- Pip Munch

- Posts

- 🚀 Payouts, Pass Rates & 2024

🚀 Payouts, Pass Rates & 2024

GM Lark Traders. Happy New Year’s! 🥳

This is Lark Digest, the trading newsletter that ignores the Lambo Gurus and focuses on what matters.

Here’s what we got for you today:

Revealing our largest payouts in 2023 🤑

Predicting the 2 major events that will drive the markets in 2024 📈

4 changes we expect to see in the prop firm industry 😯

Our 2023 pass rates 🚀

THE 2023 LARK AWARDS 💰

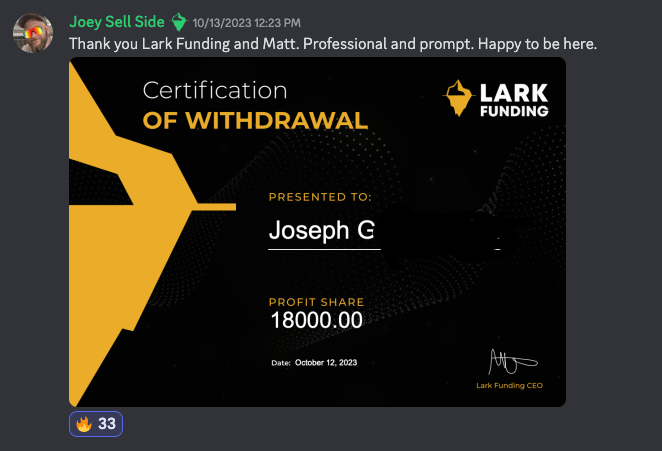

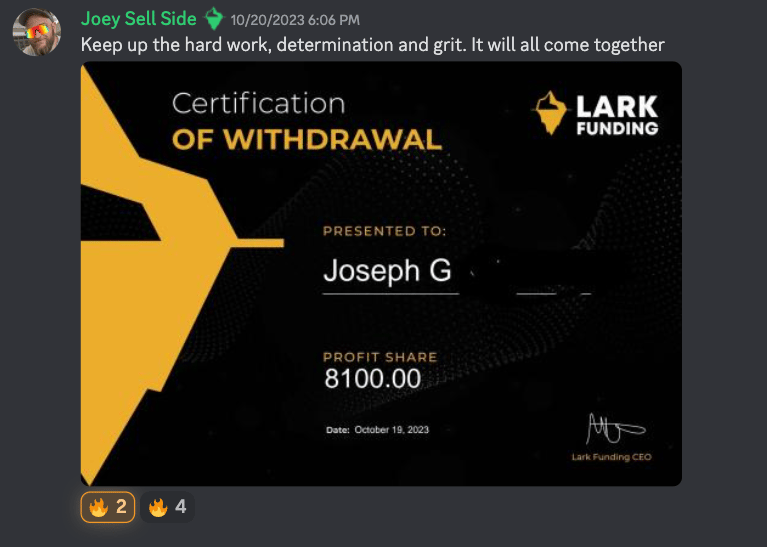

Our most successful trader in 2023 was Joe, who withdrew a mouthwatering $32,661 over three payouts. Joe, drinks are on you.

Our largest single payout, however, goes to Robert, who received $18,845 this week. What a way to end 2023, Robert.

Our average payout this year was $3,360.56.

We’re shamelessly giving ourselves the award for Best Giveaways since we gave away 2,879 accounts this year. Should be double that in 2024?

The Most Profitable Country award goes to the UK 🇬🇧 for having over $350,000 of withdrawable profit in 2023.

Being Canadian, we, of course, have to mention the not-so-close second-place finisher. Canada 🇨🇦 very politely finished in second place with $164,000 in withdrawable profit.

2024 | 2 THINGS TO WATCH OUT FOR

1/ TRUMP OR BIDEN? 🇺🇸

2024 is an election year and we’re only 308 days out from seeing who will be the next US President. Will it be Biden for another 4 years? Or will Trump make a comeback? Or, against all odds, could it be somebody else?

Anybody’s guess is as good as the next, but one thing is certain: The market will be watching as closely as Biden stares down a vanilla ice cream cone.

According to usbank.com, elections have “minimal impact on financial market performance in the medium to long term.”

However, the uncertainty typically does have an impact. The average return on equities is more than 8% in non-election years and less than 6% when there is an election.

In times like this, we like to be reminded of Uncle Charlie Munger, who famously said: “The big money is not in the buying or selling, but in the waiting.”

So wait we shall, Charlie.

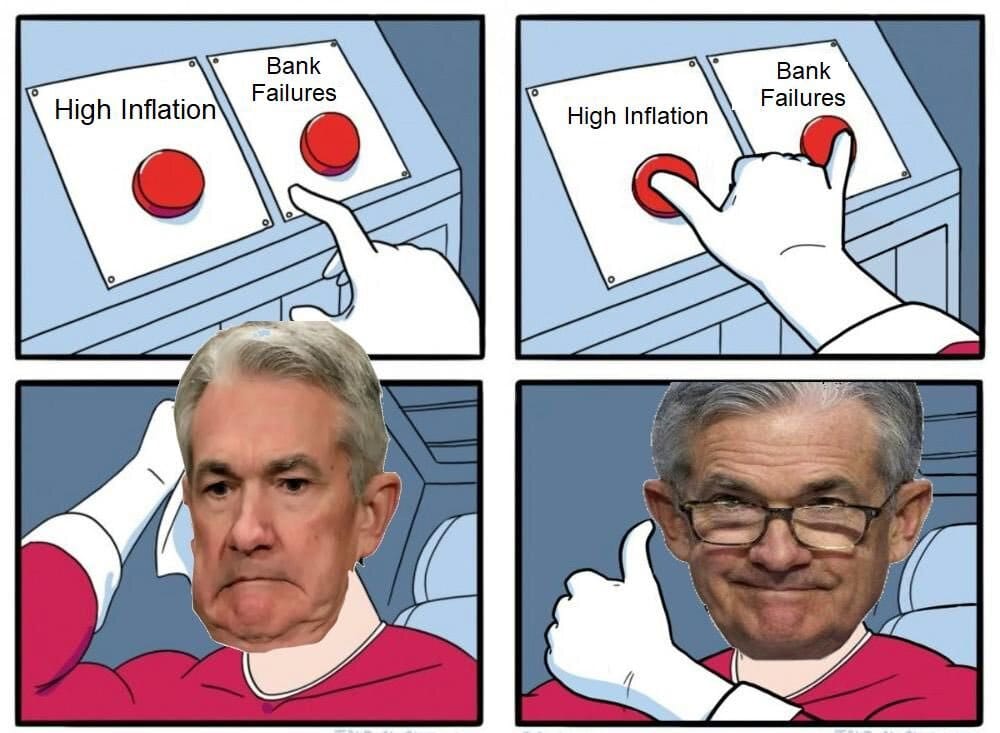

2/ WILL POWELL GET SCARED?

While most of the world is focusing on Trump Vs Biden or Dubai Bling on Netflix, we spend our time thinking about Jerome Powell.

How’s he feeling? How’s his home life? Was his Christmas turkey cooked okay?

It might sound silly, but you can’t overlook anything when the entire financial system relies on the guy and what he does with rates.

With interest rates still below 6%, Americans are at the mercy of Powell and what he decides to do. Many are predicting rates to come down in 2024 but the money markets expect rates above 3% for years.

Only two things are certain:

1) The largest market driver in 2024 will likely be what Powell does.

2) We’re glad we don’t have his job.

WILL YOUR UNCLE OPEN A PROP FIRM?

Every time we log on to Twitter, it seems like a new prop firm just launched. Just look at this post that breaks down each firm by payout frequency.

#Propfirms' Payout Frequency 🔍 twitter.com/i/web/status/1…

— Prop Firm Match (@PropFirmMatch)

11:41 AM • Dec 22, 2023

The number keeps growing every day. What does this mean? Well, don’t be surprised if your cousin or crazy uncle is talking about opening their own firm over turkey dinner next Christmas.

So, what do we expect to see in 2024 beyond a growing number of firms?

1/ MORE COPYING

Prop firms, at this point, have essentially become a commodity.

The only thing separating one firm from another is a 1-2% difference in targets and drawdowns.

This means the difference between firms will get smaller and smaller.

Except for one thing: Trust.

It doesn’t matter if a firm has the largest drawdown, the smallest targets and the lowest prices if you can’t trust them to pay you out.

And unfortuneately, building that trust isn’t something one firm can copy from another.

Without trust, you have nothing. Well, except for an angry Twitter mob.

That’s why it’s always our top priority. It’s also why, in over 19 months of operating, we’ve never denied a single payout.

2/ MORE VALUE

The tougher competition is great for traders. This means that companies will race to see who can provide the most value.

At Lark, that’s our #1 focus this year.

In 2023, we wanted everyone to think we were robots for answering our emails so quickly. Our support staff have yet to be called the Terminator, but we’re getting close.

That said, our focus in 2024 is on providing as much value upfront, for free. Hence, this newsletter.

A few things we’re working on:

Increasing our upload frequency on YouTube. Our goal is to provide the most entertaining and educational trading content out there. But still no diamonds or Lambos.

Finalizing a few courses we’re building. One is our 10-Day Trading Psychology Transformation. All for free.

Building out our new dashboard that will look way better than our current 1990s-looking one.

Pretty nice, ayy?

WHO ACTUALLY PASSES?

Everyone thinks that only 10% of traders pass. Is that true?

Let’s see.

1-STAGE

This is our OG challenge model, the one we launched on June 1st, 2022, with the highest pass rate at just over 10%.

2-STAGE

The 2-Stage model is the most popular and common in the industry. But should it be?

Well, in 2023, it had an overall pass rate of 8%. But for those that did pass, the 2-Stage model did have the largest payouts… We’ll discuss that another time.

3-STAGE

Our 3-Stage model made a ton of noise when we launched it in the second half of 2023, and for good reason.

With no daily loss limit, targets of 5% > 4% > 3% and 75% discount codes, it’s tough to beat.

And the overall pass rate of 9% shows exactly that.

A massive thank you for supporting us in 2023. Without you, we wouldn’t be where we are.

2024 is going to be a big year for us. We’ll be working day and night to help you get one step closer to becoming a Lark Funded Trader.

Happy 2024 🚀

Matt | Your Lark CEO