- Pip Munch

- Posts

- 📈 Six Day Streak

📈 Six Day Streak

Still waiting for your payout? That’s cute. At Lark Funding, traders get paid in under 6 hours. No red tape. No fine print. Just raw spreads, fast payouts, and up to 90% profit splits.

☕️ GM Traders! This is Pip Munch, the daily newsletter that gives you market news faster than your stop-loss gets hit on NFP Friday.

On today’s menu:

📈 Six Day Streak

🇨🇦 Canada Chooses the Liberals… Again

☕️ Starbucks, Snap, Spotify—Yikes

😂 The European Stock Market Is A Joke

🇮🇳 A Trade Deal Is Getting Closer With India

Yesterday’s numbers:

S&P 500 | 5,560 | +0.58% |

Nasdaq | 17,461 | +0.55% |

Dow Jones | 40,527 | +0.75% |

Gold | $3,319 | +0.18% |

Bitcoin | $94,231 | -0.85% |

BREAKING NEWS

📈 Six Day Streak

The market just posted its sixth straight day of gains, and traders are starting to feel like maybe—just maybe—we’re not in a doom spiral after all.

So what happened?

Turns out, the White House teased that a major trade deal is this close to being finalized. “I have a deal done, done, done, done... but I need to wait for their prime minister,” said Commerce Secretary Howard Lutnick—who also wouldn’t reveal what country he was referring to.

The comment lit a spark under the market, especially for stocks bruised by the tariff war.

GM was down earlier in the day after suspending buybacks due to tariff uncertainty but clawed back to close just -0.6%. Apple rose +0.5%, and Honeywell surged +5.4% after beating earnings expectations.

Meanwhile, Amazon scrapped a plan to show tariff surcharges at checkout after the White House called it “hostile and political.” Shares dipped -0.2%.

💵 In forex land:

The USD gained across the board, especially against AUD and NZD

CAD surprisingly strengthened—likely still riding that post-election weirdness

WTI crude dropped to $60.26

Gold fell to $3,322

US 10-year yield dipped to 4.665%

🧠 Zooming out: Traders are eyeing Wednesday’s Q1 GDP report and Friday’s NFP—aka the trader’s Super Bowl. If markets have felt sleepy this week, that’s why.

Don’t worry, we’ll break it all down for you tomorrow.

SPONSORED BY

Want to trade larger accounts—without risking your own savings?

That’s exactly what prop firm challenges are designed for.

At Lark Funding, traders can access simulated accounts up to $600K and earn up to 90% profit splits based on performance.

No need to fund a big account. No risking personal capital.

Prove your skill in a challenge, and you’ll be eligible for real payouts—fast. In fact, they process most in under 6 hours.

FOREX

🇨🇦 Canada Chooses the Liberals… Again

Oh Canada. After a vote of no confidence triggered a snap election on Monday, Canadians took a long, hard look at their options—and elected the same government that’s been in power for the past 9 years. Bold move.

Despite holding a double-digit lead in the polls for months, Conservative leader Pierre Poilievre fumbled what some are calling the greatest political choke in Canadian history—thanks, in part, to the chaos surrounding Trump’s tariff war.

Now it’s Mark Carney’s turn to step in as Prime Minister and fix… well, everything. Canada is still battling:

📉 The lowest GDP-per-capita growth in the G7

🏠 A housing market more unlivable than a Toronto basement

💸 A cost of living crisis that makes avocado toast look like a luxury

On the FX front, USD/CAD is sitting around 1.38—well off February’s high of 1.47, but still elevated.

For CAD traders, the next moves will depend heavily on both domestic momentum and global commodity demand.

📉 Remember, the loonie is a commodity currency—when oil sinks, so does CAD.

If global growth keeps slowing and crude stays under pressure, the Conservatives won’t be the only ones nursing a bruised ego.

STOCKS

☕ Starbucks, Snap, Spotify—Yikes

It’s not just your trades feeling shaky this week—big-name stocks are taking hits too.

📉 Starbucks Stock Spills Its Coffee

Starbucks missed both earnings and revenue targets, sending its stock down 6% in extended trading. Same-store sales dropped for the fifth straight quarter and net income was sliced in half from a year ago.

CEO Brian Niccol says they're “testing and learning at speed” and pushing a “Back to Starbucks” turnaround plan—but right now, investors are just seeing a backslide.

Add rising labor costs, paused equipment upgrades, and Trump’s tariffs on coffee beans to the mix, and you've got a bitter brew.

Operating margin? Down to 6.9% from 12.8%.

Starbucks is betting on “premium touches” in stores and barista training to win back customers. So far, it’s a latte effort with little foam on top.

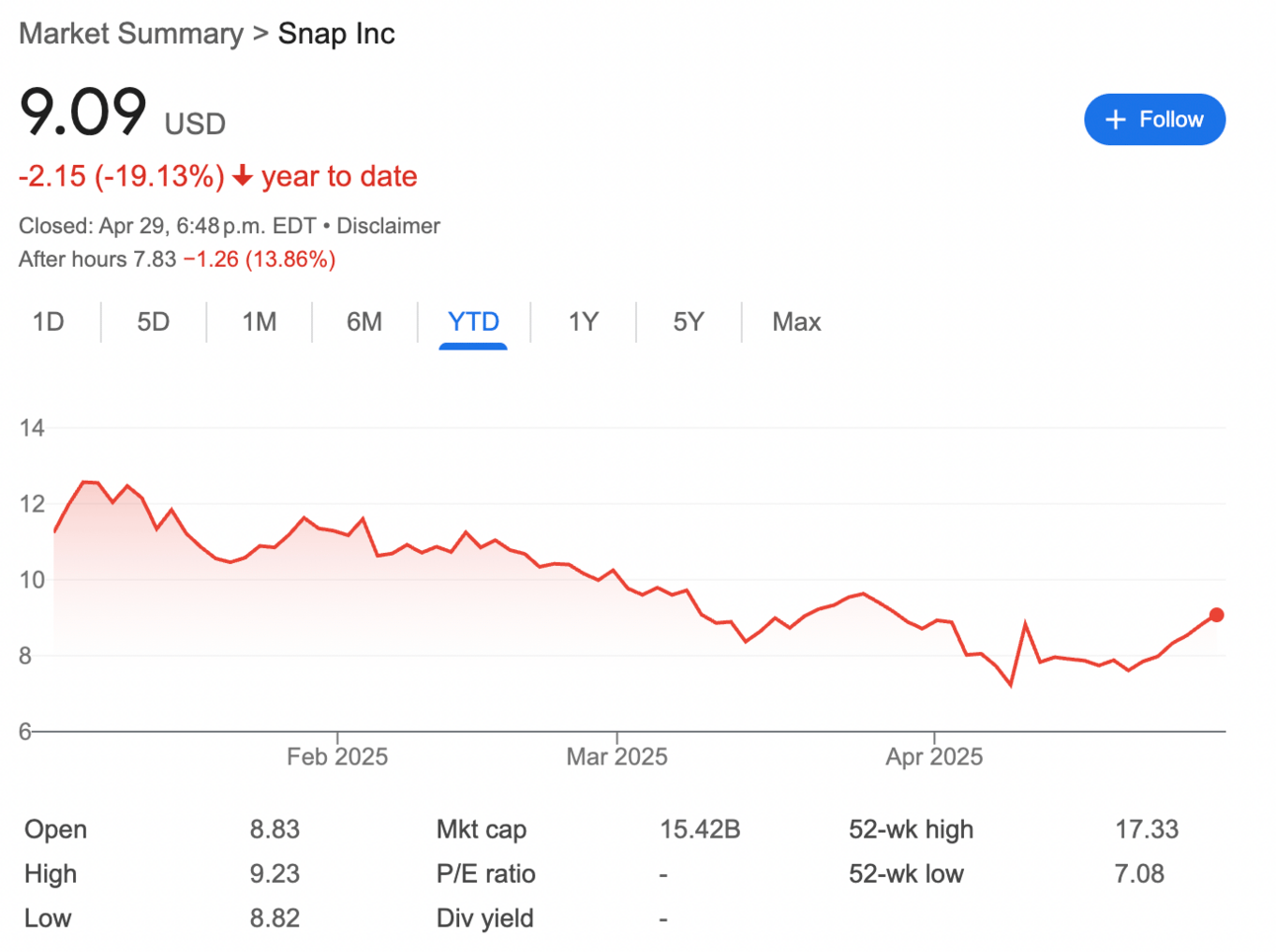

👻 Snap: Ghosted by Guidance

Snap reported a 14% revenue jump to $1.36B, beating expectations, but investors didn’t care—it dropped 13% after hours.

Why?

No guidance. And when a tech company refuses to look ahead, traders start looking for the exit.

Snap blamed “macroeconomic uncertainty” and trade policy drama.

Plus, changes to the de minimis tax exemption (aka the online shopping loophole) could hurt ad spending. Sound familiar? Alphabet warned about the same thing last week.

Even though users grew to 460M and ARPU hit $2.96, Snap is still not profitable—losing 8 cents per share this quarter. So much for “momentum.”

🎧 Spotify Misses the Beat

Spotify closed down over 3% after weak forward guidance. The stock dipped as much as 6% intraday.

The good news?

Premium subscribers jumped 12% to 268M—its best Q1 gain since 2020.

The bad news? It missed monthly user estimates (came in at 678M vs 679M expected), and guidance for Q2 operating income and margins came in light.

Traders don’t care if your playlist is fire if your financials aren’t.

PROP FIRMS

🤑 Wednesday Motivation

Just secured a $1,600 payout ✅

Not every trade wins — but discipline stacks.

Withdraw. Reset. Keep going.— James Bruce 🇿🇦 (@JamesBruce131)

9:18 AM • Apr 22, 2025

🚀 Pre-Market Fuel

😂 This stat about the European stock market is both mind-blowing and heartbreaking.

🧑✈️ JetBlue is rumoured to be partnering with a U.S. airline in the next few weeks.

😢 UPS will cut 20,000 jobs this year due to Amazon downsizing.

🤑 Interested in Bitcoin? This 3-minute video is a masterclass on why you should be paying attention.

🍪 Munchy Memes

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER