- Pip Munch

- Posts

- 📉 S&P 500 Hits 7,000 & Fed Meeting Recap

📉 S&P 500 Hits 7,000 & Fed Meeting Recap

Want to make more money from trading? Stop trading your small $500 account. It’s not going to go anywhere. The answer? Prop firms.

☕️ GM Munchers! I invited my wife to watch the Fed meeting with me yesterday thinking it might count as "spending time together." She stared at me with the kind of disgust usually reserved for finding expired milk in the fridge. I've sat through 47 home renovation shows where people cry over subway tile, but apparently Jerome Powell discussing monetary policy is where she draws the line.

On today’s menu:

📉 S&P 500 Hits 7,000 & Fed Meeting Recap

❌ Amazon Fires 16,000 Workers

☕️ Starbucks Stages a Comeback (Sort Of)

🤝 Apple Makes A Deal With Elon

👀 Is This Insider Trading On JP Morgan?

Yesterday’s numbers:

S&P 500 | 6,978 | +0.00% |

Nasdaq | 23,857 | +0.17% |

Dow Jones | 49,015 | +0.02% |

Bitcoin | $88,145 | -1.10% |

BREAKING NEWS

📉 S&P 500 Hits 7,000, Then Remembers the Fed Exists

The S&P 500 kissed 7,000 yesterday before pulling back ahead of the Fed meeting—because apparently even all-time highs get nervous when Jerome Powell's about to speak.

What happened at the Fed meeting? Exactly what everyone expected: absolutely nothing. The Fed kept rates unchanged at 3.5%-3.75%, breaking a string of three straight cuts. Powell's vibe? "We're in wait-and-see mode until further notice."

Translation: The economy either rips and validates the pause, or recession odds climb from the current 25% and we all panic later.

Powell's press conference was peak snoozer energy. On five separate occasions, he delivered variations of "I have nothing for you on that" to reporters desperate for drama. When asked what advice he'd give his successor, Powell responded, "Stay out of elected politics." Riveting stuff.

Wall Street's take:

Morgan Stanley: "The Fed hasn't shut the door on further cuts, but Powell raised the bar."

Navy Federal Credit Union: "It's détente for now. But a shakeup is coming with the new Fed Chair in May."

Allianz: "Policy rates are much closer to neutral. It's time for a long pause."

Market reaction? Traders yawned. Major stock averages barely moved. Everyone's still pricing in about 60% odds of two more quarter-point cuts this year—basically saying "we'll believe rate cuts when we see them."

The Munch Take: This was the definition of a non-event masquerading as news. Powell said nothing, markets did nothing, and we're all pretending this mattered. The real story? We're in limbo. Either the economy stays strong and stocks grind higher, or cracks appear and the Fed scrambles. For now, risk-on stays alive—but barely.

❌ Amazon Fires 16,000 Workers: AI's Corporate Takeover Accelerates

Amazon just dropped a leaked memo confirming they're eliminating approximately 16,000 corporate jobs—their second massive round of layoffs since October.

The official reason? "Removing bureaucracy." The actual reason? These jobs are being replaced by AI faster than you can say "machine learning algorithm."

For workers: This is brutal.

For stockholders? It's margin expansion wrapped in a pink slip. Cost-cutting pumps bottom-line numbers, and Wall Street loves efficiency more than your ex loved pointing out your flaws.

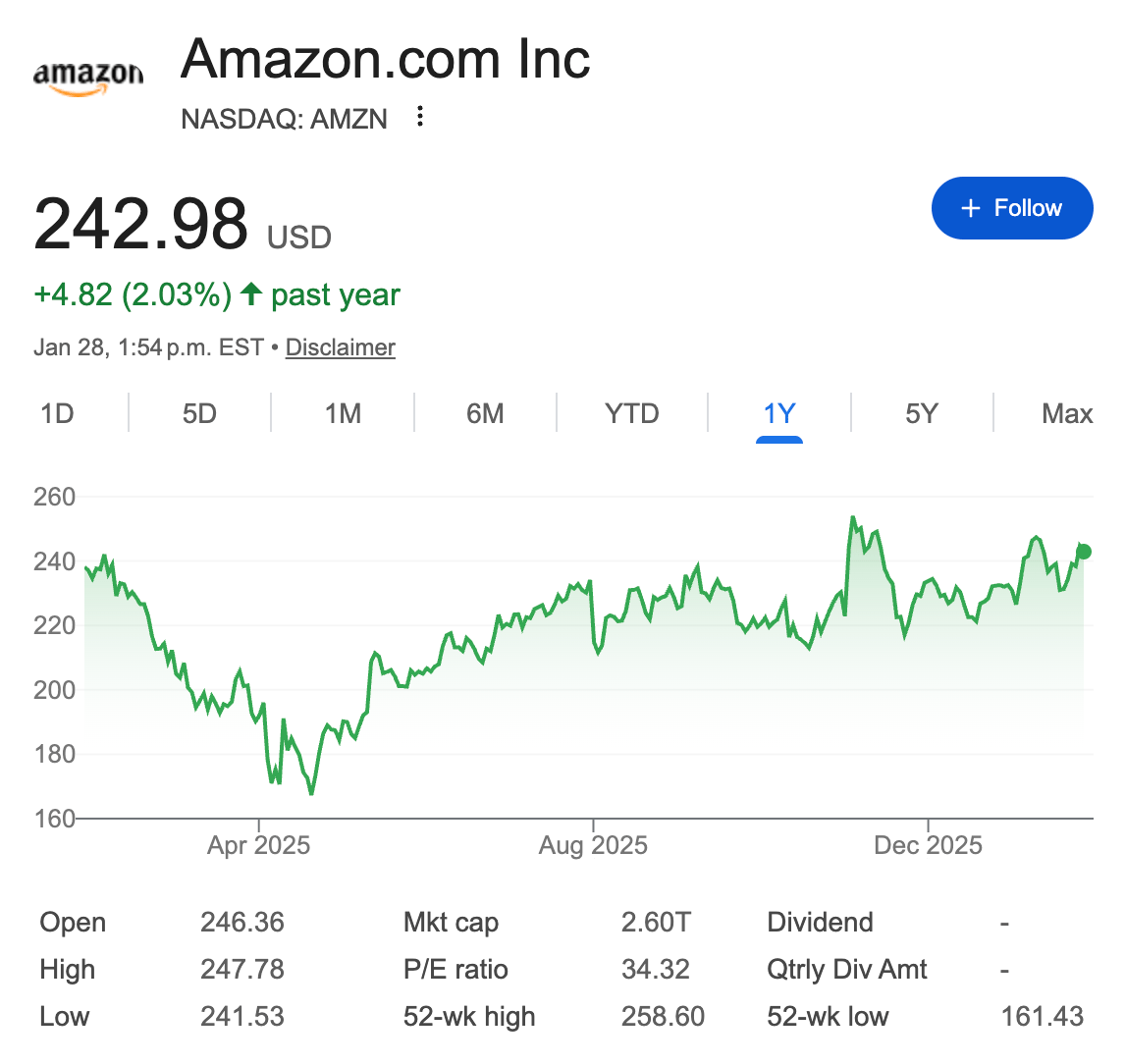

The stock performance: Amazon's up 7% in 2026 so far, but only 2% over the past year—lagging badly behind other Mag 7 stocks. This is management scrambling to shake things up and justify their valuations.

The bigger picture gets darker: Consumer sentiment is at its lowest since 2014. Prediction markets are pricing 25% odds of a US recession by year-end. Mass layoffs don't exactly inspire confidence in economic stability—they're gasoline on a anxiety fire that's already raging.

The Munch Take: Amazon's playing the classic "cut costs, pump margins" playbook. Short-term? This could juice earnings and prop up the stock. Long-term? Gutting 16,000 jobs while consumer sentiment craters and recession fears spike is like throwing a party on the Titanic. If you're holding $AMZN, watch earnings closely. If consumer spending weakens further, no amount of cost-cutting saves retail dominance.

BROUGHT TO YOU BY

Want to make money trading? Use prop firms.

Lark's 1-Step Career Program pays you up to $1,000 monthly even during drawdowns. Hit 3 profitable days of 0.5% and stay above -3.5%—that's it.

January Promo: Get your first payout and we'll give you a free account of the same size. Automatically. No extra cost.

One payout = instant second evaluation. Scale faster. Pay less.

7% max drawdown. Free retry. TradingView included. AI journal. Fast payouts. 24/7 support.

Build consistency while getting paid to learn. Most firms make you start over. We help you scale.

STOCKS

☕️ Starbucks Stages a Comeback (Sort Of)

For the first time in two years, Starbucks saw traffic and transactions grow. CEO Brian Niccol's turnaround playbook—closing hundreds of stores, simplifying the menu—is starting to show results.

The earnings reality: They missed Q1 estimates. Revenue came in at $9.92B vs $9.67B expected, but earnings per share missed at 56 cents vs 59 cents expected.

Why the stock rallied anyway: Traffic growth matters more than a slight earnings miss. Global same-store sales rose 4%, and for the first time since Q2 2022, transactions actually increased. That's forward momentum after two years of bleeding customers.

The stock performance: Up nearly 5% in early trading before giving back most of those gains. The stock still hit $100 after months of turnaround speculation and is finally showing proof of life.

The Munch Take: We're still not touching it. Starbucks stopped being a coffee shop years ago and transformed into a sugar factory for teenagers ordering drinks that require a PhD in menu engineering. Niccol's doing his job, and the stock might keep running. But until they remember how to make actual good coffee instead of dessert drinks masquerading as beverages, we'll pass. Momentum traders might profit. Long-term investors? There are better bets.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

🧑✈️ $LUV After more than half a century, Southwest Airlines just murdered their open-seating policy and started assigning seats like every other soulless airline. Is nothing sacred anymore? Apparently the chaos of cattle-herding passengers into a metal tube and watching middle-aged adults sprint down the jet bridge for an aisle seat was too pure for this world. RIP to the gladiator arena that was Southwest boarding groups A, B, and C.

📱 $AAPL Apple's reportedly planning to integrate Starlink into the iPhone 18 Pro, potentially launching this year. This is massive news for the subset of humanity that genuinely cannot survive five consecutive minutes without checking notifications, doom-scrolling Twitter, or pretending to be productive while actually watching TikTok. Elon and Tim Cook joining forces to ensure you're never, ever disconnected from the digital hellscape. Progress!

💻️ $NVDA Big win for Nvidia yesterday. China officially approved imports of the H200 chips after months of regulatory limbo. The stock climbed over 1.5% on the news because apparently geopolitical chip wars can occasionally have happy endings. Or at least temporary ceasefires that juice semiconductor stocks.

🤑 You know what's actually brilliant business? Giving $1,000 to employees' kids and getting fantastic PR for it. JPMorgan and Bank of America just announced they'll match the US government's one-time $1,000 contribution to "Trump Accounts"—new children's retirement savings accounts. It's good PR, employee retention gold, and costs less than one executive's quarterly bonus. Capitalism with a bow on top.

🚀 Pre-Market Fuel

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER