- Pip Munch

- Posts

- 📈 Three Days In A Row

📈 Three Days In A Row

Tired of waiting weeks for your payout?

Lark Funding gets you paid fast. Under 6 hours, on average. No delays. No fluff. Just raw spreads, fast payouts, and up to 90% splits.

☕️ Happy Friday, Munchers! The market’s been up three days in a row — which is about the same streak I’ve had avoiding a weekend IKEA trip with my wife.

On today’s menu:

📈 Markets Rally Three Days In A Row

💸 The Dollar’s Dropping — And That’s Weird

🥇 Gold To $4,000 & Oil Lower?

🚀 Google Goes Full Beast Mode

😍 Bitcoin On Exchanges Is Dropping

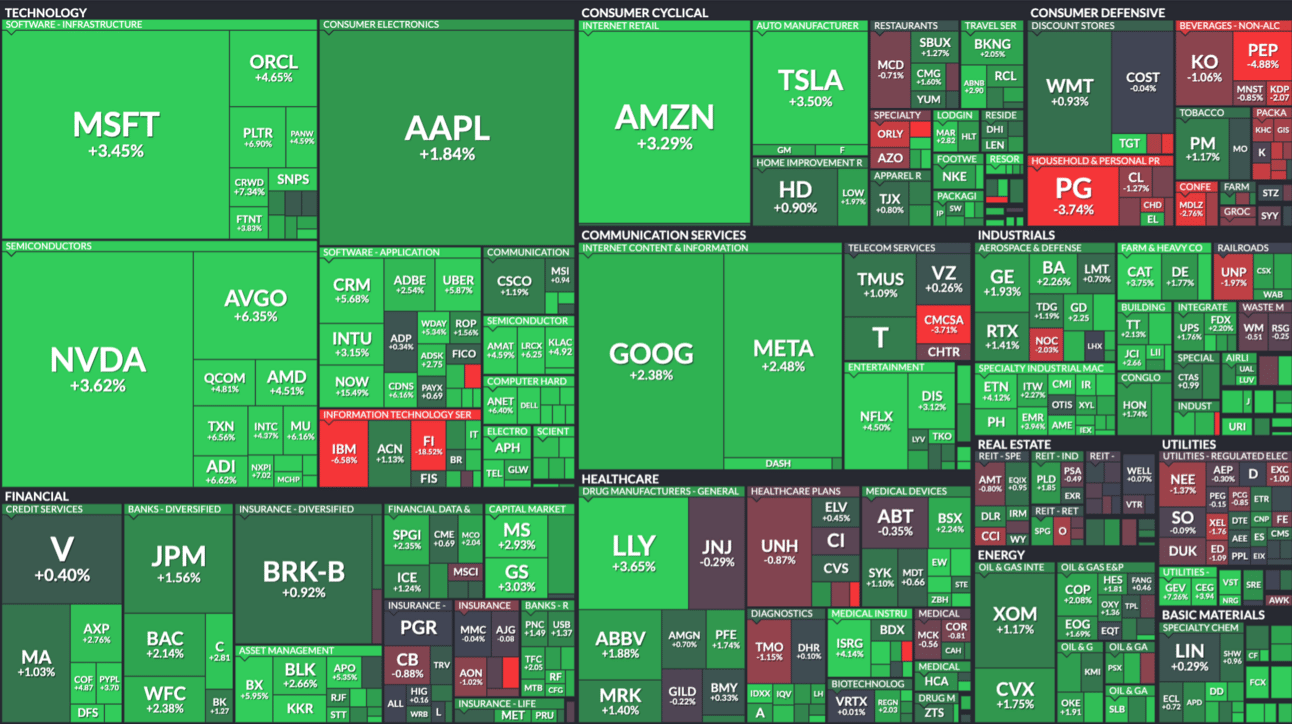

Here’s the lowdown of yesterday’s numbers:

S&P 500 | 5,484 | +2.03% |

Nasdaq | 17,166 | +2.74% |

Dow Jones | 40,093 | +1.23% |

Gold | $3,362 | +0.38% |

Bitcoin | $93,505 | -0.17% |

BREAKING NEWS

📈 Markets Rally Three Days In A Row

Well folks, the good vibes continue — markets just logged their third straight day of gains, and suddenly the economy feels about as confusing as a Forex trader’s tax return.

What’s fueling the rally?

Part of it is the same ol’ trade war soap opera.

Earlier this week, Trump said negotiations with China were “going well.” China responded like they got ghosted — saying there were no ongoing discussions.

But this morning, Trump told reporters that he did meet with China… and like magic, markets soared. Classic.

Trump yesterday: We are talking to China "every day."

China today: China and the US have not held any trade discussions, all such reports are false.

China has just effectively denied any claims of a trade deal in the making.

— The Kobeissi Letter (@KobeissiLetter)

1:36 PM • Apr 24, 2025

Tech earnings are also adding fuel. 📊

Alphabet shares jumped +5% post-earnings after beating on both the top and bottom line.

Intel, on the other hand, tripped over its own wires — falling -5% after announcing it’s cutting operational expenses and offering weak guidance.

Meanwhile, IBM reported better-than-expected earnings and revenue… and still fell -6.6%. Traders looked at the stock and said, “Cool story bro,” then hit sell.

And just to round out the madness: the US dollar dropped across the board (more on why that’s a big deal below), with the EUR, GBP, and JPY all gaining ground.

But despite the dollar weakness, this wasn’t a “sell America” day. Quite the opposite — yields fell and stocks kept climbing.

So yeah, we’ll take the win.

But in a market where tariff rumors move faster than CPI prints, just remember: the only thing more volatile than these charts… is my blood pressure after I revenge trade.

BROUGHT TO YOU BY

Other firms take days. Lark Funding takes hours.

Lark Funding was built for traders who don’t like to wait.

Payouts hit in under 6 hours—even on weekends.

Pick your path: 1-step, 2-step, 3-step, or Instant.

Get up to $600K in funding.

Keep up to 90% of what you earn.

Fast evaluations. Fast scaling. Fast payouts.

No drama. No delays.

FOREX

💸 The Dollar’s Dropping — And That’s Weird

The stock market alone would have you thinking everyone’s falling back in love with the U.S.

But zoom out — and the forex market is telling a very different story.

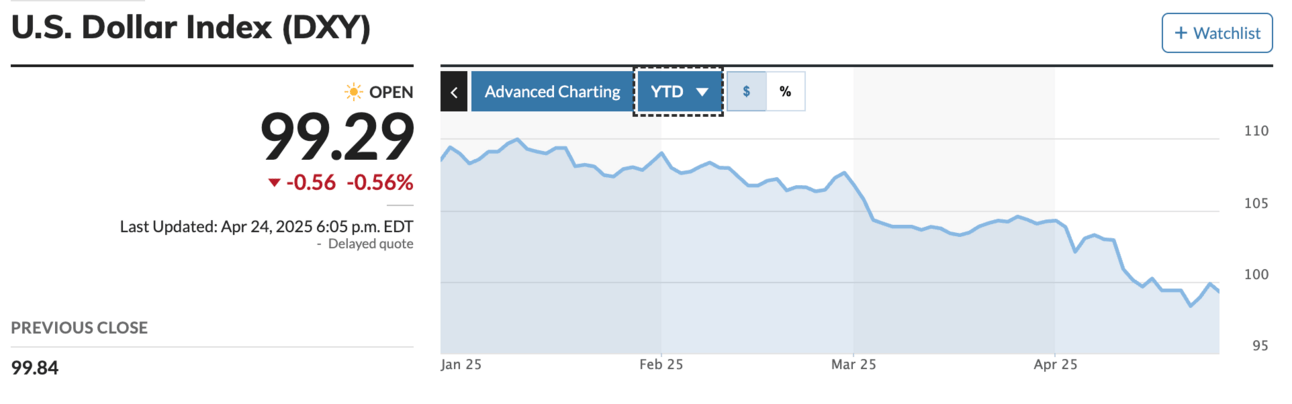

📉 The Dollar Index (DXY) is down a whopping 8.5% year-to-date. For the world’s reserve currency, that’s not a dip. That’s a faceplant.

And here’s the weird part: it’s happening even as U.S. stocks are ripping and bond yields are falling.

That’s a combo that should send the dollar up, not down. But instead, traders are bailing on USD like it's the last guy left at the trading floor Christmas party.

🧠 Why does this matter?

Because it’s a major sentiment shift.

The U.S. dollar is normally the safety blanket when things get sketchy — think war, tariffs, recessions. But instead of hiding in USD, traders are running from it.

EUR/USD is ripping. USD/JPY is struggling. And risk sentiment is acting like the dollar never existed.

Meanwhile, in Japan, things are heating up:

Tokyo CPI just came in hotter than expected, which could pressure the BoJ to actually do something for once.

And with Japanese authorities making noise about FX interventions, traders are suddenly on alert. USD/JPY just got a lot more interesting.

So what does this mean for you?

Opportunity.

Either this is just a temporary blip and the dollar returns to its throne (hello, USD buy setups)… or we’re witnessing a broader shift in safe haven dynamics.

If that’s the case? Buckle up. The market’s about to get spicy.

COMMODITIES

🥇 Gold To $4,000?

Gold’s still doing its best main character impression — climbing to $3,352.24 as traders keep piling in like it’s the only safe haven left.

Inflation fears? Central bank drama? Global weirdness? Just buy the shiny rock and hope it glows.

🛢️ Oil: The Mood Swing Asset

WTI is hanging out at $62.83, up a bit, while Brent is flat at $66.55. Traders are stuck squinting at Middle East headlines and trying to figure out if we’re going up, down, or just sideways forever.

TLDR: oil’s moody — but don’t sleep on it.

🥈 Silver’s Vibing, Palladium’s Slipping

Silver is up 0.29%, doing its usual slow grind.

Platinum dipped 0.31%.

But palladium? Down nearly 0.5%, and metals traders are suddenly paying attention — especially with EV demand potentially heating up.

💭 Big question: Is gold on its way to $4K, or is this the top?

STOCKS

🚀 Google Goes Full Beast Mode

Alphabet (GOOGL) just dropped a monster Q1 earnings report, and Wall Street is loving it. Stock popped +2.38%, riding a wave of strong numbers and big announcements:

Revenue smashed expectations, driven by robust Google Search growth and surprisingly strong cloud performance.

EPS beat analysts’ projections, signaling effective cost-cutting and margin control.

Dividends & Buybacks: Yep, they upped the dividend and greenlit a new stock buyback program—because who doesn’t love a little shareholder candy?

🧠 AI All the Way Google leaned hard into AI in the call—citing productivity tools, cloud integration, and ad targeting enhancements. Investors liked the sound of that.

👀 Munch Takeaway: Our intern has been buying the stock for months and we officially have FOMO. With it still down 15% YTD, things are about to get interesting.

PROP FIRMS

🤑 Friday Motivation

£15,000 payout received today – approved and received within just 2 hours via bank transfer, making it my fastest @FTMO_com payout yet.

Total payouts to date: £141,916.32. I’m currently max funded and have successfully scaled one of my accounts by 25% after meeting the

— Jaber (@jaber_btc)

12:48 PM • Apr 24, 2025

🚀 Pre-Market Fuel

🍪 Munchy Memes

🚨 BREAKING JIM CRAMER SAYS: "There is absolutely no way #bitcoin goes above $1 Million US dollars, i just don’t see it happening"

HOLY MOTHER OF GOD HERE WE GOOOOOO!!!!!!!

— Jason Ai. Williams (@GoingParabolic)

8:22 PM • Apr 24, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER