- Pip Munch

- Posts

- 📉 Powell Delivered. Now What?

📉 Powell Delivered. Now What?

Most traders can't quit their job because one bad month = $0 income. Lark Funding just solved that. They'll pay you a monthly salary—even when you're in drawdown.

☕️ GM Munchers! My wife asked if I've considered "not losing money" as a trading strategy and I've been thinking about it for three days—she might be onto something revolutionary here.

On today’s menu:

📉 Powell Delivers, Markets Climb, Canada Pauses

🎮️ GameStop’s Strategy Isn’t Paying Off

🚀 SpaceX IPO Incoming?

🥇 The Trump Gold Card Launches For $1 Million

💵 The Purchasing Power of $100 in Each U.S. State

Yesterday’s numbers:

S&P 500 | 6,886 | +0.68% |

Nasdaq | 23,654 | +0.33% |

Dow Jones | 48,057 | +1.05% |

Bitcoin | $92,000 | -0.70% |

BREAKING NEWS

🏦 Powell Delivered, Markets Rallied—Now What?

Well, gents (and our 5% female readers), it happened.

As expected, Mr. Powell cut rates by 0.25% and managed to not say anything wild at the press conference—a minor miracle given his track record of accidentally tanking markets mid-sentence.

The result? The market rallied.

The S&P 500 is now less than 25 points from record highs, which means we can keep our McDonald's uniforms in storage a bit longer. Crisis averted (for now).

Here are the main takeaways:

The Fed is split. The vote to cut came in at 10-3—turns out not everyone thinks easing is the brilliant strategy Powell's betting on.

Dot plot reality check: Only one rate cut in 2026, another in 2027. Translation? The rate-cutting party just got a noise complaint and is shutting down early.

Treasury buyback bonanza: Starting Friday, the Fed resumes buying $40 billion in Treasury securities. If that put you to sleep, same. Just know it's the Fed's way of pumping liquidity into markets, which lowers yields and nudges investors toward riskier assets (like your portfolio).

The Munch Take:

Exactly what was expected happened. Powell didn't fumble. Markets celebrated briefly before remembering the dot plot means fewer cuts ahead. The easy money's priced in—what happens next depends on whether inflation cooperates or decides to ruin everyone's 2026.

How did markets actually react? Let's look…

🚀 Everything Rallied Except the Dollar & Bitcoin (One Misbehaved)

As we've been reminding you almost daily, lower rates are catnip for stocks but kryptonite for the dollar.

So, what happened yesterday?

Exactly that. Well, almost.

Our beloved Bitcoin—which has been acting like a moody teenager for weeks—ripped 2% in under an hour, then promptly gave back every single gain before market close and finished in the red. It's now down 1% YTD, sulking in the corner while everything else parties.

Meanwhile, the Dow led the charge, climbing nearly 500 points. The S&P 500 closed kissing distance from record highs, and the dollar got absolutely smoked—DXY dropping over 0.6% as rate cuts made holding cash about as appealing as a timeshare presentation.

The Munch Take:

Bitcoin's having an identity crisis—up, down, sideways, repeat. It's acting like your bipolar 13-year-old cousin who can't decide if they love or hate you within the same hour. Honestly? We have no idea what's happening with BTC right now.

But the rest of the market? Behaving exactly as expected. Stocks up, dollar down, vibes cautiously bullish. For now, we're riding the wave—just keeping one eye on Bitcoin in case it decides to throw another tantrum.

🇨🇦 Canada Hits Pause (And Pretends Everything's Fine)

Unlike the Fed, the Bank of Canada kept rates at 2.25% yesterday, declaring the current level is "about right"—central banker speak for "we have no idea what we're doing but we're committed to the bit."

Recent CPI readings came in at 2.2%, practically kissing their 2% target. So inflation's technically under control, which would be great if literally anything else about Canada's economy wasn't a dumpster fire.

Policymakers said they're in an "extended pause phase." Hard to focus on monetary policy when your provinces are more interested in trade wars over American alcohol than actually governing.

Market reaction?

USD/CAD dropped 0.4% yesterday, down nearly 2% this month and about 4% YTD.

The Munch Take:

Canada's stuck. GDP per capita is massively lagging the US, inflation's crushing consumers, and Alberta's going rogue against federal mandates. The BoC saying rates are "about right" feels less like confidence and more like someone insisting their house isn't on fire while smoke alarms scream in the background.

BROUGHT TO YOU BY

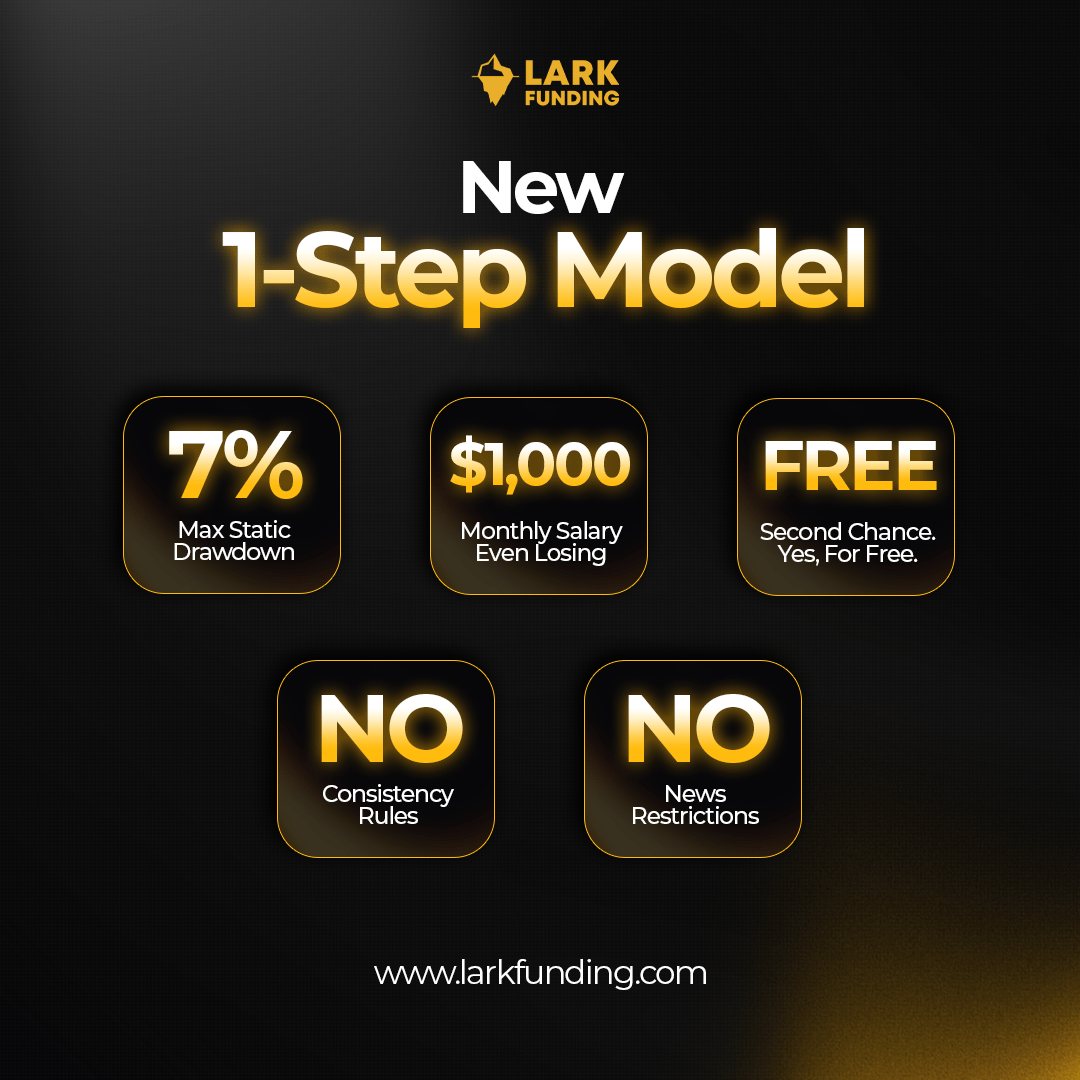

Most prop firms are designed to fail you.

Consistency rules that deny payouts. News restrictions during volatility. Resets that cost hundreds.

Lark's new 1-Step Career Program is different.

7% max drawdown—the most forgiving in the industry. Monthly salary up to $1,000 even during losing months. Free second chances when you need them. Zero consistency rules. Zero news restrictions.

We've been paying traders for 3+ years because we're here to build careers.

One evaluation. Get funded. Start your trading career.

STOCKS

🎮️ GameStop’s Strategy Isn’t Paying Off

GameStop couldn't ride retail trader vibes forever, so in May, management pivoted strategies: turning the company into a digital asset treasury and buying Bitcoin.

Spoiler alert: it's not going great.

GameStop's feeling the sting of crypto's recent selloff—their Bitcoin holdings cratered from $528.6 million at the end of Q2 to just $519.4 million last quarter. Meanwhile, the actual business? Sales slumped about 4.6%.

The (barely) good news: Shareholders aren't freaking out yet because the company's cash hoard has nearly doubled to $8.8 billion since last year, giving management breathing room to figure out what comes next.

Yesterday's earnings:

Adjusted EPS: $0.24 (beat estimates of $0.20)

Revenue: $821 million (missed forecasts of $987 million)

The stock still dropped 4.28% because beating on earnings while missing on revenue is the financial equivalent of winning the participation trophy.

The Munch Take: GameStop went from meme stock darling to Bitcoin treasury experiment, and now they're learning what every crypto holder discovers eventually—number go up is fun until number go down. At least they've got $8.8 billion to cushion the fall.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

$BA The Homeland Security Department just announced they're buying Boeing 737s for ICE deportations. Politics aside, nothing says "we believe in your product quality" quite like the government choosing your planes to fly people out of the country. Is this... bullish? The market's as confused as we are.

$NFLX Netflix is officially in its largest drawdown in 3 years, bleeding harder than a trader's first margin call. I know Warren Buffett says to buy when there's blood in the streets, but my goodness—just greenlight 47 more seasons of Love Is Blind with increasingly unhinged contestants and watch the stock recover. The formula works. We've seen it.

$ORCL Oracle tanked 5% after missing on revenue, which is Wall Street's way of saying "we don't care that you beat earnings." The irony? They grew revenue 14% year-over-year and crushed EPS estimates ($2.26 vs $1.64 expected). They're still up 34% YTD, but apparently that's not enough when expectations are trading at "flawless execution or die."

SpaceX IPO incoming: SpaceX plans to go public in 2026 with a $1.5 trillion valuation—the largest IPO in history. So our investment returns now officially depend on whether Elon can successfully colonize Mars. No pressure. Just humanity's financial future riding on interplanetary real estate. Totally normal stuff.

🚀 Pre-Market Fuel

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER