- Pip Munch

- Posts

- 📉 Markets Yawn, But Consumers Are Screaming

📉 Markets Yawn, But Consumers Are Screaming

☕️ GM Munchers! The market was so dull yesterday, even Nvidia got bored and crashed after hours. Meanwhile, I got roped into family time — which, like tech earnings, is full of unexpected downside risk.

On today’s menu:

📉 Sentiment Sinks, Markets Snooze

🚀 Two Big Events Traders Are Watching Today

📊 What Growth Cuts + a Falling VIX Mean for Traders

🤯 This Guy Has Made $2 Million on Polymarket

🤑 Michael Saylor Buys More Bitcoin

BREAKING NEWS

📉 Sentiment Sinks, Markets Snooze

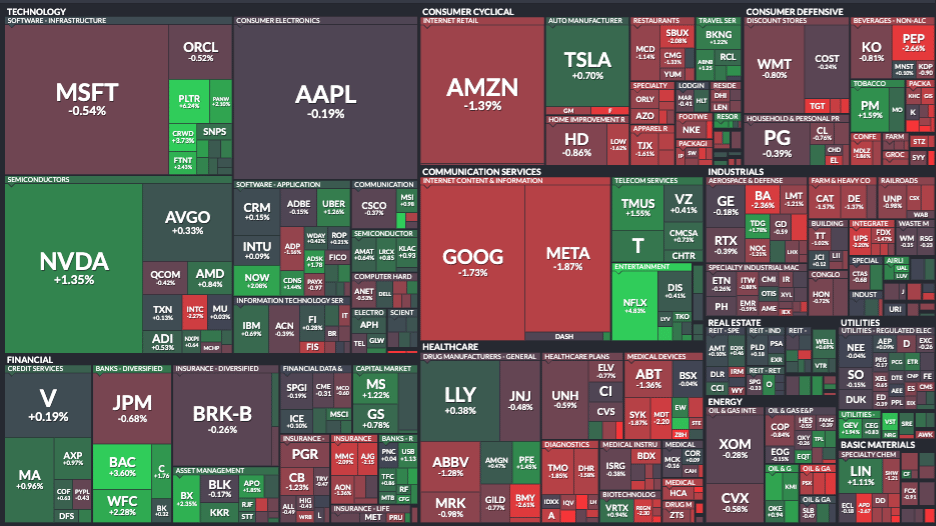

If the market felt sluggish Tuesday, it’s probably because consumer sentiment just hit a record low — and the stock market is still nursing its tariff-induced hangover.

The Dow dropped 0.38%

The S&P 500 fell 0.17%

The Nasdaq slipped 0.05%

Tech stocks didn’t offer much support either:

Meta dropped -1.87%

Microsoft shed -0.54%

Amazon slid -1.39%

Apple gave up -0.19%

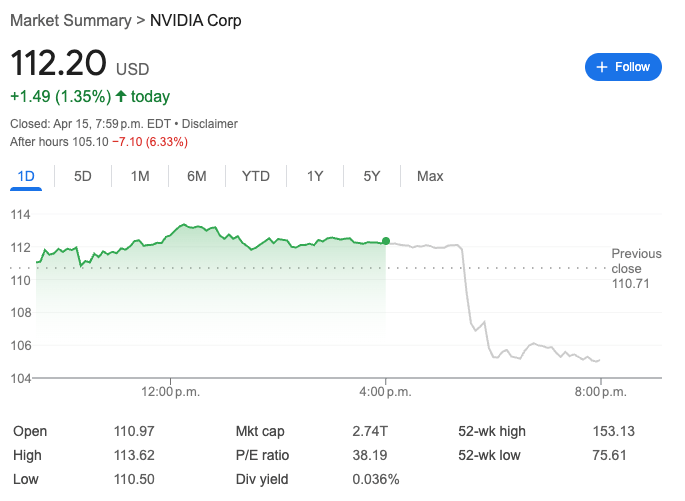

Even Nvidia, which managed to climb +1.35% during regular hours, face-planted in after-hours trading.

The reason?

The U.S. just banned Nvidia from selling its H20 chips to China “for the indefinite future.”

That’s going to cost Nvidia a cool $5.5 billion charge to Q1 earnings — and investors responded like they just found out their favourite meme stock filed for bankruptcy.

The stock dropped over -5% after hours, falling from $112.20 to $106.50 in a matter of minutes.

So yes — Nvidia spent the day in the green. But the after-hours party was like watching someone blow out their birthday candles only to realize they were sitting on a cake made of SEC filings and export restrictions.

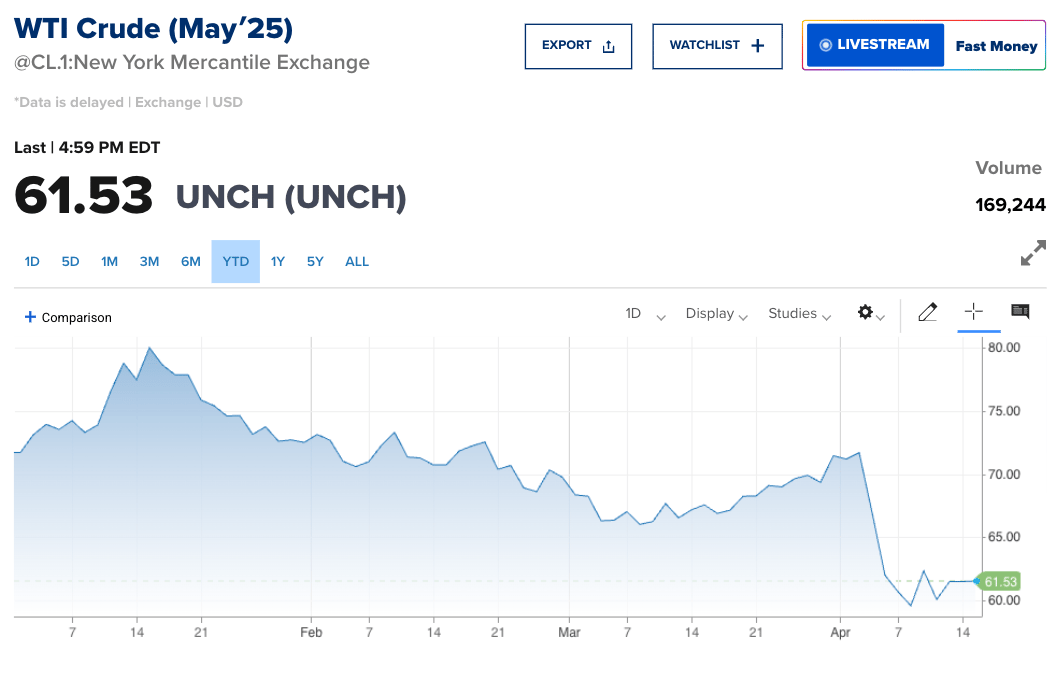

Meanwhile, gold rose another 0.56% to $3,228.70, oil settled at $61.53, and the 10-year Treasury yield dipped to 4.331%, down 3.3 basis points.

A pretty textbook example of risk-off sentiment if there ever was one.

But the real headline?

American consumers just set a record — for pessimism. 📉

According to the University of Michigan, expectations about personal finances over the next year have dropped to the lowest level ever recorded.

And yes, that includes the 2008 financial crisis.

US consumers' expectations about personal finances over the next year have dropped to the lowest on record.

The index of financial situation expectations is 8% below the lowest level seen during the 2008 Financial Crisis.

In other words, not even the most severe recession since

— The Kobeissi Letter (@KobeissiLetter)

7:11 PM • Apr 15, 2025

The index of financial expectations is now 8% lower than it was during the GFC and even gloomier than anything seen during the Great Depression (at least in survey form).

This matters because consumer spending makes up over 66% of U.S. GDP.

If people don’t feel confident, they don’t spend. If they don’t spend, growth slows.

If growth slows… cue the risk-off plays.

This is a reminder that the market isn’t just a math problem. It’s a mood ring. And right now, the mood is “please stop asking me to go outside.”

Oh — and one last sentiment signal?

Crude oil just had its second consecutive day trading below $62.

That’s the lowest close in over four months. In short: markets are down, expectations are down, and the only thing up… is gold.

BROUGHT TO YOU BY

A New Standard For 2-Step Challenges

Lark Funding just launched the new 2-Step Pro Challenge—built for serious traders who want fewer rules and faster payouts.

✅ 4% Phase 2 Target

✅ First Payout On Demand

✅ No locks, no restrictions

✅ $100K Account for $399

Use code PRO20 for 20% off (ends today).

UPCOMING

🚀 Two Big Events Traders Are Watching Today

Today’s a “strap in” kind of day for traders.

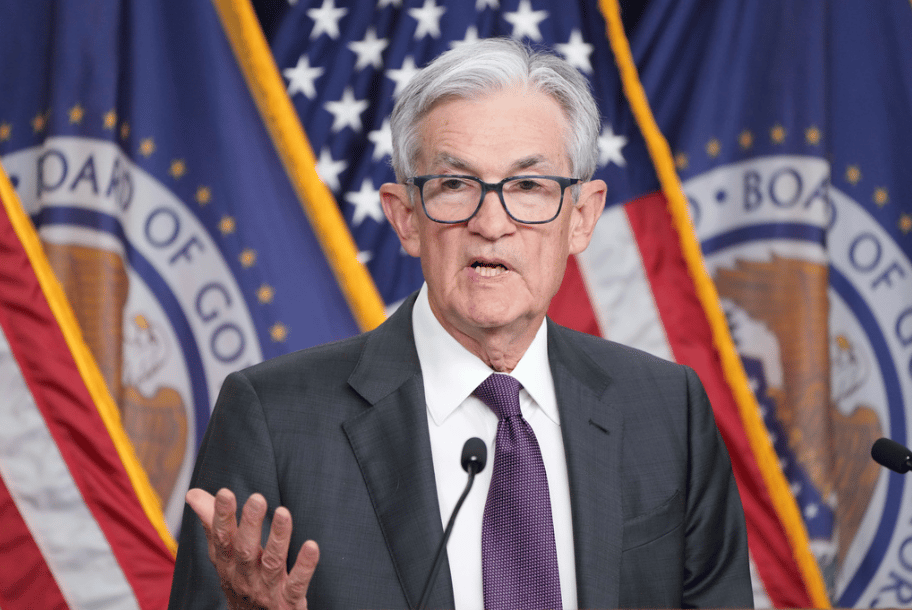

Two major events are on deck: the Bank of Canada’s interest rate decision at 9:45 AM ET, and Jerome Powell’s speech at 1:30 PM ET.

What to expect from the BoC 🇨🇦

The market is split down the middle — 45% are pricing in a rate cut, 55% think we’ll get a hold.

Translation? Volatility risk is high.

And if you're new to this: rate cuts weaken a currency, while rate hikes strengthen it.

That’s because lower interest rates make a country’s bonds and deposits less attractive to global investors — so capital flows out. And when capital leaves, the currency drops.

With the Canadian dollar already wobbling lately, today’s decision could send the loonie flying in either direction.

With Canada’s federal election coming up on April 28th, don’t be surprised if CAD volatility becomes part of the political conversation.

Although, let’s be honest — it’s Canada, so they'll probably still spend more time talking about U.S. politics and whether Justin Trudeau’s hair still counts as “electable.”

Later in the day: Powell takes the mic 🇺🇲

At 1:30 PM ET, Fed Chair Jerome Powell will speak. No rate decision is coming — but traders will still dissect every word like it’s an SEC filing for GameStop in 2021.

Markets are desperate for clarity: Will inflation keep cooling? Will rate cuts still happen this year? Or is the Fed getting cold feet?

If Powell even hints at more dovish policy or economic softness, expect stocks to get a tailwind and the dollar to dip.

If he leans hawkish or vague? Risk-off mode could kick back in. 🚀

Today’s takeaway: this is a sentiment day.

Big headlines + indecisive markets = lots of opportunity (and risk).

Plan your trades — and maybe keep that stop loss a little closer than usual.

TRADING101

📊 What Forecast Cuts + a Falling VIX Mean for Traders

If you're trying to understand what really moves the markets, look no further than two key clues that dropped this week:

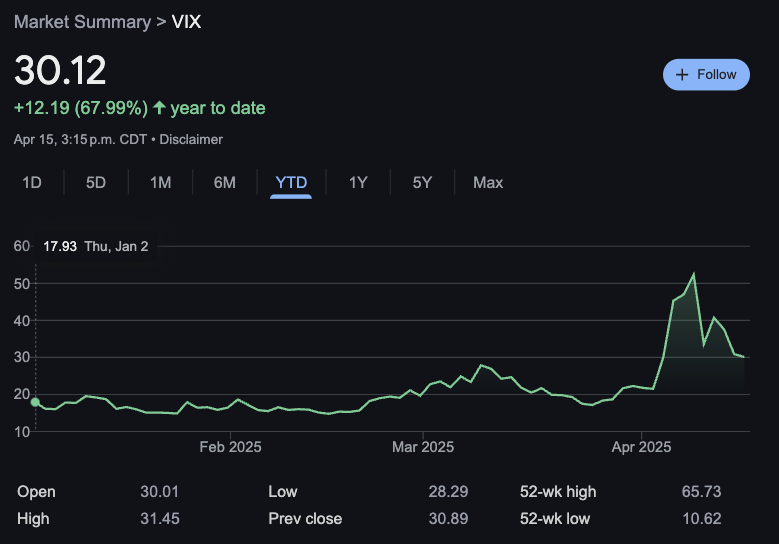

The VIX (Wall Street’s fear gauge) just fell to 30 after peaking near 60 last week.

Wall Street firms are slashing their S&P 500 forecasts like they found out their bullish calls were on FTX.

Let’s start with the VIX.

When it spikes, it means traders expect bigger market swings — fear is rising. When it drops? Traders think things are calming down.

But here’s the catch: the VIX didn’t fall because things are better.

It fell because traders are mentally exhausted after two weeks of chaotic tariff news, surprise exemptions, and flip-flopping policy guidance. In other words, the market is taking a breather — not because it wants to — but because it has to.

Now enter the forecast cuts.

Citi: from 6,500 → 5,800 📉

Goldman Sachs: 6,500 → 5,700 📉

Bank of America: 6,666 → 5,600 📉

JPMorgan: 6,500 → 5,200 📉

When the biggest institutions are dialing back their targets, it’s because they don’t believe earnings, growth, or sentiment can support the bull case anymore.

And that’s a big deal — because these aren’t crypto YouTubers. These are the banks that move billions.

So what does it all mean for you, the trader?

It means it’s time to start thinking like a sentiment detective. Forecast cuts signal bearishness. A falling VIX signals indecision.

The game now is identifying what assets are weak (e.g. USD, CAD) and pairing them with strong ones (e.g. gold, CHF, maybe even JPY).

That’s how you catch big moves.

Don’t just follow headlines — follow the mood behind them.

Because trading is about more than price action. It’s about vibes. And right now? Wall Street’s vibe is: “meh… but keep your stops tight.”

PROP FIRMS

🤑 Wednesday Motivation

15 Months difference.

Don't let them tell you what's possible and what's not.

You determine your fate.Curious how suddenly no one is laughing at me now for trying something different.

— TraderCluti (@ClutiFx_)

11:35 AM • Apr 12, 2025

🚀 Pre-Market Fuel

🍪 Munchy Memes

Boomers selling their house for $3 million after buying it in 1969 for 7 raspberries

— Not Jerome Powell (@alifarhat79)

11:54 PM • Apr 14, 2025

My accountant going through all my trades to report a $0.37 cent profit

— Not Jerome Powell (@alifarhat79)

5:47 PM • Apr 15, 2025

Can't wait for WW1 to end so we can get rid of this temporary income tax.

— Thomas Fahrer (@thomas_fahrer)

12:19 PM • Apr 15, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER