- Pip Munch

- Posts

- 📉 Netflix Drama, Nvidia Wins, PPI Cancelled

📉 Netflix Drama, Nvidia Wins, PPI Cancelled

Most traders can't quit their job because one bad month = $0 income. Lark Funding just solved that. They'll pay you a monthly salary—even when you're in drawdown.

☕️ GM Munchers! I told my wife I'm "building generational wealth" and she looked at my portfolio and asked which generation I'm planning to disappoint.

On today’s menu:

📉 Netflix Drama, Nvidia Wins, PPI Cancelled

😬 Warren Buffett Is Falling Behind

👀 Tesla Gets Downgraded & Google Drives

🚗 Carvana’s Stock Is Absolutely Insane

🇨🇳 China’s Trade Surplus Is Insane

Yesterday’s numbers:

S&P 500 | 6,846 | -0.35% |

Nasdaq | 23,545 | -0.14% |

Dow Jones | 47,739 | -0.45% |

Bitcoin | $90,805 | +0.42% |

BREAKING NEWS

🎬 Paramount Crashes Netflix's Warner Bros. Party With Hostile Bid

Just when you thought the Netflix-Warner Bros. deal was done, Paramount Skydance showed up and said “Hold my drink.”

The Timeline:

Dec 5: Netflix agrees to acquire Warner Bros. Discovery for $27.75/share

Dec 7: Trump says the deal "could be a problem" (spoiler: his son-in-law Jared Kushner is backing Paramount's counter-bid)

Dec 8: Paramount launches hostile takeover bid at $30/share, backed by the Ellison family

The Numbers:

Paramount's offer totals $108.4 billion in all cash, crushing Netflix's $72.5 billion offer. The Ellison family has deep pockets—part of the financing comes from parties in the Middle East, including Saudi Arabia's Public Investment Fund.

Another backer? Jared Kushner's Affinity Partners.

If Paramount wins, the conservative Ellison family would control: Paramount Studios, CBS, CNN, MTV, HBO, Comedy Central, Nickelodeon, Warner Bros., DC Studios, TNT Sports, and basically every network that's ever existed.

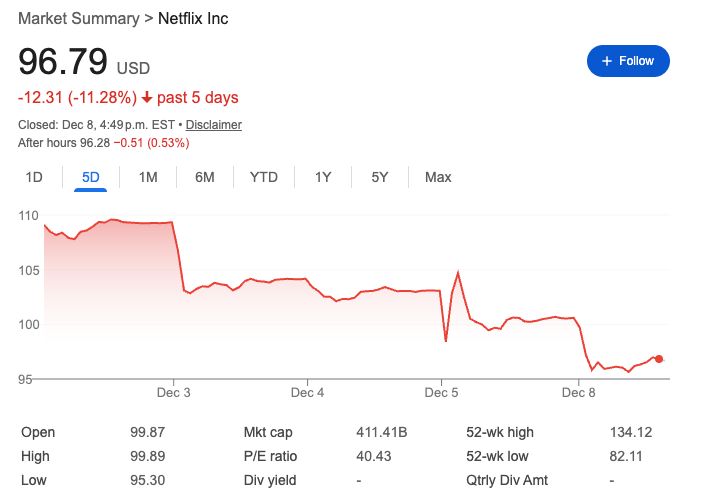

Market Reaction:

Netflix stock tanked, dropping over 4% at one point yesterday and hitting April lows—down over 30% from earlier 2025 highs. Paramount shares climbed 9.02% while Warner Bros. Discovery rose 4.45%. Netflix sank 3.4%.

The market's clearly not confident Netflix can hold this deal together.

The Munch Take:

This is a bidding war with political undertones, regulatory risk, and family empire drama. If you're holding Netflix, buckle up—this saga could drag for months. Trump's comments suggest regulatory scrutiny is coming, and Paramount's all-cash offer looks stronger. Expect more volatility in media stocks as this unfolds.

🖥️ US Greenlights Nvidia In China (Stock Pops 2%)

In a surprise move, the US will allow Nvidia to sell its H200 chips to China, and the stock climbed over 2% on the news.

This is significant because US-China tech export restrictions have been tightening for years, especially around advanced AI chips. The H200 represents cutting-edge AI infrastructure, so this signals either a thaw in restrictions or strategic exemptions being carved out.

Why This Matters:

China is a massive market for AI hardware. If Nvidia can tap back into Chinese demand without violating export controls, revenue projections get a lot rosier. The stock's 2% pop reflects optimism that Nvidia won't be completely locked out of the world's second-largest economy.

The Munch Take:

This isn’t just bullish for Nvidia but shows a geniune cooling of tensions between the US and China. Policy can flip overnight depending on who's mad at whom but for now it’s looking good.

📊 US Just Cancelled October PPI Report (Because That's Totally Normal)

The US Labor Department announced it's cancelling the October PPI inflation report.

Yes, you read that right. They just… cancelled it.

Here's Why This Is Insane:

Cancelling a report doesn't cancel the inflation. The data exists—they're just choosing not to release it. The timing is suspicious as hell considering the Fed's rate decision is Wednesday, and markets are pricing in a 94% chance of a cut.

You have to wonder: what's in that report that they don't want us to see?

The Munch Take:

This stinks. Governments don't cancel economic data releases unless something's broken or politically inconvenient. The Fed will cut rates Wednesday regardless—that's locked in—but the lack of transparency is a red flag. If they're hiding October PPI, what else are they hiding? Stay skeptical and don't blindly trust the narrative.

BROUGHT TO YOU BY

Most prop firms are designed to fail you.

Consistency rules that deny payouts. News restrictions during volatility. Resets that cost hundreds.

Lark's new 1-Step Career Program is different.

7% max drawdown—the most forgiving in the industry. Monthly salary up to $1,000 even during losing months. Free second chances when you need them. Zero consistency rules. Zero news restrictions.

We've been paying traders for 3+ years because we're here to build careers.

One evaluation. Get funded. Start your trading career.

STOCKS

📉 Berkshire's Underperforming the S&P (In Buffett's Last Year as CEO)

Warren Buffett announced in May he's stepping down as CEO at year-end, and Berkshire Hathaway's stock is limping toward the finish line.

The Numbers:

Berkshire B shares are up 10.23% YTD, trading just below $500 at $497.23. Not bad—except the S&P 500 is up 16.66% YTD, meaning Berkshire is lagging by over 6 percentage points.

What the Chart Shows:

Berkshire just broke below its 200-day moving average, a technical red flag suggesting momentum is fading. The stock hit a 52-week low of $440.10 earlier this year, rallied to a high of $542.07, but has since pulled back and is now losing steam.

Why This Matters:

Buffett's stepping down. Greg Abel takes over in 17 trading days. The market's clearly pricing in uncertainty about the leadership transition and whether Berkshire can maintain its edge without the Oracle of Omaha calling the shots.

The Munch Take:

Berkshire's underperformance in Buffett's final year is symbolic. The stock's breaking technical support, leadership transition is looming, and the market's skeptical. If you're holding BRK.B, watch that 200-day MA closely—a sustained break lower could signal more pain ahead. Or maybe the market's just waiting to see if Greg Abel can actually fill the legend's shoes.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

$CFLT IBM is dropping $11 billion to acquire Confluent, and the stock absolutely ripped 29% on the news. IBM's betting Confluent will strengthen their AI portfolio—because apparently the only way to stay relevant in 2025 is to buy your way into every AI conversation.

$MSFT Rumor has it Microsoft is chatting with Broadcom about making custom chips. Broadcom climbed 2% yesterday on the whispers, and Microsoft tagged along with a 1.5% gain. If you can't beat Nvidia, just build your own chips and pretend you never needed them anyway.

$MCD McDonald's announced they're "enhancing global franchising standards" starting January 1, 2026. What does that mean? Nobody knows. But with the stock up only 5% YTD, they clearly need to do something to win back cash-strapped customers who've realized a Big Mac costs more than actual dinner now.

$GOOGL If you need another reason to love Google's stock, Waymo just crossed 450,000 weekly paid rides. Considering they were at 250,000 in April, that's legitimately solid growth. Your move, Tesla.

$TSLA Tesla dropped 3.39% after news broke that less than 40% of analysts have Buy ratings on the stock. Turns out when your valuation is based purely on vibes and Elon tweets, Wall Street eventually starts asking uncomfortable questions about fundamentals.

🚀 Pre-Market Fuel

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER