- Pip Munch

- Posts

- 🤑 The Largest Payout In Prop Firm History

🤑 The Largest Payout In Prop Firm History

Tired of waiting weeks for your payout?

Lark Funding gets you paid fast. Under 6 hours, on average. No delays. No fluff. Just raw spreads, fast payouts, and up to 90% splits.

☕️ GM Munchers! Yesterday the market felt as relieved as I do when I find out I don't need to go to my in-laws for dinner on the weekend.

On today’s menu:

📈 Markets Rally On Potential Trade Deal

🤑 The Largest Payout In Prop Firm History

📊 Earnings Are In: What They’re Telling Us

🚀 Trump’s Meme Coin Explodes

👀 Neuralink Tries To Raise $500 Million

BREAKING NEWS

📈 Markets Rally On Potential Trade Deal

Traders, the markets rallied harder than my mother-in-law after a margarita.

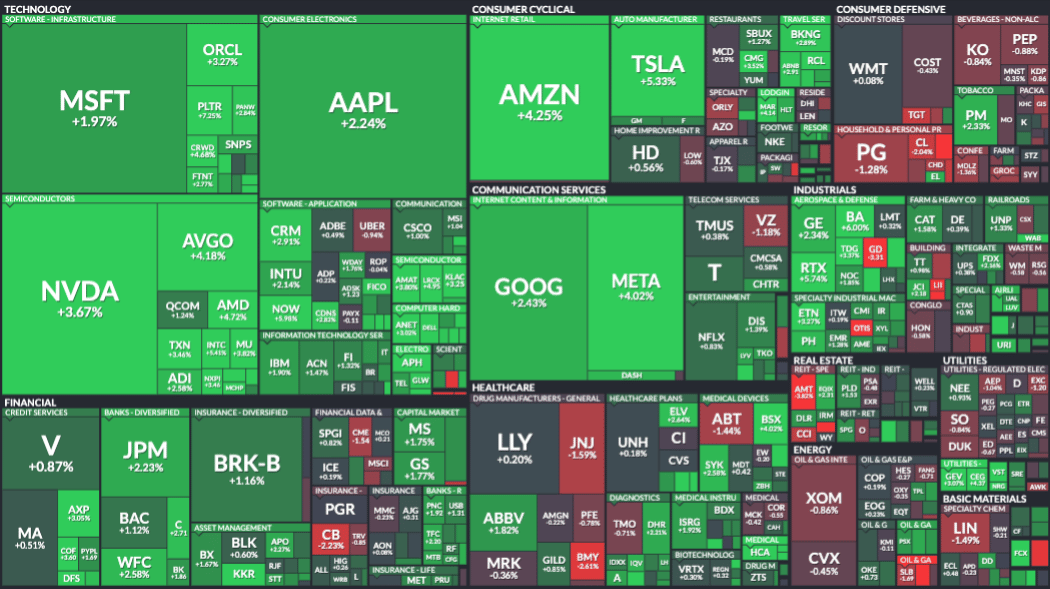

The Dow jumped 419.59 points (+1.07%), the S&P 500 climbed 1.67%, and the Nasdaq led the pack with a +2.5% gain.

At one point, the Dow was up over 1,100 points and the S&P was flirting with +3.44%. Then reality set in and we cooled off—but the gains still held.

So what caused this sudden mood swing?

👴 Trump said that the current 145% tariffs on China are “very high, and it won’t be that high… No, it won’t be anywhere near that high. It’ll come down substantially. But it won’t be zero.” Which, coincidentally, is also how I describe my win rate on reversal trades.

💬 Treasury Sec. Bessent added that there’s a real shot at “a big deal” with China. Meanwhile, whispers emerged about the White House potentially lowering China tariffs to 50–65%.

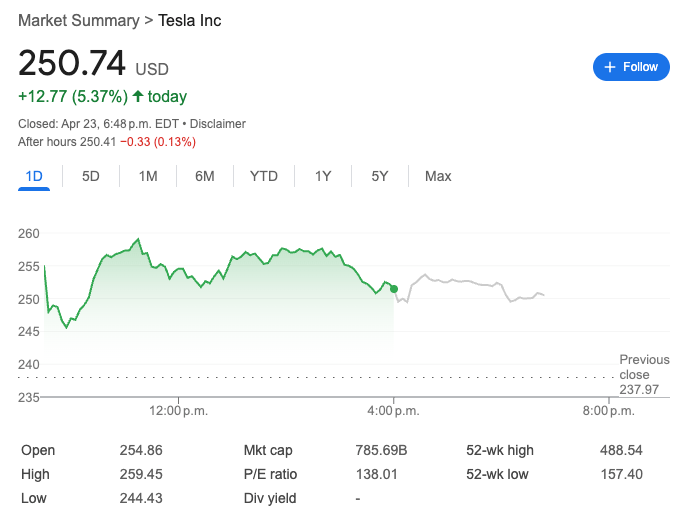

All of this came as Tesla stock rallied 5%, not because their earnings were good (they weren’t—revenue fell 20%), but investors continue to believe Tesla’s future is in autonomous driving and robots.

Oh, and the market is happy that Elon will be spending less time at the White House.

In short: Markets were relieved. ✅

Stocks tied to China—like Apple (+2.2%) and Nvidia (+3%)—jumped, and investors got the dopamine hit they’ve been begging for.

BROUGHT TO YOU BY

Other firms take days. Lark Funding takes hours.

Lark Funding was built for traders who don’t like to wait.

Payouts hit in under 6 hours—even on weekends.

Pick your path: 1-step, 2-step, 3-step, or Instant.

Get up to $600K in funding.

Keep up to 90% of what you earn.

Fast evaluations. Fast scaling. Fast payouts.

No drama. No delays.

PROP FIRMS

🤑 $2.55 Million. One Trader. One Prop Firm.

I just received the BIGGEST single payout in prop firm history from @ApexTradeFund this morning.

A lifetime of consistent efforts, battling through the darkest moments of life, self-doubt, depression, anger..

It all happens for a purpose.

Keep going. 📈🆙

— JadeCap (@jadecap_)

2:20 PM • Apr 22, 2025

Sometimes my trading is so rocky I’m eating ramen like it’s a delicacy.

But you know who isn’t?

@jadecap — the trader who just secured the largest payout in prop firm history.

The amount?

$2,552,919.67.

Nope, not a typo. And no, it didn’t come from YOLOing into a meme coin.

It came from Apex Trader Funding — one of the biggest names in the game.

We don’t know exactly what trades he took, but we do know this:

They were good enough to trigger a wire transfer that could make your broker faint.

The payout lit up Twitter like a Christmas tree.

Traders were reposting it with a mix of awe, jealousy, and silent Googling of “how to pass a prop firm challenge.”

And hey, we get it.

Most prop firm payouts don’t even sniff seven figures.

Industry average? Around 4% of account balance.

Unless @jadecap was trading $50 million (which, let’s be honest, he wasn’t), this was elite-level execution.

It’s a reminder:

All those losing streaks, drawdowns, and “I should just become a plumber” moments…

They can still lead to something huge.

We’re not saying you’ll hit $2.5M.

But if you do, dinner’s on you.

MARKET ANALYSIS

📊 Earnings Are In: What They’re Telling Us

At Pip Munch, we’re all about pro trading tips — and here’s a big one:

Earnings reports are one of the best leading indicators of where the economy is headed.

Doesn’t matter if you’re a EUR/USD 1-min scalper or a commodities swing trader. You’re not just trading charts — you’re trading sentiment, and earnings are a direct pipeline into it.

Here’s what earnings told us this week:

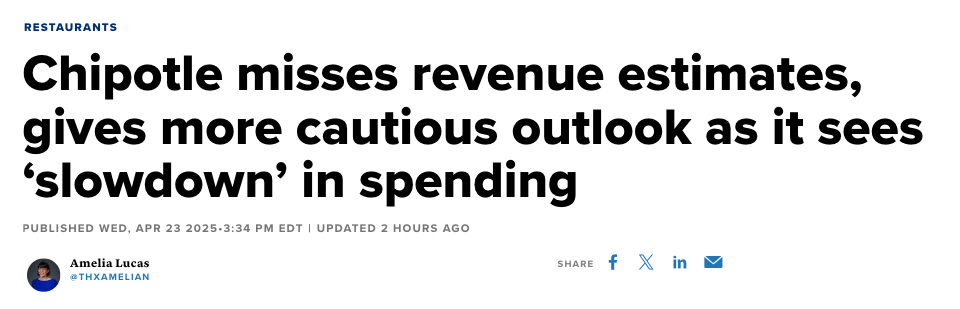

🍔 Chipotle: People Are Cutting Back

Revenue: $2.88B vs. $2.95B expected

Same-store sales: fell 0.4% (first decline since 2020)

Result: Stock dropped 5% in extended trading

CEO Scott Boatwright cited a slowdown in consumer spending. Not great when burritos are suddenly considered a luxury.

🛫 Airlines: Macro Uncertainty Takes Flight

Alaska Airlines expects a 6-point revenue hit in Q2 due to “softer demand”

Earnings miss: -$0.77/share vs. -$0.75 expected

Southwest beat Q1 estimates but pulled 2025 and 2026 guidance

Revenue flat to down 4% expected in Q2

Citing "macroeconomic uncertainty" and weaker bookings

Travel demand is not collapsing, but airlines are clearly nervous. If you're trading oil or airline stocks — take note.

🖥️ IBM: The Bright Spot

Earnings per share: $1.60 vs. $1.40 expected

Revenue: $14.54B vs. $14.4B expected

Maintained full-year guidance, despite calling the economy "fluid"

Stock has risen 11% this year, outperforming the Nasdaq (-14%)

While IBM's infrastructure biz declined 6%, software and consulting held strong.

🧠 Trader Takeaway:

The consumer is slowing. Airlines are nervous. But IBM is still flying high. Welcome to the world’s most confusing economy.

If you’re waiting on some clean macro signal, don’t. Sentiment is messy. That’s why you need to be the one who interprets the tea leaves — and right now, those leaves say: Trade war risk down, consumer demand softening.

Stay nimble. And maybe keep some ramen on standby.

PROP FIRMS

🤑 Thursday Motivation

Read the above story. A $2 million payout is enough motivation for today. 😂

🚀 Pre-Market Fuel

🥖 Trump’s meme coin surged 50% after the top holders were offered a dinner with him.

👶 Trump is thinking about giving out $5,000 baby bonuses to boost the declining birth rate.

😬 On May 5th, the government is going to begin collecting on late student loan payments.

🧠 Neuralink is trying to raise $500 million at an $8.5 billion valuable.

🍪 Munchy Memes

Bookmark this for June

— Lark Davis (@TheCryptoLark)

7:16 AM • Apr 23, 2025

My accountant watching me finally execute a $20 profitable trade

— naiive (@naiivememe)

7:42 AM • Apr 23, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER