- Pip Munch

- Posts

- 💰 The Fed’s Big Decision + Inflation Data—What’s Next for Markets?

💰 The Fed’s Big Decision + Inflation Data—What’s Next for Markets?

I know you’re tired of us saying it but it’s true: The best way to make money with trading is prop firms.

And our favourite prop firm? Lark Funding, the only CDBO-certified firm. Use code MARCH10 for 10% off all of their challenges.

☕️ GM Munchers! The Fed might cut rates, the dollar is slipping, and my wife just “adjusted” our budget to include more home décor. Safe to say, I’m the one in a bear market.

On today’s menu:

🚨 The Big Events That Will Shake Markets This Week

📉 A $332M Bitcoin Short—What Does This Whale Know?

🇺🇲 Why the US Dollar Keeps Dropping

😬 Joe Biden’s Pardons Are Void?

💣️ The US Government Interest Expenses Explode

🤑 A New Prop Firm Giveaway

MARKET OVERVIEW

🚨 The Big Events That Will Shake Markets This Week

Another week, another round of market-moving events that could shake things up.

This time, we’re eyeing central bank decisions, inflation reports, and stock market volatility to see if markets can recover—or if the pain train continues.

Let’s break it down.

🔥 The Fed’s Interest Rate Decision (Wednesday)

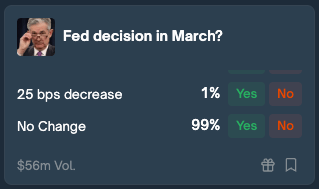

No surprises expected here—the Fed is NOT cutting rates this week.

But don’t let that fool you into thinking it’s a non-event. The real action will be in Powell’s press conference and the FOMC economic projections.

👀 What traders should watch:

✅ Dot Plot Update – Will the Fed still signal three cuts in 2025, or have recent inflation concerns changed that?

✅ Powell’s Tone – If he acknowledges rising recession risks, markets could speculate on faster cuts later in the year.

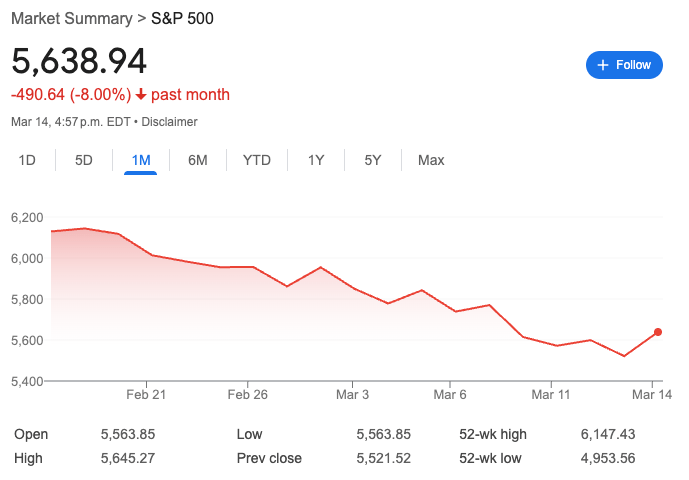

✅ Market Reaction – The S&P 500 just entered correction territory—will the Fed give it a reason to bounce back?

Right now, the market is pricing ZERO rate cuts this week and the first one happening in June or later.

But traders will be watching for any shift in that timeline.

📊 Canada’s Inflation Report (Tuesday)

With inflation cooling in Canada, traders will be watching to see if this reinforces expectations of more rate cuts from the Bank of Canada this year.

💡 Why it matters:

A lower-than-expected CPI print → Could increase the odds of a BoC rate cut, impacting CAD and North American markets.

A hotter-than-expected print → Might force the BoC to delay cuts, keeping rates higher for longer.

While this won’t move U.S. markets much, it’s another global signal on where inflation is headed.

🌍 Global Interest Rate Decisions (Tuesday & Thursday)

It’s not just the Fed making moves—other major central banks will have traders on alert:

🏦 Bank of Japan (Tuesday) – Expected to hold rates at 0.5%, but traders will listen for clues on future hikes. Japan has been slowly tightening policy, and any shift could impact FX markets, especially USD/JPY.

🏦 Swiss National Bank (Thursday) – Expected to go from 0.5% to 0.25%.

While these decisions might not directly impact U.S. stocks, they could affect global risk sentiment—especially if Japan hints at future rate hikes.

📉 How Will Stocks React?

With the S&P 500 officially in correction mode, this week’s central bank updates will help decide if we see a bounce—or another leg lower.

🔻 S&P 500 is down 10% from its February highs.

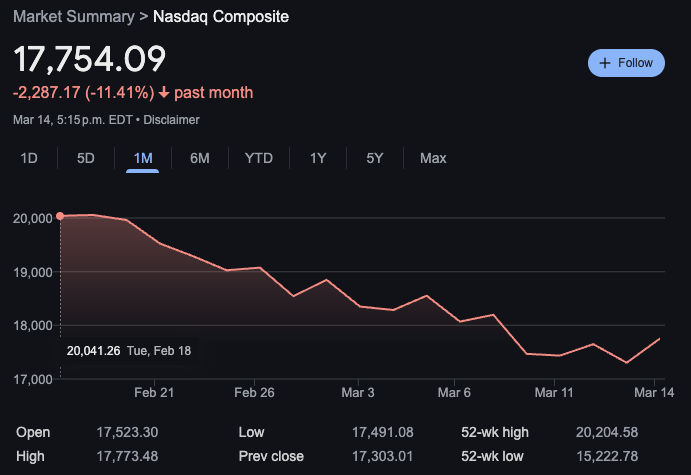

📉 Nasdaq has dropped 14% into correction territory.

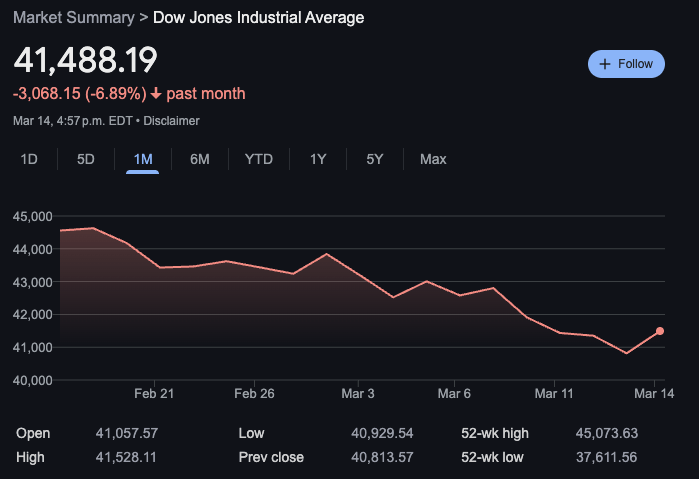

📊 Dow fell another 550 points last week, struggling to find footing.

If the Fed stays cautious and Powell reassures markets, we could see a short-term relief rally.

But if the Fed pushes back on rate cut expectations, the selloff might not be over.

SPONSORED BY LARK FUNDING

Wanna add an extra $2,800 to your wallet? 😏

Wanna add an extra $2,800 to your wallet? 😏

That's what the average trader gets paid at Lark Funding.

Stack that over a year, and you’re looking at $33,600. Talk about a lifestyle upgrade.

How can you get in on this?

Easy. Start with as little as $35 and test your trading skills in a prop firm evaluation.

Pass the test, and keep up to 90% of the profits you earn in your Lark Account.

Oh, and because Lark loves the Munch fam, they're giving you 10% off any challenge.

Just use code: MARCH10

CRYPTO

📉 A $332M Bitcoin Short—What Does This Whale Know?

💥BREAKING:

THE WHALE WHO OPENED A $332M SHORT ON BITCOIN AT $84,040 YESTERDAY HAS SET TAKE PROFITS:

1ST TP: $69,414

2ND TP: $58,664HE 100% KNOWS SOMETHING...

— Crypto Rover (@rovercrc)

10:21 AM • Mar 16, 2025

In the world of crypto, there are big trades, and then there are trades so big they make you question reality—and today, we’re dealing with the latter.

A mystery whale just dropped a $332 million short on Bitcoin at $84,040 and set some oddly specific take-profit levels:

✅ 1st TP: $69,414

✅ 2nd TP: $58,664

And just like that, the internet is on full conspiracy mode.

Whale Moves & Insider Theories

This isn’t just any random degen shorting BTC for the memes—this is a calculated move, and traders are wondering if this whale knows something the rest of us don’t.

Some key theories floating around:

1️⃣ Insider Intel?

The last time we saw a trade this precise, it was a massive long position placed right before a major crypto summit announcement.

Many believe that was a Trump insider who knew the event would pump Bitcoin.

Now, this short trade could be the reverse—does someone have advance notice of bad news?

2️⃣ Regulatory Hit Incoming?

With Trump’s recent crypto-friendly stance, some think new policies or regulations could be incoming—maybe this whale is hedging against a surprise move.

3️⃣ A Classic Trap?

Some traders think this is just a whale manipulation move—get retail to short, then rip the market higher.

The Bottom Line

Whether this whale is a genius insider or just another trader rolling the dice, this is a high-stakes bet that has everyone watching.

📉 If Bitcoin dumps to $69K or lower, this whale prints money.

📈 If BTC rips higher, they get rekt.

One thing’s for sure—crypto never disappoints when it comes to drama.

Now we wait. 🚀

FOREX

🇺🇲 Why the US Dollar Keeps Dropping

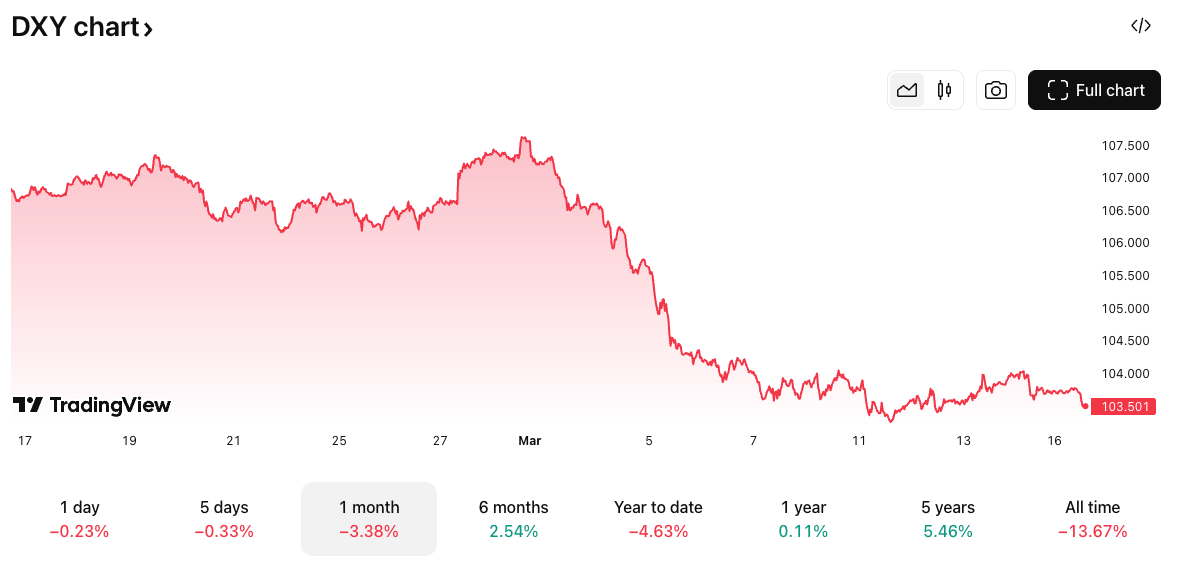

The Dollar Index (DXY) is down to 103.462, and traders are starting to take notice. Here’s why the greenback is losing steam.

1️⃣ Trade War Jitters

Trump’s tariff threats (including a 200% tax on EU wine) are spooking investors. Net-long dollar positions—once at decade highs—are shrinking fast as traders brace for economic fallout.

2️⃣ US Economy Wobbling?

Recession fears are creeping in. Consumer spending and manufacturing data have been mixed, and the once-overcrowded dollar trade is starting to thin out as investors weigh the risks.

3️⃣ Fed Rate Cut Expectations

Markets expect rates to fall throughout 2025.

Lower rates = weaker USD, as capital flows into higher-yielding foreign assets.

4️⃣ Profit-Taking After a Massive Rally

The dollar soared in late 2024, and now traders are cashing in. Some of this decline is just healthy profit-taking after a strong run.

The Bottom Line

Yes, the dollar is dropping—but it’s still strong compared to other currencies.

👀 Watch these catalysts:

✅ Fed’s rate cut timeline – A dovish pivot would push the dollar lower.

✅ Trade war developments – More tariffs = more dollar weakness.

For now, USD bears are in control, but the big question remains: How low can it go? 🚨

PROP FIRMS

🤑 Monday Motivation

Payout no 32 && 33 with @fundingpips | Bi-weekly && monthly payouts ☑️ , @Khldfx 🙂🤝

— Mohammed 🇲🇦 (@vikingtradingfx)

10:38 AM • Mar 12, 2025

🚀 Pre-Market Fuel

Canada’s growth versus other countries. This is an interesting chart and shows just how disastrous a dollar-for-dollar tariff policy would be for Canada.

Joe Biden’s presidential pardons are void? Apparently, he didn’t sign them by hand, and Trump is declaring that that makes them void. This should get interesting…

Current interest expense of the US government. Why can’t my stock portfolio look like this?

Feeling lucky? Join this new prop firm challenge giveaway.

🍪 Munchy Memes

2025 Buyer right now :

— naiive (@naiivememe)

7:53 PM • Mar 13, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER