- Pip Munch

- Posts

- 📉 Musk Loses It. Markets Love It. Traders Confused.

📉 Musk Loses It. Markets Love It. Traders Confused.

Want to triple your trading power? Buy 1 challenge with 90% rewards + weekend holding, get 2 bonus accounts (half the size) free. No payout required. No waiting. Just 3x the firepower—instant.

☕️ GM Munchers! Did you miss us yesterday? We skipped a day to see if the market would collapse without us. It didn’t. Rude.

On today’s menu:

📉 Musk Loses It. Markets Love It. Traders Confused.

😍 Buy 1 Prop Firm Challenge, Get 3?

🇨🇦 BoC Day: Will Canada Finally Blink?

🚀 MicroStrategy, Nvidia & Robinhood Move

🤔 Trump Goes All-In On Crypto?

Yesterday’s numbers:

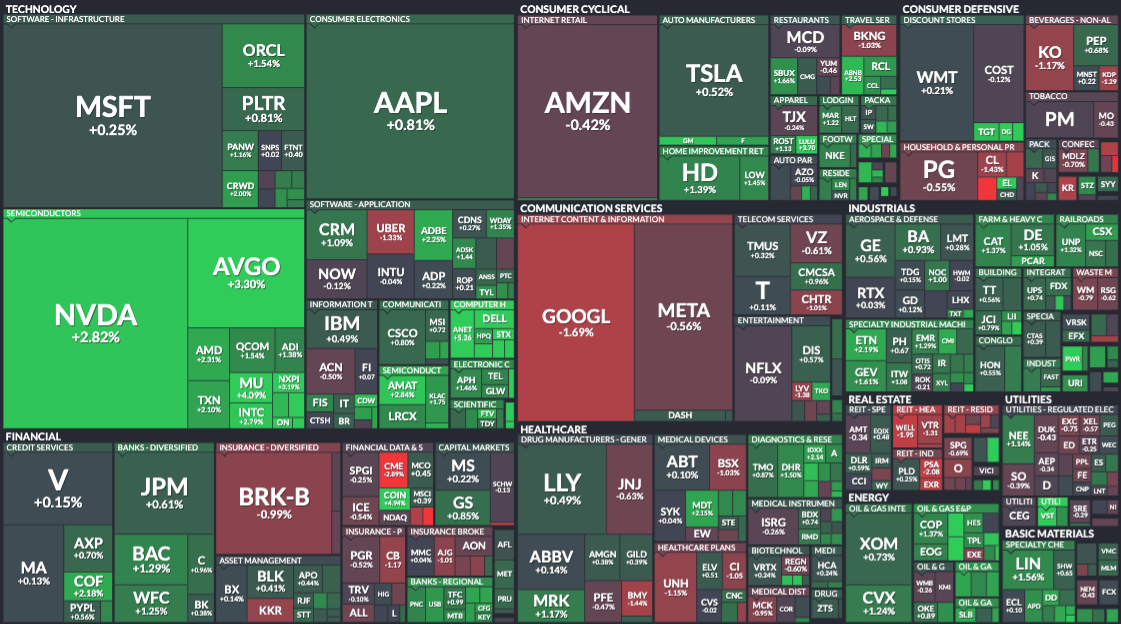

S&P 500 | 5,970 | +0.58% |

Nasdaq | 19,398 | +0.81% |

Dow Jones | 42,519 | +0.51% |

Bitcoin | $106,109 | +0.17% |

BREAKING NEWS

📈 Markets Climb as Tariff Fears Ease

Markets caught a vibe after the U.S. and China reached a deal to temporarily cut reciprocal tariffs. In other words: less talk about trade war, more room for bulls to breathe.

Why Markets Care:

Lower tariffs = less pain for global supply chains

Especially good news for tech, chipmakers, and your stress levels

🧵 Plain-English Play:

Don’t forget the Trump TACO trade. He talks big, then walks it back. We’re risk-on—for now—but we’re not putting the phone down mid-trade.

🧾 Musk Slams Trump’s Budget Bill Amid Rising Debt Concerns

I’m sorry, but I just can’t stand it anymore.

This massive, outrageous, pork-filled Congressional spending bill is a disgusting abomination.

Shame on those who voted for it: you know you did wrong. You know it.

— Elon Musk (@elonmusk)

5:31 PM • Jun 3, 2025

Elon Musk is mad online again—this time over Trump’s tax-and-spending bill. He called it a “disgusting abomination,” which is exactly how we describe our Monday trades.

What happened?

Trump’s bill will increase the national budget deficit to $2.5 trillion which is by far the largest in history.

🇺🇸 USA budget deficit:

2000: $236 billion

2001: $128 billion

2002: $158 billion

2003: $378 billion

2004: $413 billion

2005: $318 billion

2006: $248 billion

2007: $161 billion

2008: $459 billion

2009: $1.41 trillion

2010: $1.29 trillion

2011: $1.30 trillion

2012: $1.07— World of Statistics (@stats_feed)

5:36 PM • Jun 3, 2025

Why Markets Care:

U.S. debt is already at $34T+

More debt = higher yields = risk-off vibes

The 30Y Treasury yield is flirting with 5% again

📉 Plain-English Play:

Rising debt is no longer just a boogeyman—it’s showing up in yields, equities, and your portfolio drawdowns. As yields climb, we expect pressure on stocks (especially growth names) and a return to “safe” plays.

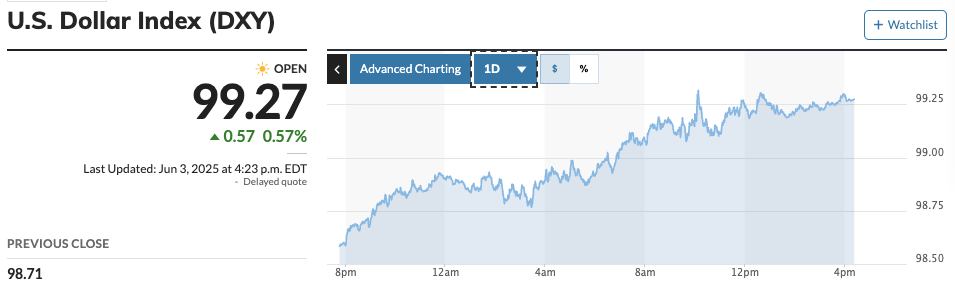

💵 U.S. Dollar Rips Higher

The U.S. dollar jumped yesterday, proving that not all strength gains are made in the gym.

What happened?

A retracement after Monday’s drop

Cooling fears of a trade war redux

USD/JPY spiked +135 pips to 144.05

JOLTS data showed improved labor market

Why Markets Care:

It goes against a month-long theme of dollar weakness

It's bullish for rates, treasuries, and USD-denominated assets

Commodities & risk FX (AUD/NZD/CAD) took the hit

🧵 Plain-English Play:

We’re back in a DXY vs. yields tug-of-war. Watch USD/CAD for sentiment, and keep an eye on gold—it’s been climbing even as the dollar rises, which breaks old correlations. If this keeps up, the safest trade might just be confusion.

SPONSORED BY LARK FUNDING

⏳ Last Call: 24 Hours Left to Triple Your Account

⏰ FINAL 24 HOURS ⏰

Our Buy 1, Get 3 promo ends tomorrow — and it’s the best deal we run all year.

Buy any $10K, $100K, or $200K challenge with 90% rewards + weekend holding and get 2 bonus accounts (half the size) for FREE.

No payout required. No BS.

Use code: 3YEARTRIPLE

— larkfunding (@larkfunding)

11:12 AM • Jun 3, 2025

We extended the promo — but this is really your final shot.

To celebrate 3 years of funding traders, Lark is running the best prop firm deal in the industry:

Buy 1 challenge, get 2 bonus accounts (half the size) — completely free.

Example: Buy a $100K challenge → Get two $50K challenges on the house.

No payout required. No catch. Just instant trader firepower.

✅ Works on $10K, $100K, $200K

✅ Valid for 1-Step, 2-Step, and 3-Step

❌ Not available on Instant Funding

🚨 You must select 90% rewards + weekend holding

🎟️ Use code 3YEARTRIPLE at checkout

🕛 Expires in 24 hours

👉 Grab the triple deal now: https://larkfunding.com

FOREX

🇨🇦 BoC Day: Will Canada Finally Blink?

The Canadian dollar is stuck in a holding pattern tighter than my pants after a long weekend BBQ.

All eyes are on the Bank of Canada today, with markets betting they’ll keep rates steady at 2.75%. While cuts were expected earlier this year, the economy had other plans—mainly, anxiety attacks over tariffs, debt, and sky-high mortgage rates.

📉 Why Markets Care:

The CAD isn’t moving much, but this meeting could change that.

The BoC is walking a tightrope: Cut rates, and they risk stoking inflation. Hold steady, and they risk freezing an already ice-cold housing market.

Fixed mortgage rates are still above 4%, keeping buyers on the sidelines and real estate agents binge-watching Zillow for dopamine.

📊 What to Watch:

A dovish surprise could weaken the CAD and boost equities.

A hawkish tone might strengthen the loonie, but could crush consumer confidence further.

Translation? If the BoC sounds nervous today, traders might pile into risk… unless they’re Canadian homeowners, in which case they’re just piling on stress.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

$MSTR ( ▼ 2.92% ) Michael Saylor just bought another 705 BTC for $75.1 million… because apparently $40 billion in Bitcoin wasn’t enough. At this point, MicroStrategy is basically a crypto hedge fund with a corporate email address.

$NVDA ( ▼ 4.17% ) Nvidia popped after Jefferies said their profit margins could hit 80%. We would’ve said 81%, but no one asked us. Typical.

$HOOD ( ▼ 4.53% ) Robinhood officially closed its acquisition of Bitstamp. Translation: they're trying to become the Costco of trading apps — one-stop-shop, minus the free samples.

$CTC.A.TSX ( ▲ 0.36% ) Canadian Tire just bought Hudson’s Bay’s trademarks for $30 million. Bit of a steal for a brand that’s older than electricity.

PROP FIRMS

🤑 Wednesday Motivation

@FTMO_com Im capped to 1% per trade with FTMO

— ZamcoCapital (@ZamcoCapital)

6:55 PM • Jun 2, 2025

🚀 Pre-Market Fuel

🍪 Munchy Memes

CT scan of people who held Bitcoin at 15K in 2022

— Gambling is Life (@GamblingMemez)

9:51 PM • Jun 2, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER