- Pip Munch

- Posts

- 🚀 Did Oanda Just Launch Their Own Prop Firm?

🚀 Did Oanda Just Launch Their Own Prop Firm?

PLUS: How long does it take to receive a payout? 🤑

Howdy Lark Traders. This is Lark Digest, the trading newsletter that’s more exciting than going full margin on XAUUSD.

We’ve got a good one for you:

Did Oanda just launch their own prop firm? 🤔

What challenge has the fastest payout frequency? 🤑

OANDA LAUNCHES THEIR OWN PROP FIRM? 👀

I don’t know about you, but I’m not a fan of rollercoasters, and on Monday, we had a wild one in the prop firm space.

On Monday, Oanda, a regulated broker that’s been in the business for years, made noise by announcing the launch of Oanda Labs Trader, their own evaluation company.

At least, that’s what it first looked like…

No but in all seriousness.

This is huge!!

A regulated broker entering this game is absolutely huge and just gives us more opportunity as traders.

It’s never been easier to be a trader!

— Kimmel (@kimmeltrading)

4:43 PM • Jan 22, 2024

OANDA regulated broker creates an in-house prop firm with leverage up to 1:50 and multiple funding options.

Interesting times!

— Capital Hungry (@Capital_Hungry)

3:10 PM • Jan 22, 2024

But after this got out on Twitter, without there being an official announcement from Oanda, there was uncertainty around whether they really backed it or if it was a scam.

Don’t believe everything you see online.. Oanda got no clue about this new prop firm they supposedly released. If this is true then you people need to be careful what you see and post.

— Umar A (@umziefx)

8:12 PM • Jan 22, 2024

So the Oanda prop news has turned out to be fake 🤔

Funny how quickly fake news can spread when it fits a narrative

— Ben Sparham (@bensparham_)

10:12 AM • Jan 23, 2024

OANDA launched their own prop firm but their own support doesn't know about it!!

— PropFirms Real Talk (@PropFirmsRT)

5:50 AM • Jan 23, 2024

But like every good Hollywood movie, by the end of the day, there was yet another twist.

It was pointed out by several that Oanda Labs Trader is indeed a subdomain of Oanda.

Oanda Labs is literally featured on Oanda .com

The Oanda Labs is a subdomain of oanda .com

Oanda Labs is by Oanda

— The Prop Journalist (@PropJournalist)

9:04 PM • Jan 22, 2024

All of that to say, as of now, it does look like it’s from Oanda.

*But we encourage you to be cautious. We recommend that all traders wait until things are more clear.*

But assuming this is a legit launch, it means that regulated brokers are now entering the space.

So the question is, how does their challenge look, and what does this mean for the industry?

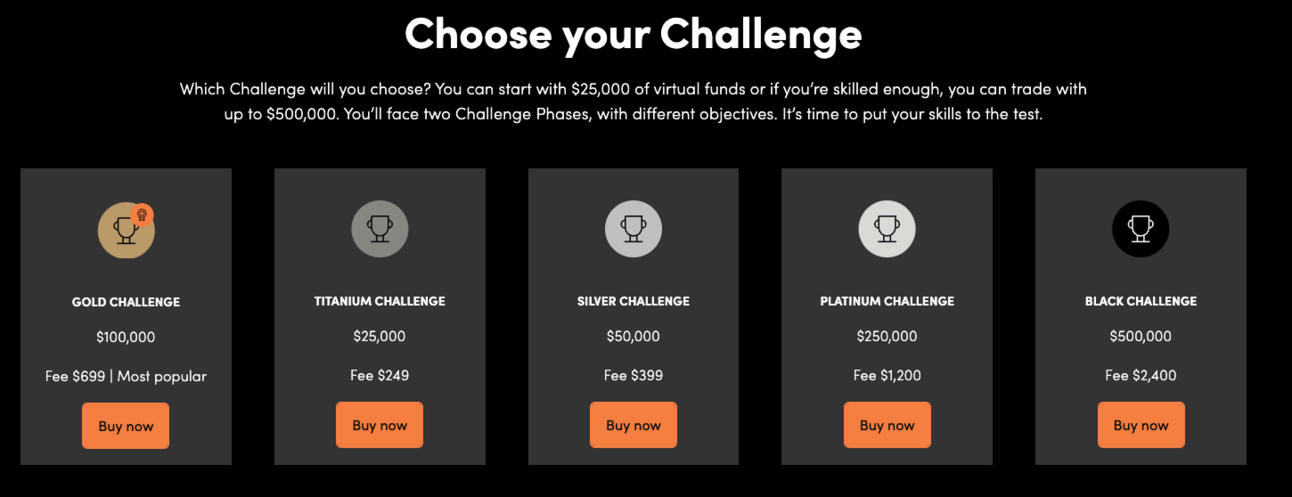

1/ THEIR CHALLENGE = HARD & EXPENSIVE 💰️

If you’re familiar with standard challenge pricing and rules, you’ll be surprised to see what Oanda Labs is offering.

First off, their challenges are very expensive, with a $100,000 one going for $699.

Second, the challenge is anything but easy with:

Phase 1 Target = 10%

Phase 2 Target = 5%

Max Drawdown = 10%

Time limit = 120 days

But this is what makes it even more interesting. If Oanda legitimately backs the launch (we need more evidence), then it’s very telling.

Oanda has been in the brokerage industry for years, and they know what it takes to make things sustainable.

There's a reason Oanda launched its own prop firm challenge with:

- Low leverage

- High prices

- Difficult targetsThey know what it takes to make things sustainable.

It's just another option for traders and I'm all for it.

— Matt L (@MeetMattL)

5:34 PM • Jan 22, 2024

2/ MANY RESTRICTED COUNTRIES ❌

The list of restricted countries is massive.

United States 🇺🇸

Canada 🇨🇦

United Kingdom 🇬🇧

And many others

Why is this?

It’s tough to say, especially since FTMO stopped accepting new US clients just recently.

Hopefully, once we receive an official announcement from Oanda, it will be more clear.

3/ WHAT DOES THIS MEAN FOR THE INDUSTRY?

Brokers entering the funding space have been anticipated longer than the "undo send" feature for regrettable trade decisions.

And it makes sense.

Prop firms have been stealing a ton of their clients.

They already have the infrastructure, so why wouldn’t they offer the service?

It’s essentially inevitable, and I think it will add one very needed thing to the industry:

Trust.

If a broker is regulated and enters the space, it’s likely that traders will have higher levels of trust.

But it’s actually a double-edged sword.

If a broker offering their own prop services is using their own in-house liquidity provider, then it could raise some concerns and red flags.

*cough MFF cough *

So we’ll have to wait and see how this one plays out.

WHO GETS PAID THE FASTEST? 🤑

As always, being a Lark Trader means that you’re going to get insider access that no other firm shares.

Today, the question we asked ourselves is:

Which challenges, on average, has the shortest time between registration and payout?

In other words, if your goal is to receive your payout faster than it takes GBPJPY to break your heart, this is what you need to know.

1-STAGE PROGRAM

Starting off with our most straightforward program, we’re happy to report that the simplicity of it isn’t leading traders to try and pass ASAP.

They’re not rushing things.

They’re going slow and steady.

And we’re all for it.

To cut to the chase, on average, it takes traders on our 1-Stage Program 92 days from signing up to receive their first payout.

Well done, Steady Eddy.

2-STAGE PROGRAM

The illustrious, industry-standard 2-stage program has a much faster registration-to-payout duration.

On average, it takes traders 51 days from signing up to receive their first payout.

We’re not entirely sure why this is, but the larger drawdown room is likely leading trading to increase their risk and pass faster.

3-STAGE PROGRAM

This is where things start to get interesting.

Many think that a 3-stage program is more difficult to pass and that it will take longer.

But at Lark, we like to ignore the trading gurus with face tattoos and focus on only the data.

And what does the data say?

On average, it takes only 32 days from signing up to receive a payout on our 3-Step Program.

We think this is from:

Having no daily loss limit

The emotional benefits of having smaller targets (5% > 4% > 3%)

I hope you enjoyed today’s email. We’re focused on building the #1 newsletter in trading and helping you get funded.

We’re happy to have you here, and we’ll see you on Friday,

Matt | Lark CEO

DIGESTIBLE MEMES 🍪

What do you think of today's edition? |