- Pip Munch

- Posts

- CPI Shockwave: Here's What It Means for You 💥

CPI Shockwave: Here's What It Means for You 💥

Inflation came in hot, markets went wild, and Bitcoin is flirting with $100K again. Let’s break it all down.

Ready to take advantage of these wild market swings? Join a prop firm that’s CDBO Certified and start earning from Day 1.

☕️ Happy CPI Hangover Day! Yesterday, the markets partied harder than your cousin at a wedding open bar, and now we’re here to clean up the confetti.

On today’s menu:

CPI Sends Markets Into Overdrive 🚀

The Best Instant Funding Program? 🥇

Is The Bitcoin Run Over? 😥

What The Market Is Missing Right Now 😬

CPI Sends Markets Into Overdrive 🚀

Well, folks, yesterday was one for the books.

CPI day came, conquered, and left traders scrambling like someone just announced free pizza in the trading floor cafeteria.

The CPI Numbers

Here’s the breakdown:

Headline inflation: +0.4% month-over-month, +2.9% year-over-year

Core CPI (excluding food and energy): +0.2% month-over-month, +3.2% year-over-year

Translation?

Inflation is cooling slightly faster than expected.

It’s like the Fed’s Christmas wish came a little late, but better late than never. 🎅

What Happened in the Market?

Cue the fireworks:

1️⃣ Stocks Took Off:

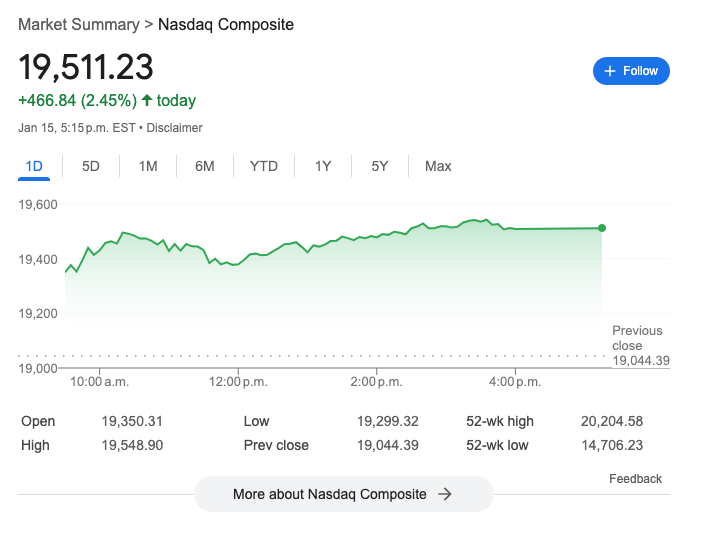

The Dow Jones climbed 1.7%.

The S&P 500 gained 1.8%.

The Nasdaq stole the show, rallying 2.5%.

2️⃣ Bitcoin Staged a Comeback:

After stumbling recently, BTC touched $100,000 again. Like that one friend who keeps showing up late but always makes an entrance.

3️⃣ Bond Yields Fell:

The 10-year Treasury yield dropped as traders flocked to bonds, pricing in a friendlier Fed.

4️⃣ The Dollar Dipped:

A weaker dollar is good news for international buyers—and maybe even gold bugs.

5️⃣ Oil Prices Rallied:

WTI crude was all smiles, buoyed by inflation easing and a brighter economic outlook.

What It All Means for Traders

1️⃣ Disinflation is Back on the Menu:

The cooling CPI data gave traders reason to believe the Fed might ease up on rate hikes.

And guess what?

The market is now betting on two rate cuts in 2025 (up from just one). Rate cuts mean cheaper money, which could fuel equities further.

2️⃣ Growth Stocks Lead the Pack:

Tech and growth sectors—already rallying on AI and innovation buzz—could keep outperforming as borrowing costs drop.

Think of it as their moment to shine, while defensive sectors might take a back seat.

3️⃣ Market Sentiment is Shifting:

Bitcoin hitting $100K again? That’s not just a crypto story; it’s a signal of broader risk appetite.

When Bitcoin rallies, you’ll often see commodity currencies like AUD and CAD get a boost, while safe-haven plays like JPY and CHF take a back seat.

4️⃣ Don’t Forget Inflation’s Still Here:

Sure, this was a win for the disinflation camp, but some pesky pressures remain.

Shelter, food, and energy are still bubbling, which could mean choppier waters ahead.

5️⃣ The Fed Isn’t Out of the Picture Yet:

Let’s not forget: inflation is still above the Fed’s 2% target.

Powell isn’t ready to throw in the towel just yet, so keep an eye on future jobs and inflation reports for clues about what’s next.

The Bottom Line

This CPI print sent markets flying, but remember: what goes up fast can come down faster.

For now, the vibe is optimistic—stocks are partying, Bitcoin’s making noise, and traders are adjusting their strategies.

Stay frosty, keep your stops tight, and remember, the market loves to keep us guessing.

Tired of prop firm challenges?

Instant funding is here.

Lark Funding just made getting funded easier and faster with their brand new Instant Funding Program.

Here’s the breakdown:

No News Restrictions ✅

No Consistency Rule ✅

First Payout On Demand ✅

No Lot Size Limits ✅

Ready to start earning from Day 1?

Why wait?

Start your trading journey today.

CRYPTO

Is The Bitcoin Run Over? 😥

Bitcoin has been doing its best impression of a yo-yo lately.

Earlier this week, it dropped below $90,000, leaving traders sweating more than a day trader during an FOMC meeting.

But yesterday’s CPI report threw the market a lifeline, and this morning, Bitcoin touched $100,000 again.

So… is the run over, or is BTC just catching its breath before another moonshot?

Let’s look at both sides of the coin (pun intended).

The Bull Case 🐂

Trump’s Pro-Crypto Stance: Love him or hate him, Donald Trump is just days away from taking office, and he’s been making all the right noises for the crypto crowd. Pro-Bitcoin SEC chair? Check. Promises of clear regulations? Check. Whether he delivers or not, the market seems to like the idea of crypto getting a seat at the table.

CPI Sparks Hope: Yesterday’s better-than-expected CPI data brought back the “disinflation is here” narrative, with markets now pricing in two rate cuts for 2025. Lower rates mean a weaker dollar, and historically, Bitcoin loves a weaker dollar.

Market Sentiment: Bitcoin remains a risk-on asset, and the fact that it rebounded so quickly after falling below $90K shows there’s still plenty of demand. Whales are buying dips like they’re at Costco on a Saturday.

The Bear Case 🐻

Inflation Woes: Let’s not forget inflation has been rising for three straight months now. Sure, CPI didn’t come in hotter than expected, but it’s still above the Fed’s 2% target. If inflation doesn’t cool off soon, the Fed might have to ditch those rate cut plans and start talking about hikes again. And let’s be real—Bitcoin and rate hikes are not friends.

Profit-Taking Pressure: After Bitcoin’s insane run to $108,000 last year, some big players are bound to take profits. We’ve already seen this happen, and it could continue to weigh on prices in the short term.

The Macro Picture: The global economy is still a mixed bag. Strong economic data could keep the dollar strong, which would put more downward pressure on Bitcoin. Add in rising Treasury yields, and it’s no wonder BTC has been struggling to break out.

What Are We Doing?

Absolutely nothing.

That’s right—no panic selling, no FOMO buying, just holding steady.

Bitcoin is, and always will be, the greatest money ever invented (fight us in the comments). The short-term moves might be noisy, but our conviction in Bitcoin hasn’t wavered.

So, is the run over? Maybe, maybe not.

But one thing’s for sure—Bitcoin’s story is far from finished.

What do you think of today's edition? |

🚀 Pre-Market Fuel

The market is rallying but inflation is still a major problem… Here’s a great breakdown from our friend Pomp.

🍪 Munchy Memes

"I sold at 90K, because bond yields were rising"

— Thomas | heyapollo.com (@thomas_fahrer)

10:13 AM • Jan 14, 2025

you could have bought fartcoin 24 hours ago and outperformed ethereum over the last 3 years

— Milk Road (@MilkRoadDaily)

3:15 PM • Jan 14, 2025

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER