- Pip Munch

- Posts

- 📉 The Worst Day Of 2025 (So Far)

📉 The Worst Day Of 2025 (So Far)

Today’s email is brought to you by Lark Funding – home of the new Vintage Challenge!

🚀 Happy Friday, Munchers! Or is it happy? The market just had its worst day of 2025 (so far), and while we can’t cover your trading losses, we’re here to bring some clarity to what’s going on.

On today’s menu:

😬 Is Trump Crashing the Market on Purpose?

🎢 ECB Cuts Rates & Your NFP Preview

🚨 Trump Just Made Bitcoin Untouchable

🇨🇳 Is China About To Unleash Massive Stimulus?

📉 Costco & Netflix Take A Hit

😍 Japan Lowers Taxes on Crypto

NEWS

📉 Is Trump Crashing the Market on Purpose?

Step aside, Jay Powell—there’s a new market maker in town, and his name is Donald J. Trump.

After a week of economic chaos, traders are starting to wonder: Is Trump actually trying to crash the market, or is this just another episode of “Tariff Wars: The Sequel”?

Let’s break it all down.

🚨 Trump: “I’m Not Even Looking at the Market”

When asked about the market meltdown, Trump had one response:

“I’m not even looking at the market, because long term the United States will be very strong with what is happening here.”

Translation: Forget the Nasdaq. We’re playing the long game, baby.

But investors? Yeah, they’re definitely looking at the market—and they don’t like what they see.

Investors right now

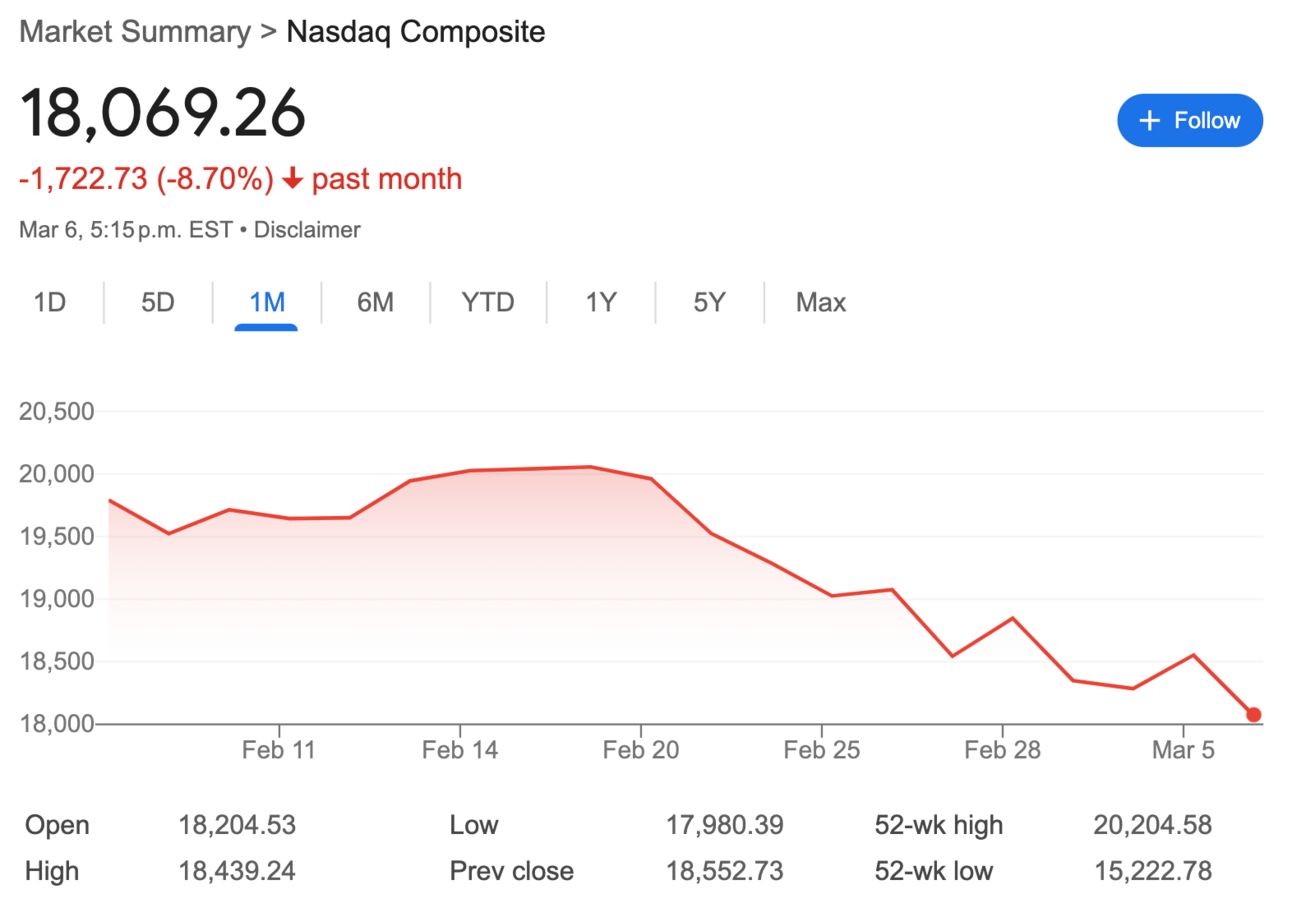

Nasdaq officially entered correction territory (down 10% from its highs).

The S&P 500 tested a major support level, triggering panic selling.

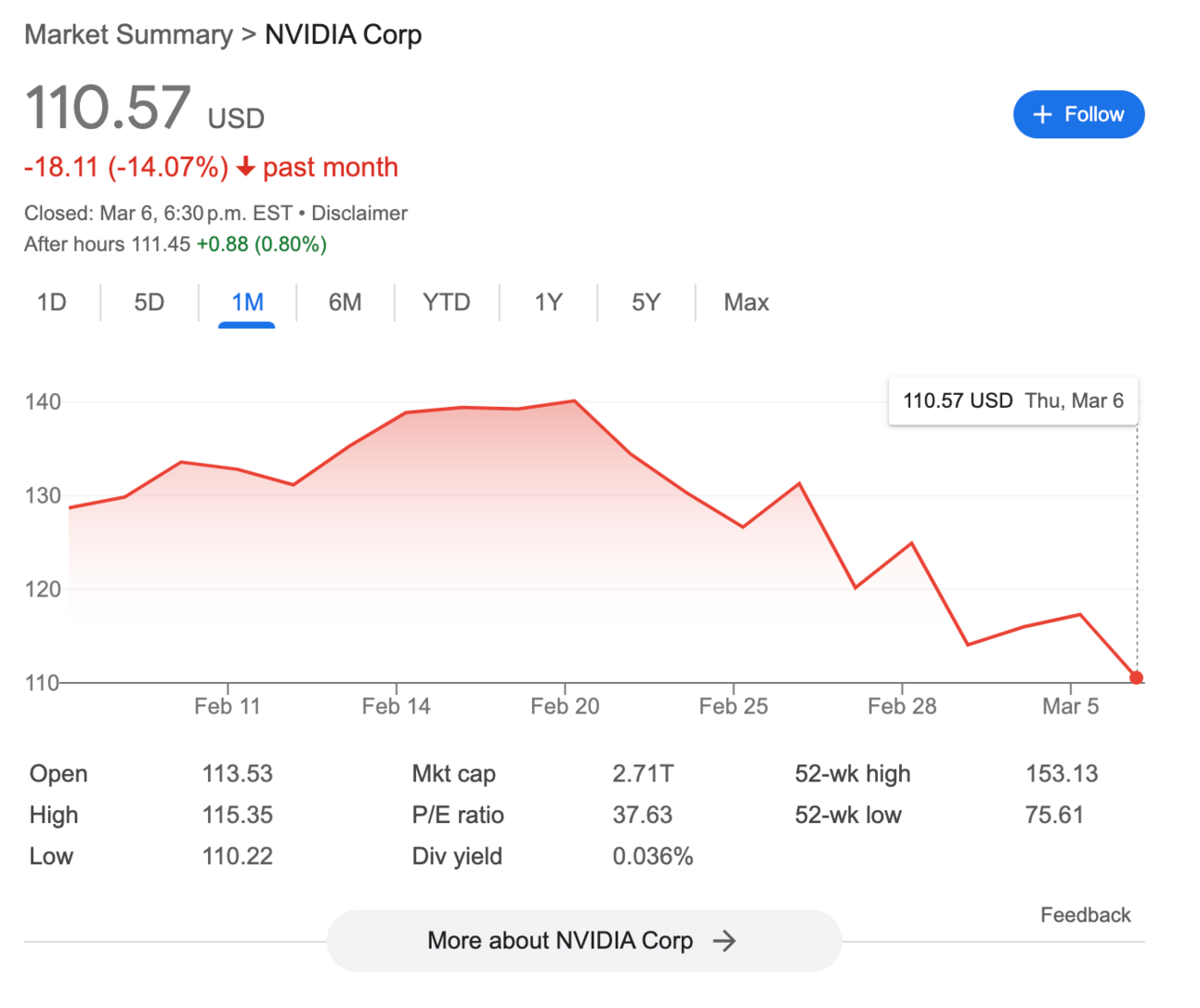

Tech stocks have been getting annihilated, with AI and semiconductor names leading the plunge.

And Trump isn’t exactly throwing them a lifeline. Instead, he’s doubling down on tariffs.

🔥 The Tariff Drama Continues

This week’s market carnage can be traced back to Trump’s latest policy playbook:

✅ Tariffs on Canada & Mexico officially took effect

✅ China threatened to retaliate, calling the new duties "economic sabotage"

✅ The U.S. granted a one-month tariff exemption to automakers (so they don’t riot)

✅ The White House hinted at more tariff exemptions—but only if other countries “do their part”

This has sent the market into a full-blown identity crisis.

Is the U.S. economy strong? 💪

Or is the labor market cooling? 🥶

Will tariffs make America great again? 🇺🇲

Or will they just make my wife’s Trader Joe bill more expensive? 😢

Which brings us to…

📉 The Nasdaq’s Big Fall

The Nasdaq didn’t just trip—it faceplanted.

It’s now down over 10% from its recent highs, officially in correction territory.

The S&P 500 barely held the “line in the sand” 200-day moving average.

BREAKING 🚨: Stock Market

S&P 500 falls below its 200D moving average for the first time since November 2023 👀 x.com/i/web/status/1…

— Barchart (@Barchart)

6:15 PM • Mar 6, 2025

Tech stocks are getting smoked, with AI and chip stocks leading the decline.

This isn’t just a “bad week” for stocks. It’s a shift in sentiment.

Why? Because markets are finally realizing that Trump’s tariffs might actually stick.

🤔 So… What Happens Next?

If we knew the answer to that, I’d be sitting on a beach drinking a margarita and counting my billions.

Nobody knows what’s next and if anybody says they do, run away from them faster than your high school bully.

But even though we don’t have a magic ball that can tell the future, here are a couple of scenarios we see playing out:

1️⃣ Will Trump blink?

If markets keep tanking, will he pull back on tariffs? History suggests… maybe.

2️⃣ Will the Fed step in?

The weaker dollar and cooling jobs data could fuel rate cut expectations.

3️⃣ Will the dip get bought?

Spoiler: It always does. But where? That’s the million-dollar question.

For traders, this is prime volatility.

Keep your eye on the headlines (and our emails), and go grab those pips.

SPONSORED BY LARK FUNDING

The Vintage Challenge is HERE – And It’s Only Available for 15 More Days! 🚨

Traders, Lark Funding just dropped the best deal in prop trading—but it won’t be around forever.

The Vintage Challenge is here for a limited 15-day run, and this is your shot to get funded at insanely low prices.

💰 $100K Challenge for just $350

💰 $200K Challenge for just $700

💰 No lock on payouts + first payout on demand

Yeah, you read that right. No waiting. No delays. Get paid when you want.

Why Lark Funding?

✅ CDBO Certified – The gold standard of regulation.

✅ 1,000+ Days in Business – We’ve been around, and we’re not going anywhere.

✅ The Best Prices in the Industry – Find a better deal, we’ll wait.

The clock is ticking ⏳—get in before the Vintage Challenge disappears on March 21st.

FOREX

🇪🇺🇺🇲 ECB Cuts Rates & NFP Is Here

The ECB just hit the gas pedal on rate cuts, and now all eyes are on the U.S. Non-Farm Payrolls (NFP) report.

The market is moving fast, so let’s break down what’s happening and why today could be a very volatile session for traders.

The European Central Bank (ECB) just cut rates by 25 basis points, bringing the deposit rate down to 2.50%. No surprises there—this was widely expected—but the real question is: What’s next?

Lagarde signaled more cuts could be on the table, but the ECB isn’t committing to a set path.

Inflation is slowing, but still sticky, meaning they’ll be watching data closely.

GDP growth forecasts were cut, reflecting concerns about slowing exports and weak consumer confidence.

Why does this matter?

Because the ECB is officially ahead of the Fed in cutting rates.

That puts pressure on the U.S. to follow suit, which makes today’s NFP report even more critical.

The U.S. Non-Farm Payrolls (NFP) report drops today at 8:30 AM ET, and traders are locked in.

Here’s what’s expected:

✅ Total NFP: 143K jobs added (prev. 160K)

✅ Private NFP: 111K jobs added (prev. 142K)

✅ Government Payrolls: 32K jobs added (prev. -20K)

✅ Participation Rate: 62.6% (unchanged)

✅ Unemployment Rate: 4.0% (unchanged)

So, why does this matter?

1️⃣ A WEAK JOBS REPORT = DOLLAR DROP & STOCKS RIP

If job growth slows more than expected, the Fed could lean toward rate cuts sooner. That’s bullish for risk assets like stocks, crypto, and gold.

2️⃣ A STRONG JOBS REPORT = DOLLAR SURGE & STOCKS DUMP

If hiring remains strong, the Fed might delay rate cuts, which could send stocks lower and the dollar higher.

3️⃣ THE WILD CARD = UNEMPLOYMENT RATE

A rising unemployment rate could add fuel to the rate-cut narrative, while a drop could spook markets into thinking the Fed will stay hawkish longer.

👀 What Traders Should Watch

If you’ve made it to Friday without blowing your account, congrats—you’re already ahead of the curve.

Now, what should you watch? Everything.

In markets like this, there’s no magic setup or single headline that tells the whole story.

It’s about trading what’s in front of you, taking what the market gives, and not getting greedy.

Keep those stops tight and get after it, Munchers.

CRYPTO

Trump Just Made Bitcoin Untouchable 🚨

Well, well, well… looks like Bitcoin just got its own Fort Knox.

Last night, Trump signed an executive order establishing the Strategic Bitcoin Reserve (SBR)—a government vault for all the seized BTC from criminal and civil asset forfeitures.

Just a few minutes ago, President Trump signed an Executive Order to establish a Strategic Bitcoin Reserve.

The Reserve will be capitalized with Bitcoin owned by the federal government that was forfeited as part of criminal or civil asset forfeiture proceedings. This means it… x.com/i/web/status/1…

— David Sacks (@davidsacks47)

12:11 AM • Mar 7, 2025

That’s roughly 200,000 BTC now off the market and locked up under Uncle Sam’s watch.

Here’s what you need to know:

✅ The U.S. government will NOT sell Bitcoin in the SBR

✅ The Treasury can create strategies to buy more BTC

✅ A U.S. Digital Asset Stockpile will also store seized digital assets beyond Bitcoin

✅ No additional Bitcoin purchases are happening (yet)

This is the first time a major government has openly declared Bitcoin as a strategic reserve asset. Six months ago, this would’ve been unthinkable.

What This Means for Bitcoin & Markets:

1️⃣ No Sell Pressure – Unlike past cycles where the government dumped seized BTC on the market (cough Silk Road cough), this BTC is staying put. That’s a huge shift.

2️⃣ Institutional Green Light – If the U.S. government is treating Bitcoin like digital gold, you think BlackRock, JPMorgan, and other big players aren’t taking notes?

3️⃣ Market Confusion – The knee-jerk reaction from traders may be negative (since there’s no new buying), but long-term? This is bullish.

The Bigger Picture

This move is more than just politics—it’s a massive validation for Bitcoin as an asset class.

If the U.S. is securing Bitcoin like it’s gold, expect other governments to follow.

The next big question: Will the government eventually start accumulating Bitcoin outright? 🤔

🚀 Pre-Market Fuel

🇨🇳 China has a GDP target of 5%. This means only one thing: Government spending. Remember, the AUD is used as a proxy to the Yuan so we could see some movement.

🌭$COST ( ▲ 1.26% ) . Their poor earnings dropped the stock 2% in after-hours.

✅ Japan lowered the capital gains tax on crypto to just 20%.

🍿 $NFLX ( ▲ 2.66% ) . The stock is down over 8% on fears that growth is slowing.

😃 Walgreens is going private. In a $10 billion deal, the private equity firm Sycamore Partners is taking over.

🍪 Munchy Memes

Trump’s economic cycle for the next 4 years

— Not Jerome Powell (@alifarhat79)

3:45 PM • Mar 6, 2025

Inverse Cramer never fails.

— Brew Markets (@brewmarkets)

6:54 PM • Mar 6, 2025

"Excuse me...I was promised a Strategic Bitcoin Reserve."

— Autism Capital 🧩 (@AutismCapital)

12:39 AM • Mar 7, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER