- Pip Munch

- Posts

- 📉 Mixed Signals

📉 Mixed Signals

Imagine buying one prop challenge and walking away with three. No strings. Lark Funding’s legendary Buy 1 Get 3 is officially back.

Grab any $100K challenge and get two $50K accounts completely free. Works on 1-step, 2-step, and 3-step. Use code BUY1GET3 at checkout.

☕️ GM Munchers! The market’s been mood-swinging harder than my wife after I said “it’s fine, we don’t need curtains.” Red Tuesday, green Wednesday, red after-hours. Buckle up — we’re here to decode the chaos.

On today’s menu:

📉 More Jobs, More Tariffs & More Canadian Insanity

🏙️ NYC Elects a Socialist… What Could Go Wrong?

🍟 McDonald’s Reports Earnings

📺️ Netflix Hits A 7-Month Low

😬 Household Debt Hits A Record High

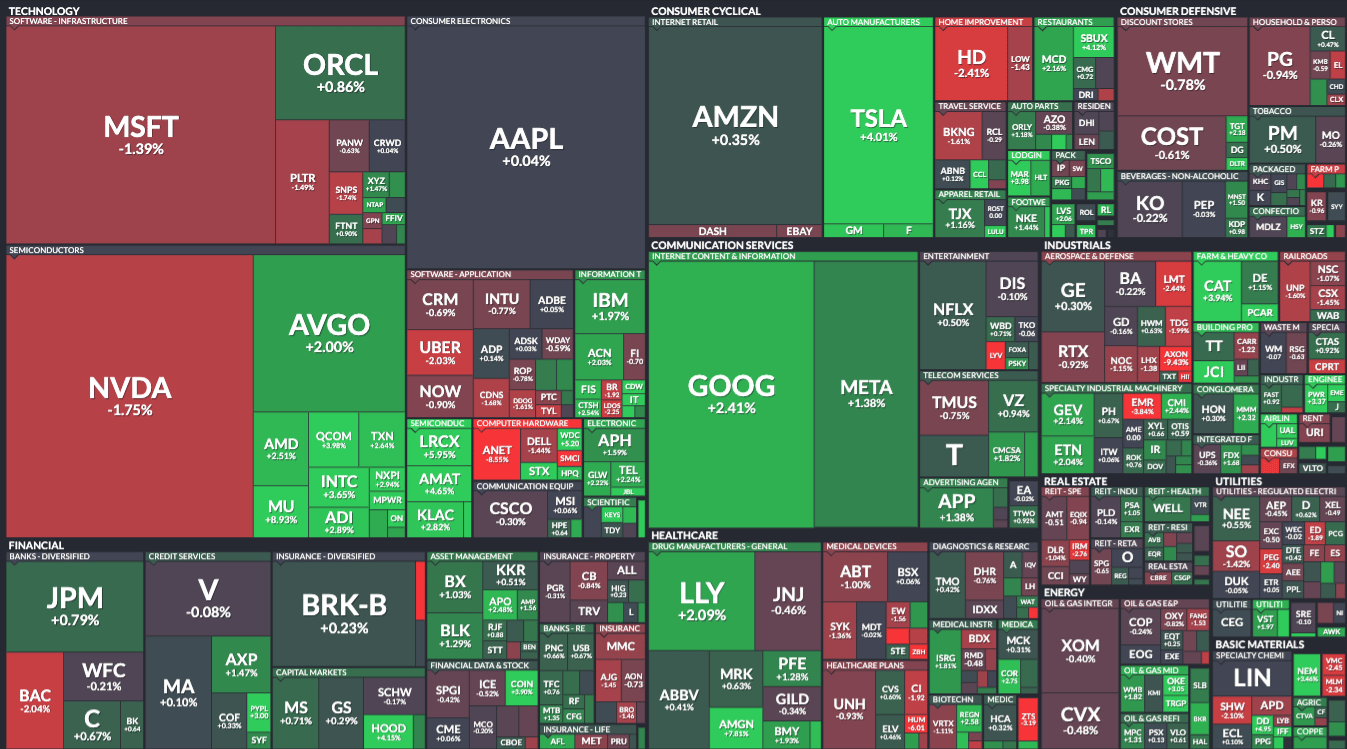

Yesterday’s numbers:

S&P 500 | 6,796 | +0.37% |

Nasdaq | 23,499 | +0.65% |

Dow Jones | 47,311 | +0.48% |

Bitcoin | $103,750 | +2.20% |

BREAKING NEWS

📉 More Jobs = More Hopium

We staggered in yesterday, still tasting Tuesday's bloodbath, but boom—the indices slipped into rally mode and mooned higher, like we'd cracked the code to endless green candles. (My portfolio's finally speaking to me again. Therapy works.)

What sparked the fire?

ADP jobs report, that feisty sidekick filling in while Uncle Sam's on strike. Private payrolls flipped the script: +42k in October after -29k in September—first win since July, crushing economist bets of 22k-37.5k.

So, why didn’t the market rip more than it did?

One word: Tariffs.

Keep reading…

⚖️ SCOTUS vs. Tariffs: Trump's Trade Tantrum on Trial

BREAKING: The odds of President Trump's tariffs being ruled as "legal" by the Supreme Court collapse to just 18%, per Polymarket.

— The Kobeissi Letter (@KobeissiLetter)

4:37 PM • Nov 5, 2025

All eyes on the Supreme Court yesterday, grilling if Trump's "Liberation Day" tariffs are genius power move or unconstitutional overkill—like calling a national emergency over a fantasy football flop.

Polymarket Trump-win odds? Tanked from 50% to 23% mid-hearing, as even his picks started squirming.

JUST IN: 78% chance Supreme Court rules Trump tariffs as "illegal"

— Kalshi (@Kalshi)

4:31 PM • Nov 5, 2025

Here's the cheat sheet on why this could flip your portfolio faster than a bad earnings call:

Trump's Hail Mary: He's leaning on the 1977 International Emergency Economic Powers Act (IEEPA) to slap tariffs on imports claiming it's all for "national security" amid trade deficits.

Lower courts' smackdown: Federal benches ruled Trump overstepped, saying Congress owns taxes, not the Oval Office.

Risk-on roulette: If SCOTUS axes 'em, expect $100B+ refunds and a global stock party. Tariffs stick? Cue the trade war blues, higher costs, and us all panic-buying puts like it's March 2020.

Even if the robes rule "nope," Trump's got backups—like the Trade Act of 1974 (we won't nerd out on the fine print, promise).

When will they make a decision?

Nobody knows how long it’ll take. AKA, brace for more chop that we’ve already been dealing with.

🍁 Canada’s Budget Is… a Bit Rich

BREAKING: Mark Carney's budget deficit for the fiscal year of 2025-26 is over $78 BILLION, 10 billion higher than what the PBO had predicted.

78 BILLION...

The Liberals are bankrupting our country right before our very own eyes and delivering us GENERATIONAL DEBT.

— Jinglai He 🇨🇦 (@JinglaiHe)

9:16 PM • Nov 4, 2025

Folks, I’ve gone over budget before — like that time I bought a $1,200 espresso machine to “save money on coffee”… but now I’m just spending $60 a week on milk trying to master latte art.

Turns out I’ve got competition in bad budgeting — the entire Canadian government.

Carney dropped the new budget this week, and it’s more bloated than me after three bowls of fettuccine.

The deficit? $78.3 billion — double last year.

Debt charges? $55.6 billion.

GDP growth? A thrilling 1.1%, with per-capita growth basically flatlining.

Liberals are calling it a “responsible budget,” but the only thing responsible here is the level of denial. The market’s not buying it — literally.

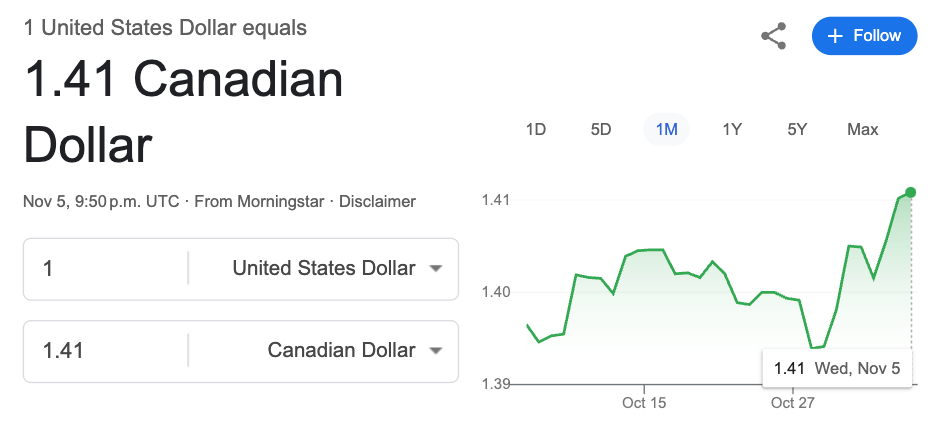

USD/CAD just ripped from 1.39 → 1.41 in a week, a clear vote of “no confidence” from traders.

The Munch Take:

Canada’s economy is slowing, debt is ballooning, and the only thing growing fast is the interest bill. Mr. Market doesn’t care about talking points — and he’s saying loud and clear: the loonie’s cooked.

At this point, the only thing more overvalued than Canada’s optimism is my espresso setup.

BROUGHT TO YOU BY

⏰ 8 Days Left - The Industry’s Best Prop Firm Promo Is Back

Now through Nov 14, grab a $100K evaluation (with Weekend Holding + 90% split) and get two bonus $50K accounts — totally free.

✅ Works on 1-step, 2-step, and 3-step

✅ Perfect time to stack before Lark 3.0

✅ Use code BUY1GET3 at checkout

Let’s be honest — if you’re serious about scaling in 2026, this is your shot.

POLITICS

🏙️ NYC Elects a Socialist… What Could Go Wrong?

A socialist just got elected mayor in the heart of the financial world at the top of the greatest bubble of all time.

— Rex (@R89Capital)

2:35 AM • Nov 5, 2025

What was once the most capitalist city on Earth is now being run by a self-proclaimed democratic socialist — which, let’s be honest, is just PR-speak for “I’m kinda into communism.”

Ugandan-born Zohran Mamdani officially won the NYC mayoral election, and the reactions couldn’t be more predictable:

Young liberals are celebrating like it’s Coachella.

Florida and Texas realtors are popping champagne — because rich New Yorkers are about to start house-hunting.

JUST IN: Florida & Texas real estate prices projected to soar, as NYC sees exodus of up to 1 million people.

— Polymarket (@Polymarket)

11:46 AM • Nov 5, 2025

The big question: will this actually hit markets?

Maybe a little. Real estate and finance stocks with heavy NYC exposure could see some short-term volatility, but beyond that, it’s not a market mover — just a front-row ticket to a four-year economic experiment.

The Munch Take:

This isn’t about price action — it’s about popcorn. Grab some. The memes alone might be worth the taxes.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

🍽️ $DASH

Doordash just delivered a cold bag of disappointment. The stock collapsed 20% after-hours after missing earnings — $0.55 per share vs. $0.69 expected.

Revenue was still up 27% year-over-year and orders climbed 21%, but apparently growth doesn’t matter when Wall Street expected a side of profits with that.

🍟 $MCD

Let’s be honest — it’s McDonald’s $1 coffee that powers this newsletter. But the Golden Arches weren’t shining too bright this quarter.

They missed earnings, though same-store sales rose 3.6%. The problem? The CEO said traffic from lower-income consumers dropped almost double digits. Translation: people are finally realizing $14 combo meals are not part of a balanced budget.

📺️ $NFLX

Netflix just hit its lowest level in almost 7 months — though it’s still up 23% YTD, so don’t start canceling your subscription just yet.

At this point, even another season of Love Is Blind might not save the stock… unless they start putting traders in there and making them marry based on each other’s P&L.

🏦 $9984.T (SoftBank)

SoftBank just got soft, crashing 10% and wiping out $32 billion in market cap in a single day. Still up 145% YTD though — so maybe they just needed a “healthy correction,” as bagholders like to call it.

🛢️ Oil

Crude slipped to $59/barrel after Trump said he wants $2 gas again. Guess we shouldn’t have bought a Tesla… unless it comes with a built-in gas pump at this point.

TRADING SUCCESS

🤑 Thursday Motivation

Higher highs - not just on the charts.

October recap: 48.370,92$ in payouts.

New record month for me. It‘s not even too long ago that I had my first ever payout, that being back in July 2024.

And now months like this, shit‘s too crazy honestly. Feels surreal.

Thank you to all

— Harry (@ApparentlyTr8dr)

11:32 AM • Nov 4, 2025

🚀 Pre-Market Fuel

🍪 Munchy Memes

“Look babe we just lost everything.”

— Not Jerome Powell (@alifarhat79)

6:30 PM • Nov 4, 2025

“Mom, how did we get so poor?”

“Your dad got liquidated in 2025”

— Divix (@cryptodivix)

9:13 PM • Nov 4, 2025

Me buying one more dip

— naiive (@naiivememe)

1:44 AM • Nov 4, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER