- Pip Munch

- Posts

- 📉 Stimulus Checks Are Back?

📉 Stimulus Checks Are Back?

Imagine buying one prop challenge and walking away with three. No strings. Lark Funding’s legendary Buy 1 Get 3 is officially back.

Grab any $100K challenge and get two $50K accounts completely free. Works on 1-step, 2-step, and 3-step. Use code BUY1GET3 at checkout.

☕️ GM Munchers! Word on the street is the government shutdown is over — after 40 long days. Moses parted the Red Sea faster than these guys figured out a budget.

On today’s menu:

📉 Mood Swings, Stimulus Checks & Pound Pain

🧵 Market Recap: Everyone’s Confused (Including the Fed)

🏦 Bank of America Is Back (After 16 Years)

🚀 Expedia & Snapchat Pop

👀 Bitcoin’s Weekly Chart = Almost In Trouble

Friday’s numbers:

S&P 500 | 6,728 | +0.13% |

Nasdaq | 23,004 | -0.21% |

Dow Jones | 46,987 | +0.16% |

Bitcoin | $104,750 | +2.41% |

BREAKING NEWS

📉 Markets Have Full-Blown Mood Swings

Was your weekend calmer than Friday's market tantrum? We hope so — because Wall Street washed down an espresso with a Four Loko.

Early Friday, Nvidia dropped 3% and tech stocks nuked $1 trillion in market cap. The reason? Traders finally realized AI stocks might be slightly overvalued — plus that weak labour data we covered didn't help.

But everyone forgot about it by lunchtime. The market pulled a full 180 and most major indexes closed green.

Yes, our necks still hurt from the whiplash.

What's on deck this week?

Disney earnings (Wed): If people stop buying $30 Goofy hats and $18 churros, expect a selloff.

AI bubble watch: Palantir's getting roasted since Michael Burry shorted it. When the guy from The Big Short calls it frothy, people listen.

The Munch Take

This week isn't about the calendar — it's about vibes. Will traders show up Monday risk-on, or will seasonal depression kick in early?

💸 Trump Promises $2,000 “Tariff Dividend”

My Twitter feed lost its mind on Sunday after Trump announced a $2,000 “tariff dividend” and — wait for it — 50-year mortgages.

No, that’s not a typo.

We didn’t have “fresh stimmie checks” on our 2025 bingo card, but here we are. The market instantly went nuts, flashing back to 2020 when COVID checks turned everyone with a Robinhood account into a financial genius for about three months.

If you were still in elementary school picking your nose back then, here’s the short version: stocks and crypto went vertical.

And déjà vu hit fast — Bitcoin popped 2% on Sunday, with altcoins up even more. Apparently, who needs Sunday Night Football when you can YOLO your next rent payment into Dogecoin?

The Munch Take

Is this fiscally responsible when the national debt’s already at record highs? Of course not. Will it actually pass? Who knows — but if it does, markets are going to lose their minds faster than Powell trying to explain “transitory” again.

Buckle up, Munchers. The money printer might be warming up for one last encore.

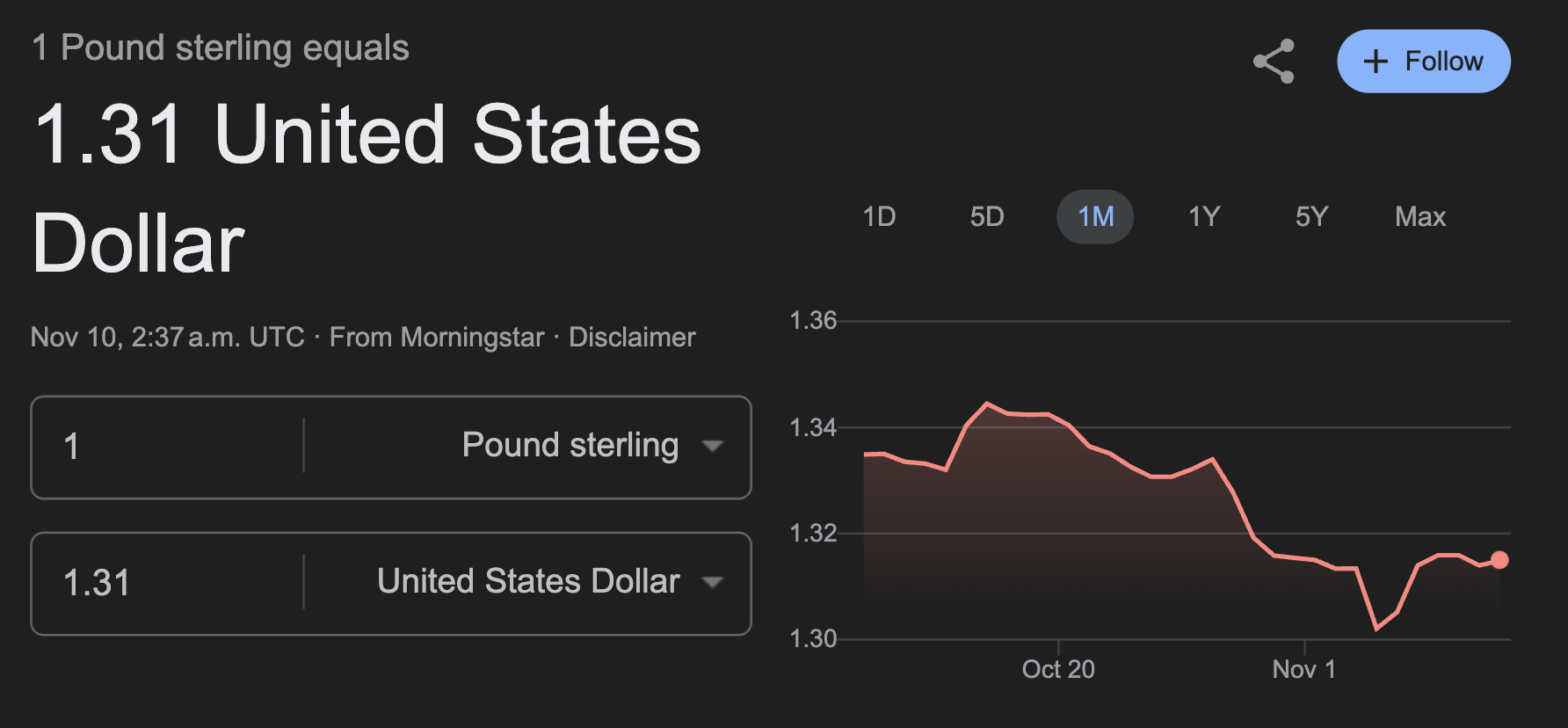

🇬🇧 The Pound’s Getting Pounded

For all the FX traders out there — one of the best trades lately has been shorting the British pound against, well… pretty much everything.

So what’s going on with the Brits? Are they just being too polite and don’t want their currency to look intimidating?

Yeah, not exactly.

Here’s the deal:

The Bank of England has already cut rates three times this year, with another one possibly coming.

The Autumn Budget looks rough — there’s a £22 billion hole with no real tax increases planned. (Translation: someone’s maxing out the national credit card again.)

Unemployment’s climbing, and growth is basically flatlining.

Add it all up, and the UK’s economy looks… meh.

Not dramatically worse than Canada or Europe, but definitely not better.

Meanwhile, the U.S. is still the “least ugly” economy on the dance floor — and that’s why the dollar keeps flexing while the pound’s getting smoked.

If you had $1 million to park somewhere, are you choosing the U.K. or the U.S.?

The market’s already answered that question. Just check the GBP/USD chart — it’s screaming it in all caps.

BROUGHT TO YOU BY

⏰ 5 Days Left - The Industry’s Best Prop Firm Promo Is Back

Now through Nov 14, grab a $100K evaluation (with Weekend Holding + 90% split) and get two bonus $50K accounts — totally free.

✅ Works on 1-step, 2-step, and 3-step

✅ Perfect time to stack before Lark 3.0

✅ Use code BUY1GET3 at checkout

Let’s be honest — if you’re serious about scaling in 2026, this is your shot.

BIG PICTURE

🧭 Market Recap: Everyone’s Confused (Including the Fed)

Markets are on espresso and NyQuil simultaneously, so let's break down where we actually are.

Here's the deal:

The market only cares about rate cuts right now.

Rates down → markets pump

Rates up → markets dump

We got a cut recently, but Powell basically said "Don't ask me how many more are coming." December cut odds dropped from 90% to 70%.

Powell's Problem:

The government shutdown (now the longest in history) means no economic reports. He's flying blind with super mixed signals:

80% of S&P 500 companies beat earnings

October had worst job cuts since 2003

Is the economy healthy or cracking? Nobody knows. That's why the market's choppy.

The M

Short-term traders: drop down timeframes and trade what's in front of you.

Long-term investors (like us): we've got cash ready. Bought some Bitcoin last week but otherwise sitting tight.

Sometimes the best trade is no trade.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

💰 $BAC

Bank of America’s finally back from the dead — literally. The stock is up 20% this year, and someone pointed out it just now recovered from the 2008 Global Financial Crisis.

That’s 16 years shareholders had to wait just to break even. Imagine holding that long without throwing your laptop out the window.

✈️ $EXPE

Expedia absolutely crushed earnings and popped 17%. Revenue’s up 9% this year.

Apparently, even with the worst October job cuts since 2003, people are still out here booking flights like it’s the Roaring Twenties.

We don’t get it either — must be that “I’ll go broke, but I’ll go to Bali” energy.

👻 $SNAP

Snapchat climbed 5.5% last week after announcing a deal with Perplexity AI to integrate its search engine into the app.

Translation: Gen Z can now ignore you and get AI-powered search results while doing it.

Still down 27% YTD, though — so there’s a long way to go before those Snap streaks turn into actual profits.

📈 $QQQ

Our favorite ETF (tracks the Nasdaq) just saw a massive volume spike. Average weekly volume is around 61 million, but last week? 82 million.

Translation: traders are waking up, and the market’s starting to heat up again.

Either that, or everyone’s trying to hedge their weekend stress.

🚀 Pre-Market Fuel

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER