- Pip Munch

- Posts

- 🧑🚀 How This Trader Made $2,856.26 🤑

🧑🚀 How This Trader Made $2,856.26 🤑

PLUS: Get $4,650 of FREE courses! 😏

GM Lark Traders! This is Lark Digest, the trading newsletter that reads the market better than your pet reads your mind at dinnertime.

We’re sorry it’s been a few days since we last popped in. But we’re back and ready to go. We hope you missed us as much as we missed you.

Mr.Lark

On today’s menu:

Why The Stock Market Just Won’t Quit 📈

Get $4,650 of FREE Courses! 😏

How This Trader Made $2,856.26 🤑

📈 Why the Stock Market is Partying Like It’s 1999

The stock market has been feeling nothing but good vibes lately. 🥳

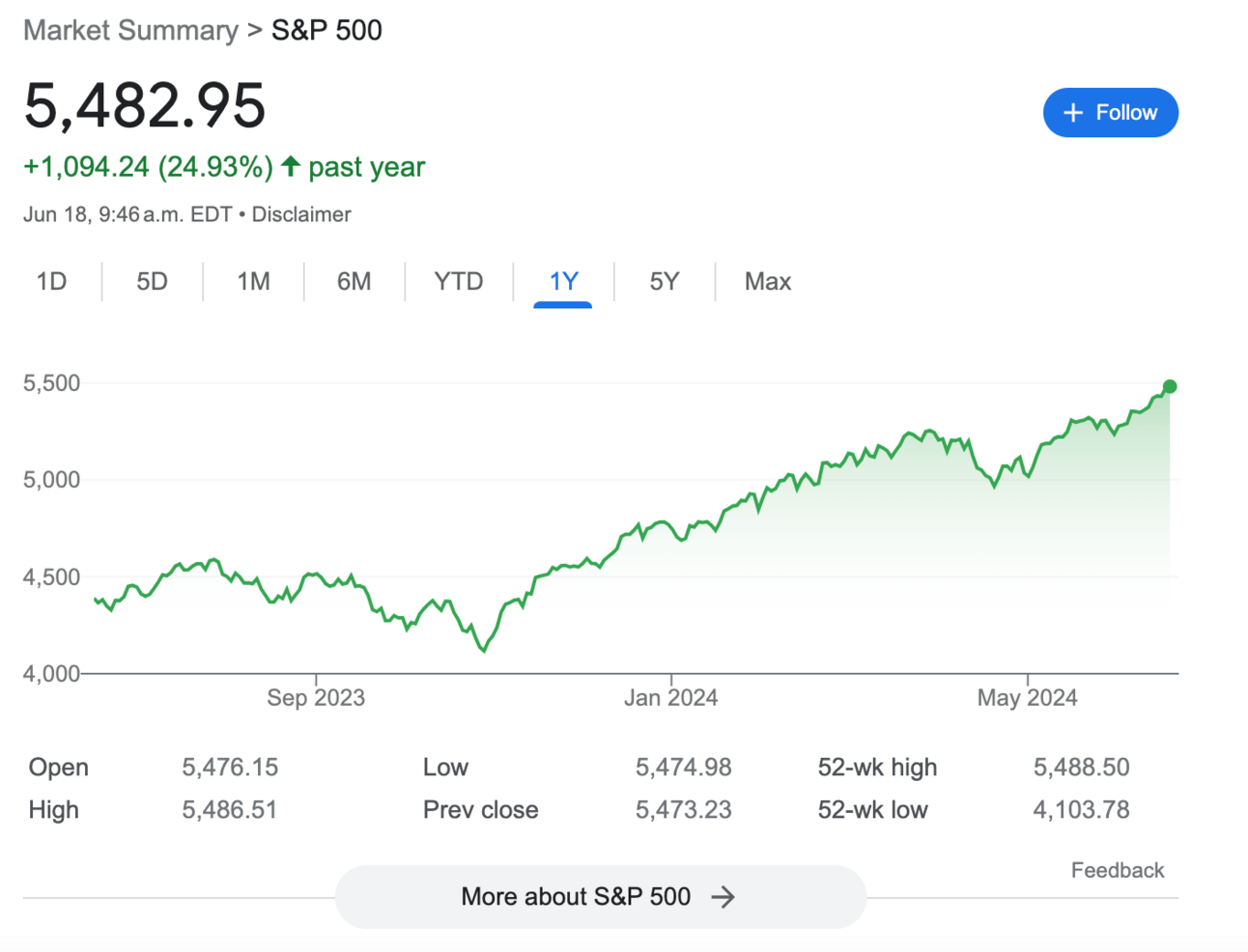

Yesterday, the S&P500 climbed over 1% to hit a brand-new all-time high. In fact, it’s the 30th time this year that it’s hit a new all-time high!

It's like the market just downed an espresso shot and decided to sprint a marathon.

But the question is, why?

With countries worldwide starting to cut interest rates and fears about a global recession growing, why are stocks feeling so good?

The answer is something all traders need to be paying attention to.

1/ What’s Fueling This Rally? 🤔

While the Bank of Canada (BoC) and the European Central Bank (ECB) were busy slashing interest rates last week, the US economy is still busy flexing its muscles.

Strong economic data over the last few weeks has investors thinking, “Rate cuts in June? Maybe not so fast.”

This led investors to think the Fed is less likely to ease rates. This is strengthening the dollar, and stocks are riding this wave of optimism.

Remember:

High Interest Rates = Strong Dollar 📈

Low Interest Rates = Weak Dollar 📉

But before you go all-in on Gamestop, the party might actually be close to being over…

2/ Eyes on the Data 🧮

It’s not all smooth sailing from here.

Traders have eagerly awaited May retail sales data, which was released just minutes ago.

And the print is thickening the plot…

The expected print was 2.8%, but the number came in at 2.3%. 😬

For those who didn’t pass grade 2 math class (it’s okay; we’ve all been there), that’s bad news.

It means that consumers aren’t feeling so hot about the economy, and while not majorly serious (yet), it could hurt the Fed's confidence in maintaining rates at their current level.

3/ Why You Should Care About Rate Hike Expectations 👀

Here’s the lowdown, Larkers: Monitoring rate hike expectations is crucial.

Interest rates are like the puppeteers behind the curtain, pulling the strings of both the FX, equity, commodity and Crypto markets.

When rate cut expectations drop, the dollar strengthens, which can lift stocks—especially those tied to domestic growth.

And as much as it’s nice to think that the market will move 100 pips because of your trendline, it’s what’s happening in the real world that’s really driving the markets.

So, in short, if you’re sleeping on what’s going on here, you’re going to get burned in your trading.

4/ Stay Nimble, Stay Smart 😎

As Mr. Lark always says, “In the world of trading, the only constant is change.”

We must remember as traders that the market doesn’t care what’s happening RIGHT NOW.

It cares about what’s GOING TO HAPPEN.

This is a concept called “pricing-in” and is a fundamental aspect of understanding how the market moves.

As we learn more about the health of the economy over the next few weeks, the market will continue to price in their adjusting expectations of when rate cuts will arrive.

If any of that confused you, it’s time to join our Skool community below. 👇️

🤑 Join Our Skool Community!

Want to get $4,650 of free trading courses?

We’re building the #1 community for traders and the best part is that it’s FREE!

When you join, you’ll receive:

🎁 The 12 Video Technical Analysis Course That I Used To Quit My Job ($3,000 Value)

🎁 The Ultimate Guide To Currency Fundamentals ($1,000 Value)

🎁 The 9-Minute Never Get Burned On News Trading Masterclass ($500 Value)

🎁 The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges ($150 Value)

🤑 Total Value = $4,650.

And the best part is that the community is only going to improve over time.

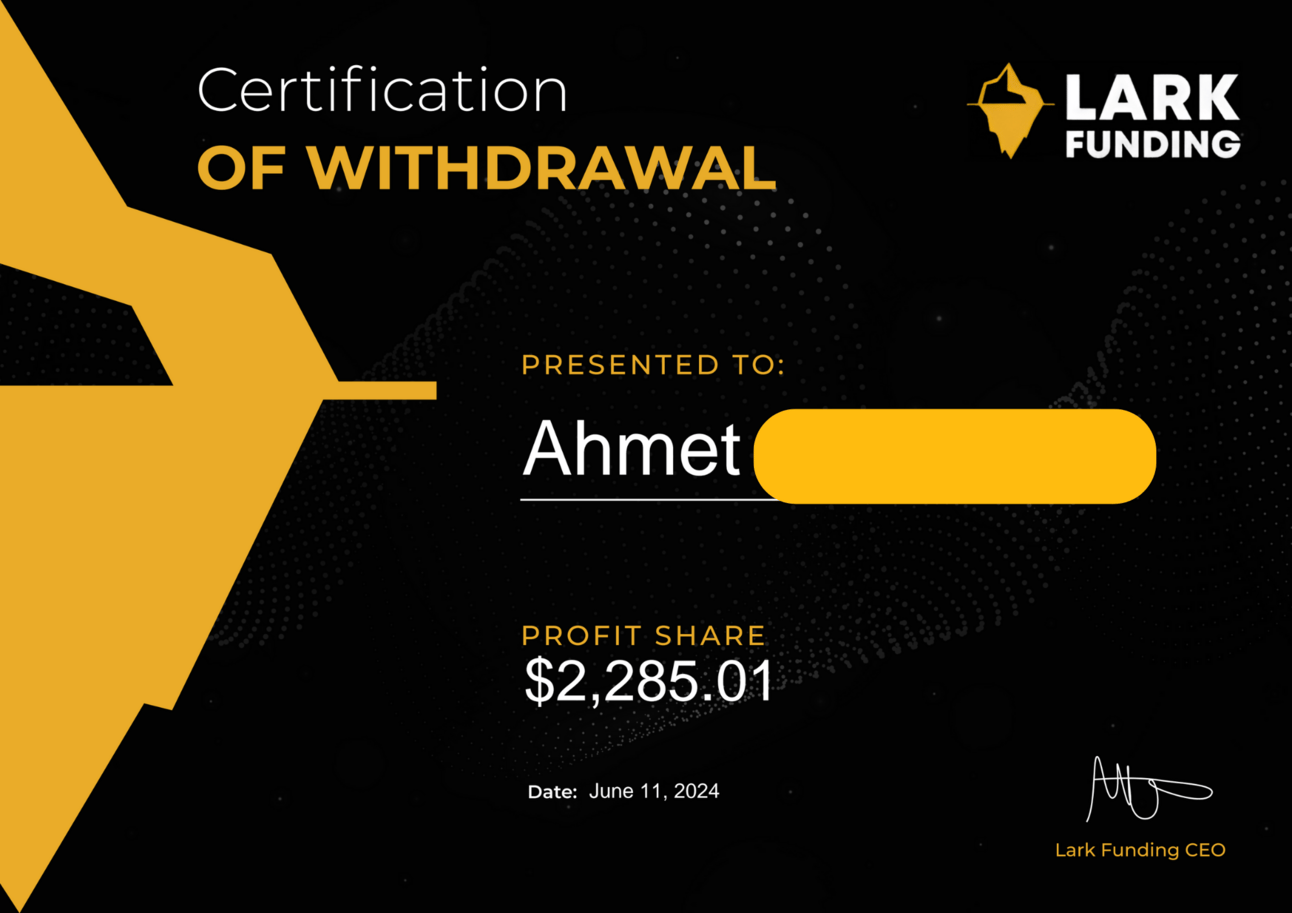

🤑 How This Trader Made $2,856.26

Just take a look at this beautiful payout certificate!

What would you do with the money?

So, in classic Lark fashion, we will reveal some insider stats on how this trader earned such a lovely payout.

Account Size: 2-Step $100,000

Active Trading Days: 4

Time Holding Account: 54 Days

Win Rate: 50%

Largest Win: $2,174.13

Largest Loss: -$1,448.42

Markets Traded: USD/CHF, EUR/USD, AUD/USD, USD/JPY, USD/CAD

There are a lot of things to take away and learn from these stats.

1/ Quality Over Quantity. This trader held their account for 54 days but only traded for 4 days, which proves they’re only taking A+ setups.

2/ Risk-To-Reward > Win Rate. This trader proves your risk-to-reward ratio is much more important than your win rate.

3/ Trade Multiple Pairs? Based on our data, traders tend to do better by focusing on just one or two trading instruments. But this trader shows that there’s always an exception to every rule.

We hope this gives you a couple of things to think about!

As always, keep improving your trading, and we’ll keep the payouts flowing.

Happy Tuesday,

Mr.Lark

☕️ Pre-Market Fuel

FTMO changed the headline on their website. Will more firms follow suit?

The Royal Bank of Australia decided not to cut interest rates. They’re now taking a wait-and-see approach. The AUD rallied on the news.

Why the best traders remain private. Don’t trust everything you see on social media.

🍪 Digestible Memes

Sheesh... I gotta get away from these screens

— Crypto Giggle (@CryptoGiggle)

8:27 PM • Jun 16, 2024

Share Lark Digest

Chances are you have some trading friends. Why don’t you be a pal, share Lark Digest and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER

What do you think of today's edition? |