates that this trick could boost Meta’s reported earnings by ~20% and Oracle’s by ~27% by 2028. And if he’s right, the whole AI infrastructure crowd — Amazon, Google, Microsoft, you name it — could be hiding $176 billion in costs between 2026 and 2028.

Of course, Meta’s stock still climbed nearly 2% yesterday and Oracle was flat. Because, let’s be real — nobody ever made money betting on investors suddenly caring about accounting ethics.

The Munch Take:

Burry might be early (again), but he’s not wrong — if AI growth slows and depreciation catches up, the “AI boom” could start looking more like an accounting trick. For now, though, Wall Street’s still hypnotized by the shiny AI buzzwords.

BROUGHT TO YOU BY

⏰ 4 Days Left - The Industry’s Best Prop Firm Promo Is Back

Now through Nov 14, grab a $100K evaluation (with Weekend Holding + 90% split) and get two bonus $50K accounts — totally free.

✅ Works on 1-step, 2-step, and 3-step

✅ Perfect time to stack before Lark 3.0

✅ Use code BUY1GET3 at checkout

Let’s be honest — if you’re serious about scaling in 2026, this is your shot.

BIG PICTURE

💶 Europe Just Declared War on Cash

The EU officially announced it’ll ban all cash transactions over €10,000 starting January 2027. Anything above that? You’ll have to go digital. Oh, and if you pay more than €3,000 in cash, you’ll need to show digital ID.

They’re calling it “anti–money laundering.”

We’re calling it what it is — financial surveillance.

Critics are already sounding the alarm, warning this is a “totalitarian attack on freedom.” Because once every payment is traceable, the government doesn’t just see how much you spend — it sees what you spend on.

This is exactly what Bitcoin was designed to fight.

When Balaji Srinivasan burned $1 million during his viral 2023 “Bitcoin bet,” he wasn’t flexing — he was warning.

He said that the debt crisis, digital IDs, and capital controls would eventually merge into one thing: a system where cash dies and freedom goes with it.

We feel for our European brothers. But let’s be real — it’s only a matter of time before this kind of control creeps into Canada, too.

The Munch Take:

The lifeboat is here. Don’t wait until the ramps are closed to try getting on.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

🚀 $NVDA

Nvidia carried the entire market on its back yesterday — up 5%, dragging the indexes up with it like the overachiever in a group project.

Do we still think it’s overvalued? Absolutely.

Are we complaining while our portfolios go up? Absolutely not.

☕️ $SBUX

More than 100 lawmakers are pushing Starbucks to restart union talks, with strikes brewing (pun intended) in 25 cities on November 13th — a.k.a. Red Cup Day, one of their biggest sales events.

Our take? Starbucks coffee isn’t even coffee. It’s liquid sugar with a loyalty program.

💻️ $CRWV

CoreWeave more than doubled revenue this quarter as it keeps building out its AI empire. The stock’s now up 164% since its March IPO. AI’s cooling down, but CoreWeave’s acting like it’s still 2023.

🥇 $B

Barrick Gold is the quiet winner of the year — up 7% yesterday and 120% YTD. When everyone’s busy arguing over rate cuts and AI, Barrick’s just out here digging money out of the ground.

🚀 Pre-Market Fuel

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER