- Pip Munch

- Posts

- 📉 Trade War. Again.

📉 Trade War. Again.

Only 48 hours left to unlock the best prop firm deal in the industry.

Buy 1 challenge with 90% rewards + weekend holding, and Lark Funding will give you 2 bonus accounts (half the size) completely free. No payout required. No waiting. Just 3x the firepower from Day 1.

☀️ Happy Monday, Munchers! Markets are open, coffee’s brewed, and I’m emotionally prepared to be wrong again before 9:35am.

On today’s menu:

📉 Trade War. Again.

🥇The New #1 Prop Firm Promo

🌍 Global Debt Hits $324 Trillion

❌ Is FTMO Banning Traders?

😬 Are Stocks Massively Overpriced?

Friday’s numbers:

S&P 500 | 5,911 | +0.00% |

Nasdaq | 19,113 | -0.32% |

Dow Jones | 42,270 | +0.13% |

Bitcoin | $105,000 | +0.42% |

BREAKING NEWS

📉 Trade War. Again.

Trump just doubled U.S. tariffs on steel imports — from 25% to 50%. The EU isn’t happy. They’re already threatening countermeasures and said new tariffs could hit by July 14 if a deal isn’t reached. Canada’s steelworkers? Also fuming.

BREAKING: US Commerce Secretary Lutnick says tariffs are “not going away.”

— The Kobeissi Letter (@KobeissiLetter)

2:24 PM • Jun 1, 2025

Translation? Global trade tensions are heating up again, which usually means investors move from “risk on” (buy stocks, buy high-yield FX) to “risk off” (buy USD, JPY, gold, or stare at the chart praying for a reversal).

But here’s the twist: Markets haven’t fully flipped risk-off yet. The tariff hike adds uncertainty, but oil is falling, crypto’s still relatively strong, and equities aren’t puking.

What traders should watch:

USD strength vs EUR and CAD

Steel-related equities and industrials

Whether tit-for-tat headlines escalate or fizzle

Sentiment isn’t clean right now. It’s like our trading journal: all over the place.

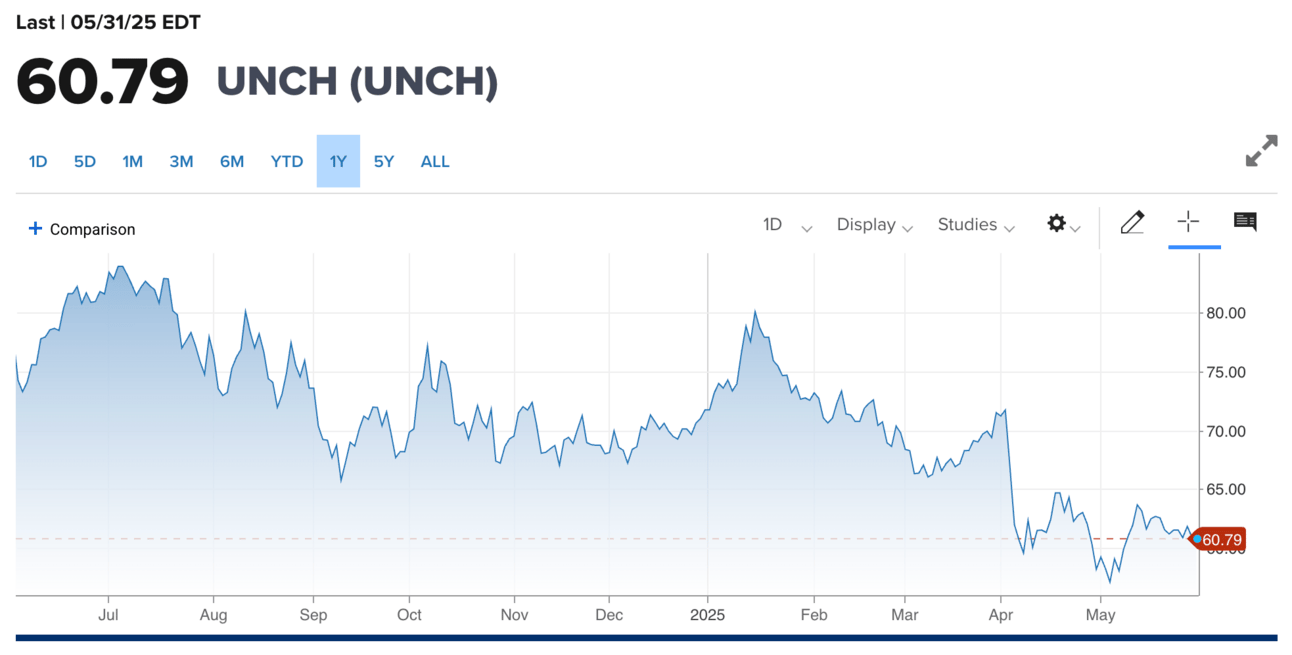

🛢️ Oil Just Can’t Catch a Bid

WTI crude just dropped to ~$60/barrel — the lowest since early 2021. What’s tanking it?

OPEC+ keeps flooding the market. Another 411,000 barrels/day are being added for July, despite a backdrop of shaky global growth and oversupply concerns. Saudi Arabia and Russia are basically yelling “market share or die” while punishing over-producers like Iraq and Kazakhstan.

Why it matters:

Falling oil hurts commodity currencies like CAD and NOK

Weaker oil demand = traders expecting weaker global growth

Lower oil = lower inflation pressure = maybe more dovish central banks

🧵 Plain-English Play:

Watch CAD pairs for downside setups

Risk sentiment may tilt more neutral-to-negative if oil keeps bleeding

Don’t buy oil dips blindly — this is a supply glut, not a flash crash

🇨🇦 Bonus: Gas prices in Canada just hit their cheapest level (inflation-adjusted) in nearly a decade. Good news if you drive to the charts when you’re emotional.

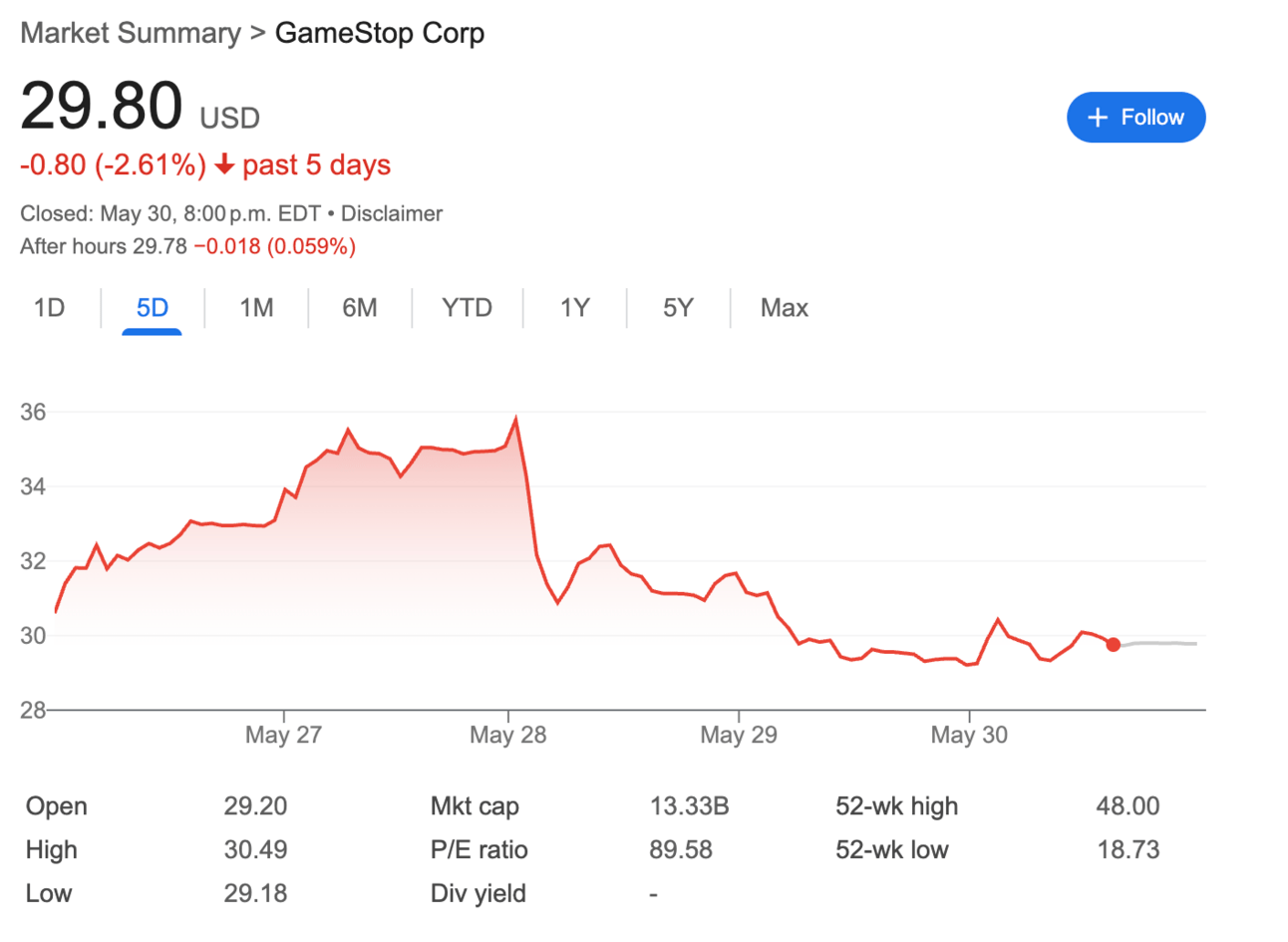

₿ Bitcoin Treasuries Are the New Flex

Michael Saylor’s “buy every dip, then buy the dip’s dip” BTC strategy is spreading.

Trump Media and GameStop both announced plans to stack Bitcoin. Saylor’s own firm (Strategy) has 42,000+ BTC and is now worth over $60 billion — up 26x since late 2022.

Orange is my Preferred Color

— Michael Saylor (@saylor)

12:27 PM • Jun 1, 2025

This isn’t just a corporate trend. Trump signed an executive order establishing a Strategic Bitcoin Reserve, and Vice President JD Vance said the quiet part out loud: “Bitcoin is digital capital and maybe the most explosive idea of the era.”

BTC is still holding above $100K (now ~$104K, off its ATH of $112K), but the bigger story is adoption.

Why it matters:

This builds institutional demand floor for BTC

Could shift long-term sentiment bullish even if short-term chops

Alts may start rallying again if BTC remains stable and dominant

🧵 Plain-English Play:

BTC holding $100K = strong support

Meme stocks with BTC treasuries = high beta plays

More headlines = more momentum (especially around elections)

And yes, we’re still trying to buy the dip — after missing the dip before that dip.

SPONSORED BY LARK FUNDING

You’re Not Seeing Triple — We’re Just Built Different

🚨 Our 3-Year Anniversary Promo is LIVE 🚨

Buy 1 challenge, get 2 bonus accounts — half the size, 100% free.

Example: Buy a $100K challenge, get 2 x $50K challenges. No strings. No payout required.

Valid on $10K, $100K, $200K accounts.

Code: 3YEARTRIPLE— larkfunding (@larkfunding)

11:12 AM • Jun 1, 2025

To celebrate 3 years of funding traders, Lark’s running the best promo in the industry: Buy 1 challenge, get 2 bonus accounts (half the size) absolutely free.

Example: Buy a $100K challenge, get two $50K challenges on us. No payout needed. No gimmicks.

✅ Works on $10K, $100K, $200K

✅ Valid on 1-Step, 2-Step, and 3-Step

❌ Not available for Instant Funding

⚠️ Ends in 48 hours

Just select 90% rewards + weekend holding and use code 3YEARTRIPLE at checkout.

BIG PICTURE

🌍 Global Debt Hits $324 Trillion — What It Means for Your Trades

Global Debt hits new all-time high of $324 Trillion 🚨🚨

— Barchart (@Barchart)

8:41 PM • Jun 1, 2025

The world just racked up a casual $324 TRILLION in debt. That’s trillion with a “T,” as in: "The T-bills are getting terrifying."

Here’s the deal:

Governments, companies, and households have been borrowing like rates will never rise again.

But surprise: yields are rising, inflation’s still lurking, and central banks are stuck between a debt bomb and a rate hike.

🧠 Why traders care:

Bonds: Expect higher yields, more volatility, and “bond vigilantes” if confidence cracks.

Currencies: Weak fiscal countries = weak FX.

Equities: High debt + high rates = lower valuations, especially in rate-sensitive sectors.

👀 What to watch:

Risk-on rallies could fizzle fast.

Central banks forced into soft landings... or hard faceplants.

So yeah, global debt just made risk-on trading a bit like my marriage during earnings season: fragile and full of surprise selloffs.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

$HIMS ( ▼ 6.92% ) Telehealth startup Hims is trimming 4% of staff after the U.S. banned mass production of generic Wegovy. Turns out, cutting workforce is the only thing slimming down faster than weight-loss meds right now.

$F ( ▼ 2.22% ) Ford just recalled 29,000+ F-150 Lightnings due to a rogue control arm that might detach and cause... you know, no steering. Great for off-roading, not ideal on highways.

$GOOGL ( ▲ 1.43% ) Critics say Waymo can’t scale its robotaxi biz. Judging by this video, they might be right — unless the goal is to provide scenic, 4-hour tours of the same intersection.

$UNH ( ▲ 2.31% ) UnitedHealth is in freefall, hitting its most oversold level since 2008. Traders are starting to look at this chart the way my wife looks at my credit card statement: horrified but weirdly intrigued.

$TLT ( ▲ 0.61% ) Big money’s running to safety: $1.8B poured into long-duration bonds via $TLT last week. That’s the biggest ETF inflow in the game — bond dads are back.

PROP FIRMS

❌ Is FTMO Banning Traders?

🚨 How FTMO use their solid reputation to secretly ban traders

I started using FTMO last year. My trading was on the riskier side, I had some good trades but I was mainly blowing accounts.

I finally managed to pass an account at the beginning of this year, and...

(Thread 👇)

— Professional HODLer (@VladTheForexer)

12:52 PM • May 31, 2025

🚀 Pre-Market Fuel

🍪 Munchy Memes

My plan was to make $100,000 trading this year.

$152,000 to go…

— Not Jerome Powell (@alifarhat79)

6:10 PM • May 30, 2025

Every single time

— Thomas Fahrer (@thomas_fahrer)

11:32 PM • May 30, 2025

Dog goes viral after accidentally adopting himself at a stoplight

— This Account Makes You Happy (@FeelYouHappy)

5:50 AM • Jun 1, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER