- Pip Munch

- Posts

- 📉 Stocks Rally... But April Was Still Trash

📉 Stocks Rally... But April Was Still Trash

Still waiting for your payout? That’s cute. At Lark Funding, traders get paid in under 6 hours. No red tape. No fine print. Just raw spreads, fast payouts, and up to 90% profit splits.

☕️ GM Traders! Welcome to Pip Munch — where the caffeine is strong, but the market’s mood swings are stronger.

On today’s menu:

📉 Stocks Rally… But April Was Still Trash

🚢 Cruises Sink, Tech Stocks Surf

🤑 This Prop Firm Has Paid $87 Million!?

🇨🇦 The Bank of Canada Is Confused

🚗 Amazon Plans To Invest $4 Billion In…

Yesterday’s numbers:

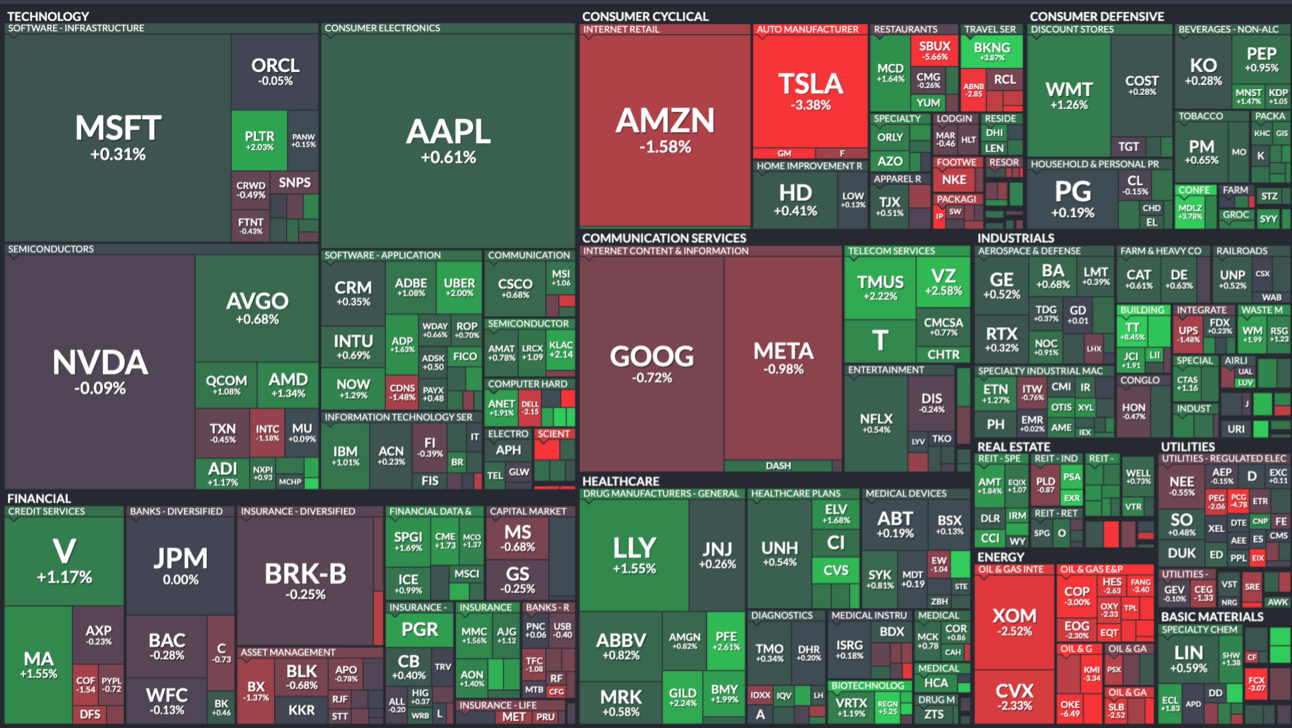

S&P 500 | 5,569 | +0.15% |

Nasdaq | 17,446 | -0.08% |

Dow Jones | 40,669 | +0.35% |

Gold | $3,272 | -0.46% |

Bitcoin | $94,187 | +0.02% |

BREAKING NEWS

📉 Stocks Rally… But April Was Still Trash

If the market were a trader, it would’ve rage-quit April halfway through—only to come crawling back at the close asking for a second chance.

The S&P 500 and Dow Jones managed to close up slightly green for the day. And despite the Nasdaq slipping 0.09%, it still wrapped up April in the green, up 0.9% for the month.

Sounds like a decent day, right?

Not so fast.

At one point, the S&P was down 2.3% and the Dow had dropped more than 780 points before staging a dramatic comeback.

Basically, the day started like a horror movie and ended like a lukewarm rom-com—technically not a disaster, but nobody’s watching it twice.

Why the drama? 🤔

Two words: shrinking GDP 📉

New data showed the U.S. economy contracted in Q1, with GDP declining at a 0.3% annualized rate. That’s a faceplant compared to the +2.4% growth we saw in Q4.

It’s the first negative print since the pandemic era and caught traders off guard.

To make things worse, spending slowed to its weakest since 2023. So basically, the economy is acting like my wife when I suggest we skip Barnes & Noble.

Some blamed the weak GDP on a massive 41% spike in imports last quarter as businesses scrambled to beat Trump’s tariffs. Others pointed fingers at slower government spending, Elon Musk’s work at DOGE (yes, really), or just the usual recession doom spiral.

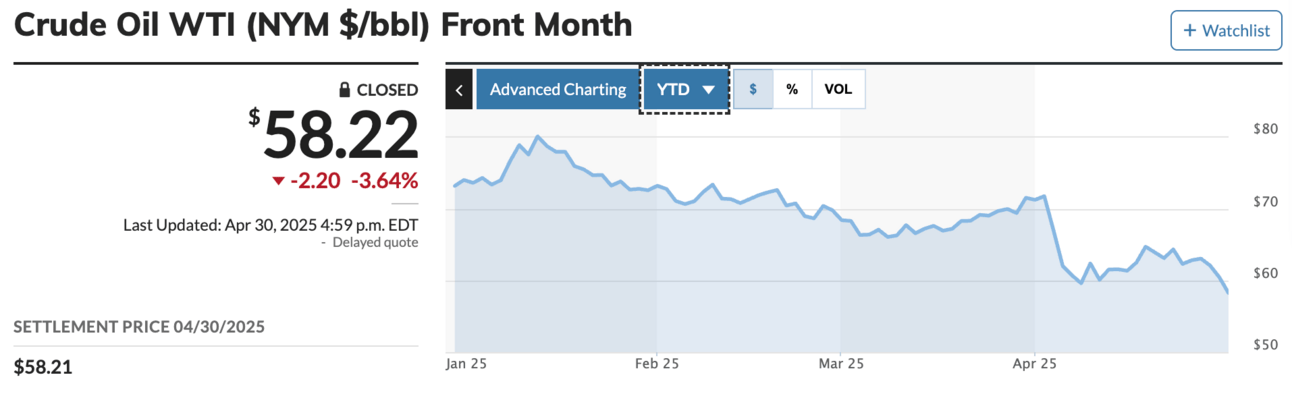

Even the bond market got the message—10-year yields fell 1.2 bps to 4.16%, and gold dropped $28 to $3,287. Meanwhile, WTI crude oil closed at $58.17… its lowest level since 2021.

The silver lining?

Trump walked back his tariff threats, helping spark the intraday bounce. He also called newly elected Canadian PM Mark Carney “a strong partner,” which gave the loonie a bit of a lift.

But big picture: April was rough. 😢

The S&P 500 finished the month down 0.8%, the Dow lost 3.2%, and the data confirms what many feared—this economy is limping.

Still, Wednesday’s late-day rally was a reminder that sentiment can flip faster than a guru on YouTube. In this market, pain is temporary… but the liquidation email is forever.

SPONSORED BY

Want to trade larger accounts—without risking your own savings?

That’s exactly what prop firm challenges are designed for.

At Lark Funding, traders can access simulated accounts up to $600K and earn up to 90% profit splits based on performance.

No need to fund a big account. No risking personal capital.

Prove your skill in a challenge, and you’ll be eligible for real payouts—fast. In fact, they process most in under 6 hours.

STOCKS

🚢 Cruises Sink, Tech Stocks Surf

It was a tale of two sectors on Wednesday: tech stocks rode a wave of strong earnings, while cruise lines hit choppy waters — proving once again that it’s easier to build virtual reality than to convince Americans to vacation in actual reality.

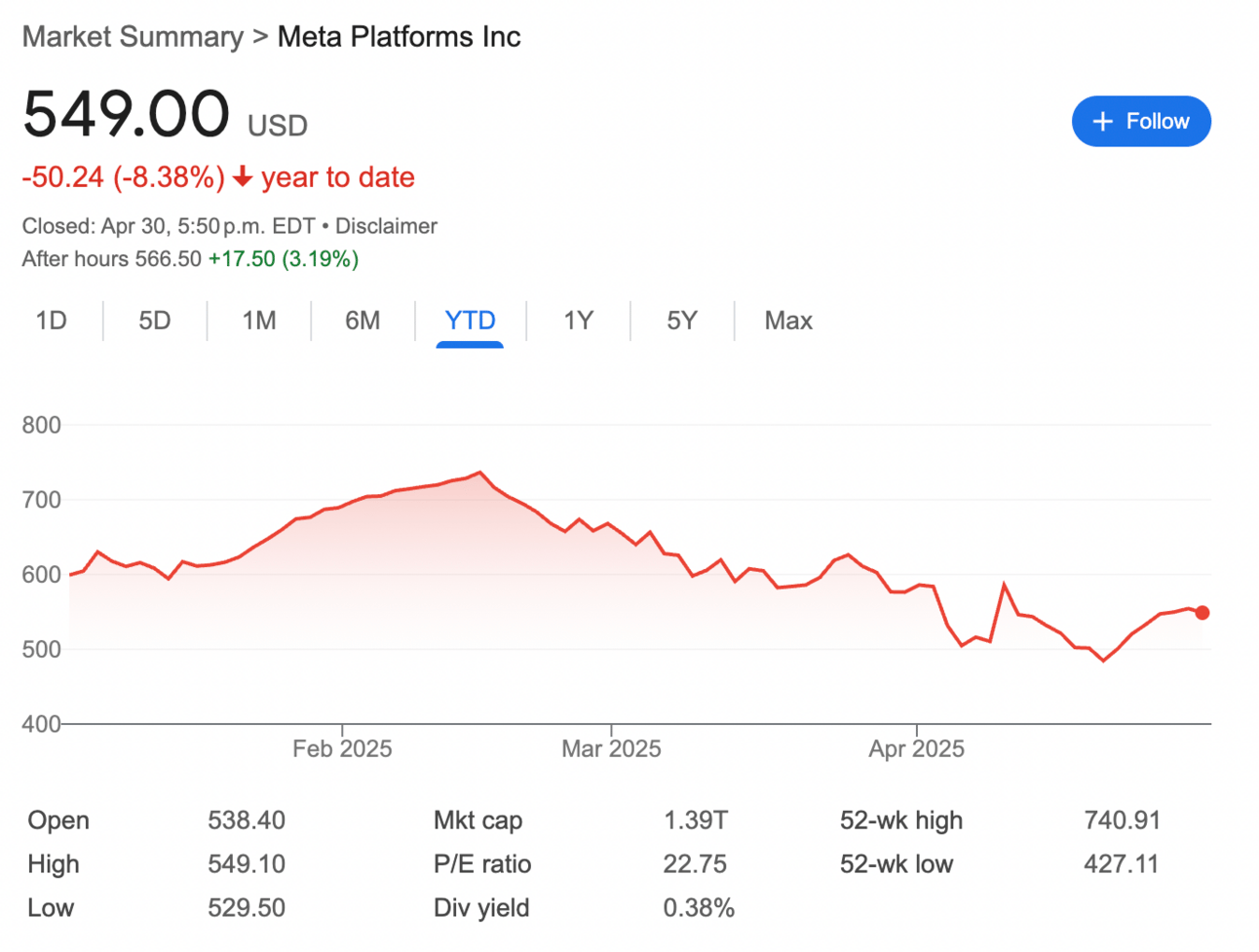

📈 Meta: AI Hype Still Paying the Bills

Meta rose over 5% after beating expectations on both revenue and earnings.

EPS: $6.43 vs. $5.28 expected

Revenue: $42.31B vs. $41.40B expected

Net income: Up 35% YoY to $16.64B

Q2 Sales Outlook: $42.5B–$45.5B (inline with expectations of $44.03B)

Despite a $4.2B loss from its Reality Labs division (because who needs legs in the metaverse), Meta is betting big on AI. Capital expenditures were bumped to $64B–$72B (up from $60B–$65B), largely to expand data centers and juice its AI systems.

Monthly active users for Meta AI? Just shy of 1 billion.

Even Threads — the social media platform everyone forgot about — now has 350M users. Not bad for a Twitter clone without the memes or mayhem.

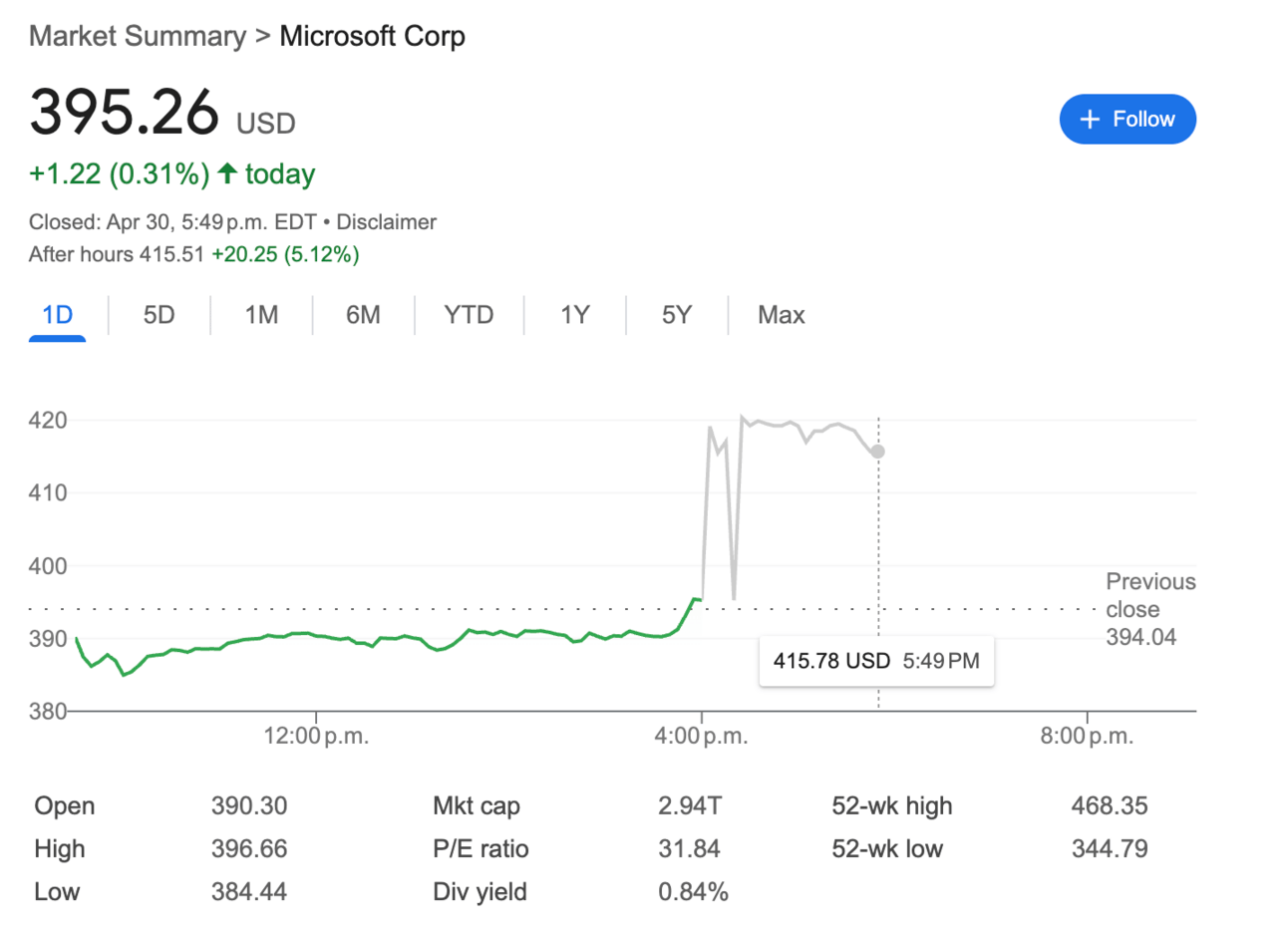

🚀 Microsoft: Cloud Nine

Microsoft shares jumped over 6% after Azure's cloud growth outpaced expectations:

EPS: $3.46 vs. $3.22 expected

Revenue: $70.07B vs. $68.42B expected

Azure growth: +33%, with 16% attributed to AI

Net income: Up 18% YoY to $25.8B

Capital spending surged 53% to $16.75B as Microsoft prepares for an $80B infrastructure buildout to power its AI push. Investors are thrilled — at least until Trump’s tariffs hit and every data center becomes 30% more expensive.

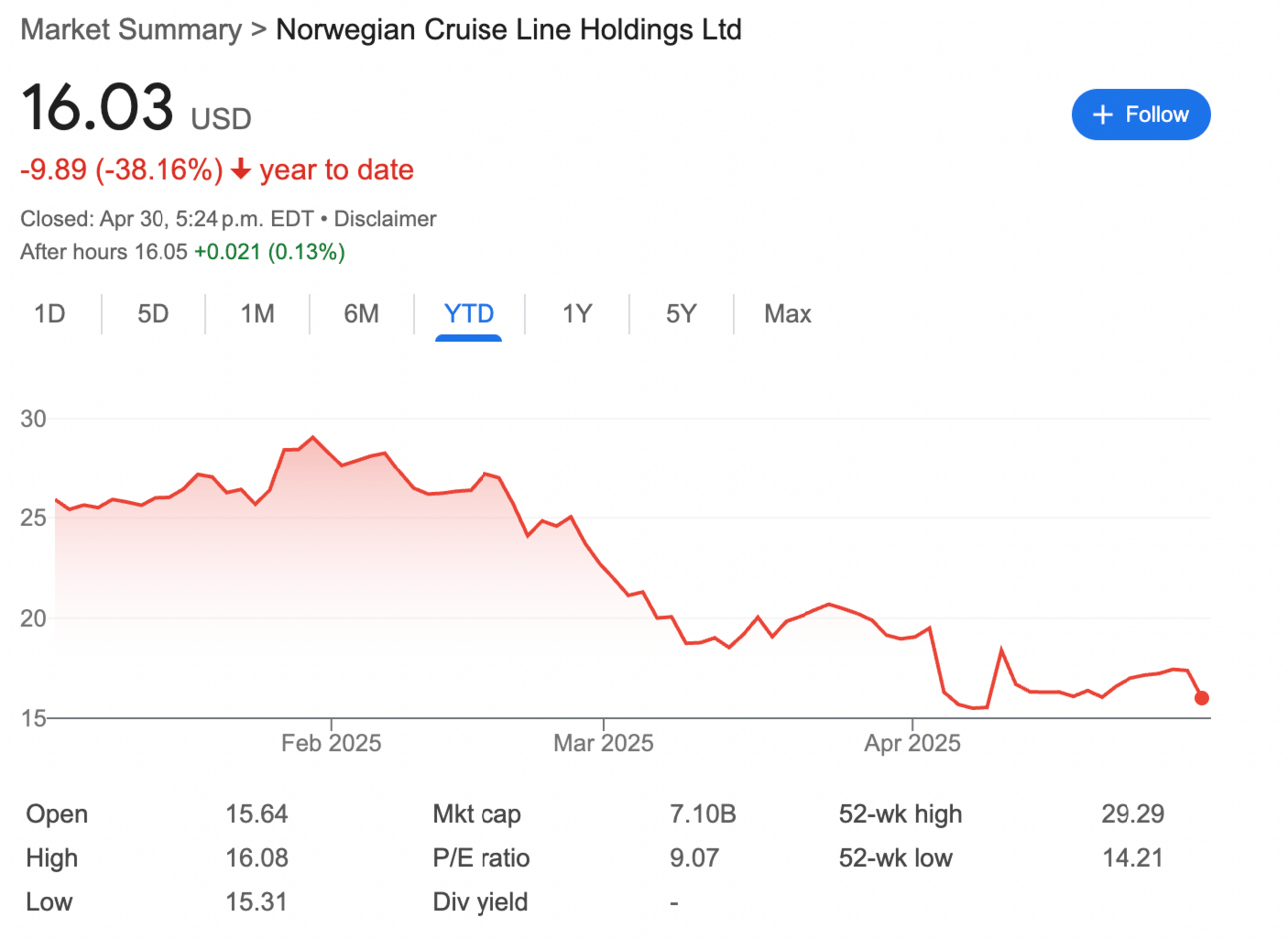

🛳️ Norwegian Cruise: Not So Bon Voyage

Meanwhile, Norwegian Cruise Line shares sank more than 7% after a rough earnings report.

Revenue: $2.13B vs. $2.15B expected

EPS: $0.07 adjusted vs. $0.09 expected

2025 booking rate: 86%

Stock YTD: -37%

CEO Harry Sommer blamed “choppiness” in Europe-bound bookings and noted that Americans are getting skittish about long-haul vacations. (Same, Harry. I also get nervous booking a non-refundable AirBnB.)

Royal Caribbean also fell, even after raising guidance. Cruise investors are clearly seasick, even when the numbers are steady.

PROP FIRMS

🤑 This Prop Firm Has Paid $87 Million!?

🚀 Pre-Market Fuel

🍪 Munchy Memes

Recession in 1940: 4 years

Recession in 1980: 3 years

Recession in 1990: 2 years

Recession in 2025: 37 minutes

— Not Jerome Powell (@alifarhat79)

7:56 PM • Apr 30, 2025

New trading strategy just dropped

— Not Jerome Powell (@alifarhat79)

10:59 PM • Apr 30, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER