- Pip Munch

- Posts

- 📈 Stocks Up, Bitcoin Strong, CPI Looms

📈 Stocks Up, Bitcoin Strong, CPI Looms

Want to trade without risking your own cash? Lark Funding gives you simulated capital to trade—plus up to 90% profit splits, no hidden rules, and instant payouts.

Use code JUNE15 for 15% off + a 125% refund on your next challenge.

☕️ Mornin’ Munchers! Markets are waiting on CPI like I wait on my DoorDash driver — sweating and pretending to be patient.

On today’s menu:

📈 Stocks Up, Bitcoin Strong, CPI Looms

🇬🇧 GBP Gets KO’d by Jobs Data

🥳 Robotaxis Are Officially Here

✅ Nancy Pelosi’s Updated Stock Portfolio

❌ Another Prop Firm With Issues?

Yesterday’s numbers:

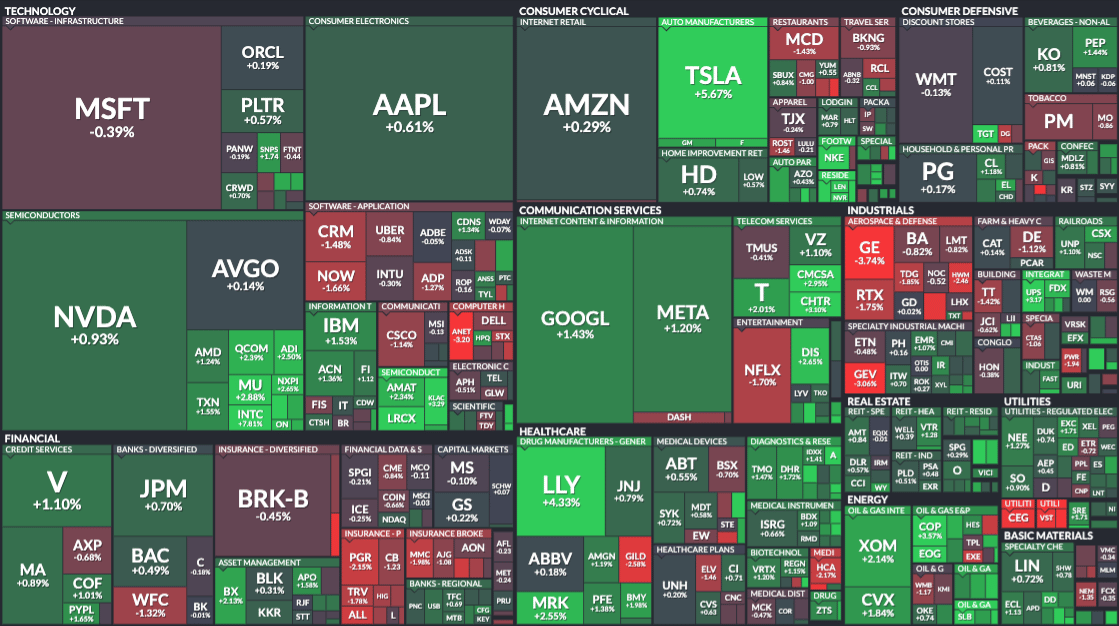

S&P 500 | 6,038 | +0.55% |

Nasdaq | 19,714 | +0.63% |

Dow Jones | 42,866 | +0.25% |

Bitcoin | $109,650 | -0.52% |

BREAKING NEWS

📈 Stocks Rise on Trade Talk Hype

The market’s playing nice—because U.S. and Chinese officials just wrapped Day 2 of trade talks in London.

Commerce Secretary Howard Lutnick says everyone’s “working closely,” which in D.C.-speak means “we still don’t hate each other yet.”

Translation?

Investors are banking on tariffs easing soon.

Remember: both countries agreed last month to temporarily cut duties, and markets are betting those cuts stick. That’s bullish for global equities and risk-on trades, but FX stayed lukewarm.

USD/JPY spiked to 145 before retracing. GBP got rocked on weak jobs data (more on that below)

👉 Watch for: Any signs of breakdown in talks. A nasty tweet, a mistranslation, or someone spilling tea could send this rally packing.

₿ Bitcoin’s 30-Day $100K Streak 🔥

JUST IN: Bitcoin has stayed above $100,000 for 30 consecutive days for the first time ever! 🚀

— Bitcoin Magazine (@BitcoinMagazine)

5:32 PM • Jun 10, 2025

Bitcoin just did something no crypto—or my marriage—has done: held steady for 30 straight days. It’s been glued above $100K for a month and now trades at $109,650.

That’s the longest winning streak at six figures ever.

And that’s not all:

IBIT just became the fastest ETF in history to hit $70B AUM—only 341 trading days.

BTC is up 57% YoY and just crossed $110K intraday.

Why it matters: ETF demand, macro optimism, and whales loading the dip are keeping the floor strong. This is starting to look like real institutional stickiness, not just your uncle with a Ledger.

👉 Watch for: Breakout above $110K with volume. And if you’re short… maybe don’t tell your kids.

🧨 CPI Print Today = Calm Before the Boom?

Markets are in holding pattern mode as traders stare at their calendars, waiting for today’s CPI like it’s the Fed’s season finale.

Expectations:

Headline CPI (MoM): 0.2% (unchanged)

YoY: 2.5% (up from 2.3%)

Core CPI: 0.3% MoM / 2.9% YoY

Why it matters: This is the final inflation print before the Fed’s June meeting.

A hotter-than-expected number could blow up rate cut hopes—and with recent tariffs starting to trickle in, CPI could surprise. Investors are jittery, but the actual price action has been about as exciting as my wife reading our grocery budget aloud.

👉 Watch for: Goods vs. services breakdown, signs of tariff impact, and whether the Fed starts sweating publicly.

BROUGHT TO YOU BY

Want to earn real money without risking your own?

That’s exactly what prop firms offer: they fund you.

You trade. You keep up to 90% of the gains.

The catch?

Most prop firms are built to make you fail—with hidden rules, payout delays, and random “consistency” penalties that block your earnings.

Lark Funding flips the script.

✅ No news restrictions

✅ No consistency rules

✅ First payout on demand

✅ Fast, transparent funding

It’s built for traders who want to win—not jump through hoops.

And right now, you can get 15% OFF any funding program with code JUNE15.

FOREX

🇬🇧 GBP Gets KO’d by Jobs Data

The pound just tripped over its own economic report card.

New UK labor data showed unemployment jumped to 4.6%—the highest since 2021—while wage growth slowed to 5.2%, missing expectations.

Translation?

The British economy is cooling off faster than my wife’s interest when I bring up “just one more backtest.”

Markets didn’t like it. ❌

GBP/USD broke below the key 1.3500 level, and traders now expect the Bank of England to roll out two more rate cuts this year (up from 1.5 before). More cuts = less yield = less love for the pound.

Making things worse?

A strong US dollar, fueled by optimism over U.S.-China trade talks, is shining even brighter next to the limp GBP.

Quick hits:

🧊 UK labor market = softening

📉 GBP down vs USD, EUR, and friends

🏦 Rate cut expectations jumping = bearish

What traders should watch next:

If GBP/USD can hold 1.3500 or if we’re about to slide into technical breakdown territory. Keep an eye on BoE commentary too—one more dovish whisper and GBP could face more pain than I did when I suggested my wife “just relax” during IKEA assembly.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

$SBUX ( ▼ 0.06% ) Starbucks is rolling out an AI barista assistant next year, built with Microsoft. It’ll help real baristas across the U.S. and Canada — ideally speeding up orders, reducing errors, and finally ending the “is your name spelled Bryttany or Brtny?” era.

$TSLA ( ▼ 1.49% ) It’s official: Tesla just launched its self-driving Robotaxi service in Austin. Same car as the regular Tesla, just with fewer humans involved — including drivers. Elon says it’s the same factory build, meaning your future Model 3 could moonlight as an Uber while you sleep. You can see the car here.

$GOOGL ( ▲ 1.43% ) Google’s hopping on the tech layoff bandwagon and offering buyouts across multiple divisions. The move follows 12,000 job cuts since 2023, because apparently “Do the right thing” now includes “Do more with less people.”

$GME ( ▼ 0.29% ) Gamestop missed earnings. Water is wet. In a development that shocked absolutely no one (except maybe one guy on Reddit still holding since 2021), $GME dropped in after-hours. Maybe they’ll announce a pivot to Bitcoin mining next.

PROP FIRMS

❌ Another Prop Firm With Issues?

The Truth About CK Capital – From an Insider Who Helped Build It

@PropFirmMatch@PropFirmMedia

1/

I was one of the core people behind CK Capital. I did everything – from graphics, HR, tech, social media, to even handling fake cash giveaways and personal favors. I’ve stayed— Hammad (@fx_hammad)

1:59 PM • Jun 9, 2025

🚀 Pre-Market Fuel

🍪 Munchy Memes

BREAKING: Waymo resumes its service in Los Angeles

— Not Jerome Powell (@alifarhat79)

5:06 PM • Jun 10, 2025

My accountant going through all my trades to report a $0.50 cent profit

— Not Jerome Powell (@alifarhat79)

10:21 PM • Jun 9, 2025

"Mom, how did we get so rich?"

"Your father said 'thanks, nothing from my end' on thousands of important Zoom meetings"

— Parody CEO (@parody_ceo)

9:12 PM • Jun 9, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER