- Pip Munch

- Posts

- 📉 Powell Presses Pause, Market Smashes Sell Button

📉 Powell Presses Pause, Market Smashes Sell Button

☕️ GM Munchers! I thought my wife was the master of talking in circles—then Jerome Powell took the mic yesterday and made her look like a straight shooter.

On today’s menu:

📉 Powell Presses Pause, Market Smashes Sell Button

🇨🇦 Canada Holds Steady, But the CAD’s Still Slipping

🛳 The Great Supply Chain Slowdown — It’s Back.

❌ The S&P 500 Forms A Death Cross

🚗 Ford Made $900 Million In China

BREAKING NEWS

📉 Powell Presses Pause, Market Smashes Sell Button

If the market had a face yesterday, it would've looked like it just saw its tax bill.

Stocks sank hard after Fed Chair Jerome Powell stepped up to the mic at the Economic Club of Chicago and delivered his favorite monetary strategy: wait and see.

And the market’s response? Immediate panic.

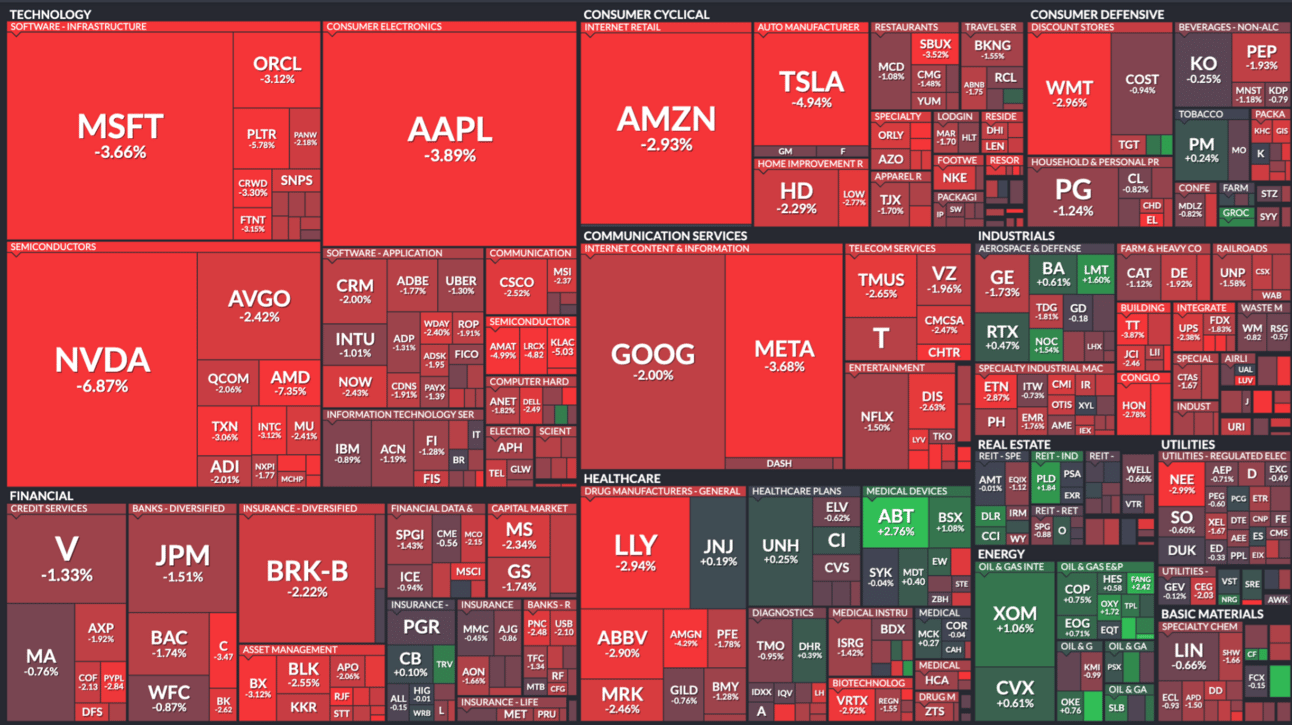

📊 Here’s how it closed:

S&P 500: 5,276 (–2.24%)

Nasdaq: 16,307 (–3.07%)

Dow Jones: 36,669 (–3.04%)

Russell 2000: 1,863 (–1.03%)

Tech led the fall off a cliff. Just look at these red flags:

Nvidia: –6.87%

AMD: –7.35%

Intel: –3.12%

Microsoft: –3.66%

Apple: –3.88%

Amazon: –2.90%

Meta: –1.86%

Even Powell couldn’t sugarcoat it.

He admitted the Fed’s dual mandate—price stability and maximum employment—is “in tension.”

Translation? If tariffs push up inflation while growth slows, the Fed could be stuck between a rock and an even rockier place.

He called it “a strong possibility” that tariffs move the U.S. further from its goals for the rest of 2025.

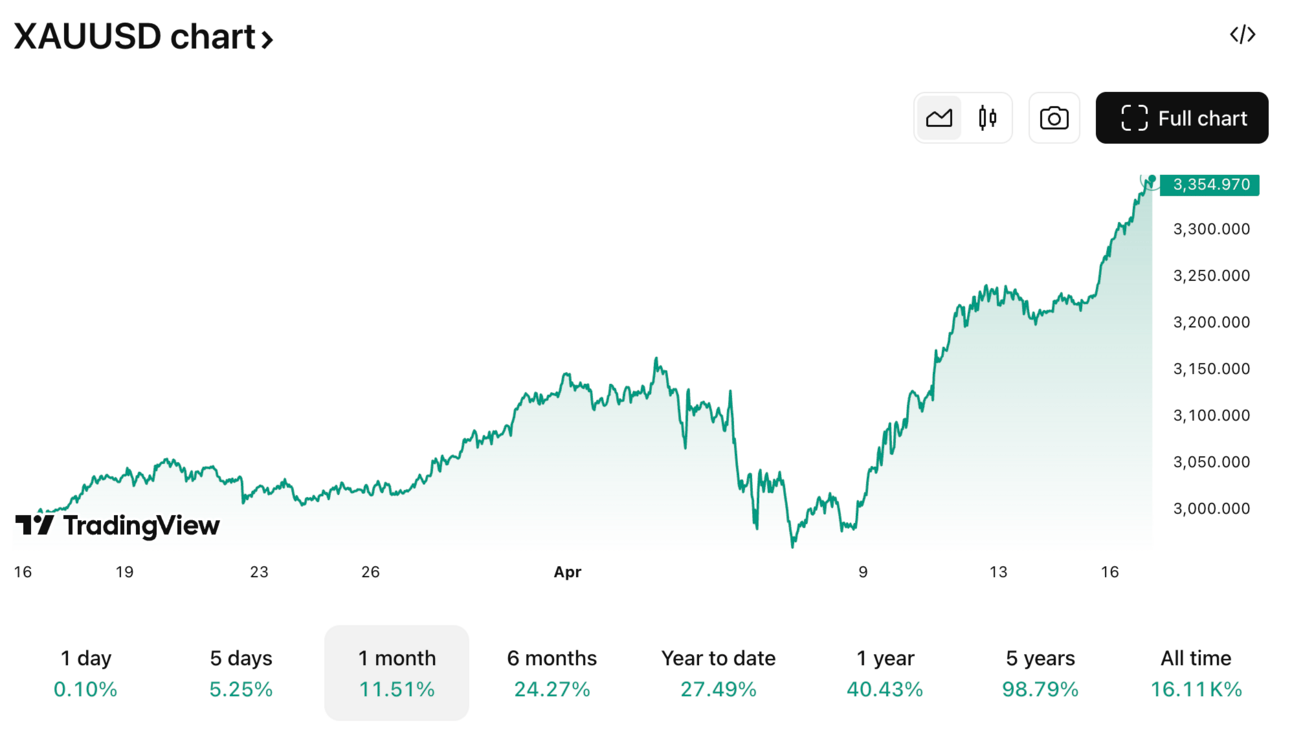

The only thing that went up yesterday?

🚀 Gold, which surged $113 or +3.5% to close at $3,348.40.

That’s the biggest single-day gain since at least 2013. (Anyone shorting gold right now is probably stress-eating their monitor.)

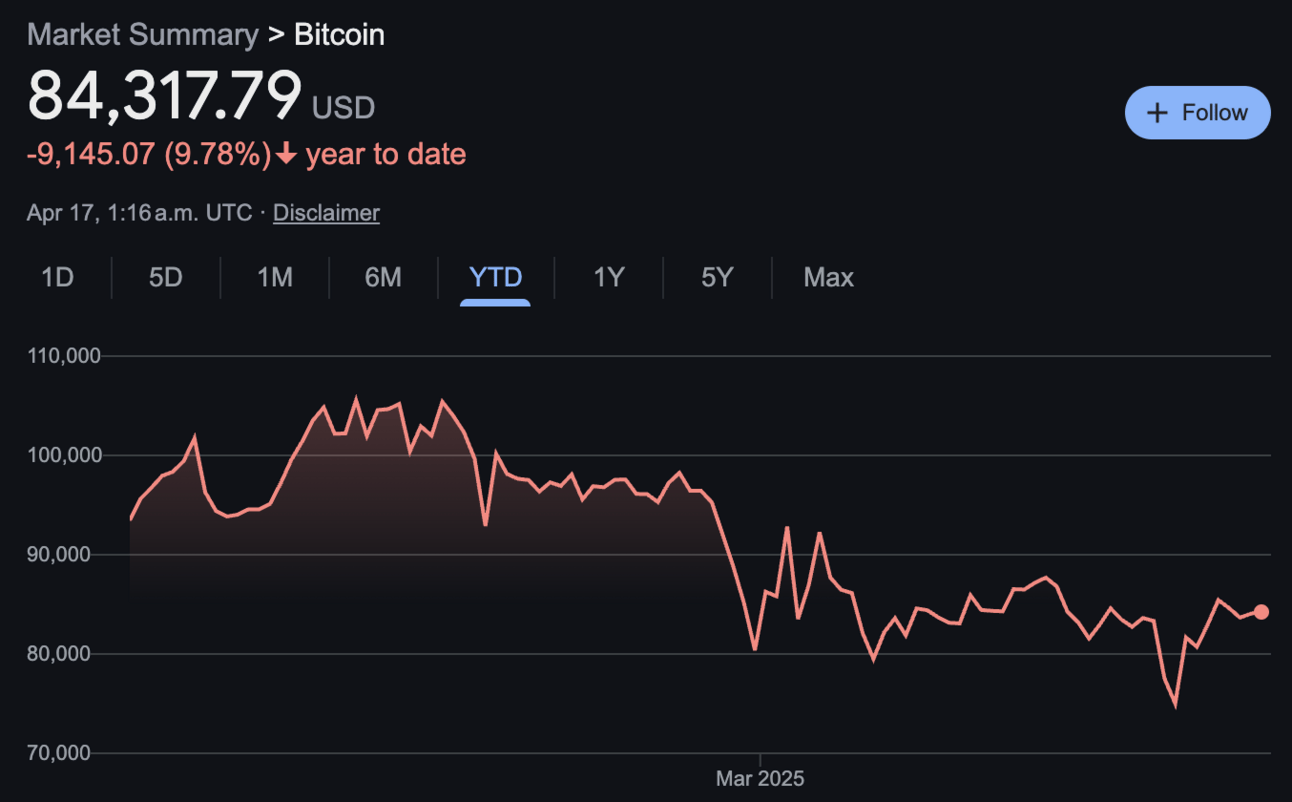

Meanwhile, crude oil rose to $62.80, and even Bitcoin joined the fun, jumping $657 to $84,343.

Semiconductors were hit the hardest after Nvidia said the U.S. government banned exports of its H20 AI chips to China “for the indefinite future.”

That alone will cost Nvidia a $5.5 billion charge to Q1 earnings. Other chipmakers like AMD and Intel quickly followed Nvidia’s slide.

In short, it was a full-blown sentiment shift.

Powell said the Fed was “well positioned to wait,” but markets were clearly hoping for something—anything—more concrete.

And so… we sold off.

Because if there’s one thing traders hate more than bad news, it’s uncertainty.

BROUGHT TO YOU BY

Instant Funding, Now With More Firepower

Lark Funding just supercharged its Instant Program.

✅ Max drawdown: 8%

✅ Daily loss: 5%

✅ Leverage: 50:1

✅ First payout on demand

No challenges. No rules holding you back. Just pure trading freedom.

👉 Use code APRIL90 for 9% off + 90% split.

FOREX

🇨🇦 Canada Holds Steady, But the CAD’s Still Slipping

The Bank of Canada hit the pause button Wednesday, holding its benchmark interest rate at 2.75% and ending a streak of seven consecutive cuts.

The decision wasn’t exactly a shocker — analysts were completely split going into the meeting. Some expected another 25 basis point cut.

Others figured the BoC would hold, waiting to see how the Trump tariffs and oil slump shake out.

Turns out, the wait-and-see camp was right.

And the reasoning? In one word: uncertainty.

In more words: “pervasive uncertainty… challenging to project GDP growth and inflation in Canada and globally,” as the BoC put it.

Governor Tiff Macklem’s press conference didn’t exactly inspire confidence either. In fact, it might’ve made things worse. He admitted the bank is flying half-blind:

“We decided to hold our policy rate unchanged as we gain more information about both the path forward for U.S. tariffs and their impacts.”

That "more information" can’t come soon enough.

With consumption, residential investment, and business spending all weakening, and the labour market showing signs of strain, the economic outlook isn't exactly rosy.

Macklem floated two scenarios:

Scenario 1: Tariffs get negotiated away → growth returns, inflation drops below 2% in 2025–26.

Scenario 2: Long-lasting global trade war → Canada enters recession, growth stays soft through 2027, and inflation rises above 3%.

So yeah, just a tiny range of outcomes.

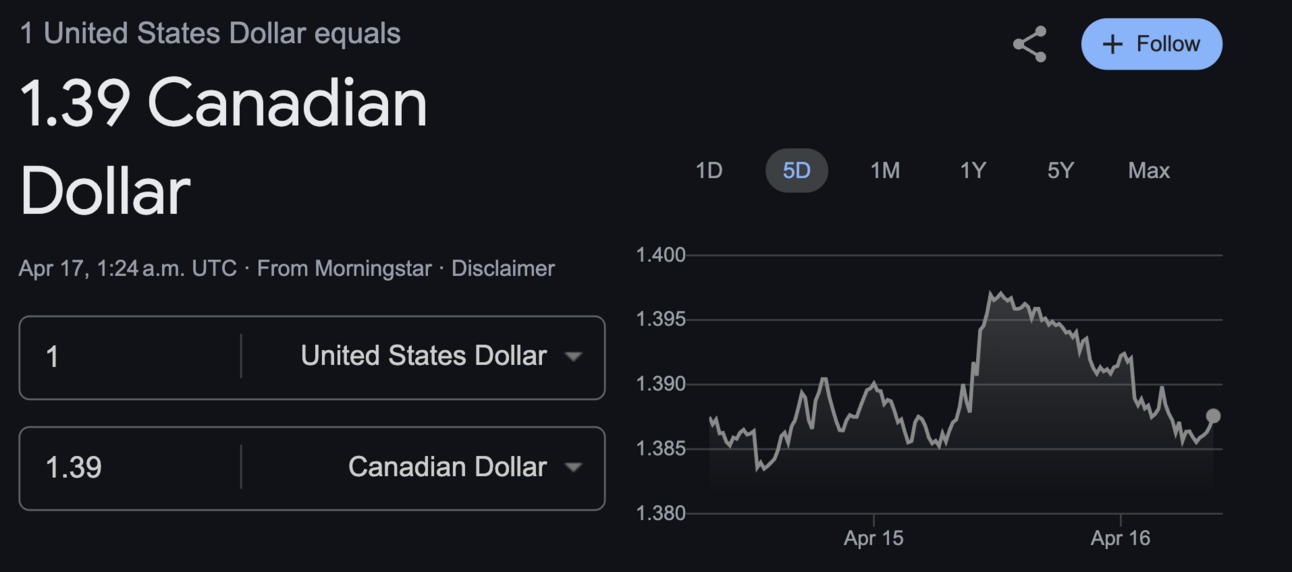

Meanwhile, the USD/CAD pushed higher to 1.39 as traders bet on further CAD weakness.

With oil prices low and the Fed still sounding hawkish, the loonie is starting to look like the weak kid in the currency gym.

Bottom line for traders: If the BoC’s not sure what to do, don’t expect smooth sailing in the CAD.

Stick to clean setups, manage risk tight, and know this — when central banks say “the future is unclear,” that’s your cue to be extra careful.

BIG PICTURE

🛳 The Great Supply Chain Slowdown — It’s Back

Just when you thought we were done talking about freight ships, tariffs have decided to bring the bottlenecks back.

According to new reporting, freight cancellations out of China are surging. Ocean carriers are scrapping planned sailings left and right as demand from the U.S. starts to dry up.

The culprit? You guessed it: tariffs.

“We won’t go to zero containers,” one freight expert said, “but we will see a decrease in containers and as a result... a massive raft of blank sailings.”

Translation for traders:

📉 Fewer containers = slower trade

🧊 Slower trade = cooling global growth

💵 Cooling growth = rising demand for safe haven currencies (USD, JPY)

🚫 Risky currencies like AUD, NZD, and even CAD could take a hit

And it’s not just about boats.

A decline in container shipping cascades down the entire economy — from ports to trucking, rail, warehousing, and eventually retail shelves. It’s one of the clearest real-world indicators that global demand is shrinking.

So what’s the takeaway for beginners?

If you’re trading forex, this is how you spot macro risk before it hits the charts.

When global trade starts freezing up, markets tend to shift into risk-off mode.

That’s when the dollar flexes, the yen wakes up, and anything tied to commodities or exports (like AUD, NZD, and CAD) can get pummeled.

📊 Pro tip: When in doubt, pair weak economies with strong ones. That’s where the juiciest forex setups tend to live.

This might not be March 2020, but trade is slowing, ships are canceling, and volatility is starting to boil again.

Don’t sleep on the supply chain—it’s the quiet indicator that often shouts first.

PROP FIRMS

🤑 Thursday Motivation

Congratulations to Syed! 💰

Will you be next?

— larkfunding (@larkfunding)

11:03 PM • Apr 16, 2025

🚀 Pre-Market Fuel

🍪 Munchy Memes

Me leaving my 9-5 job when Bitcoin hits 300K this year

— naiive (@naiivememe)

11:40 AM • Apr 16, 2025

Me with 1 share of Nvidia worrying about a 6% drop in the stock price this morning

— Not Jerome Powell (@alifarhat79)

2:01 PM • Apr 16, 2025

"they're selling debt packages made up of coachella ticket obligations & door dash loans?"

— Dip Wheeler (@DipWheeler)

4:10 PM • Apr 15, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER