- Pip Munch

- Posts

- 📉 Trade War Over

📉 Trade War Over

Want to make more money from trading? Stop trading your small $500 account. It’s not going to go anywhere. The answer? Prop firms.

☕️ GM Munchers! I can't get my wife to acknowledge my existence before 9 AM but Trump can convince NATO to negotiate over Greenland? Some men command respect. Some men get reminded to take out the trash. Guess which category I'm in.

On today’s menu:

📉 TACO Trade Strikes Again

😢 Gold & Silver Crash on Peace News

🍅 Berkshire Dumps Heinz

💊 Tesla Insurance & Amazon’s Health AI

🇺🇲 US Home Sales Are Crashing

Yesterday’s numbers:

S&P 500 | 6,875 | +1.16% |

Nasdaq | 23,224 | +1.18% |

Dow Jones | 49,077 | +1.21% |

Bitcoin | $90,000 | +2.00% |

BREAKING NEWS

📉 TACO Trade Strikes Again: Markets Rip on Trump's Latest U-Turn

Remember when we said every single morning that we believe in the TACO trade—Trump Always Chickens Out? Yeah, about that. We were right. Again.

What happened: Trump announced at Davos he's canceling the 10% tariffs on eight European countries that were supposed to start February 1st. The same tariffs he threatened just days ago. The same ones that sent markets into a meltdown Monday.

His reasoning? He "formed the framework of a future deal" with NATO Secretary General Mark Rutte regarding Greenland and "the entire Arctic Region."

Translation: He got absolutely nothing concrete but needed an off-ramp before markets imploded further.

The market's response: Stocks launched into orbit. Tech stocks like Nvidia and AMD led the comeback as investors remembered that diplomatic normalcy still exists somewhere in this timeline.

The Munch Take: Our necks hurt from the whiplash, but our portfolios are grateful we held cash through the chaos. This feels like the 18th trade war tantrum since Trump took office, and every single one followed the same playbook: threaten apocalypse, tank markets, backtrack, rip higher. The TACO trade isn't market timing—it's pattern recognition. If you panic-sold Monday's dip, you just funded someone else's retirement. Stay patient, ignore the noise, and remember that Trump's threats have a shorter shelf life than gas station sushi.

😢 Gold & Silver Crash on Peace News

Gold and silver got destroyed when Trump canceled the EU tariffs. Precious metals dumped hard as safe-haven demand evaporated faster than my trading discipline during earnings season. The Dollar Index rose, hammering metals prices—when geopolitical fear fades, so does the rush to safety.

But zoom out: Gold's up 10% this month, hitting $4,750/oz before pulling back. Silver touched $95/oz for the first time in history. This pullback is barely a speed bump on an historic run fueled by solar panels, AI data centers, and genuine physical shortages.

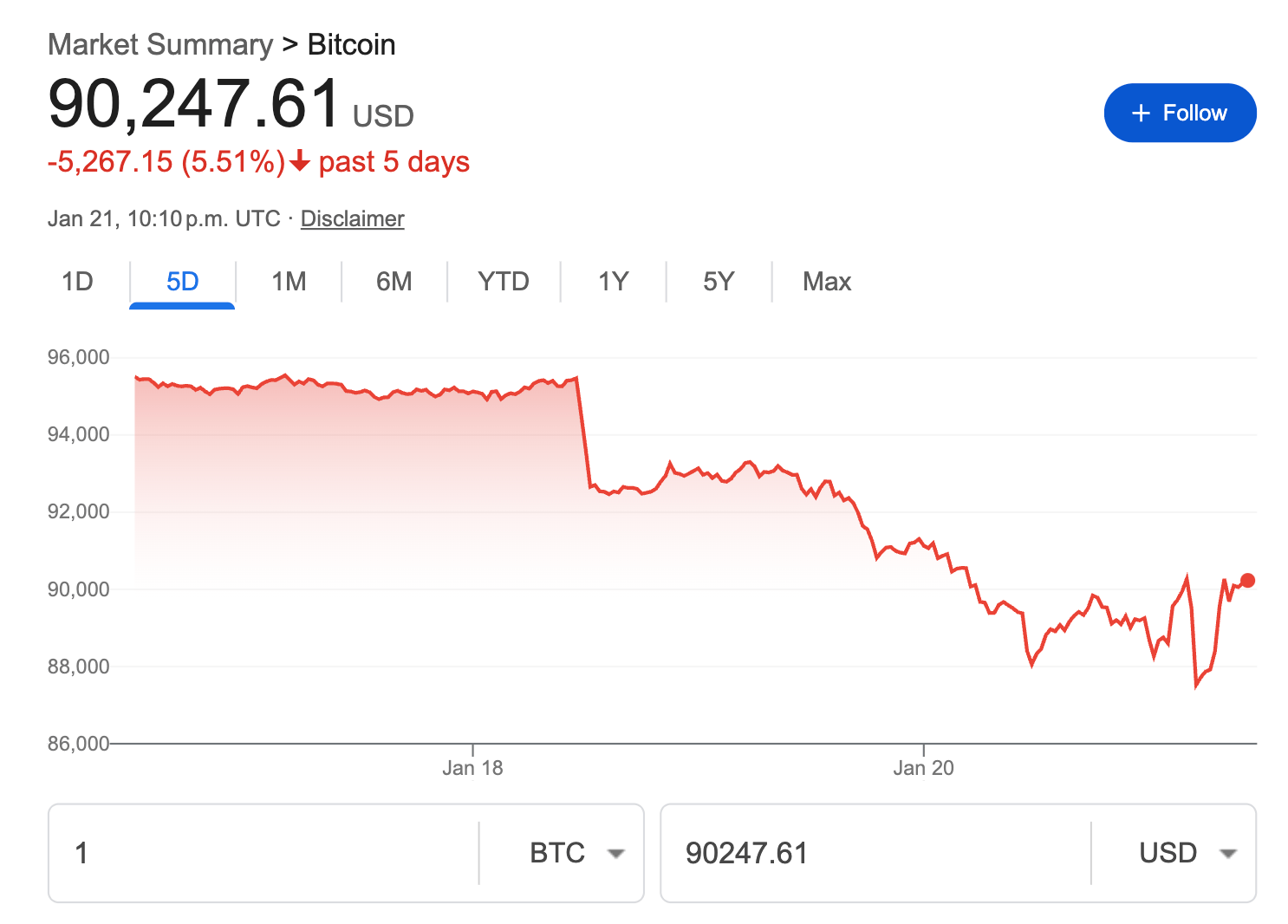

Bitcoin? Finished up almost 2%, hovering around $90K. Below $90K we're bearish. Above $95K we might see a real run to $100K, which feels like it hasn't happened since the Paleolithic era.

The Munch Take: Metals sold off because the immediate crisis faded, not because the long-term thesis died. Currency debasement, industrial demand, physical squeeze—none of that changed overnight. If you're holding metals as insurance, yesterday was noise. If you were buying fear? The fear premium just got repriced.

BROUGHT TO YOU BY

Want to make money trading? Use prop firms.

Lark's 1-Step Career Program pays you up to $1,000 monthly even during drawdowns. Hit 3 profitable days of 0.5% and stay above -3.5%—that's it.

January Promo: Get your first payout and we'll give you a free account of the same size. Automatically. No extra cost.

One payout = instant second evaluation. Scale faster. Pay less.

7% max drawdown. Free retry. TradingView included. AI journal. Fast payouts. 24/7 support.

Build consistency while getting paid to learn. Most firms make you start over. We help you scale.

STOCKS

🍅 Berkshire Dumps Heinz: When Even Buffett Says "Too Expensive"

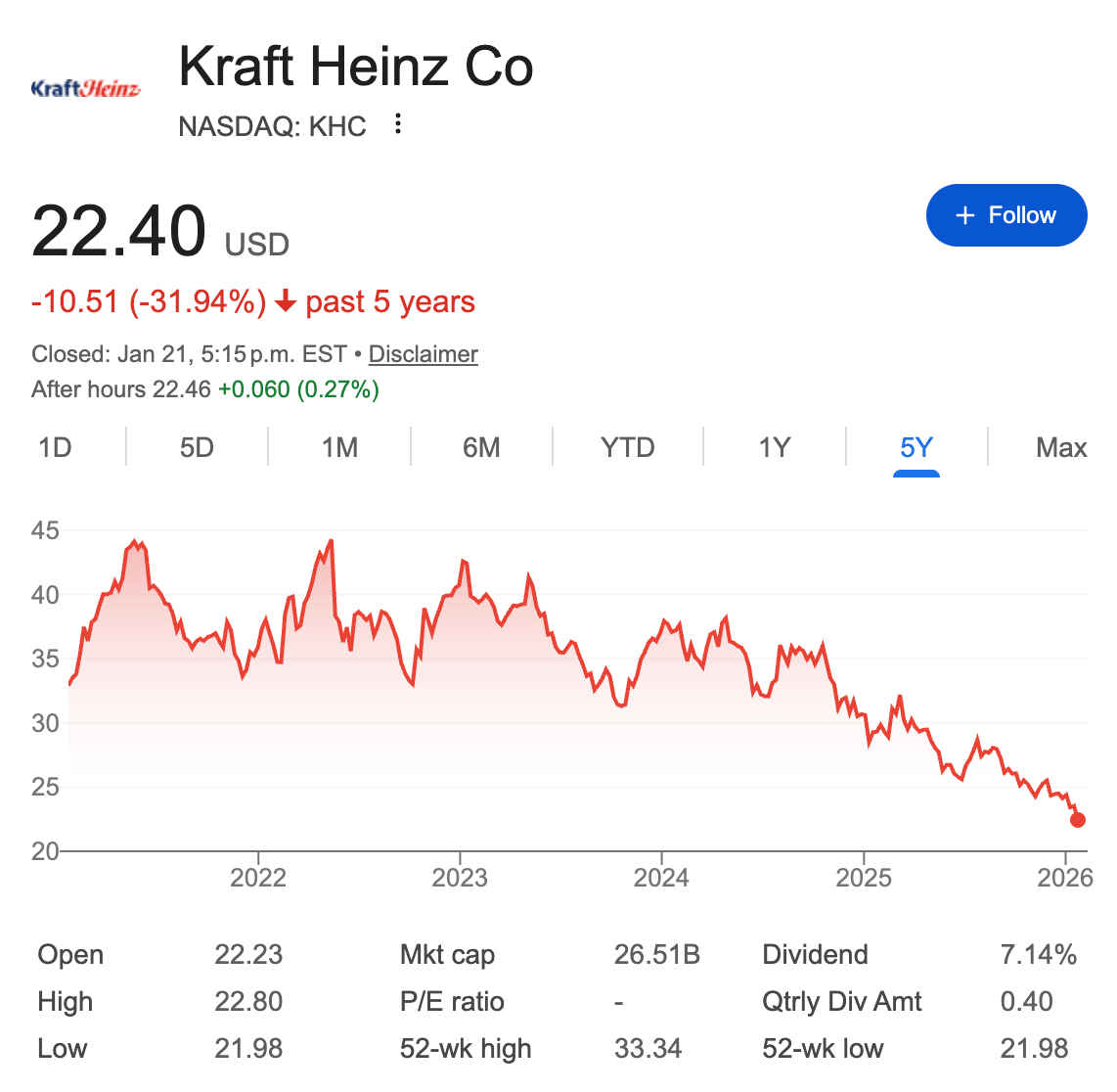

Berkshire Hathaway is exiting its 28% stake in Kraft Heinz after taking a $3.8 billion writedown last year. The stock fell 5.72% on the news.

The backstory: Berkshire bought in 2015 alongside Brazilian private equity firm 3G Capital, combining Kraft and Heinz. The company has struggled ever since, falling 70% as costs rose, consumer preferences shifted, and brand momentum died. Even Buffett previously criticized management's plan to split the company.

Why this matters: Berkshire's been a net seller of stocks for 12 straight quarters and paused share buybacks for the past five. Translation? Buffett (and now successor Greg Abel, who Buffett says "can do anything I can do, way better") thinks valuations are too rich. Since Buffett stepped down, Berkshire's Class B shares dropped 7% as the "Buffett premium" fades.

They're sitting on $358 billion in cash—waiting for better opportunities.

The Munch Take: When the greatest investor in history sells for 12 straight quarters and hoards cash, maybe—just maybe—markets are expensive. The S&P trades at a price-to-book ratio of 5.5, well above its 3.16 average. Until Abel spots deals worth making, don't expect Berkshire rushing into acquisitions. If you're wondering whether to buy this dip, remember: even Buffett's staying on the sidelines.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

🚗 $LMND Major car insurance provider Lemonade just announced they're slashing Tesla insurance costs by 50% once Full Self-Driving rolls out. Their reasoning? Data shows FSD reduces accidents. Translation: The AI drives better than your average human who thinks turn signals are optional. If you needed another reason to justify that Tesla purchase to your spouse, congratulations—you just got it.

💊 $AMZN Amazon's rolling out a new Health AI feature where an AI assistant accesses your medical records, labs, and medications to answer health questions and book appointments. Privacy concerns? Absolutely questionable. Convenient? Undeniably. It's the tech equivalent of inviting Big Brother to organize your medicine cabinet—creepy, efficient, and probably inevitable.

🥩 Starting March 1st, Steak 'n Shake will pay all employees hourly bonuses in Bitcoin. Because nothing says "stable income" quite like getting paid in an asset that can swing 10% before your shift ends.

😥 $NVDA Nvidia CEO Jensen Huang publicly admitted he regrets selling NVDA shares when the company was valued at $300 million. Current valuation? North of $3 trillion. That's not a mistake—that's a generational wealth fumble that should be studied in business schools as "Exhibit A: How to Haunt Yourself Forever."

🤑 $IBKR Interactive Brokers climbed 6% after crushing Q4 expectations, powered by heavy trading activity on their platform. They're up 57% over the past year. Turns out when everyone's panic-trading through volatility like caffeinated day traders, the house always wins. Thanks for your contribution to their record quarter, retail army.

🎮️ $GME GameStop shares rose 2.8% after CEO Ryan Cohen bought 500,000 shares. Say what you will about GameStop's business model, but Cohen's commitment to buying his own stock is either brilliant conviction or the most expensive form of stubbornness in modern finance. Either way, the meme stock faithful are absolutely here for it.

🚀 Pre-Market Fuel

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER