- Pip Munch

- Posts

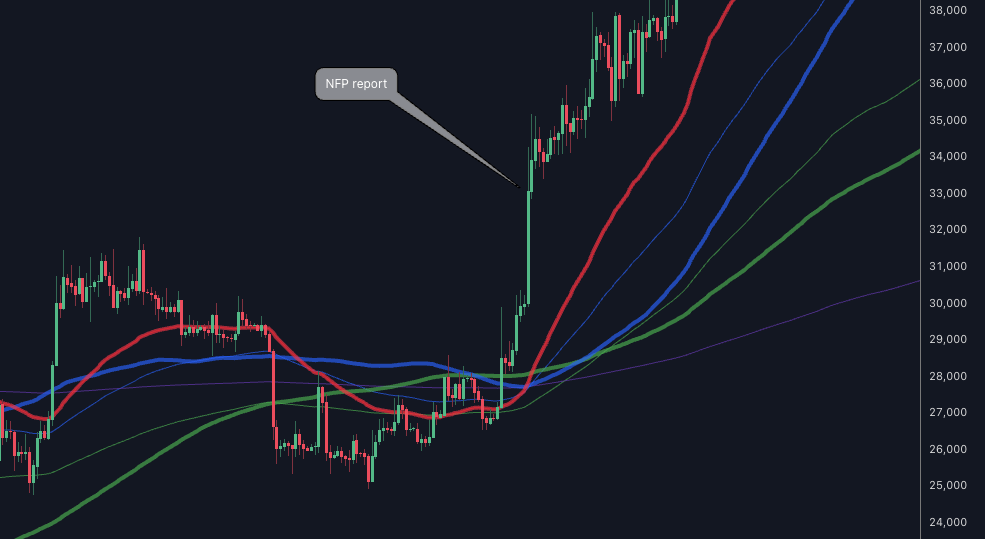

- 📉 NFP: Jobs Report Madness

📉 NFP: Jobs Report Madness

☕️ GM Munchers — weekend edition

We’re back with Round 3 of our “market events traders should actually understand” series.

Week 1 was FOMC (Powell’s Money Circus).

Week 2 was CPI (aka the Fed’s Mood Ring).

This week? It’s the Non-Farm Payrolls report — the one that decides whether markets moon… or nuke before breakfast.

🎤 What’s NFP?

The Non-Farm Payrolls (NFP) report tracks how many jobs the U.S. added last month — excluding farmers, government workers, and private household staff (sorry, butlers).

Think of it as the market’s monthly jobs thermometer — showing how hot or cold the labor market is.

Why it matters:

Jobs → Wages → Inflation → Fed Policy.

That chain runs the entire economy.

It’s not just one number, either. NFP drops with a full data buffet:

Headline jobs added

Unemployment rate

Average hourly earnings

Labor force participation

One surprise in any of these = instant whiplash in USD, stocks and crypto.

Traders when they don’t read our morning email

📊 Why Markets Care

The Fed’s got two jobs — fight inflation and keep people employed.

(Think of Powell as trying to drive with one foot on the gas and one on the brake.)

To pull that off, they raise or cut interest rates depending on how hot the job market is.

Here’s the playbook:

Strong NFP: Hawkish Fed → USD up → stocks take a nap.

Weak NFP: Dovish Fed → USD down → stocks rally (for now).

Wages: If pay’s jumping, the Fed panics — that’s “sticky inflation” 101.

Bottom line: NFP is the Fed’s stress test for the economy.

🔥 Hot jobs = rate-cut dreams on hold.

🥶 Cold jobs = Powell can finally chill — maybe even reach for the scissors.

🕰️ Past Action

Feb 2024: Blowout jobs → USD soared, gold tanked, stocks puked.

Oct 2023: Weak jobs → BTC +7% same day, equities moonwalked higher.

The massive rally began right around the NFP report.

Pattern? NFP whipsaws hard in the first 10 minutes.

Smart traders wait. Then ride the real trend.

Something our intern likes to repeat is “First candle is noise. Second candle is truth.”

👀 What to Watch Next

The market’s basically having an identity crisis right now.

Big names like Amazon are cutting thousands of jobs.

The unemployment rate is creeping higher.

Yet 80% of S&P 500 companies just beat earnings.

Confused? Same. Even Powell admitted this week that future cuts aren’t a sure thing.

So until we get more clarity:

Weak NFP = higher odds of cuts → dollar down, stocks up.

Strong NFP = fewer cuts → dollar up, stocks down.

Translation: everyone’s pretending they understand the data — but the truth is, even the Fed’s flying blind.

🤝 Closeout

Most rookie traders skip this stuff — that’s why 90% of them blow up their accounts and never make it past Step 1 of a prop firm challenge.

Speaking of prop firms…

The only thing we have to sell you is Lark Funding — because it’s actually built for traders, not rule lawyers.

Here’s what makes us different:

✅ 3+ years in business (we’re not disappearing overnight)

✅ No news restrictions or weird consistency rules

✅ Trade FX, stocks, indices, commodities — even crypto

If you’re thinking of taking a challenge, we’d love to have you.

Use code NOVEMBER5 for 5% off.

— Matthew, CEO

P.S. You’ve made it this far… it’s Sunday. Go spend time with people who don’t ask about your drawdown. The markets will still be there tomorrow.

What do you think of today's edition? |