- Pip Munch

- Posts

- ☕️ Tariff Tornado

☕️ Tariff Tornado

Are you missing out on this market’s volatility?

Stop getting left behind and unlock your potential by using code MARCH10 for 10% off all prop firm challenges at Lark Funding.

☕️ GM Munchers! It’s Pip Munch, your trading sidekick that’s more consistent than my wife’s ability to say “I’m fine” and mean the exact opposite.

On today’s menu:

🚀 Trump’s Tariff Spree Just Got Wilder

📈 Tesla Snaps Back After Brutal Slide

🥇 The Best 3-Step Prop Firm Challenge

🤑 Bitcoin Bounces Back — With Some Help from Uncle Sam

👀 Coinbase Wants To Control Options Trading

💣️ 23andMe Files For Bankruptcy

🇨🇦 The Conservatives Make A Comeback

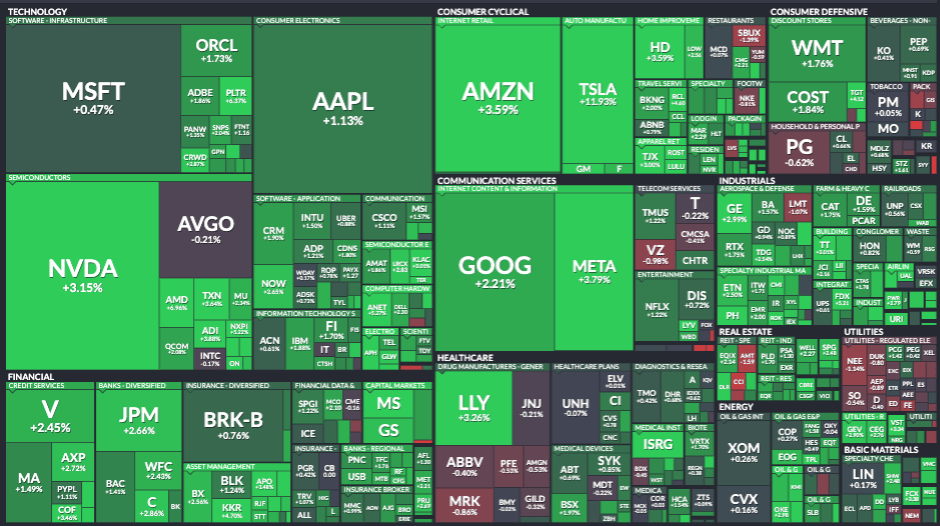

MARKET OVERVIEW

🚀 Trump’s Tariff Spree Just Got Wilder

Markets started the week like a trader on their fifth espresso—nervous, jittery, and unsure if they were about to moon or melt.

But then came a gust of tariff-related optimism.

President Trump hinted Monday that the U.S. might go easier than expected on the sweeping tariffs set to take effect April 2.

While he did confirm more duties are coming—on cars, pharmaceuticals, lumber, semiconductors, and basically anything you can pronounce—he also said there “may be a lot of countries” that get breaks.

So… reciprocal tariffs are still a thing.

But sector-specific ones? Those “may or may not” kick off at the same time, according to a White House official. Or as Trump put it: “Yeah, it’s going to be everything... but not all tariffs are included that day.”

Clear as molasses in a snowstorm.

Still, this was enough for markets to breathe a sigh of relief and rip higher:

📈 The Dow jumped 597 points (+1.42%)

📈 The S&P 500 gained 1.76%

📈 The Nasdaq surged 2.27%

The market’s move wasn’t just about tariffs—it also got a boost from better-than-expected U.S. services PMI data and easing fears of an imminent recession.

But make no mistake: this rally was powered by hopes that Trump’s trade team will go with the “mild” sauce instead of ghost pepper-level tariffs.

Until we get clarity on what April 2 actually brings, expect volatility to stay spicy.

Because right now, the only thing more uncertain than tariff policy… is your cousin’s crypto portfolio.

BROUGHT TO YOU BY

🚀 Introducing the 3-Step Challenge at Lark Funding

A smarter way to get funded—with way more forgiveness.

✅ No daily drawdown limit

✅ Profit targets? Just 5% → 4% → 3%

✅ Mess up once or twice? No problem.

With our 75% reset discount, you can restart a $100K challenge for just $92.50.

That’s less than what your Uber Eats order cost last weekend.

This challenge is designed to be realistic, resilient, and actually rewarding.

No gimmicks. No fine print. Just a real shot at passing.

Challenge accepted?

STOCKS

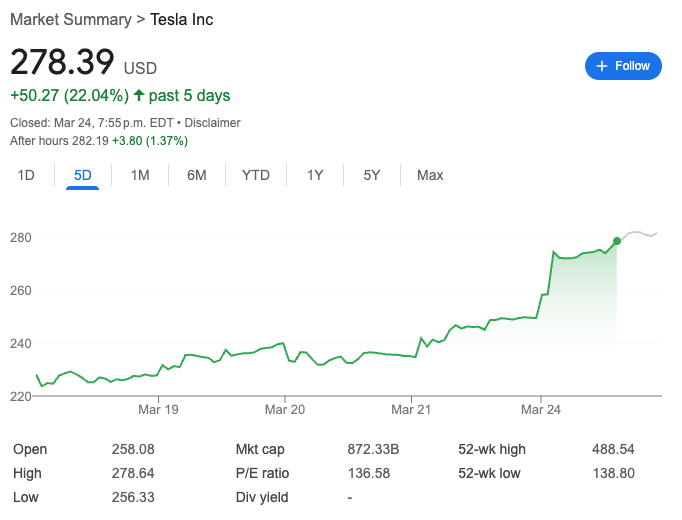

📈 Tesla Snaps Back After Brutal Slide

Tesla stock staged a massive comeback on Monday, jumping nearly 12%—its best day in months—after spending much of 2025 getting pummeled by bad news and worse vibes.

The rally was sparked by growing optimism that Trump’s proposed auto tariffs, part of his broader trade spat with the world, might be watered down.

Reports that he may “give a lot of countries breaks” helped ease fears that Tesla’s already-sliding international sales would get hit even harder.

That was enough to send TSLA up nearly $30 to close at $278.39. The stock is still down roughly 30% year-to-date, but Monday’s move was a much-needed jolt after nine straight weeks of declines.

Other catalysts included:

Robotaxi plans: Tesla said it would launch its robotaxi service in 2025.

FSD drama: After complaints about the Full Self-Driving pause in China, the company said it’s just waiting for regulatory approval before resuming the trial.

A rare Musk moment: Elon Musk held an all-hands meeting last Thursday to assure employees he was, in fact, still paying attention to the company.

Still, it hasn’t been all sunshine. ❌

Sales have slumped in the US, Europe, and China. Some analysts blame the Model Y refresh. Others point to Musk’s increasingly political image, which may be hurting the brand.

But at least for now, traders are breathing a sigh of relief—and Tesla is off life support.

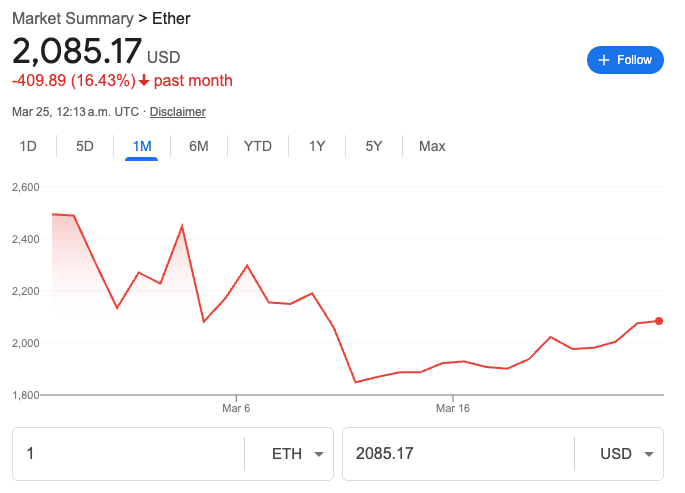

CRYPTO

🤑 Bitcoin Bounces Back — With Some Help from Uncle Sam

Bitcoin is back in beast mode.

After chilling around $84K last Friday, BTC flexed its way up to $88.5K by Monday afternoon.

No ETF announcement. No halving buzz. Just a little... macro magic.

What kind?

Let’s just say when traditional markets get a whiff of “maybe things won’t be as bad as we feared,” crypto puts on its moon boots.

But the real story wasn’t just the price spike — it was the flood of money rushing in behind it.

💸 ETF Inflows Are Heating Up Again

After five straight weeks of outflows, the tide has officially turned:

Total digital asset inflows: $644M

Bitcoin alone: $724M (yep, it carried the team)

Fidelity BTC ETF: +$136M

iShares BTC ETF: +$464M last week (though still -$131M for the month)

Meanwhile, Ethereum had a bit of a mid-life crisis:

ETH outflows: $86M

Short BTC products: More bleeding for the bears (-$7.1M)

Big picture?

The inflows are back, and they’re bringing receipts.

🧠 Munch Take

The crypto market didn’t just react to macro headlines — it front-ran them. BTC moved first, then Wall Street started writing think pieces about why.

Now with flows reversing and volatility creeping up, the market looks more alive than my wife watching the latest Love Is Blind season.

The real test?

If BTC can hold this range without another helping hand from macro news…

PROP FIRMS

🤑 Tuesday Motivation

In January 2024, FTMO paid out $9.6 million.

And you're still wondering if you can make $10K/month?

— Matt L (@MeetMattL)

12:02 AM • Mar 25, 2025

🚀 Pre-Market Fuel

👀 Is Coinbase about to control the options market? They’re close to buying Deribit which controls 80% of crypto options trading for $4 to $5 billion.

💣️ 23andMe files for bankruptcy. The CEO has resigned and they were never the same after their 2023 data breach.

🇨🇦 The Conservatives have taken back the lead for the upcoming Canadian election.

🚀 Trump Media makes a deal with Crypto.com. It’s another licensing deal that will allow the company to roll out products using the Trump brand.

😏 Trading platform eToro is going public. Founded in 2007, their latest report shows a net income of $192.4 million.

🤑 Berkshire Hathaway employee wins $1 million in Warren Buffett’s March Madness challenge.

🍪 Munchy Memes

Me listening to a couple of normal people talk about cryptocurrency

— Alan Carroll (@alancarroII)

3:02 PM • Mar 21, 2025

Me at work at 5am because my crypto stuff didn’t work out

— naiive (@naiivememe)

11:52 PM • Mar 20, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER