- Pip Munch

- Posts

- ☕️ Tech Exemption

☕️ Tech Exemption

The best way to make money in this market? Prop firms.

And our favourite prop firm? Lark Funding. Use code APRIL90 for 90% profit splits and 9% off.

☕️ GM Munchers! The markets were so quiet yesterday, my wife made me clean up the yard—said it was the only thing with less volatility than my trading account.

On today’s menu:

📈 Markets Yawn, Gold Shines & Wall Street Panics

🙄 How Do You Know a Recession’s Coming? Coachella.

🧵 3 Things Traders Should Watch This Week

💰️ How Much Cash Is Warren Buffett Holding?

🤯 Trump Freezes $2.2 Billion of Harvard Grants

BREAKING NEWS

📈 Markets Yawn, Gold Shines & Wall Street Panics

If last week was fireworks, yesterday was the smoke clearing.

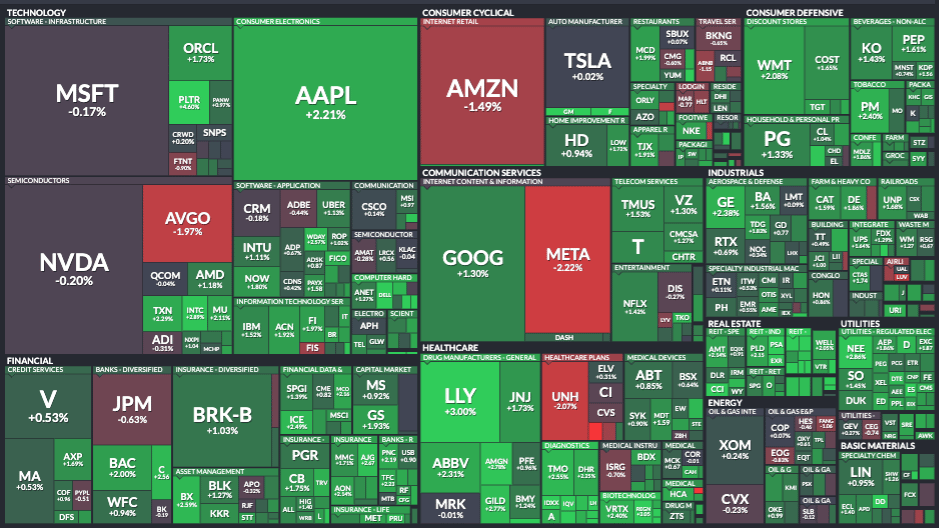

Markets stayed relatively quiet yesterday, but the Dow still managed to gain 312 points (+0.78%) during the session.

The S&P 500 climbed +0.79%, and the Nasdaq Composite added +0.64%.

But while stocks chilled, gold kept strutting down the runway like it was Coachella headliner. Gold is now up over 1000% since 2000, compared to the S&P 500’s 485%.

Gold is now up 1000% since the year 2000.

The S&P 500 has returned 485%.

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi)

12:25 PM • Apr 14, 2025

Not to get dramatic, but gold’s performance makes the rest of us look like we’ve been trading with oven mitts on.

Why?

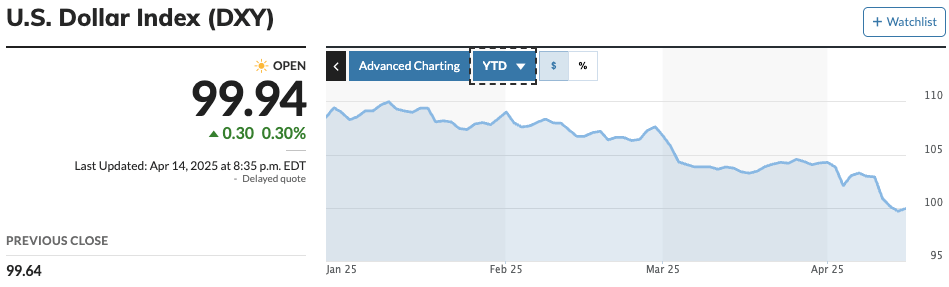

It’s all about dollar weakness.

The U.S. Dollar Index (DXY) is down nearly 8% year-to-date, making gold cheaper for foreign buyers. As the dollar slides, investors slide into gold.

Even Wall Street seems to be waving the white flag:

Citi slashed its S&P 500 target from 6,500 → 5,800

JPMorgan: 6,500 → 5,200

Goldman Sachs: 6,500 → 5,700

Bank of America: 6,666 → 5,600

Meanwhile, Fed Governor Christopher Waller warned that tariffs are now one of the biggest shocks the U.S. economy has seen in decades.

If tariffs stick at 10%, inflation could peak around 3%.

But a 25% average?

That could push inflation up to 5% and drive unemployment to 5%.

So yes, it was a "quiet" day—but underneath the surface, even the Fed is sweating like it’s long on Peloton.

📊 Closing Stats:

Bond yields eased slightly after last week’s blowout, with the 10-year ending at 4.35% (down 10bps).

BROUGHT TO YOU BY

A New Standard For 2-Step Challenges

Lark Funding just launched the new 2-Step Pro Challenge—built for serious traders who want fewer rules and faster payouts.

✅ 4% Phase 2 Target

✅ First Payout On Demand

✅ No locks, no restrictions

✅ $100K Account for $399

Use code PRO20 for 20% off (48 hours only).

ECONOMY

🙄 How Do You Know a Recession’s Coming? Coachella.

Here’s a fun (read: horrifying) stat — 60% of general admission Coachella tickets were bought on Buy-Now-Pay-Later.

60% of general admission ticket buyers at Coachella used Buy-Now-Pay-Later to finance their tickets, per Billboard.

— unusual_whales (@unusual_whales)

11:56 AM • Apr 14, 2025

Yes, Coachella — the land of $18 lemonades, flower crowns, and overpriced nostalgia — is now on payment plans.

According to Billboard, GA tickets started at $499 (plus fees), and buyers were even hit with a $41 enrollment fee just to finance it.

If this sounds familiar, it should. Just a few weeks ago, we told you that Doordash now offers installment plans for your burritos.

If you’re wondering why this matters to traders, here’s the cheat code:

🧠 It’s all about risk sentiment. When consumers are so strapped for cash they need loans to party, that’s not exactly bullish.

Tight wallets mean weaker consumer spending.

Weak consumer spending means slower corporate earnings.

And slower earnings? That’s when risk gets re-priced.

And guess what usually performs well when consumers are broke and the market gets nervous?

Safe-haven currencies like the U.S. dollar and Japanese yen—and yes, our golden old friend gold. So while this Coachella stat may sound like a punchline, it’s actually a flashing warning light for traders.

If things get worse, risk-on assets (like growth stocks and crypto) could take a hit, and the market may start rotating into defense.

Bottom line? Watch the vibes.

Because when festival tickets go on layaway, recessions tend to RSVP shortly after.

TRADING101

🧵 3 Things Traders Should Watch This Week

Not a ton of headlines yesterday, but there’s still plenty to keep your eyes on. Here are a few stories worth diving into this week:

1. 🧠 Nvidia’s $500B U.S. Manufacturing Push

Nvidia announced plans to produce AI supercomputers entirely in the U.S. over the next 4 years, starting with facilities in Phoenix, Houston, and Dallas. It’s one of the largest AI infrastructure moves in history—and a sign that reshoring is real.

2. 📉 Bond Market Volatility

After last week’s monster move in yields (10-year up 50bps), U.S. Treasury yields eased slightly Monday. Traders should watch to see if this is a real reversal or just a breather.

3. 🧮 Fed Rate Path + Inflation

Waller outlined multiple tariff scenarios, ranging from mild to “get your bunker ready.” The Fed now sees inflation hitting 2.3% to 2.7%, depending on tariff levels. Markets should brace for more speeches this week, especially ahead of upcoming CPI/PPI data.

We’ll be covering all of this and more—because as traders, your job is to know when the party’s over, and when it’s just getting started.

PROP FIRMS

🤑 Tuesday Motivation

Currently 1.2 million funded with

400k @FTMO_com

300k @thinkcapitalcom

300k @thepipfarm

200k @fundingpipsI’ve also got 3 challenges currently on the go

400k phase 2 @E8Markets

200k phase 1 @FunderProfx

100k phase 2 @the5erstradingThis year is looking very good 🫡

— Tom (@t0mbfx)

7:48 PM • Apr 14, 2025

🚀 Pre-Market Fuel

🍪 Munchy Memes

When the stock you’re holding gets a tariff exemption

— Not Jerome Powell (@alifarhat79)

6:17 PM • Apr 14, 2025

Trading is easy. I just turned $50,000 to $0

— Not Jerome Powell (@alifarhat79)

1:28 PM • Mar 10, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER