- Pip Munch

- Posts

- 📉 Prediction Markets & Insider Trading

📉 Prediction Markets & Insider Trading

🚨 FINAL DAY: Free Trading Competition, 10% Win Rate, $1M in Challenge Accounts

1,000 traders. 100 funded accounts. That's 1-in-10 odds.

Lark Funding's New Year Competition ends registration TODAY. Two weeks to trade (Jan 6-20), top 100 win funded prop accounts.

Prizes:

1st: $100K prop firm challenge

2nd-100th: Challenge accounts from $50K down to $1K

Entry: $0

Most traders waited until the last minute. That's why your odds are this good.

Registration closes tonight (free) → larkchallenge.com

☕️ GM Munchers! Writing this while my wife shoots death glares because I'm supposed to be watching German Love Is Blind, not typing about markets. Marriage is compromise—she gets reality TV, I get 15 minutes to expose the wildest insider trading scheme that's technically legal.

Prediction markets are exploding in 2026—and they might be one of the most interesting ways to make (or lose) money this year.

But here's what nobody's discussing: while everyone celebrates "wisdom of crowds," some people are placing $30,000 bets on 13-to-1 odds and winning not because they're smart, but because they already knew the answer.

Welcome to prediction markets, where insider trading meets zero regulation, and "miraculous predictions" are just classified intelligence with better marketing.

Let me show you what I mean.

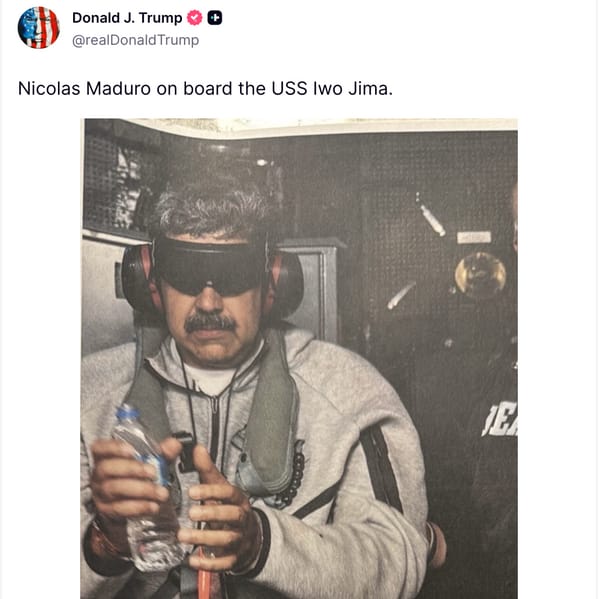

🎯 The Maduro Miracle: Perfect Timing or Perfect Crime?

January 4th, 2026, 3:30 AM EST: A brand-new Polymarket account places $30,000 betting Maduro gets captured within 72 hours. Odds: 13-to-1 against.

The timeline that breaks physics:

3:30 AM: Account created, bets placed

4:47 AM: U.S. military operations begin (classified)

6:15 AM: Maduro captured

8:30 AM: News breaks publicly

9:45 AM: Account withdraws $403,000, goes dormant forever

The red flags screaming fraud:

Zero trading history before this bet

Account created 30 minutes before classified military operation

Maximum bets across multiple Venezuela contracts

Withdrew immediately, never traded again

This isn't prediction. This is arbitrage with classified intelligence.

Polymarket's response? Silence. Took their 2% cut ($8,060) and moved on.

Legal consequences? None. Because there's no framework yet.

⏱️ The Press Briefing Manipulation: When 32 Seconds = 50x Returns

January 7th, 2026: White House press briefing becomes a prediction market casino.

The setup:

Historical data: 73% of Karoline Leavitt's briefings exceed 65 minutes

Market pricing: 98% probability it goes long

Odds for briefing ending early: 50-to-1

What happened:

At 64 minutes, 28 seconds—with reporters mid-question—Leavitt abruptly kills the briefing. "Thank you, everyone. That's all."

Traders betting "NO" (ends early) just made 50x in one sentence. $1,000 became $50,000.

The smoking gun: Trading volume on the NO side spiked in the final 5 minutes before cutoff. Someone knew.

Unlike the Maduro situation (insider knew classified info), this implies coordination—someone (potentially) influenced the outcome to win bets. That's not insider trading. That's fraud.

💀 Why This Destroys More Than Just Retail Traders

1. It Poisons Information Markets

Hedge funds and institutions use prediction markets as forecasting tools. When insiders manipulate prices, everyone downstream makes worse decisions based on corrupted signals.

2. Regulatory Vacuum = Perverse Incentives

Traditional insider trading on stocks? 10-year federal prison. Insider trading on prediction markets? Maybe a slap, maybe nothing. The math is simple: same crime, zero enforcement.

3. It Kills the Promise

Prediction markets were supposed to be "wisdom of crowds"—decentralized, trustless, pure market signals. Instead, they're centralized information monetized by those closest to power.

🎲 The Playbook: How Insiders Execute

Step 1: Create anonymous account (no KYC until six-figure withdrawals)

Step 2: Identify edge (classified military ops, policy decisions, corporate M&A)

Step 3: Place concentrated bet (it's "just speculation," regulators ignore it)

Step 4: Cash out immediately (contracts settle in hours)

Step 5: Rinse and repeat with new account, new event

Why it works: Unlike stock purchases (which trigger SEC alerts), prediction market bets fly under the radar. By the time anyone notices, the profits are gone and the account's dead.

⚖️ What Happens Next?

Polymarket and Kalshi exploded from $100M (2024) to $13B+ (2025) in volume. That growth attracts institutional capital—and regulatory scrutiny.

Three possible futures:

Crackdown: SEC/CFTC declare prediction markets fall under securities law. KYC required. Insider trading rules applied.

Outcome: Integrity improves, liquidity dies as whales exit.

Self-Regulation: Platforms add bet limits, account history requirements, anomaly detection.

Outcome: Modest improvement, sophisticated actors adapt.

Status Quo: Nothing changes. Insiders win. Retail loses. House takes its cut.

Outcome: Markets become openly recognized as insider playgrounds, retail exits.

Our bet: Status quo wins. There's too much money in keeping it broken.

🎯 The Munch Take: Imperfect Markets, Asymmetric Opportunities

Prediction markets are exploding in 2026—volume's up 13,000% in two years, institutional money's flooding in, and retail traders are following. That's not stopping anytime soon.

Are they perfect? Absolutely not. The cases above prove insiders are playing a different game with loaded dice. But does that mean you ignore them entirely?

Not if there's still money on the table.

Here's the reality: If you're sharp, selective, and understand you're sometimes betting against people who already know the outcome, there's alpha in prediction markets. That 10-to-1 contract offering outsized odds? Sometimes it's mispriced sentiment. Sometimes it's an insider on the other side with classified intel.

Your job is figuring out which is which—and knowing when the deck's too stacked to play.

But here's why we prefer prop firms over prediction market gambling:

Prediction markets: You're betting against anonymous whales who might have DOD briefings.

Prop firms: You're trading based on price action and strategy—everyone sees the same charts, same data, same opportunity. No insider edges. Just skill.

The math on prop firms is stupid simple:

Spend $100-500 on a trading challenge

Pass the evaluation (prove you can manage risk without detonating capital)

Get access to $100K-200K of demo capital

Keep 90% of what you earn

Example: Make 5% in a single month on a $200K account? That's $10,000 total. You keep $9,000. From a $500 initial fee.

That's 18x return on your money—and you're not betting against someone with a security clearance and advance knowledge of military operations.

Prediction markets can work if you're selective and understand the risks. But if you're choosing where to deploy limited capital, prop firms offer asymmetric upside without the "am I betting against a CIA analyst?" paranoia.

One lets you speculate on rigged outcomes. The other lets you trade real markets with institutional capital.

We know which one we're picking.

See you Monday morning with our regular email,

— Matthew, Pip Munch

PS: Go register for the trading competition HERE. It’s free. Come on.

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER