- Pip Munch

- Posts

- 📉 NASDAQ Goes 24/7

📉 NASDAQ Goes 24/7

Most Prop Firms Are Designed to Fail You

Hit your profit target? Great. Now here's a consistency rule you didn't see coming. News restriction during NFP. Trailing drawdown that follows you like a shadow. Payout "processing" for weeks.

7% static drawdown—the most forgiving in the industry. Base Monthly Reward up to $1,000 even when you're losing. One evaluation phase. Zero consistency rules. Zero news restrictions. Zero hidden gotchas.

Request your payout and keep trading. No account lock. No "processing delays."

We've been paying traders consistently for 3+ years. Not 3 months. If we were running a challenge mill, we'd be bankrupt by now.

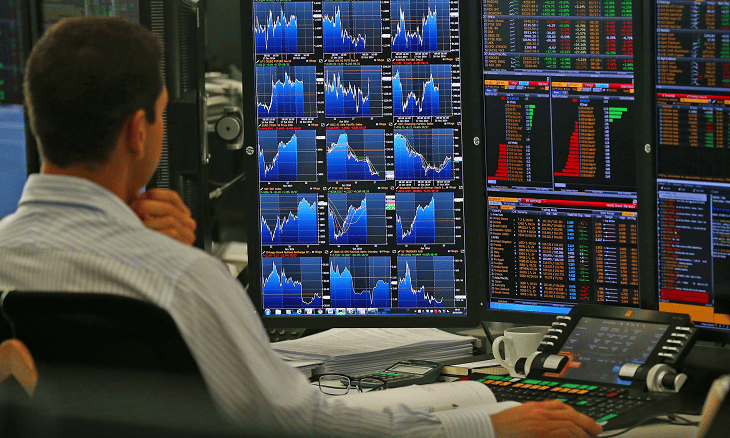

🚨 NASDAQ Just Announced 24/7 Trading—Your Losses Can Now Be Round-the-Clock

Imagine a world where the market never closes. Where 3 AM panic selling isn't just possible—it's encouraged. Where your portfolio can hemorrhage value on a Sunday morning while you're at brunch pretending your life is together.

Welcome to the future. NASDAQ just announced they're moving forward with 24/7 stock trading, expected to roll out 24-hour weekday trading by Q2.

And if you think this is good news, let me introduce you to a concept called "liquidity"—or more accurately, the complete absence of it at 2 AM on a Saturday.

📉 What This Actually Means (Spoiler: It's Not Great)

The Pitch: NASDAQ will frame this as "democratizing access" and "giving retail investors more flexibility." Translation? They're creating more opportunities for you to make catastrophically bad decisions at hours when your judgment is impaired by exhaustion, alcohol, or both.

The Reality: Let's walk through what 24/7 trading actually looks like in practice.

Weekend Liquidity = Financial Quicksand

Right now, markets close Friday at 4 PM EST and reopen Monday at 9:30 AM. During that window, the world keeps spinning—companies announce earnings, CEOs resign, geopolitical crises erupt, Elon tweets something unhinged—and all of that gets "priced in" Monday morning with a violent gap up or gap down.

It's brutal, but at least everyone's playing the same game. The market opens, liquidity floods in, and prices find equilibrium relatively quickly.

Now? You get to trade through the chaos in real-time with a fraction of the normal liquidity.

Picture this: It's 11 PM Saturday. A major news story breaks. You panic and hit "sell" on your position. Except there's nobody on the other side of that trade except algos and a few degenerate traders in different time zones. Your order gets filled—at a price 5-10% worse than fair value because liquidity is thinner than the plot of a Michael Bay movie.

Congratulations, you just got fleeced by low liquidity and your own anxiety.

🗞️ Weekend News Just Became a Nightmare

Here's something most retail traders don't think about: a lot of major news drops on weekends.

Why?

Because companies and governments know markets are closed. They release bad news Friday after close or Sunday evening, specifically to give everyone time to digest it before trading resumes.

It's a controlled burn. Everyone processes the information, analysts write their takes, and by Monday morning, the market had 48 hours to mentally prepare for the chaos.

With 24/7 trading? That safety buffer evaporates.

Now, when a company announces a surprise earnings miss at 9 PM Sunday, you're not waiting until Monday to see the fallout—you're watching it happen in real-time with virtually no liquidity to absorb the selling pressure.

Remember "Red Mondays"—those brutal gap-downs after bad weekend news? Get ready for Red Weekends, except worse because there's nobody around to catch the falling knife.

🎰 The Casino Analogy (Because It's Basically That)

Let's be honest: 24/7 trading turns the stock market into a literal casino that never closes.

And just like a casino, the house always wins when you're playing tired, emotional, and without proper liquidity.

Here's what's going to happen:

Scenario 1: The 2 AM Panic Sell

Bad news drops at 1:45 AM

You wake up, check your phone, see your position tanking

You panic sell into zero liquidity

Algos buy your shares at a massive discount

By 9:30 AM Monday, the stock recovers 80% of the move

You just sold the bottom because you were half-asleep and scared

Scenario 2: The Weekend FOMO Buy

A stock rips 15% Saturday afternoon on some viral tweet

You FOMO in at the top with terrible execution

By Monday morning, sanity returns and the stock gives back most of the move

You're now bagholding because you chased momentum in an illiquid market

Scenario 3: The Algo Feast

Sophisticated trading firms run algorithms 24/7

Retail traders check in sporadically, make emotional decisions

Algos systematically extract value from retail order flow in low-liquidity environments

Retail traders wonder why they keep losing money

📊 Who Actually Wins Here?

Let's be clear about who benefits from 24/7 trading:

✅ Market makers and HFT firms – They profit from the bid-ask spread, which widens massively in low-liquidity environments

✅ Sophisticated algo traders – They never sleep, never panic, and systematically exploit retail emotional trading

✅ NASDAQ – More trading = more transaction fees

❌ You – The retail trader who's already struggling to beat the market during normal hours

🤔 The Bigger Picture: A Solution Looking for a Problem

Here's the uncomfortable truth: nobody was asking for this.

Retail traders weren't banging down NASDAQ's door demanding the ability to trade $AAPL at 4 AM on a Sunday. Institutional investors weren't complaining that markets close for 65.5 hours every weekend.

This is a solution to a problem that doesn't exist—except for NASDAQ, who gets to collect fees on trades happening at literally any hour of any day.

The real question: If you're consistently losing money during regular market hours with maximum liquidity and normal spreads, what makes you think you'll do better at 3 AM on a Saturday with skeleton liquidity and algos hunting for your order flow?

✍🏻 The Munch Take: Don't Play a Rigged Game

Look, we're not saying 24/7 trading is inherently evil. If you're a disciplined trader with a systematic strategy, proper risk management, and the ability to ignore emotional impulses at ungodly hours, maybe—maybe—you can navigate this.

But for 99% of retail traders? This is a trap.

Our advice?

Don't trade weekends. Just don't.

Unless you're running a systematic algo or you have a genuine edge in low-liquidity environments (you don't), there's zero reason to be executing trades at 11 PM Saturday.

Stick to regular market hours when liquidity is deep and spreads are tight

Ignore weekend price action—it's noise, not signal

If major news breaks over the weekend, wait until Monday open when real liquidity returns

Don't let FOMO or panic dictate trades in illiquid markets

The market already takes enough from retail traders during normal hours. Don't hand them even more by trading in conditions specifically designed to exploit your worst instincts.

See you tomorrow when we find another way the market is evolving to separate you from your money,

— Pip Munch

P.S. If you absolutely must trade 24/7, at least do it with someone else's money. Lark Funding's 1-Step Career Program gives you up to $200K in simulated capital plus a monthly reward up to $1,000 for staying disciplined. If you're going to make questionable decisions at 2 AM, at least don't risk your own rent money doing it.

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER