- Pip Munch

- Posts

- 📉 The Fed. The War. The Chaos.

📉 The Fed. The War. The Chaos.

Want to trade without risking your own cash? Lark Funding gives you simulated capital to trade—plus up to 90% profit splits, no hidden rules, and instant payouts.

Use code JUNE15 for 15% off + a 125% refund on your next challenge.

☕️ GM Munchers! Happy Monday! Nothing says "fresh start to the week" like geopolitical tension, oil spikes, and the Fed looming like an unpaid parking ticket.

On today’s menu:

📉 The Fed. The War. The Chaos.

🔥 Oil’s on Fire (and Not Just Figuratively)

🧑✈️ Boeing Feels The Pain

😬 Inflation Vs Manhattan

👀 Everybody Is Holding Stocks

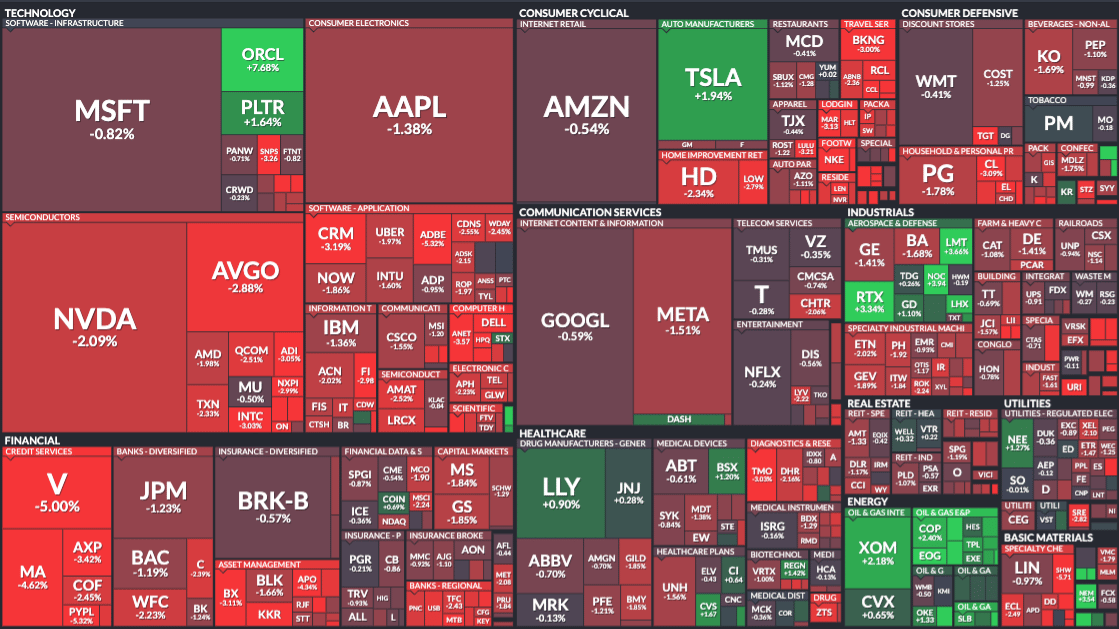

Friday’s numbers:

S&P 500 | 5,975 | -1.13% |

Nasdaq | 19,406 | -1.30% |

Dow Jones | 42,197 | -1.79% |

Bitcoin | $105,955 | +0.30% |

BREAKING NEWS

🔥 MARKET MELTDOWN: ISRAEL, IRAN & THE “PLEASE STOP” DIPLOMACY

Things got tense on Friday—like "meet the in-laws for the first time" tense.

Markets got smacked as Israel and Iran continued launching strikes at each other. Stocks tumbled, oil spiked, and risk sentiment went full-on risk-off.

But by the end of the day, the mood flipped slightly as both sides hinted at a ceasefire: Trump said a peace deal is “easily” doable, and Iran’s Foreign Minister said they’d halt strikes if Israel stops first.

BREAKING: Iran's Foreign Minister says Iran will halt its strikes on Israel if Israel ceases its strikes on Iran.

Just hours ago, President Trump said "we can easily get a deal done between Iran and Israel."

— The Kobeissi Letter (@KobeissiLetter)

10:08 AM • Jun 15, 2025

Classic “you hang up first” energy.

🛢 JP Morgan says oil could hit $130 if things escalate

📈 That could double U.S. CPI inflation to ~5%

✂️ Rate cuts? Delayed even more

🚫 Worst case: Strait of Hormuz shutdown = chaos in global supply chains

Economic ramifications of Israel/Iran conflict:

1. Oil prices could rise as high as $130/barrel, per JP Morgan

2. Iran currently produces 3.3 million barrels of oil per day, or ~3.5% of global supply

3. Oil at $130 would likely double US CPI inflation to ~5%

4. Interest rate

— The Kobeissi Letter (@KobeissiLetter)

2:13 PM • Jun 15, 2025

What to watch: If peace talks hold, expect oil to cool and risk appetite to return. If missiles keep flying, buckle up—safe havens like gold and USD could catch bids, while equities eat dirt.

📅 THE WEEK AHEAD: ALL EYES ON WEDNESDAY’S FED MEETING

The Fed meets this Wednesday, and it’s less about what they do (they’re holding steady) and more about what they say. Everyone’s watching the infamous dot plot and updated forecasts.

Why?

• Unemployment is creeping higher

• Inflation is cooling down

• Traders want cuts, but Powell’s holding the line… for now

If the Fed signals cuts later this year (September is the street’s favorite guess), markets could rip. If they keep talking tough, don’t be surprised if risk appetite shrivels up like my plants when I said I’d water them “later.”

🌏 GLOBAL CENTRAL BANK BONANZA

It’s not just the Fed in the spotlight this week. Here’s what else is cooking:

🇯🇵 Bank of Japan — Decision Tuesday

• Expected to hold steady

• Still ultra-dovish, slightly allergic to rate hikes

• Yen weakness in play, depending on Israel-Iran talks

🇬🇧 Bank of England — Thursday

• Likely to hold, but with growing pressure from soft inflation

• GBP reaction depends on tone more than action

🇨🇭 Swiss National Bank — Thursday

• Forecasting a 25bp cut

• That would take policy rates to 0.00%

• CHF could weaken off the news

Translation? The global pivot to rate cuts is underway... just not in the U.S. yet.

Watch FX pairs this week:

USD/JPY 🇺🇲

GBP/USD 🇬🇧

USD/CHF

BROUGHT TO YOU BY

🤑 He Turned a Challenge Account Into a $6,725.70 Payout

One of our readers, Duan, just walked away with a $6,725.70 profit share from his simulated funded account at Lark Funding.

No payout delays.

No weird consistency rules.

Just a clean setup built for traders who can perform under pressure.

Here’s how it works: Lark Funding provides simulated funded accounts, where traders can prove their skills and earn a share of the simulated profits—without risking their own money.

If you’ve never taken a prop firm challenge before, this might feel new. But for traders looking to level up without draining their personal account, it’s quickly becoming the smartest play on the board.

👉 LarkFunding.com — take a look and see if you’re ready to turn performance into payout.

PS: Code JUNE15 will get you 15% off and a 125% refund on your 1st payout.

COMMODITIES

🔥 Oil’s on Fire (and Not Just Figuratively)

BREAKING: Oil prices surge nearly +5% as markets open for the first time Friday as geopolitical tensions escalate between Iran and Israel.

— The Kobeissi Letter (@KobeissiLetter)

10:02 PM • Jun 15, 2025

Oil just pulled a Bitcoin—spiking nearly 5% as Monday trading kicked off, thanks to the latest flare-up between Israel and Iran. Israeli airstrikes reportedly hit Iranian nuclear and energy facilities, and Iran hit back, sending crude traders into full panic mode.

Here’s what’s driving the spike:

Direct hits on Iranian oil infrastructure = immediate fears of supply disruptions

Strait of Hormuz risk = 20% of global oil flows through it, and it’s now a geopolitical Jenga tower

Regional war worries = Higher oil prices + lower risk appetite across the board

Translation? The market’s doing that “uh-oh” thing again.

Why it matters:

This could delay rate cuts if oil inflation creeps into CPI

Safe-haven assets like gold and USD are up

Stocks are skittish, because no one wants to hold risk when oil jumps + missiles fly

What traders should watch:

Headlines: Peace talks = potential oil dump. More attacks = more FOMO for crude.

Safe-haven flows: Watch gold, bonds, and the dollar.

Energy stocks: XLE just became the main character.

It’s a big geopolitical mess—but if you’re nimble and watching the tape, this could be one of those rare “chaos = cash” weeks.

Now if only my wife would believe that “watching oil futures” counts as quality time.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

$BA ( ▼ 0.82% ) After last week’s Air India crash, Boeing is in PR survival mode. The airline ordered inspections on all 787s, and now Boeing has slashed its 20-year jet demand forecast. Translation: investor confidence is grounded, and so are a lot of planes. No word yet on whether the turbulence extends to their earnings guidance.

$SBUX ( ▼ 0.06% ) Starbucks’ CEO is still trying to fix the company’s vibes. The new plan? More indoor seating, more full-time assistant managers, and a desperate attempt to win back employee morale. Apparently “burnt coffee and burnout” isn’t a sustainable culture model.

$META ( ▼ 1.34% ) Meta just poached the 28-year-old founder of Scale AI to run their brand-new $14.3B Superintelligence Lab. Zuck’s going full Iron Man mode—college dropout edition. The goal? Beat OpenAI at its own game. Who knew the next arms race would be fought in GPU clusters and protein shakes?

$COIN ( ▼ 2.88% ) Coinbase and Shopify are teaming up to let e-commerce merchants accept USDC. Stablecoin payments, mainstream rails. If you ever bought a hoodie and thought “this should settle on-chain,” your moment has arrived.

🚀 Pre-Market Fuel

🍪 Munchy Memes

Nobody:

mfs with a $5 bet on Polymarket about nuclear wars

— naiive (@naiivememe)

1:18 AM • Jun 16, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER