- Pip Munch

- Posts

- 📉 Tariff Roulette

📉 Tariff Roulette

The best way to make money in this market? Prop firms.

And our favourite prop firm? Lark Funding. Use code APRIL90 for 90% profit splits and 9% off.

☕️ GM Munchers! I hope your weekend was better than mine… My wife was already mad at me because our portfolio was down double digits — then I ignored her all weekend to watch the Masters. Now I'm sleeping on the couch and reevaluating our exposure to tech.

On today’s menu:

🙄 Tariff Roulette

🧠 Dalio’s Warning: “Worse Than a Recession”

📈 Gold Keeps Climbing

😬 Consumers Are Worried About Inflation

🇨🇳 China Says “Be Rational”

BREAKING NEWS

🙄 Tariff Roulette

This week’s episode of Tariff Theater brought yet another plot twist.

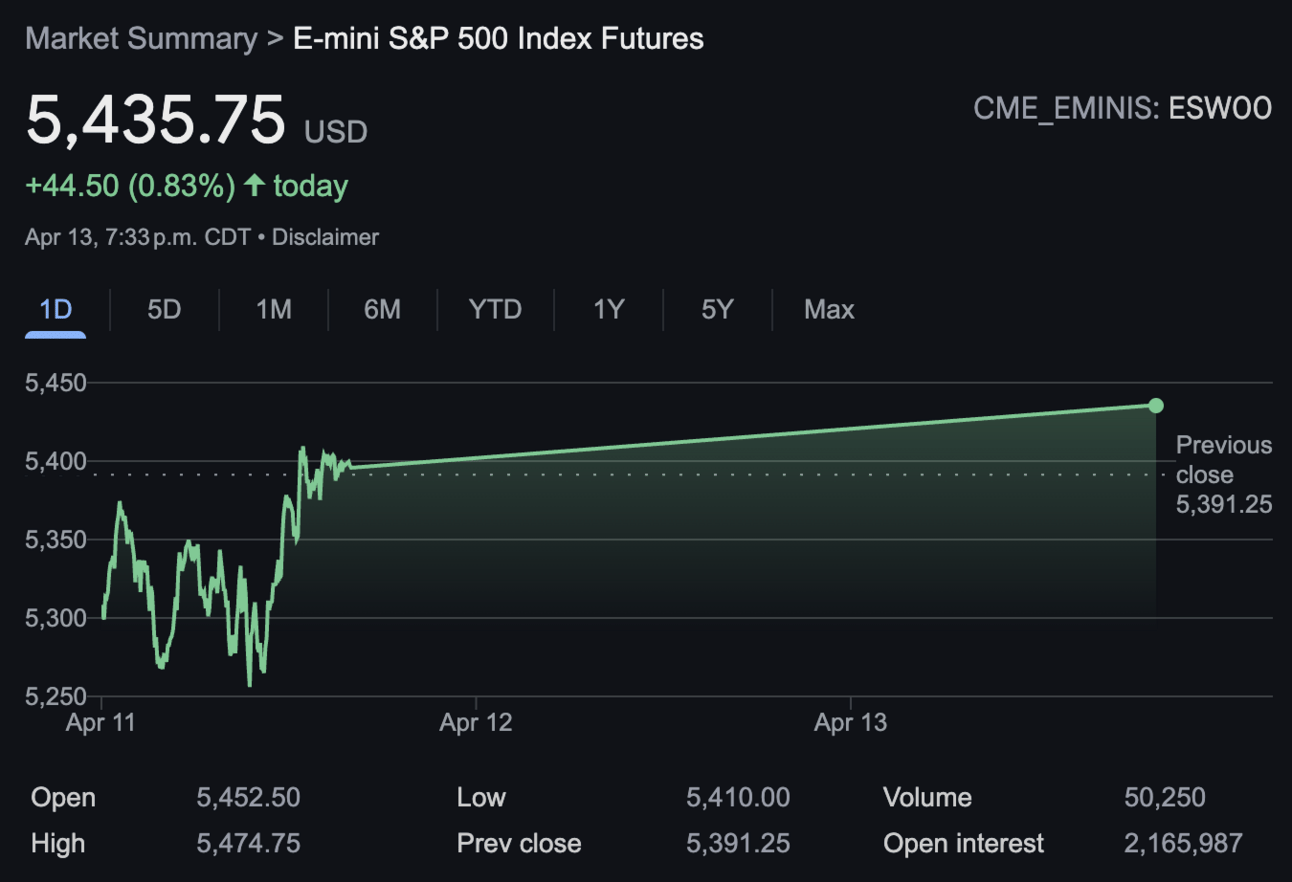

Stock futures popped on Sunday after traders learned that smartphones, computers, and semiconductors would be exempt from the new 10% tariffs Trump recently slapped on nearly every country.

It looked like Big Tech had dodged a bullet… until they didn’t.

Commerce Secretary Howard Lutnick clarified that the exemptions are temporary, and those items will likely face semiconductor-specific tariffs “in a month or two.”

Translation? Enjoy the breather while it lasts.

The exemptions helped the market claw back some optimism.

S&P 500 futures almost 1%

Nasdaq-100 futures jumped 1.32%

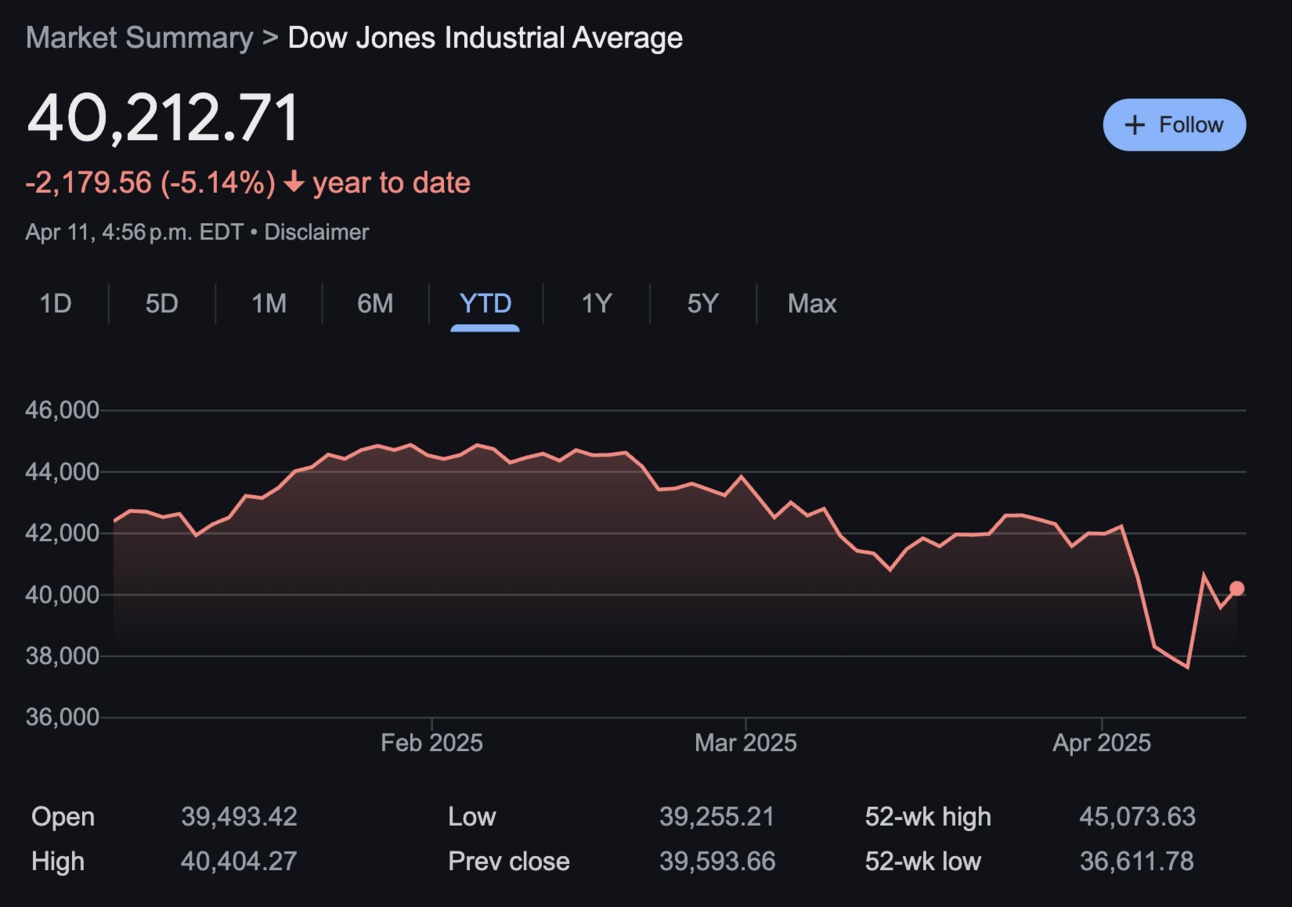

Dow Jones futures gained 139 points (0.3%)

But make no mistake—investor confidence is still shaken.

Apple alone has shed nearly $640 billion in market cap in the past three trading days. Oof.

And while this tech carveout is helpful in the short term, Lutnick made it clear:

“We can’t be reliant on Southeast Asia for all of the things that operate for us.”

Meanwhile, traders are trying to parse whether these announcements are part of a strategic rollout—or if we’re just watching tariff roulette in real-time.

Even with last week’s bounce, the S&P 500 is still down 5.4% since the tariffs were announced, and the Nasdaq and Dow are down around 5% too.

The cherry on top?

Trump says the exempted products are still “subject to the 20% fentanyl tariff,” just moved to a different “tariff bucket.”

Whatever that means. 🤷

Moral of the story: markets hate uncertainty, and right now, this policy feels like trying to assemble IKEA furniture with no instructions—sure, you might get a bookshelf, but it probably wobbles.

BROUGHT TO YOU BY

Tired of unreliable prop firms?

Lark Funding has been helping traders scale with fast payouts and flexible challenge options since 2022.

Choose from:

✅ 1-Step, 2-Step, 3-Step, or Instant

✅ On-Demand & Bi-weekly payouts

✅ Up to $600K in challenge accounts

Join the prop firm that’s CDBO Certified.

Code: APRIL90 gets you 9% off + 90% profit split.

MARKETS

🧠 Dalio’s Warning: “Worse Than a Recession”

Ray Dalio just sent a spiritual slap across Wall Street’s face—and no, it’s not because of the tariffs.

The billionaire founder of Bridgewater Associates says we’re approaching a moment of global economic breakdown—and if you were already nervous, well… now you’re not alone.

“I’m worried about something worse than a recession if this isn’t handled well.”

Dalio points to five forces shaping history:

The economy

Political conflict

International order

Tech innovation

Natural events like pandemics

According to him, Trump’s tariff policy—while understandable—is being executed in a “very disruptive” way that’s escalating global tensions.

He’s especially worried about:

The rising U.S. deficit

A breakdown in international trade

And a shift away from a post-WWII multilateral world order

Dalio even compared the current bond market pain to Nixon’s cancellation of the gold standard in 1971 and the 2008 financial crisis.

Not exactly the softest of landings. ❌

“We are going from multilateralism… to a unilateral world order in which there’s great conflict.”

For traders, this means watching more than just earnings season.

If capital continues fleeing U.S. assets, the implications could go far beyond the next CPI report.

So yeah—Ray didn’t exactly say to panic. But he didn’t not say it either.

COMMODITIES

📈 Gold Keeps Climbing

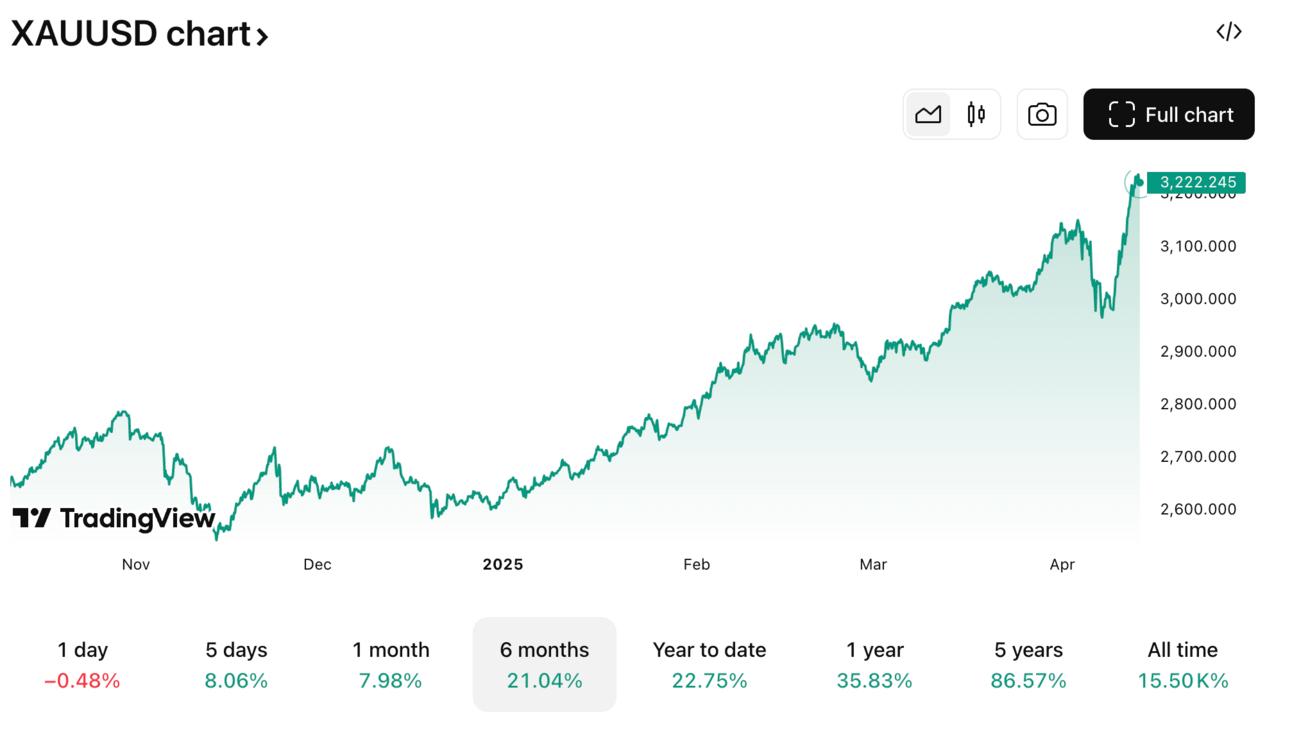

Another day, another gold chart that looks like it’s had one too many energy drinks.

Gold just cracked $3,200, marking yet another all-time high as investors continue their stampede out of the U.S. dollar and into anything that doesn’t carry a flag, a yield curve, or a trade war headache.

So, what’s fueling the move?

It’s a cocktail of chaos:

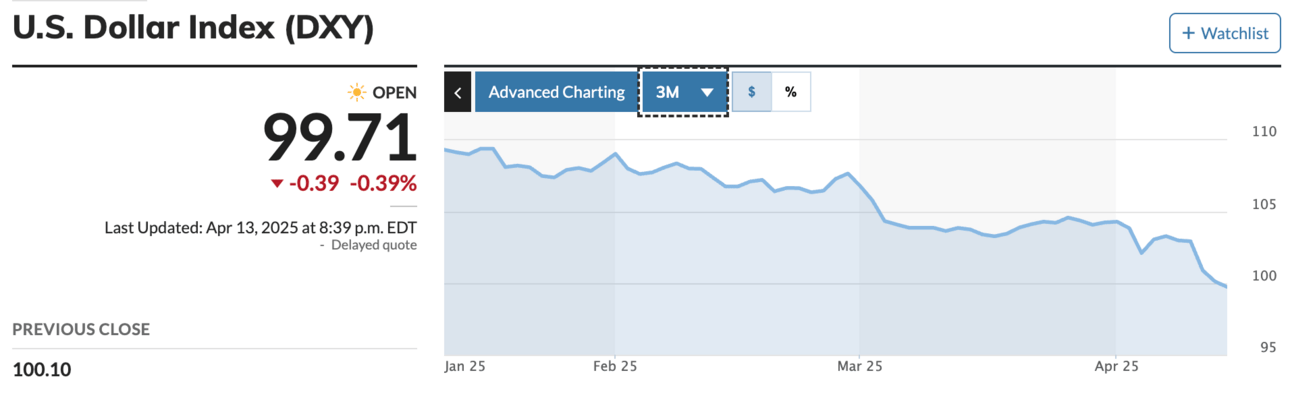

The U.S. Dollar Index (DXY) dropped 0.9% to 99.95, its lowest since 2022.

Yields are surging. The 10-year Treasury hit 4.49%, up 50 basis points, and the 30-year jumped 48 bps to 4.87% — their biggest weekly gain in decades.

Traders are pricing in 90 basis points of Fed cuts by the end of 2025.

That combo — falling dollar + rising yields + expectations of looser monetary policy — is the financial market equivalent of throwing gasoline on a gold bonfire.

But it’s not just fear and yield curves driving this thing. Central banks (especially in emerging markets) are loading up on gold.

Why?

One word: dedollarization.

Institutions are buying too, with gold-backed ETFs seeing fresh inflows.

"gold could plausibly trade near $4,500/oz by end-2025." - Goldman

— zerohedge (@zerohedge)

4:06 PM • Apr 13, 2025

And with everyone from retail investors to global banks giving gold the heart-eyes emoji, the broader trend looks intact.

Even if we get a short-term pullback, the runway into Q2 looks bullish unless trade tensions cool off or the dollar magically starts working out again.

Final note: this isn’t just about inflation hedging anymore — it’s about confidence. Or more accurately, the lack of it.

PROP FIRMS

🤑 Monday Motivation

q1 summary

↳ made ( $35,189/ £26,899 ) from January 15th, 2025 with @FTMO_com alone

↳ reached max allocation with @FTMO_com

goals for q2

↳ reaching $1m funding

↳ consistent payouts with this size of funding

↳ exploring other business ventureshere's to q2 🚀

— kalcryptev (@kalcryptev)

1:10 PM • Apr 12, 2025

🚀 Pre-Market Fuel

🍪 Munchy Memes

thank you crypto

— Jeremy (@Jeremyybtc)

12:18 PM • Mar 18, 2025

Just witnessed my co-founder give up 50% of his equity … it was beautiful.

— marty.com (@martymadrid)

12:43 AM • Apr 13, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER