- Pip Munch

- Posts

- 🛠️ Tariff Drama, Tech Hopes, & Choppy Markets

🛠️ Tariff Drama, Tech Hopes, & Choppy Markets

Tired of waiting weeks for your payout?

Lark Funding gets you paid fast. Under 6 hours, on average. No delays. No fluff. Just raw spreads, fast payouts, and up to 90% splits.

☕️ GM Munchers! I told my wife trading is about patience and discipline. She said I should try using those skills at home too.

On today’s menu:

🛠️ Tariff Drama, Tech Hopes, & Choppy Markets

🕵️♂️ Congress vs. Insider Trading: Round 294

📅 Why Friday’s Jobs Report Could Make or Break the Market

❌ Beware of This Prop Firm Rule

🏘️ How Much Gold Does It Take To Buy A House?

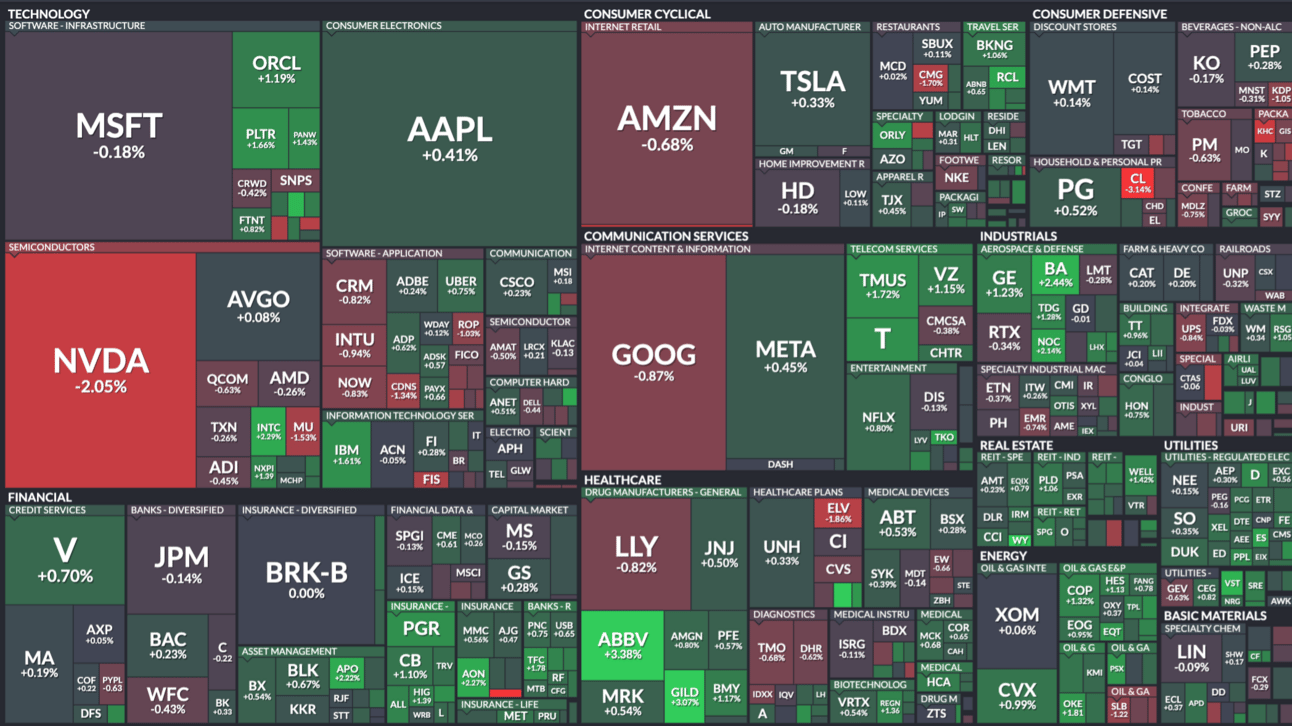

Yesterday’s numbers:

S&P 500 | 5,529 | +0.06% |

Nasdaq | 17,366 | -0.10% |

Dow Jones | 40,228 | +0.28% |

Gold | $3,337 | -0.20% |

Bitcoin | $94,956 | -0.10% |

BREAKING NEWS

🛠️ Tariff Drama, Tech Hopes, & Choppy Markets

Well folks, it was another one of those days in the market — the kind where headlines whipsaw you so hard you start looking for your chiropractor’s number.

Here’s what went down:

📈 The Market

The S&P 500 eked out a teeny-tiny gain of less than 0.1%, enough to keep its winning streak alive.

The Dow added about 0.3%.

The Nasdaq Composite ticked 0.1% lower, proving that even tech bros need a breather.

It was a choppy session, with the Dow swinging more than 240 points at the low and rallying nearly 300 points by the high. The S&P 500 and Nasdaq each spent time over 1% in the red before climbing back in afternoon trading.

Bulls are sniffing around again. As Larry Tentarelli of Blue Chip Daily put it: "Any pullbacks have turned to be buyable." Translation: The bulls are back in town, but they're a little hungover.

🚘 Trump’s Tariff Softening

Big news from D.C.: a White House official confirmed President Trump is expected to soften his brutal automotive tariffs as soon as today.

Here’s the plan:

Soften duties on foreign-made car parts used in U.S. manufacturing.

Avoid stacking tariffs on top of other Trump-era levies.

Keep tariffs focused mostly on fully imported cars.

Commerce Secretary Howard Lutnick said the move is meant to reward domestic manufacturers and expand U.S. production. Or in other words: Make Detroit Great Again.

Markets like the sound of it, especially automakers and any trader who's long on Ford or GM.

🇨🇳 The China Confusion Continues

Meanwhile, in the world’s most passive-aggressive relationship, the U.S. claims it’s "actively negotiating" with China to ease tariffs.

China? They’re saying "What negotiations?"

Chinese officials completely denied that any tariff talks are happening.

They also threw cold water on Trump’s claim that President Xi called him. ("As far as I know, there have been no calls," said a Chinese spokesperson.)

So basically, it’s like when you text your ex "You up?" and they claim they never saw the message. 👀

Despite the confusion, U.S. officials are staying hopeful that a de-escalation is coming very soon. In the meantime, American business owners are bracing for higher prices, product shortages, and a serious case of tariff-induced headaches.

COMMODITIES

🕵️♂️ Congress vs. Insider Trading: Round 294

BREAKING: The PELOSI Act (Preventing Elected Leaders from Owning Securities and Investments Act) has been reintroduced to Congress.

— The Kobeissi Letter (@KobeissiLetter)

8:02 PM • Apr 28, 2025

If you’ve ever looked at a politician’s trading record and thought, "Man, they trade better than Warren Buffett," you’re not alone — and you’re not crazy.

Senator Josh Hawley is once again trying to put a leash on Congressional day traders by reintroducing the Preventing Elected Leaders from Owning Securities and Investments (PELOSI) Act.

Yes, it’s literally named after that Pelosi — whose husband Paul Pelosi famously turned chip stocks into a personal ATM.

The goal?

Ban members of Congress and their spouses from trading individual stocks. Because nothing says "conflict of interest" like voting on a semiconductor bill right after buying a million bucks of Nvidia calls. (True story.)

Highlights:

Paul Pelosi reportedly pulled in 20x Nancy Pelosi’s annual salary on one Nvidia trade.

The Pelosi family saw gains of nearly +28% in six months.

Just this January, Pelosi disclosed more juicy call option plays on names like Alphabet, Amazon, and Palo Alto Networks.

And while technically, Congress reps are supposed to file trades within 30 days under the Stock Act, there’s a big loophole: They only have to disclose if the trade falls into vague categories — like "$1M+" — making it harder to sniff out sketchy plays in real time.

In case you were wondering, 95% of Congress owned investment funds last year, and 46% also owned individual stocks. (Spoiler: 59% of those stock owners were Republicans, 41% were Democrats.)

Oh, and fun fact: Senator Hawley himself owns widely held investment funds according to the Campaign Legal Center. Because, you know, it’s different when he does it. 😉

TRADING OUTLOOK

📅 Why Friday’s Jobs Report Could Make or Break the Market

Traders, mark your calendars: this Friday could be one of the most important days of the year.

That’s because the next U.S. labor report is dropping—and according to CNBC’s Jim Cramer, it could determine whether we dodge a recession... or slide straight into one.

Cramer said Monday that despite all the noise about tariffs, inflation, and global slowdowns, the real battleground is the labor market. And so far? Jobs are holding up surprisingly well.

“Will tariffs hurt? Yes.

Will prices go higher? Yes.

Could there be shortages? Absolutely,” Cramer said. “But recessions revolve around employment—and there are still so many more jobs than we have people to fill them.”

🧠 Why Jobs Matter More Than Tariffs Right Now

Cramer’s argument is simple: even though Trump’s sweeping tariffs are raising concerns about higher costs and supply chain pain, companies are still hiring. And companies are scared to lay off workers because it’s gotten so hard to replace them.

He’s predicting Friday’s jobs data will be “fairly robust,” which would reinforce the idea that a full-blown recession isn't imminent—even if inflation ticks higher and growth cools off.

Investors are nervous (as always), but Cramer thinks a strong jobs report could pour cold water on the recession talk and keep consumer spending alive. Even if shoppers have to start switching from Whole Foods to Costco to survive those tariff price hikes.

🛎️ Bottom Line for Traders:

Friday’s jobs report is everything right now.

Strong jobs = no recession (for now).

Weak jobs = buckle up.

The market is looking for any excuse to pick a direction—and Friday’s data could be the spark that sets off the next big move.

Stay sharp and maybe hold off on panic-selling... at least until after Friday’s report.

PROP FIRMS

🤑 Tuesday Motivation

I made $130k+ last year in just 9 trades.

Trading isn’t about quantity, it’s about quality.

Here’s exactly how I trade less and make more:🧵

— Tori 💜 (@toritrades)

9:46 PM • Apr 28, 2025

🚀 Pre-Market Fuel

🍪 Munchy Memes

My goal this year was to make $50,000 in the stock market.

$77,000 to go…

— Not Jerome Powell (@alifarhat79)

5:11 PM • Apr 28, 2025

This is who you’re trading against.

— John Coogan (@johncoogan)

8:58 PM • Apr 28, 2025

How it's going in Spain right now.

— 7️⃣1️⃣6️⃣ TJ (@TJDMCR)

11:36 AM • Apr 28, 2025

Fartcoin is now worth over $1 billion, more than 70% of U.S. publicly traded companies

— Stocktwits (@Stocktwits)

8:42 PM • Apr 28, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER