- Pip Munch

- Posts

- 📉 The US Dollar Is Crashing

📉 The US Dollar Is Crashing

Looking for a prop firm that actually pays you more when you win? Meet Lark Funding — where traders get up to 90% profit splits, payouts in under 6 hours, and zero hidden rules.

☕️ GM Munchers! I hope your morning is going better than mine. I asked my wife if she wanted to hear today’s market recap. She said she’d rather listen to the fire alarm.

On today’s menu:

📉 The US Dollar Is Crashing

🏘️ Do Housing Prices Impact Your Trades?

🧵 Amazon, Uber & Reddit

❌ California Is Coming For Your Crypto

👀 JP Morgan Offering Bitcoin Loans?

Yesterday’s numbers:

S&P 500 | 5,970 | +0.00% |

Nasdaq | 19,460 | +0.32% |

Dow Jones | 42,427 | -0.22% |

Bitcoin | $104,694 | -0.67% |

BREAKING NEWS

📉 The US Dollar Is Crashing

BREAKING 🚨: U.S. Dollar

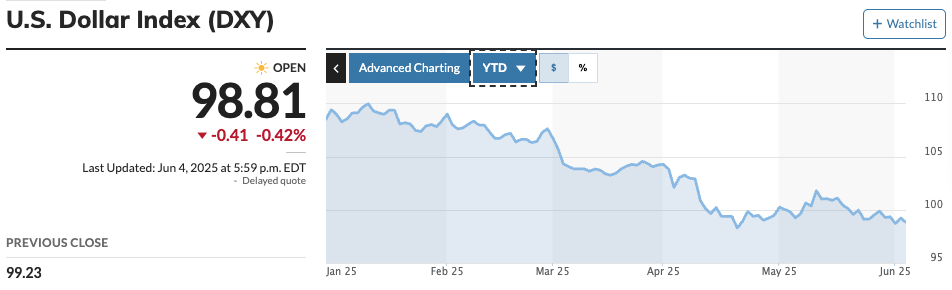

The USD has now lost almost 9% of its value this year 📉💸

— Barchart (@Barchart)

5:46 PM • Jun 4, 2025

There’s a silent crash happening—and no one’s talking about it.

It’s not stocks. Not Bitcoin. Not even my marriage after I forgot to take out the trash again.

It’s the US Dollar. 🇺🇲

Yep, the world’s reserve currency has lost nearly 9% of its value this year—and we’re only halfway through 2025.

So… what’s going on? Will it keep crashing? And what does it mean for your trades?

Let’s break it down 👇

🗣️ Trump Wants Cuts, Like Now

BREAKING: President Trump says Fed Chair Powell is "unbelievable" and "must now lower rates."

This comes minutes after the ADP Employment report showed the weakest job growth number in 2+ years.

Powell continues to state he is in "no hurry" to cut rates.

— The Kobeissi Letter (@KobeissiLetter)

12:25 PM • Jun 4, 2025

After the weakest ADP jobs report since March 2023 (just 37K vs. 110K est), Trump lit up Truth Social like a teenager after a breakup.

“ADP NUMBER OUT!!! ‘Too Late’ Powell must now LOWER THE RATE.”

He’s blaming Fed Chair Jerome Powell for dragging his feet and “hurting growth,” arguing that holding rates high gives China the upper hand. Powell, meanwhile, wants to wait for better data. Traders? They just want some clarity.

📉 Why it matters:

Rate cuts = weaker USD = risk-on across equities, crypto, and EMs.

But if Powell holds steady? That uncertainty fuels volatility instead of rallies.

📊 Weak Data, Weaker Dollar

Traders didn’t need Trump’s rant to see the slowdown. The Beige Book flagged a softer economy. ADP jobs missed. ISM services missed.

The reaction?

• USD/JPY erased yesterday’s gains 📉

• Gold spiked 📈

• Yields dropped 📉

• The dollar dipped to multi-month lows 📉

So far this year, the DXY is down nearly 9%. That’s not just a bad week… that’s a macro shift in sentiment.

🧠 What Traders Should Be Watching Now

If you're only watching Powell’s lips and not what the bond market is pricing, you're doing it wrong.

Smart money is watching:

• Fed fund futures → odds of rate cuts before Q4 are rising

• USD pairs → especially USD/JPY and USD/EMFX (more downside risk)

• Commodities → weaker USD = tailwind for gold and oil

• Bitcoin → loves a dovish Fed and a melting dollar

• Global capital flows → weakening USD = rotation into Europe, EMs, and higher-yielding risk assets

🎯 Final Thought

This isn’t just about one Trump tweet or a weak jobs report. The dollar’s drop reflects a deeper shift—on inflation, growth, and faith in the Fed.

While Powell mumbles through pressers, the dollar is bleeding—and smart traders are watching.

If this continues:

→ Be long assets that love a weak dollar (gold, crypto, foreign equities)

→ Be cautious on anything that needs a strong one (importers, USD debt, the U.S. itself)

World-class traders are already repositioning.

Will you trade what’s happening… or wait until it’s too late?

TRADING STRATEGIES

🏘️ Do Housing Prices Impact Your Trades?

BREAKING: US home values saw month-over-month declines in 61% of US counties in April, the most since 2022.

This percentage has TRIPLED over the last few months, according to Reventure.

Outside of 2022, such an elevated share was last seen in the 2007-2010 period.

However,

— The Kobeissi Letter (@KobeissiLetter)

7:55 PM • Jun 4, 2025

Short answer: Yes.

Long answer: Definitely yes.

New data shows home values dropped in 61% of U.S. counties in April—the highest rate since 2022 and eerily close to what we saw during the 2008 housing crash.

But what does this have to do with forex, equities, or bonds?

👇 Let’s break it down:

💱 Forex & Macro Traders:

Rising home prices = confidence = central banks tightening = strong currency.

Falling prices = economic weakness = potential rate cuts = weaker currency.

📉 Right now?

Soft housing data could pressure the Fed to lean dovish… and the dollar's already down nearly 9% YTD.

📈 Equity Traders:

Home prices don’t just impact Zillow searches—they shift entire sectors.

🏠 Bullish housing boosts:

• Homebuilders (e.g., $DHI, $LEN)

• Construction and furniture stocks

• Consumer spending plays

📉 Bearish housing? Time to rethink exposure to retail and discretionary.

💵 Bond Traders:

Falling home prices hit mortgage-backed securities (MBS) and raise questions about economic growth.

Translation: Lower housing demand = lower yields = rate cut bets rise.

🎯 Sentiment Traders:

Housing is a core pillar of the “soft landing” narrative.

If that pillar cracks? Expect sentiment to shift fast from risk-on to risk-off.

—

Bottom line:

When housing sneezes, the market catches a cold.

If you’re not watching price trends in the real estate world, you’re missing a key signal in the macro landscape.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

$AMZN ( ▲ 1.0% ) Amazon just threw another $10B at AI, building data centers in North Carolina like it’s SimCity. They've earmarked up to $100B in capex this year—most of it going to AI. Translation: AWS isn’t just a cloud platform anymore, it’s the future of Skynet.

$UBER ( ▲ 0.83% ) Uber added Palo Alto CEO Nikesh Arora to its board. Why? Because Tesla’s dropping its robotaxi launch in Austin on June 12—and Uber doesn’t want to get caught playing Candy Crush in the backseat.

$REDDIT.X ( 0.0% ) Reddit is suing Anthropic for allegedly training its AI models on Reddit content without permission. The kicker? Sam Altman is a top investor in Reddit… and Anthropic’s biggest rival. This one’s messier than a group chat with your ex and your current.

$XAUUSD ( 0.0% ) Gold popped to $3,361 after Trump slapped 50% tariffs on steel and aluminum. Nothing says “buy precious metals” like trade wars and a little fiscal chaos.

PROP FIRMS

🤑 Thursday Motivation

Got paid 3.4k with @FTMO_com this morning😊

Big up my mentor @omor214 🐐

— Yoz (@CeoYoz)

11:23 AM • May 29, 2025

🚀 Pre-Market Fuel

🍪 Munchy Memes

DOGE trying to trim government spending

— Not Jerome Powell (@alifarhat79)

9:56 PM • Jun 3, 2025

Elon Musk after Trump said the Debt Limit should be entirely scrapped

— Not Jerome Powell (@alifarhat79)

5:34 PM • Jun 4, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER